About the non-state pension fund

There are a large number of non-state pension funds operating on the territory of the Russian Federation.

But what is it and how much can you trust this organization? An organization that is not commercial, its action is aimed only at preserving and increasing the pension contributions of citizens during the period of their working activity - this is a non-state pension fund.

The existence and activities of the organization are regulated by current legislation. By concluding an agreement, everyone can be sure that at any time they will be able to check their account and monitor the effectiveness of their money management. Information in full is available on the official Internet resource of the NPF. Activities are under constant control of the relevant services:

- tax service;

- financial markets services;

- Russian Pension Fund;

- Accounts Chamber of the Russian Federation.

In addition to savings, non-governmental organizations offer their clients additional services:

- If an accident occurs and a client of the Fund dies, then relatives or trusted persons will be able to receive his savings. Anyone named in the will.

- Funds accumulating in the organization's account are not subject to withdrawal in the event of seizure of property.

- There is a possibility of increasing the savings portion. This is done personally by the client by transferring additional funds. You can deduct an additional amount from your salary. This is done through the accounting department of the enterprise where the client is registered.

The opinion of experts is that non-state funds are much more reliable than commercial banks. Unlike financial institutions, these organizations, in the event of bankruptcy, do not lose customer deposits and honestly transfer them to the appropriate accounts of citizens in the Pension Fund.

"Safmar" pension fund: personal account, registration

Registration in your personal account on the official website of NPF Safmar is available only to its clients with a SNILS certificate.

When signing documents, fund employees issue a login and password for the Safmar personal account.

Also in the personal account of NPF Safmar there is a registration form, which requires entering a SNILS number, email address, and mobile phone number.

Attention! Registration in the personal account of the Safmar PF is absolutely useless for those who have not previously entered into an agreement with the fund.

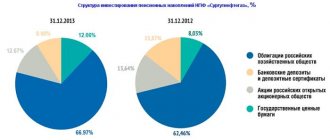

Profitability of NPF “Safmar”

One of the indicators that is looked at when choosing a non-state fund is the profitability of the organization.

The profitability indicators of JSC NPF Safmar are low, at the level of 8.87% (according to the first half of 2021). At the same time, experts assess the stability of the increase in pension savings. Cooperation with the company will not bring big profits. The increase in deposits does not occur quickly, but the process is marked by reliability and stability. This is exactly what future Russian pensioners need.

Fund hotline number

For all questions, you can contact the hotline: 8-800-700-80-20 and +7 (495) 777 9989. A call center specialist will promptly advise on pension issues. Calls are accepted every day from 8.00 to 20.00.

In general, NPF Safmar is one of those organizations that you can trust with your pension savings. The fund's profitability changes depending on the situation on the financial market, but this does not change the overall positive trend in its development.

If you want to invest in something other than the top non-state pension funds in our country, you should pay attention to the fund considered.

(

72 ratings, average: 2.64 out of 5)

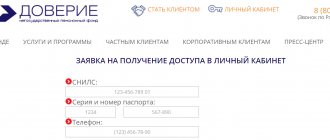

Personal account: login, registration and opportunities

Only clients who have entered into an agreement for the provision of services with the company have the right to use the “personal account” service. This removes the need for registration. To enter the page you must enter your login and password. This information is provided by bank employees when signing documents.

If you lose your login data, you can restore it yourself. Click “forgot your password?” and in the window that opens, indicate the email address reflected in the contract. An email is sent to you containing a link to restore your login to your personal account.

If the mail was not specified when concluding the agreement, it can be provided at any bank branch. Changing the password is possible on the client page service.

The personal account of the Safmara pension fund has the following advantages:

- The status of accounts with pension savings is always available;

- information about actions with funds is reflected;

- changing and supplementing the client’s personal data;

- direct connection with the fund's support service;

- create a statement of your account;

- subscribe to notifications.

NPF Safmar offices are opening in all major cities of the country.

What opportunities does a personal account provide on the website of NPF Safmar?

Many special functions are available to clients of the European Pension Fund NPF through their personal account. And although they do not receive them immediately, but only some time after the conclusion of the contract, they completely cover the long wait.

First of all, you can use the following functions of your online account:

- Opportunity to get acquainted with all the details regarding the number and date from the moment of conclusion of the contract on compulsory pension insurance or non-state pension provision.

- The ability to constantly monitor the state of your pension account, savings, and accumulated interest on income.

- Creation of a special statement about the state of a personal pension account for a certain period (for a current year, a contract period or a clearly defined period of time).

- Control and analysis of the effectiveness of all personal data that was specified on the site, as well as the opportunity to leave a special request to change it.

- Issuing a special notice to the current insured person, which must be provided in accordance with the current legislation of the Russian Federation.

- Changing the password for your personal profile, changing your email address or adding it.

- Setting up notifications to your email address (consistency and information content).

How to receive the funded part of your pension

Since 2002, a pension reform has been in effect in the Russian Federation, according to which pensions were divided into three parts. One of the parts equal to 2% is called cumulative . Stored in NPF accounts.

Over a certain period of time, the amount of deductions accumulates and multiplies thanks to the trust management service provided.

The right to receive the funded portion arises when a person reaches retirement age. To do this, just contact the NPF and provide the necessary documents:

- copy of the passport. All pages are provided, including registration. Documents must be certified by the signature of the owner;

- certificate of individual insurance (green plastic card);

- pensioner's certificate;

- application for money.

Next, the information is reviewed and a decision is made. Then, a monthly transfer or transfer of the entire amount of savings is made to the current account specified in the application. If a person does not live to see the payment, then the heirs can receive the funded portion by attaching a death certificate to the specified documents.

Payment of savings can take place in several ways:

- monthly payment to the current account;

- one-time payment of money.

The application must be written in person.

Rules for submitting applications to NPF Safmar

All the features of submitting applications can be found on the official website of the fund in one of the menu sections - “Submit an application”.

Depending on what exactly the client needs (appointment of pension payments, notification of changes in personal data, etc.), a package of documents must first be prepared. What exactly should be included in it can be found in the corresponding lists (there are 14 of them).

Applications can be submitted in person or through a legal representative. There are several ways to submit:

- by mail (the authenticity of the documents must be confirmed by a notary);

- in the fund's offices;

- through partners, at Raiffeisenbank branches (pre-submission of an electronic application is required).

If we are talking about assigning payments, then after accepting and reviewing the documents, a written response is sent to the client by email. If the paperwork is completed correctly, no later than a month after the decision is made, it will be possible to receive the first amount of funds.

“Pension in one click” from Safmar

The project will be launched on June 4, 2021. Every citizen of the Russian Federation has the opportunity to independently conclude a contract for non-state pension savings on the website https://www.npfsafmar.ru/financier/. By going to the Fund’s portal, you can fill out an agreement form for opening and replenishing an account.

The minimum amount that needs to be deposited is 2000 rubles. Minimum replenishment is 1 thousand rubles. The client decides how often to deposit money into the account.

Access to the service is open not only to current clients of the Fund. For those who are just thinking and choosing, “Pension in one click” is also available. All you have to do is enter your data on the company’s website, and then everything happens automatically. The contract already arrives completed, the client only has to agree and confirm. The procedure takes a few minutes.

When making contributions to a non-state pension fund, a person has the right to a tax deduction.

Also read information about auto cards;

3 pros and cons of an Individual Investment Account are discussed hereCredit holidays in Sberbank: https://cowcash.ru/credits/otsrochka-platezha-po-kreditu-v-sberbanke.html

Reliability rating of NPF Safmar

The Central Bank of the Russian Federation summed up the results of the activities of the Safmar fund as of the second quarter of 2021. Among 66 participants, the fund took worthy places, which demonstrates the reliability of the financial organization:

- first place among the top non-state pension funds (criterion - the size of the average compulsory pension account);

- fifth place in total savings;

- sixth place in terms of number of clients served.

Thus, the fund shows serious results, which indicate confidence in it. According to expert assessment, the organization’s financial reliability rating is the highest – A++.

This fact suggests that the fund will not close overnight, and you can trust it with your pension savings. For potential clients, such information is important because it allows them to decide whether it is worth concluding a pension agreement.