In September 2021, the reorganization of the funds ended: now “SAFMAR” also includes the “European Pension Fund”, the personal account of which still performs its functions in full. Its clients have access to a list of services and can quickly seek help through various sections of the site.

Particular attention is paid to the security of personal data; modern technologies and algorithms are used to protect confidentiality.

Personal account features

In the PFU personal account, the user can:

- Get information about personal and corporate accounts.

- Read the electronic version of the document on non-state pension provision.

- Submit a notification to the insurance company.

- Keep confidential information up to date.

- Receive a pension account statement for any period of time.

- See the history of replenishment of the savings part.

- View your total funds.

The service is available both on the website and in the mobile application.

Fund fraud

According to the latest information, NPF Evropeisky has not been caught in fraud with savings transfers, unlike other funds.

Not all citizens know about the rules for transferring funds, so ordinary people often fall for the tricks of scammers.

Properly organized agencies operate as follows:

- customer service in the fund's branches;

- the place of signing the agreement is the NPF office after an explanatory lecture or by mail if complete information on the formation of the funded part is available;

- information about the fund is publicly available.

What does every citizen need to know in order not to fall into the network of a fraudster ?

- Don't open the door to strangers.

- Carefully check the personal details of a potential employee of one of the NPFs

- Once a year, make a request to the Pension Fund to check your SNILS data. After all, fraudsters can transfer funds to another non-state pension fund without the knowledge of the insured person.

- Read all the documents when applying for banking services, because employees often enclose an agreement on transfer to a new NPF.

- You should not show personal documents to strangers, much less provide them with copies.

- Before signing the contract, carefully study all clauses of the document.

It is important to know! NPF Surgutneftegaz: general characteristics

How to register in the system

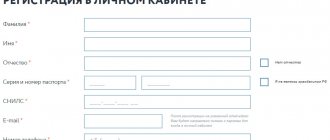

The non-state European Pension Fund offers a fairly simple registration of a personal account for individuals. You will need:

- SNILS number;

- Mobile phone number;

- Email.

Important! At the moment, registration is available for clients under compulsory pension insurance.

Service functionality

The user account is a service that allows the fund’s client access to certain information. The functions of the personal account of NPF "European" are as follows:

- Obtaining detailed information about the timing of concluding an agreement on pension provision or compulsory pension insurance, as well as the details of the document;

- Monitoring the status of your personal account and reserves;

- Studying interest accrued as income;

- Preparation of a personal account statement for any selected period;

- Registration of notifications to insured persons in accordance with the established procedure;

- Checking the accuracy of personal information and making adjustments if they change.

The user can change the password for the service, the email address associated with the account, and independently determine the frequency of notifications by email.

What to do if you have problems logging in

Safmar has detailed instructions on how to log into the European Pension Fund through your personal account if certain problems arise.

Important! If the client does not remember the email, then it is required to fill out an application “On making changes to personal data” and take it to the branches of PFU or the partner bank of JSC Raiffeisenbank with a Russian passport and SNILS. Another way to send: via mail. To do this, you will need “Consent” and photocopies of the pages of the Russian passport, on each page of which a signature and the mark “Copy is correct” are placed.

Important! If you lose your password, you need to click on “Forgot your password?”, and you will receive instructions on how to recover your data by email.

About NPF European

The fund has existed for more than 25 years; as of 2021, it has been abolished for three years, since in 2021 it entered the extensive SAFMAR fund through a reorganization procedure. All assets, pension savings of citizens and partners of the European Fund have now been transferred to NPF SAFMAR and continue to operate as usual.

In 2021, SAFMAR acquired not only the European fund, and thus became one of the largest funds in the Russian Federation with assets of more than 180 billion rubles. The founders and partners of the fund are large holdings from the industrial and banking sectors. The organization also has assets in the real estate and construction markets.

After the reorganization of the European funds, it ceased to exist, and SAFMAR continued its activities and offers clients compulsory insurance and non-state support programs.

SAFMAR currently serves more than 2.2 million insured persons.

Personal account mobile application

PF "European" was the first Fund to develop a mobile application for providing pension services.

This includes:

- Information about the nearest branches, addresses and telephone numbers.

- Information on topics of financial support for old age.

- Up-to-date mailbox support.

- The ability to send messages directly from the application to the Contact Center.

- Checking your retirement account.

The developers focus on modern methods of protecting confidential information. The application is available in Play Market and Apple Store.

Credit Europe Bank: download mobile application

There is a mobile application "Credit Europe Bank" , which implements most of the functions of your personal account. It was created for greater user convenience, because you do not need a computer with Internet access and a browser to log in.

You can download the mobile application on two platforms:

Download from Google play Install in App Store

The programs are available for download free of charge. For authorization, as on the official website, you will need a login and password. You must first register from your computer.

- Instant payment card with permitted overdraft MEGACARD

The mobile program allows clients to perform the following actions:

- Check your account balance;

- Familiarize yourself with the loan payment schedule;

- Receive a detailed statement of funds;

- Exchange currency;

- Pay for various services without commission;

- Transfer funds to another client or to another bank;

- Pay off loan debt;

- And much more.

Based on customer reviews, the application is designed in a convenient, intuitive interface. There are no malfunctions in the operation of the program and everything is performed with maximum user comfort.

Customer support via account

On the official website in the “Feedback” section, the client can ask any question, including technical problems.

“European Pension Fund” also responds on social networks.

NPF European hotline

The company operates a Hotline for 12 hours from 8 am. Contact numbers and 8 (800) 700 80 20.

Email for letters

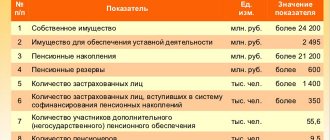

NPF rating

According to the latest data, the reliability rating of NPF European was A++ , which means “an exceptional level of reliability.” The data was determined by the independent agency Expert RA. According to the indicators, the European one was supposed to work regardless of external fluctuations in the pension market.

The rating agency withdrew the results of the rating of this NPF after the completion of the reorganization, that is, in September 2021!

When determining rating indicators, the Expert RA agency takes into account the following criteria:

- choosing a direction for investing capital;

- size of the authorized capital;

- number of active pensioners;

- the amount of pension payments to citizens of retirement age;

- number of fund clients;

- profitability level;

- volume of pension reserves.

It is important to know! Useful information about NPF Rosgosstrakh

How to disable your personal account

The account is linked to the validity of the contract. If the client refuses to provide services and terminates it, the personal account ceases to be active.

Thus, the “European Pension Fund” provides a wide range of services and supports customer service on mobile devices using an application. The website has a feedback form and a hotline, where Foundation employees will provide answers to questions. PFE ensures that all clients receive quality service.

Credit Europe Bank: login to your personal account

To increase the level of user convenience, representatives of Bank Europe Credit have developed a personal account system that allows clients to manage their accounts at a distance from the office or ATM.

To log into your account, you must be a client of the Eurobank and go to the official website using the link https://online.crediteurope.ru On the left side of the main page you will find a special form. For authorization you will need a login and password.

When using the Internet banking in question, you don’t have to worry about the risk of fraud and the safety of your funds. The official website uses a special secure connection to maintain confidentiality and important information.

Your personal account is divided into 2 main categories. The first is intended for ordinary citizens, and the second for legal clients. For individuals, there are a number of advantages of using a personal account, which include:

- Detailed details of all recent transactions made with the client’s account;

- Timely informing users about special offers from the bank;

- Monitoring the status of all accounts and bank cards;

- Familiarization with the loan repayment schedule, as well as current debts;

- Creation of templates for frequent transfers;

- Setting up automatic payments option.

In fact, this list includes most of the actions that are required by the client to cooperate with the bank. In this regard, Internet banking is actively used by many bank clients.

- Credit Europe Bank personal account: instructions for registering, changing and restoring your access password

European Pension Fund personal account card entrance

As soon as a person receives an official social insurance agreement, the organization issues and issues a special plastic access card to the personal account of the European pension fund. It will be possible to perform authorization using it. If such a card is not available, entry will be denied. This is a fairly reliable method of protecting your investor. The security of all personal information is confirmed by a special SSL certificate.

After passing authorization, which is available to everyone, the user has the opportunity to familiarize himself with personal information regarding the position and amount of funds in the account.

The management of the organization puts a lot of effort into ensuring that the services provided to clients fully comply with international standards. There is a special section where answers to questions that arise most often are collected.