The transition to the Pension Fund of the Russian Federation can increase the profitability of the funded part of the pension.

There are a large number of non-state pension funds operating in Russia. By placing his pension funds in them, a citizen expects to receive income at the maximum level. Non-state pension funds do everything possible to increase their profits and thereby the income of investors, but this is not always achieved. It is possible that a person will want to take his money from a private fund and invest it in the Pension Fund. Let's consider whether this is possible and how exactly to transfer from a non-state pension fund to a Pension Fund.

Reverse transition from NPF to Pension Fund: is it permissible?

Everyone has the right to refuse services, even when charges are already being generated.

Afterwards the money is sent only for the insurance pension:

- The money accumulated up to that moment does not disappear anywhere. They will continue to be directed to certain areas of investment. When the right to receive occurs, the citizen will receive the amount in full.

- Money management can be continued if the insured person wishes. The transfer is carried out in any direction - to another management company, to an insurance pension.

Application to the Pension Fund for the funded part of the pension

At the moment, Russia does not provide a specific form for drawing up an application to pension funds to receive a funded portion. Some NPFs independently developed a form for their clients, but such forms can be used for any fund.

The date of acceptance of the application for consideration will be indicated, since after two weeks the fund must respond in printed form by mail, electronically or directly in the building of the Pension Fund of the Russian Federation or NPF that the application is approved or rejected.

How to transfer savings from NPF to Pension Fund: instructions

Every citizen has the right to transfer money. But you are only allowed to exercise this right once every 12 months.

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

If you change insurer more than once every five years, there is a risk of losing the investment income accumulated by the previous partner. Without loss of profit, it is allowed to change only the management company or its investment portfolio.

To exit the NPF you will need to take several actions:

- Determining the management company where the money will be transferred. After this, they are determined with a specific investment portfolio. The official website contains a detailed list of organizations with which agreements have been concluded.

- All that remains is to submit an application where the citizen describes his intention in detail.

Is transfer to PF allowed?

Citizens can independently decide which organization will manage pension savings. These institutions can be either government or commercial. When transferring money to private companies, approval is required from PF employees. You can refuse the services of a commercial company at any time, even when generating charges.

As soon as the funds are returned to the PF account, they are not lost, but are sent to form an insurance pension. They are still used for profitable investment. As soon as a citizen retires, he receives the payment in full.

You are allowed to change your mind again in the future and transfer funds to the account of any NPF.

Submitting an application for transfer: deadlines, methods

The deadline for submitting documents is December 31 of the current year . The transaction is usually completed from the beginning of the year after the application submission period.

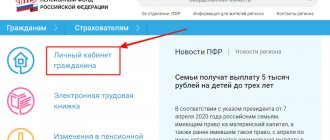

Submitting applications through State Services

A citizen will need SNILS and a passport to fill out the application form on this website. Additionally, you will be asked to provide an email and mobile phone number for contact. This is usually required during registration. But it is recommended in any case to contact the Pension Fund or MFC for complete confirmation of identity. Then the site visitor will have access to all maintenance functions.

The procedure is described step by step as follows:

- Visit the State Services website. You will need to register or log in to your account.

- Go to the tab dedicated to services.

- Opening the “Authorities” tab.

- Selecting an icon representing the Pension Fund.

- Selecting a point for receiving and considering applications from registered persons.

- Go to the section related to the transfer of savings from one direction to another.

- On the page with a description of the service, click on the button to receive them.

An inscription will appear indicating that a qualified electronic signature will be required to certify the application. All that remains is to fill out the application itself; in most cases, personal data is entered automatically. You must indicate the current company responsible for the money. And the one where you plan to go.

Next, select the Pension Fund department where the documents will be sent. All that remains is to select the “proceed to signing the form” button.

When contacting in person through the MFC

A citizen must visit the institution, following the following procedure:

- Filling out an application with all the necessary details. This applies to personal information, the current type of management and what is desired.

- Submit documents to specialists for review.

- Wait for the procedure to complete.

Important to remember! The financial year ends in Russia in March. Therefore, it is recommended to complete all financial transactions before this period. The same applies to applications to transfer your money from one source to another.

By mail

Here the list of documents remains the same as for previous cases. Simply, photocopies of papers are attached to the application in the letter to verify the information provided by the citizen. It is recommended to use the form of a registered letter, with acknowledgment of receipt. And a description of all applications. Then the citizen will receive notifications about what stage the consideration of papers is at. And it will be easier to control the process.

What other papers may be needed?

Apart from a passport and SNILS along with an application, no additional requirements are usually presented to citizens. Changing your opinion regarding the insurer to whom the money is entrusted is a right retained until December 31 of the current year. The rule applies to investment portfolios and management companies. When a decision is made, a new application is sent to the notification. The information most recently received from citizens is subject to consideration.

March 1 of the current year is the deadline by which the consideration of applications must be completed.

- If the requirement is satisfied, all changes are made to the appropriate register before the end of the required period of time. The Pension Fund together with the insured person receives the message.

- The citizen is also informed if the final decision is negative. The agreement with the NPF remains valid, the register is not subject to any adjustments.

How to apply for a pension through government services: procedure and conditions for registration

To do this, in the “State Services”, in the applicant’s personal account, select, which is provided by the Pension Fund. When you click the “Get service” button, an application in the form of a questionnaire will appear on the screen. Basic data (full name, passport, date of birth, SNILS, address, citizenship) will already be indicated. It is necessary to check their correctness.

We recommend reading: What salary to include in a certificate for assigning a pension

The responsibility for collecting the required papers for assigning a pension falls entirely on the shoulders of the applicant. It is he who must, before contacting a government agency, independently collect all the documents required by law.

Obligation of NPFs to transfer savings back to the Pension Fund

After completion of the procedure, the previous contract with the NPF is considered to be terminated. The organization must decide on the transfer of money before March 31 of the year following the time of application. A maximum of a month after signing the agreement, the Pension Fund itself transfers the savings to the management company.

Here the main regulatory document is No. 75-FZ. It also describes other cases when the transfer of money is carried out by a non-state pension fund without fail, even without an application from a citizen:

- The arbitration court declared the fund bankrupt and began bankruptcy proceedings regarding the organization.

- Termination of the contract for mandatory pension protection, which is associated with a court hearing and a corresponding decision.

- The Pension Fund receives a notification about the refusal of savings by the citizen.

- The owner of the money passed away.

- Revocation of license for financial transactions.

In case of illegal activities

In the country, non-state pension funds have recently begun to actively expand their service network. Organizations invite special agents who persuade them to send money to one or another organization.

Often citizens who have no rights to commit such actions work this way. This led to the fact that the same person entered into an agreement with several funds at once. Often the transfer of money itself is carried out without consent and legal grounds. Then the first step is to draw up a claim in writing.

Attention! If violations are detected, citizens are held administratively liable and fines are issued.

Legislative framework for the transition

| Legislative act | Content |

| Law No. 75-FZ 05/07/1998 | “On non-state pension funds” |

| Law No. 111-FZ of July 24, 2002 | “On investing funds to finance the funded part of a labor pension in the Russian Federation” |

| Law No. 167-FZ of December 15, 2001 | “On compulsory pension insurance in the Russian Federation” |

| Law No. 422-FZ of December 28, 2013 | “On guaranteeing the rights of insured persons in the compulsory pension insurance system” |

Accumulations of the deceased: features of payments

If the account holder dies, his next of kin can apply to receive the remaining funds. You must visit the Pension Fund branch at your place of registration. The documentation package for applying in this case consists of the following items:

- Information about the bank details of the legal successor.

- SNILS.

- Death certificate of a relative who participated in the insurance.

- A document confirming the degree of relationship between the participants in the procedure.

- Identification.

Important! If successors miss the deadlines established by law, they must go to court. The important thing here is to prove that there was a good reason for this. The final decision of the institution is transferred to the pension fund.

The fund's staff will help you draw up an application so that there are no mistakes. The decision must be made on the seventh month following the death of the citizen. Payments are made for the 8th month, if after submitting the documents the decision is positive.

Only in a few cases can private and public companies refuse to be considered. Then the money remains as a reserve with the Pension Fund.

Features of using the State Services portal

One of the ways to authorize a user on the State Services website is an electronic signature (ES). With its help, you can log into your personal account and order electronic services. According to their type, accounts are:

- Simple. The signature is assigned immediately after registration on the portal.

- Unskilled. To obtain this electronic signature, you must contact a specialist at the Multifunctional Center (MFC) or by post, providing your passport and SNILS. After verifying the data, a special password is issued.

- Qualified. The enhanced electronic signature is provided on a flash drive. You need to contact the Management Center at your place of residence. When visiting, you must have your passport with you. There are different numbers of tariffs, but to use electronic signature on the State Services website you can apply for the minimum one. Along with the media, you must pick up the software that needs to be installed on your computer. The flash drive is inserted into the USB connector, and the “Login by electronic means” subsection is selected on the portal.

ES is a special cipher used to confirm the authenticity of a document.

The signature is valid for one year. After this period, it must be extended.

To do this, purchase a new key or certificate. The cost starts from 700 rubles and depends on the conditions included in the contract.

conclusions

It is recommended to contact financial specialists who provide individual consultations. They will calculate to what extent changing the management company would be advisable in a given case. Any citizen can choose an insurer whose conditions suit the current situation and financial needs. The main thing is to submit applications before December 31, so that the final decision is made no later than March-April next year. Then the transfer of savings will be completed, and the citizen will be informed about the level of possible income.

How to write an application to inherit the funded part of a pension through State Services

The deadline for making a decision on a specific case is 10 working days from the date of submission of the application. However, there are situations where the pension specialist may suspend the review due to pending verification of documents.

An electronic service for assigning pensions, including funded pensions, was available before. It was necessary to tick a box in the application for a pension. But, if a citizen needed to write an application for a one-time or urgent payment of pension savings, he had to apply in person or send a notarized application by mail.

When is the transfer performed?

After submitting the application and other documentation, you need to wait for a decision from the PF representatives. The transfer process is completed until March 31 of the following year. Citizens are informed about the decision made within one month. A positive decision is not always made on such applications, since there are some valid reasons why PF representatives refuse a transfer.

When the application is approved, the citizen’s pension savings are transferred to the Pension Fund account.

NPFs are required to transfer funds under the following conditions:

- if there is a court decision on the basis of which the fund is declared bankrupt;

- a person refuses pension savings, for which he transmits a corresponding request to PF employees;

- the agreement drawn up between the citizen and the NPF is declared invalid;

- the owner of the savings dies.

If the initiator of termination of the contract is the management of the fund, then the insured person is notified of this decision in writing. Additionally, the citizen is given a personal account statement containing information about accumulated funds and their transfer to the Pension Fund account.