History of NPF Electric Power Industry

The non-state pension fund of the Electric Power Industry was initially established by a large number of private companies, mostly generating and supplying electrical energy. The fund had high returns and enjoyed the trust of the population.

But changing legislation and current realities have necessitated the consolidation of pre-existing funds and, as a consequence, a decrease in their number.

Reorganization

In 2021, NPF Electric Power Industry was reorganized by merging, together with NPF RGS, into NPF LUKOIL-GARANT, which was soon renamed NPF Otkritie. As a result of this reorganization, one of the largest funds in the country appeared, with a history of activity in this area dating back to 1994.

Otkritie Foundation programs

NPF offers 2 programs for the formation of future pension payments:

- The funded part of the insurance pension (although currently no contributions are being made and the fate of this type of security remains unknown).

- Formation of a non-state pension, which depends on the amount of voluntary contributions of a citizen under a direct agreement between him and NPF Otkritie.

In essence, this is the full range of pension insurance programs that funds can offer under current legislation. Some NPFs have already moved to the formation of an individual pension plan , which, in essence, is just a non-state pension.

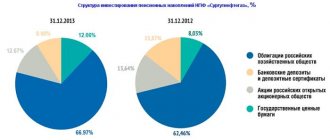

Main indicators of the fund's economic investment policy

- The yield for 2021 is 9.36% per year,

- On average, profitability since 2009 has been at around 8%,

- More than 1.2 million people are insured;

- Over the years, the fund has accumulated a return of 152.73%. per annum.

- The volume of the NPF's own property amounted to 144.1 billion rubles.

- Total pension assets at the end of the year exceeded 138 billion rubles, of which 92.8 billion rubles. – these are pension savings and another 45.3 billion rubles. accounts for reserves.

- The total volume of pension payments in 2021 amounted to 5.3 billion rubles.

The figures presented above make us wonder: does it make sense to transfer the funded part of the pension to non-state funds, while paying the company a certain percentage for managing the account, if its profitability is much less than what we could receive by default? We answer - it makes sense if you are counting on the long term and participate in modern pension insurance programs.

At the moment, the company’s proposed income exceeds the official inflation that operates in Russia. You can view the list of the most profitable funds in our country at this link.

How to transfer funds to this NPF

The procedure for transferring funds to this fund is general. To do this, it is necessary to conclude an agreement for managing the funded part of the pension with NPF Otkritie at the fund’s office or representative office. Then notify the Pension Fund of the Russian Federation about the transfer of savings to this company by filling out the appropriate application and attaching the necessary documents: a copy of the agreement with NPF Otkritie, a copy of the identity card.

Attention! If the savings were managed by the previous company for less than 5 years, there is a risk of losing part of the funds, since the state does not guarantee their preservation in the event of negative returns. If at least 5 years have passed, then all savings, including investment income, will be transferred under the management of the Otkritie fund in full.

Official website of the fund

Although the law does not oblige non-state funds to have official websites and provide depositors and insured persons with the opportunity to use personal accounts on it, the new time - the age of information technology - is forcing this to happen.

Due to the fact that the non-state pension fund of the Electric Power Industry was reorganized, clients can obtain information on the website of the Otkritie fund.

Personal Area

Like other non-state pension funds, Otkritie provides its clients with the opportunity to use a personal account on the company’s official website in order to be able not only to receive prompt and up-to-date information, but also to manage their savings.

In fact, a personal account is provided to each fund investor immediately after concluding an agreement on the formation of a funded pension or non-state voluntary provision. However, you will still have to go through formal registration to gain access to your personal account.

Registering an account on the site

To enter your personal account, it is not necessary to register; you can log in using your account on the government services portal in electronic form. This can be done if you have an account that has passed the verification procedure (confirming the identity of the owner). If there is none or the citizen simply does not want to use it, then you can go through the registration procedure, which will not take much time.

Registration of a personal account is carried out in several short steps:

- On the main page of the official website, select “Personal Account” in the upper right corner.

- On the login page at the very bottom, select “Register”.

- Select the registration method (using pension insurance certificate data or passport data).

- Enter the document data (SNILS or series, number and date of issue of the civil passport).

- Indicate your date of birth.

- The system will check the presence of the entered data in the system.

- Create and specify a username and password for your account for subsequent logins.

If you have a registered account, you can log in on the Personal Account page by entering your login and password. In this case, the login can be the insurance number of an individual personal account.

Online calculator

Another convenient service offered by the official website of NPF Otkritie is an online calculator that allows you to calculate the size of your future pension or, conversely, calculate an individual savings program based on the desired amount of your future pension.

The calculator itself is located on the main page of the site, you can find it by scrolling the page a little using vertical scrolling.

To calculate the total monthly amount you must indicate:

- citizen's gender;

- date of birth;

- the amount of wages or other income from which insurance premiums are paid, as of the current date for 1 calendar month (the amount is indicated before withholding personal income tax; more than 100 thousand rubles cannot be indicated, since the annual amount subject to contributions is limited 1,150 thousand rubles);

- the amount of the planned monthly contribution to the formation of a non-state pension (not to be confused with the funded part of the compulsory insurance pension);

- profitability of investing funds from pension reserves.

After specifying the requested information, the total amount of future pension provision will be displayed on the right side, and the amount of funded and non-state pensions will also be indicated separately.

Important! The calculator is for informational purposes only and allows for very rough calculations. The NPF Otkrytie calculator takes into account average indicators, be it the level of profitability of 7.24%, the start of working life at the age of 18, or the period of “freezing” contributions to the funded pension until 2021 (although it is not known for certain whether it will extend in the future and not Will such fees be abolished altogether?

Registration of a personal account

Persons who have entered into an agreement with NPF Elektroenergetiki can register a personal account on the Otkritie Fund website. To do this you will need to perform the following steps:

- go to the fund’s website https://open-npf.ru;

- click on the inscription “Personal Account” in its header;

- on the authorization page, click on the “Register” link;

- choose a registration method - by SNILS number or passport details;

- enter the data of the selected document in the upper fields of the form;

- set your date of birth;

- Click on the “Register” button.

By the way! Direct link to the registration page – https://lk.open-npf.ru/register/.

After the steps described above, a confirmation code will be sent to the phone number specified in the agreement signed by the user with the NPF. It will need to be entered into the field that appears on the screen, and the process of creating a personal account will be completed.

Possible difficulties and errors

During the registration process, the NPF client may see the message “Your data was not found in the system.” This usually happens when document data is entered incorrectly or there is an error in setting the date of birth in the registration form. It is worth checking that all fields are filled out correctly and, if necessary, refilling them again.

If the error continues to appear, the client can contact the NPF support service for help by calling 8-800-775-77-44. You will need to call the same number if you lose access to a cell phone, the number of which was specified in the agreement with NPF Electric Power Industry.

Reviews about NPF Elektroenergetiki

Initially, I used the services of NPF Elektroenergetika and was very pleased: a good level of profitability, an intuitive interface for my personal account, a transparent system for investing funds. Afterwards, he was automatically transferred to NPF Otkritie (with intermediate stages), and was struck by the negative level of profitability from managing pension reserves. I have decided not to switch for now, since the previous level of profitability, government participation and the number of investors inspire hope for a bright future.

Sergey, 37 years old

Of course, I cannot help but be upset by the fact that in 2021 the size of my savings did not increase due to the ineffectiveness, apparently, of its use. But I am a long-time investor in Garant-Lukoil, which is now called Otkritie, and I know that the average growth rate of pension savings is at least 7% per year, which is generally above average. Otherwise, I am satisfied with the fund’s activities, I trust it and plan to increase the amount of contributions to non-state pensions.

Natalya, 39 years old

I chose the Otkritie fund based on information on the Internet; its performance is one of the best among all other companies in this field. I registered a personal account, very convenient, comfortable feedback. So far there are no complaints, I will continue to look at the results of managing my savings.

Svyatoslav, 29 years old

Reviews from insured persons

Before transferring his own savings to a non-state pension fund, the client must study not only the main characteristics of the fund, which are described in the first chapter, but also the opinions of existing clients on the work of the specified non-state pension fund. Therefore, below we will highlight positive and negative information about NPF Electric Power Industry.

Advantages of the fund , according to clients:

- High trust level indicators - AAA.

- Long period of work in the pension market.

- The profitability is 2 times higher than in VEB.

- Transparency and stability of the fund's activities.

Disadvantages of NPF:

- Slow speed of staff.

- Pension payments are made with a delay.

- Mandatory signing of a contract when applying for employment in an energy company.

- The agreement can be signed by persons no older than 44 years of age.

We recommend watching the mini presentation:

To summarize, it is worth noting that, despite a number of negative reviews, NPF Electric Power Industry is one of the most promising and stable funds among other NPFs. Therefore, persons who read this material and decided to transfer their accumulated funds to the specified NPF will not lose their pension savings.