Description

What the study is about is a non-state pension fund. Offers services for pension insurance, as well as the formation of the funded part of the pension. Does not carry out any third-party activities.

All this makes customers happy. They can tell you exactly under what circumstances to contact the company. Safmar does not conduct any shadow politics. The organization is supported by Raiffeisen Bank.

Official company page on the Internet

The non-state pension fund "Safmar" has its own resource. NPF provides services in the field of compulsory and non-state pension provision. Additionally, a merger of several funds was previously carried out. As a result, a large customer base has emerged, which includes over 2.3 million people. The organization manages over 200 billion rubles. pension assets. NPF takes part in the system of guaranteeing the rights of insured persons. This increases the fund's reputation among potential clients.

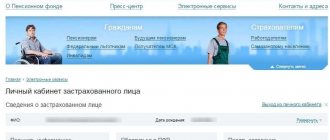

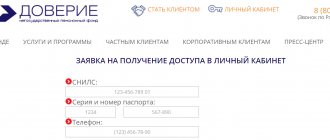

On the main page of the official website there is a menu with all the necessary sections. There is a personal account, a general information block and other online tools that clients may need.

By registering on the site, a citizen will be able to:

- control your retirement account;

- monitor the receipt of funds;

- watch the increase in pension savings.

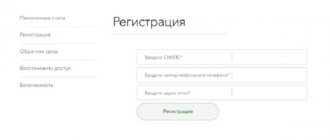

Only participants in the compulsory pension insurance program have the right to register in the system. The citizen must have SNILS. Additionally, you will need to provide your email address and mobile phone number.

Once registration is confirmed, the person has access to all information regarding the pension amount. Additionally, the site contains a calculator that allows you to determine the amount of payments. An example of a product from npfsafmar is the Online Financier program.

Please note: One of the advantages of the institution is the accrual of income from investment programs and the opportunity to take advantage of social tax deductions. A person has the right to independently determine the amount and frequency of contributions. By making monthly contributions, a person will be able to accumulate a fairly impressive amount by the time he retires.

The fund also operates a number of corporate programs. They are suitable for representatives of enterprises wishing to provide pensions to employees.

Spreading

JSC NPF Safmar has a small number of branches in Russia. The thing is that this company is not very widespread throughout the country. Therefore, some believe that Safmar is a scammer.

Actually this is not true. The company under study is nothing more than a real-life non-state pension fund. Branches of the organization can be found in Saratov and Moscow. These are separate branches of NPF.

It is also worth mentioning that (NPF) receives positive reviews from clients because the services of this fund can be used in the branches of Raiffeisen Bank. From this position, the organization is widespread very seriously. In almost every city in Russia you can apply here to create pension savings.

Personal account of NPF "Safmar"

The Fund is engaged in providing compulsory pension insurance and participates in a program to provide pensions for individuals and legal entities.

Not only pensioners, but also young people who care about their well-being in old age can use the company’s services.

To enter your individual account, you must use your login and password. If you don't have an account yet, you should go through the registration procedure.

Good to know! At the moment, registration is provided only for persons with compulsory pension insurance.

Registration

The ability for people to register for non-state pension provision who have not previously received authorization data will be introduced later.

To obtain information about the status of your personal account, you need to send a written request to the fund or check it yourself through your personal account. Questions of interest regarding the operation of your personal account or fund can be asked to the email address specified in the contact details or by the telephone numbers provided.

Individuals can independently set the time and amount of contributions and use temporary or lifetime old-age benefits. In case of early termination of the contract, the finances are reimbursed to the owner.

The amount of credits depends on the salary of corporate users.

Head office address

Some are interested in where the main branch of Safmar is located. It's not that hard to guess. The city in which the non-state pension fund is located is Moscow.

The legal address of the company coincides with the actual one. More precisely, Safmar is located at the following address: Plyushchikhina Street, 44/2. This is where the head office is located. You can contact the specified address if you have any global complaints or wishes.

Customer support through the account of NPF "Safmar"

You can request help from the support service by using the phone numbers listed on the company's main page. Alternative option: send a message describing the problem by email. Another option is to ask for help on any of the social networks that have Safmar NPF groups. Links to them are available on the main page of the official website. The company’s specialists, who monitor the activities of their own groups, will be able to help resolve the issue or provide contact information for a person who can cope with the problem.

Rating

What is the rating of NPF Safmar? This is an important nuance that many potential clients pay attention to. I don’t really want to cooperate with an organization that is closer to the bottom of the ratings of non-state pension funds in Russia.

Today, Safmar does not have the highest performance. Among non-state pension funds in terms of capital and reserves, the organization ranks 28th. If we talk about the volume of pension reserves, we can see that the fund is in 17th place. But that is not all.

Safmar (NPF) does not receive the best reviews due to the fact that the company is in 15th place in the ranking of pension funds in terms of pension savings. This is the data that is relevant today. In general, we can say that Safmar is far from a leader. And this does not suit many clients. They begin to doubt the integrity and reliability of the organization.

Security measures in your personal account

The European Pension Fund personal account as an online platform is protected by reliable encryption protocols. It is recommended to log into your account from a personal computer that has a configured and updated antivirus. If the user is not technically prepared, you need to contact the system administrator of NPF Safmar for technical support.

For account operations to be successful, you must:

- Make sure the connection to the server is secure (via SSL protocol);

- Disable auto-filling of forms and check that they are saved in the browser;

- Use a strong password for authorization;

- Do not disclose your login and password to third parties, do not transfer the card into the wrong hands;

- After completing work in your account, click the “End session” button;

- Do not visit your personal account from other people’s devices or from third-party web connections (in public places);

- If you connect to the Internet via a modem, you should check the number you are dialing;

- Use a licensed operating system on your PC;

- Use spyware monitoring software;

- Use Firewall on your device.

European Pension Fund, video:

Reliability

And in vain. JSC NPF Safmar receives positive reviews for the fact that this non-state pension fund has high reliability indicators. Experts rate the company's work as A++.

This is the highest level of reliability today. This means that the organization will not suddenly close. You can trust her with your retirement savings. And this nuance pleases many potential clients. Only taking into account Safmar’s position in the rating of Russian non-state pension funds, some begin to doubt the advisability of applying for services.

Authorization

From May 31, 2021, the joint-stock company “Non-state pension fund “SAFMAR”” changed its name. Now the fund is called the joint-stock company “Non-state pension fund “Decent Future””. The Federal Tax Service made an entry in the Unified State Register of Legal Entities about changes to the fund’s charter regarding its name. This completed the process of changing the name of JSC NPF SAFMAR.

The fund continues to serve clients as before and fulfill all its obligations, including investing pension savings, accruing income and paying pensions. All contracts for compulsory pension insurance and non-state pension provision concluded by clients with the non-state pension fund "SAFMAR" will continue to be valid and will not need to be renegotiated.

The renaming of the fund is due to the fact that the previous name had a direct correlation with the industrial and financial group SAFMAR, which ceased to be the owner of the non-state pension fund. Now the owner of 100% of the fund's shares is the investment company, which is part of the financial and investment group.

Renaming is one of the stages of the fund’s entry into the group’s united non-state pension fund.

Leningradskoe Adagio is a diversified investment company, one of the main activities of which since 2021 is the management of pension assets. The perimeter of the company’s pension block includes non-state pension funds “Future”, “Evolution”, “Telecom-Soyuz”, “Decent Future”, “Federation”, “Bolshoy” and “OPF”.

We bring to your attention answers to the main questions that may arise in connection with a change of shareholder and name of a non-state pension fund.

What does a change of shareholder mean?

This means that the fund's owner changes. The most important thing: a change of shareholder is not a reorganization of the fund or its merger with another non-state pension fund. All agreements remain in force. No additional actions are required from the fund’s clients and its partners.

Why was the fund renamed?

Renaming the fund is a logical step for the new shareholder. The former name had a direct correlation with the SAFMAR group, which ceased to be the owner of the non-state pension fund.

Do I need to renew the contract due to a change of shareholder and name?

No. All agreements on compulsory pension insurance and non-state pension provision, previously concluded by clients, will continue to be valid, their terms and conditions will remain unchanged.

What will happen to my pension savings and contributions to retirement accounts?

The fund continues to serve clients as before and fulfill all its obligations to them, including investing pension savings, accruing income and paying pensions.

I receive a pension from your fund, what should I do now?

You will continue to receive pension payments as before. All legal relations that previously arose between the client and the fund do not change. The fund will continue to fulfill all obligations to its clients, including the payment of pensions.

What bank details do I need to use to make contributions?

You can find current details for making pension contributions on the fund’s website in the information disclosure section.

Making pension contributions is also possible through the service in your personal account, and in this case you do not need to check and monitor the relevance of the details.

I recently submitted a claim for payment, will it be considered?

Of course, all previously submitted applications will be considered by the fund in the manner prescribed by law.

Will your personal account and mobile application work?

Yes, all the fund’s services, including the personal account and mobile application, operate as normal, users do not need to take any additional actions, applications are accepted and processed by the fund.

Can I leave the fund without losing investment income due to renaming?

The change of shareholder and name does not affect the procedure for transferring pension savings, which is carried out in accordance with current legislation.

We recommend that you contact the fund for advice before deciding to transfer to the Pension Fund of the Russian Federation or another non-state pension fund, since transferring pension savings may result in a loss of already accumulated investment income.

Who is the new shareholder of the fund?

The new shareholder of the fund is the limited liability company "Investment", a diversified investment company, one of the main activities of which since 2021 is the management of pension assets. The perimeter of the company’s pension block includes non-state pension funds “Future”, “Evolution”, “Telecom-Soyuz”, “Decent Future”, “Federation”, “Bolshoy” and “OPF”. The total assets of the funds amount to 900 billion rubles, the total number of clients who form their funded and non-state pensions in the funds exceeds 11 million people. Investment is part of the financial and investment group.

Profitability

The next very important point is profitability. Many potential clients pay attention to this feature. What is the profitability rating of NPF Safmar?

You can't call him tall. But many emphasize that the organization allows you to really increase pension savings. And this is only due to the fact that the money is in the specified fund.

Today, NPF Safmar offers a yield of about 8.87% per annum. This is exactly the indicator that experts called in the first half of 2021. This is not to say that the return on cooperation with an organization is too high, but it does occur. Thanks to this, Safmar (NPF) receives positive feedback from many clients. They indicate that this company is really increasing pension savings. Not too fast, but reliable and stable. Just what most future retirees need!

Cumulative part of pension in NPF Safmar – options for receiving

If you believe the Pension Fund statistics, more than 90% of pensioners receive pension savings in a lump sum payment. This is explained quite simply. Not everyone wants to receive the accumulated amounts in small parts every month; most prefer to take it all at once. There are two options for receiving funds from NPF Safmar:

- Separate payments. You can apply for payment of the funded part of your pension without taking into account the voluntary contributions you have made, if you have had any. Then you can receive two payments with an interval of 5 years. According to the law, you can receive separate payments - one formed at the expense of the employer. The second comes from voluntary contributions and state co-financing.

- Urgent pension payments. They are due to those who participated in the co-financing program or sent maternity capital to the Fund. This type of payment is assigned for a period of 10 years, and will be higher than the standard amount of the funded part of the pension paid for life.

- Lifetime payment. In this case, a fixed payment amount is assigned, which will be received monthly from the Fund for life.

Once you submit an application to the Fund, it cannot be withdrawn. Therefore, it is better to contact the NPF first so that employees can make the calculation. This way you will understand which options for a lump sum payment of the funded part of your pension will be more profitable for you.

Important! The application submitted to NPF Safmar for the appointment of payment of the funded part of the pension does not have retroactive effect. Be sure to first contact the Fund for a preliminary calculation and choose a convenient method for obtaining private equity.

Attitude towards clients

The organization receives mixed opinions regarding the attitude of employees towards clients. Some say that Safmar serves all its visitors quickly, without queues, and everyone receives attention. Paperwork is reduced to a minimum. Thanks to the professionalism of the employees, paperwork does not keep you waiting.

You can also notice that JSC NPF Safmar receives negative reviews for the work of its employees. Some visitors say that some subordinates do not treat clients in the best way. There is no sense of professionalism; you may encounter rudeness and rudeness. Fortunately, such complaints are rare.

About notifying clients

Safmar (NPF) receives not the best type of reviews for the fact that it is impossible to order personal account statements from the organization directly through the “Personal Account”. There is a special function on the official website of the fund, but it does not work.

Many people emphasize that it is not always convenient to go to Safmar branches to obtain information about the status of an open personal account. However, this is not such a significant drawback. Especially when you consider that in general the organization has a good rating of reliability and profitability.

Also, some say that all account statements can be requested by mail. Another good way to get information. It just takes a lot of time. We can say that Safmar (NPF) receives reviews as not the most mobile organization.

Information about pension calculation

You can find out the data by contacting the office, using the hotline or the “Personal Account” service. You can access it through the official website of the fund. The latter method is convenient due to the fact that it can be implemented without leaving home.

Please note: Only registered users have access to their personal account. In 2021, only citizens participating in the pension insurance program can use the method. The fund’s website states that clients who cooperate with the institution in the field of non-state support will have the opportunity to register later.

Mysterious passages

The organization does not collect the best opinions for one interesting phenomenon. The thing is that some investors complain that their pension savings are transferred to Safmar without consent. Some accuse the organization of fraud. But is this really so?

Not at all. Most often, such statements are found from clients of Raiffeisen Bank. When concluding certain contracts, he informs about the transfer of pension savings to Safmar. The main thing is to read the terms and conditions carefully. The employees themselves do not disclose such information. Therefore, all accusations of fraud are baseless. Safmar and Raiffeisen act exclusively according to the law. These organizations are bona fide.

Transfer of pension savings to JSC NPF “Safmar”

To transfer a funded pension to the non-state pension fund Raiffeisenbank, the client needs to prepare a passport, SNILS and write an application. You can submit it in several ways:

- at the nearest territorial branch of the Pension Fund or Raiffeisenbank office;

- using the Internet portal State Services in the section “Pension, benefits and benefits”;

- in the personal account of the Pension Fund of the Russian Federation;

- by pre-executed notarized power of attorney through a representative.

Note! If you make an early transition from an old insurer to a new one, you risk losing investment income. To clarify the amount, we recommend contacting the pension fund to which you are currently linked.

If you are planning to become a client of NPF Safmar, we recommend that you first familiarize yourself with the company’s charter and insurance rules in more detail.

Perhaps among the readers there will be those who already keep their pension savings in Raiffeisenbank? This information may be useful to other users! Share your experience in the comments.

Possibilities

NPF Safmar receives positive customer reviews (2015 or any other year - it’s not so important) for the opportunities that the fund offers to all its investors.

In general, they are no different from offers from similar companies. The only thing that clients often pay attention to is the speed of delivery:

- opening pension deposits;

- refill;

- closing deposits;

- transfer of funds to another pension fund at any time.

It is recommended to read about all the features of the provision of services in the signed agreement. You should pay attention to issues related to transferring money to another fund. The thing is that Safmar imposes certain sanctions on clients when transferring funds to another organization. This step leads to large monetary losses, which often upset investors.

Personal account of NPF Safmara

NPF Safmar is one of the largest funds in Russia. On the official resource, the client has access to a personal account. Thanks to modern developments, the site is quite easy to use. There is a mobile version.

Performing registration

Registration in your personal account is not required. After signing the contract, the client is given login information. Then the user just needs to go to the official resource and enter the data in the appropriate fields. You will also need to confirm your phone number and email.

Login Features

To log in you will need to enter your username, password and security code. This is a special captcha that confirms a living person. Next, all you have to do is click on the “Login” button. Below is a link to reset your password.

Sometimes problems may arise with access to your personal account. This happens when a client rarely logs in. But access can be restored in a convenient way.

Options for restoring access to your personal account:

- Contact the office of NPF Safmar.

- You can return access through a Raiffeisenbank branch. There will be no problems if you take your passport and SNILS with you.

- You can contact the post office. This is the most difficult way. First you need to download the application from the official website, fill it out and print it. You also need to have certified copies of your passport with you.

Subtleties of disabling a personal account

There are no charges for using your personal account. To turn it off, you just need to log out. It is impossible to completely block an account.

If you fundamentally do not want to have a personal account with NPF Safmar, then you can refuse registration. This is not a necessary condition. A personal account is provided solely for the convenience of users.

About working with documents

Safmar (NPF) does not receive the best reviews regarding the work of its employees with clients. Some note that the pension fund offers really fast service. But such opinions are not so common.

Safmar is often described as a pension fund that reduces paperwork to a minimum, but the organization’s paperwork leaves much to be desired. It is noted that the residence data of citizen investors is not verified. And therefore, some notifications and other papers may not reach the client.

All this suggests that the pension fund is not very conscientious about its work. In fact, Safmar checks all of its clients. And sends documents and certificates to the specified contacts. If you change your place of residence or registration, you must independently notify either Raiffeisen Bank or the non-state pension fund directly. Otherwise, the data will actually be sent to the wrong address. But not through the fault of the pension fund, but because of the dishonesty and irresponsibility of clients.

About the non-state pension fund

There are a large number of non-state pension funds operating on the territory of the Russian Federation. But what is it and how much can you trust this organization?

An organization that is not commercial, its action is aimed only at preserving and increasing the pension contributions of citizens during the period of their working activity - this is a non-state pension fund.

The existence and activities of the organization are regulated by current legislation. By concluding an agreement, everyone can be sure that at any time they will be able to check their account and monitor the effectiveness of their money management. Information in full is available on the official Internet resource of the NPF. Activities are under constant control of the relevant services:

- tax service;

- financial markets services;

- Russian Pension Fund;

- Accounts Chamber of the Russian Federation.

In addition to savings, non-governmental organizations offer their clients additional services:

- If an accident occurs and a client of the Fund dies, then relatives or trusted persons will be able to receive his savings. Anyone named in the will.

- Funds accumulating in the organization's account are not subject to withdrawal in the event of seizure of property.

- There is a possibility of increasing the savings portion. This is done personally by the client by transferring additional funds. You can deduct an additional amount from your salary. This is done through the accounting department of the enterprise where the client is registered.

The opinion of experts is that non-state funds are much more reliable than commercial banks. Unlike financial institutions, these organizations, in the event of bankruptcy, do not lose customer deposits and honestly transfer them to the appropriate accounts of citizens in the Pension Fund.

About service in general

What do they say about the organization being studied in general? How conscientious it is receives varied reviews. From all of the above, we can conclude that the fund has many shortcomings. Nevertheless, the majority of citizens emphasize that the organization as a whole offers the highest level of service. Managers have high demands on their subordinates. Sometimes because of this, Safmar (NPF) does not earn the best reviews from employees. After all, for subordinates, this is the same employer as everyone else. This must be remembered.

Sometimes you can notice that the population complains about slow service and constant queues at branches. No one is safe from them. However, employees try to pay due attention to all visitors. When compared with other non-state pension funds, Safmar is not much different from them. Every potential visitor should remember this. You should not expect too good and fast service from the organization; the company still has shortcomings.

Recovering the password from the personal account of NPF "Safmar"

Using the “Forgot your password?” button located on the web page with the authorization window. the user can restore access to the service - this function is useful if one of the identifiers is suddenly lost. To create a new password, you will need to enter the e-mail associated with your account, and then check your mailbox for a link that allows you to reset the forgotten code. By following the received URL, the client will be able to independently come up with a new identifier. You can also contact a Safmar branch or RaiffeisenBank, which is a partner of the NPF, to reset your password.

If desired, the personal account user can replace the standard password with any combination of numbers and letters. To resolve problems with authorization, call the toll-free number 8 (800) 700-80-20.

As an employer

It is clear what rating JSC NPF Safmar has for clients. What can employees say about this organization? To what extent is the fund a bona fide employer?

Overall, it doesn't stand out as anything special. Some people praise him, some don't. The complaints are standard: a lot of work, little pay, not the kindest and most honest bosses. Among the advantages are official employment, as well as good working conditions. There is no open and direct negativity towards Safmar from subordinates. But this does not mean that the pension fund is an ideal employer. Rather, it is suitable for those who simply want to work and earn money without building a career.

NPF "Safmar": official website, personal account and its capabilities

Remote service via the Internet using the personal account of JSC NPF Safmar provides its clients with comfort and convenience. At any time of the day or night, the fund’s clients have the opportunity to:

- Receive detailed information about the agreement concluded with the fund;

- Check information about the current account status;

- Independently generate a report on your personal account for the required period;

- Receive information about transactions performed on the account;

- Request a Notification from the insured person, which will be issued in accordance with all requirements of the legislation of the Russian Federation;

- Check the accuracy of your data and, if necessary, make changes to them;

- Change the email address to which the most current information will be sent;

- Contact the support service regarding a particular issue;

- Change the password for the personal account of the Safmar pension fund;

- Change notification settings.

To log in, you must follow the link “personal account” of NPF “Safmar” on the official website.

Sources used:

- https://pfrf-kabinet.ru/lk/safmar.html

- https://cowcash.ru/cash/advice/lichnyj-kabinet-safmar.html

- https://2kabinet.ru/podumaem-o-budushhem-pensionnyj-fond-safmar-lichnyj-kabinet-i-ego-vozmozhnosti/

- https://ru-npf.ru/safmar-lichnyy-kabinet/

- https://www.sravni.ru/enciklopediya/info/lichnyj-kabinet-npf-safmar/

- https://cabinetno.ru/npf/239-npf-safmar.html

- https://lichniy-kabinet.info/npfsafmar/