Learning information about the size of your future pension

If a citizen works officially, the employer pays 22% of his earnings to the Pension Fund. But they are not deducted from it, since they have nothing to do with the 13% VAT. 22% is compensated by the company where the person works. Until 2014, this 22% was divided in a ratio of 16 and 6% between the parts of the pension: insurance and funded. Now that the “savings” part is frozen, all 22% of contributions are transferred to pension insurance.

The person's future pension is formed from the transfers paid by the employer. In connection with the new reforms, it became clear that the primary task of every officially working person is to earn as much as possible. The amount of future pension provision for each citizen directly depends on the amount of income.

Organizations holding information on pension savings

For the working population of the country, money is automatically deducted from each salary to the pension fund, which will add up to the total amount after the transition to a well-deserved rest. It should be taken into account that such contributions are divided into two main parts - insurance and funded pension. In the second case, you can independently select the desired non-governmental organization, in whose accounts an accumulation of 6 percent of official earnings will be deposited. Everything else goes to the Pension Fund. This division contributes to an increase in the standard amount of payments to pensioners.

All deductions from official income are controlled by government agencies and, by default, are transferred to the required account of the responsible organization. You can change the non-state fund at your discretion, but situations of confusion may arise. A citizen may forget where his savings are. To prevent a similar situation from recurring, it is recommended to periodically check the information about the holder of your income accruals. Such issues are dealt with by authorized agencies, which can provide up-to-date information and statistics for a specific user free of charge. These include:

- Regional centers of the pension fund of the Russian Federation. Accurate information is contained in the organization’s file for each person. The staff will take your application and provide the necessary information.

- If they are officially established, then the accounting department of the company or enterprise should contain such information, and it is not confidential and every employee can request it.

- Banking organizations. There is a list of financial companies and banks for which data on pension savings is freely available. It is enough to submit a request for a certificate.

- Internet resources, among which the unified portal of public services occupies a special place.

Such departments have the information you need and should provide it upon your first request.

How to find out your pension amount

The question of future payments from the moment a person retires is relevant for most citizens. In order to get an answer to this, an Internet user can use several options:

- PFR website, personal account.

- Using a retirement calculator.

- Website Gosuslugi.ru.

The amount of pension provision in the PFR personal account is found out if the user registers. It is simple and standard. Citizen identification data is entered:

- FULL NAME.;

- contact number;

- E-mail address.

After entering the data, the system will prompt you to enter an individual code. It arrives at the specified mobile phone number. After specifying the code, the new user's account is activated.

After activation, the system will request the person’s passport data, as well as their SNILS number. Information transmitted remotely is verified. Two days are allotted for checking SNILS. After this, a message will be sent to the email address specified during registration. After activating the letter, the user can log in to his personal account.

The amount of the assigned pension is available in the tab called “individual personal account”. The user is presented with a website page on which he can obtain information about his work experience and points (accumulated). Taking them into account, pension provision is currently calculated.

An alternative way is through the Pension Fund website

If you have a confirmed account on the State Services portal, you can obtain an extract on the official website of the Pension Fund. The instructions include just three simple steps.

- Open the official website of the Pension Fund of Russia and click on the link Citizen’s Personal Account. At the very top there is a Login link - click on it and log in with your State Services account (USIA - Unified System of Identification and Authentication).

- A list of all electronic services of the Pension Fund will appear on the screen. Find the Order a certificate service in it - follow the link.

- Submit your request by clicking the Request button. If necessary, duplicate the statement by email by checking the box - the document will be sent to the email address specified in your profile.

After 1-2 minutes, the ordered document will appear on the screen. It will also be displayed in the Request History section. Read the certificate - information on the amount of savings in the Pension Fund is indicated in the first table.

Owners of smartphones and tablets can find out the amount of their personal fund using the State Services and Pension Fund mobile applications. Authorization in the Pension Fund of Russia application is carried out with an account on the State Services portal.

Please note that you will need a verified account to log into the official Pension Fund website and mobile application. Confirm it in one of the following ways:

- At Service Centers - these include MFCs, branches of the Pension Fund, company offices, commercial banks, city administrations and branches of the State Traffic Safety Inspectorate. The full list of centers is published in the Service Centers section on the State Services portal.

- Through online banking of Post Bank, Tinkoff Bank and Sberbank. Search your bank's online banking for a service to create or confirm an account - the confirmation procedure is free.

- Through a registered letter - order its sending in your personal account on the State Services portal. The received letter contains a confirmation code - enter it in your personal account.

Choose any available method and get full access to government services of the Pension Fund.

It often happens that citizens have no idea where the employer is transferring their future pension. To see how things are going with pension savings and where they are, future pensioners will be interested in how to find out which pension fund they are in through State Services. Many people were transferred to non-state pension funds and their transfers, designed to ensure a comfortable old age, are located unknown where.

We use a special calculator

It first started working in 2015. It's easy to use. His work is based on the postulate: the more money a person has earned in his life (meaning official income), the more he will receive in his well-deserved retirement.

A pension calculator is a service that takes into account the following indicators:

- Service in the RF Armed Forces;

- army;

- Holiday to care for the child.

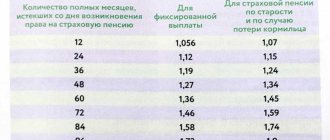

According to the new reform, the more a person works and does not retire, the larger the amount he has the right to claim.

To forecast the amount of payments, you need to visit the official PFR website. It is located at: https://www.pfrf.ru. On its main page, users are invited to familiarize themselves with current and current changes relating to pension legislation in the Russian Federation. On this same page, anyone can use a special option called “Pension Calculator”.

The advantage of using the Pension Calculator is that you do not have to register to use it. Just go to the Pension Fund website and use a calculator to make the necessary calculations. Identity verification is also not required.

To use this option you must enter the following information:

- floor;

- year of birth;

- number of years spent on aircraft;

- maternity leave;

- years of work;

- the amount of earnings received.

To correctly calculate future payments, the user must provide additional information:

- The number of years that will be spent caring for a relative (disabled people, people over 80 years old), without officially working.

- How the person’s labor activity is carried out, in what status: self-employed. Individual entrepreneur, hired labor.

Information must be entered in the appropriate fields of the request. After this, the user will see the amount of future payments and the total length of service. If desired, you can obtain detailed information regarding the nuances and procedure for the formation of savings that will be paid to a person when he retires.

How do I find out which NPF I am a member of?

You can find out the name of the non-state pension fund to which the funded part of the pension is transferred in different ways. You can even get the information you need via the Internet.

Personal appeal

Methods of obtaining information can be divided into 2 types: those in which you need to personally visit any institution, and those where everything is done via the Internet. For example, you can contact a non-state pension fund, where, as you assume, your pension savings are located . To find out which fund you are in, take your identification document with you so that the fund staff can provide you with the necessary information.

At the place of work

You can determine in which NPF your pension funds are stored in the accounting department of the company where you are employed. The accounting employee who is responsible for paying taxes will provide you with information about the organization in which you are registered.

In the bank

It is possible to obtain information about your own pension by visiting a banking organization that is a partner of the Pension Fund of the Russian Federation in the OPS.

Currently in the Russian Federation only 4 banks correspond to this description:

- Gazprombank;

- "Sberbank";

- "UralSib";

- "VTB Bank of Moscow".

To obtain the necessary information, you will need to bring an identification document with you.

To the Pension Fund

You need to visit the Pension Fund office located at your registered address and submit an application. You must take with you a Russian passport or a document that replaces it. Also take your SNILS number with you (if available). Pension Fund employees will determine from the database where your pension is stored and provide the necessary information within ten days.

Online services

You can determine which NPF you are attached to through the official PFR website. To do this, go to the Pension Fund website, log in to your personal account and submit an application through the online reception. The answer will be sent to you by email within a month.

You can also go to the website of the NPF where your pension is supposedly stored and submit an application through it. The disadvantage of this method is that you will not be able to submit applications to all NPFs, so it is easier to immediately use the PFR Internet reception.

Through government services

Currently, the most convenient method is to use the government services website. User requests for information are processed in a couple of minutes. In addition, the government services website is accessible at any time.

To find out which NPF you are a member of through the government services website, use the following algorithm:

- Go to the government services website to create an account (if you don't already have one).

- Choose a method of identity verification that suits you (a special activation code can be obtained both at the branch and through the postal service). If you receive a code via mail, the procedure may take up to a month.

- Enter your personal information in the form.

- Once you receive the activation code, enter it in the appropriate field and confirm the procedure.

- Log in to your account, go to the “Electronic Services” section.

- Find the item “Pension Fund of the Russian Federation”, click on it.

- Click on the button “Informing insured persons about the status of their individual personal accounts in the unified system of compulsory pension insurance.”

- Click on the “Get service” button. The required data will be shown to you within 2 minutes.

The service is provided completely free of charge, no state fee is required.

Using SNILS

SNILS will be useful to you if you plan to obtain information about your pension through a personal visit to the Pension Fund, Non-State Pension Fund or bank. It is presented together with an identification document.

SNILS is also needed for authorization on the website of government services and the Internet portal of the Pension Fund of Russia. In addition, using SNILS you can check the status of your individual personal account (IPA).

To do this, follow this algorithm:

- Go to the FIU website.

- Go to the “Citizen’s Personal Account” section.

- Find the “Get information about generated pension rights” button in the “Formation of pension rights” subsection. Click on it.

- Now you need to log in to the government services website. If you are already registered there, indicate your SNILS and password. You can also use your e-mail address to log in instead of SNILS. If you are not registered on the government services website, create an account on it.

- Your work history will be shown in your personal account. You can submit a request to receive the information you need by clicking on the button “Information about experience and income reflected on the ILS.”

- You will see information regarding periods of employment, employers, and the amount of pension savings. If you require an extract, click on the “Get information about the status of the HUD” button. The system will immediately create a doc file that can be saved and printed.

- Another additional option is the calculation of future labor pension. Click on the “Calculate future labor pension” button to see how many pension points (PB) you have been accrued.

Some websites offer users to instantly find out their own NPF using SNILS or passport data. They require you to provide details of documents that can later be used by them for fraud.

Another type of scam is charging money for a service. The website offers you to log in by sending an SMS to a specific phone number. Of course, after this the funds will be debited from the user’s balance. You cannot use such sites.

When changing NPF, you must remember the conditions in force since 2015 for insured citizens. So, you can transfer from one NPF to another maximum once every 12 months. To maintain investment income, it is advisable to change NPFs maximum once every 5 years. This way you can get the maximum profit from investing your employers’ contributions by the NPF.

To receive a pension and transfer it to another fund, you need to enter into an agreement with the new NPF. After this, submit an application to the old fund, attaching your passport to it. You will be transferred to the new fund after March 31 of the following year.

It also happens that a non-state pension fund is liquidated. In this case, the citizens’ money stored in it is transferred to the Pension Fund of the Russian Federation within a period not exceeding 90 days from the date of the start of the liquidation process of the organization.

Website Gosuslugi.ru

This is a large Internet portal that allows you to obtain information and make a request to receive legally significant services from the state.

In order to become a user of the site, you must register. The person’s identification data, as well as his documents, are entered. The system asks for the passport number and series, the date and place of issue. In addition, SNILS and its details are checked. If desired, the user can enter the children’s data, their documents: passport, birth certificate.

To find out the amount of pension benefits, you need to open the “Service Catalog” section. You need to scroll through the entire catalog of services and follow the link. In the “Pension, benefits” section you need to select. The user clicks on the “Get service” button.

On the page that opens, the person enters data:

- passport information;

- date of birth;

- SNILS number.

The user submits a request. The system informs him that he needs to wait for a response via email. He entered his email address when registering on the Gosuslugi.ru portal. The dynamics of an existing request are reflected in your Personal Account. If the application needs to be copied, it can be saved there. Or forward it to your mailbox.

Ways to find your pension fund

If an agreement with a commercial fund is not found, you can use one of the methods to search for it yourself:

- In the regional branch of the Pension Fund . When applying, you will need a passport and SNILS.

- At the employer . Since the accounting department makes contributions to the pension fund for all employees, they have information about exactly where the funds go.

- On the government services portal . The most convenient way to find out your pension fund, since you don’t need to leave your home to do this.

- In PFR partner banks. He has several partners, so you can call them and find out your pension fund using SNILS.

Choose the most convenient and optimal option for finding your PF branch.

Through the government services portal

The easiest way to find out the name of a pension fund is remotely. Through the government services website you can see not only the name, but also the accumulated funds. But the information is available only to registered users. Therefore, if you do not yet have a personal account for public services, then first you will have to go through the registration process.

- NPF "Future" - personal account, receive the funded part of your pension

To find out the name of your NPF:

- Log in to your personal account on the government services website.

- Select the pensions section in the services menu.

- Specify the account status notification service.

- Click to receive the service.

Within a few minutes you will be sent a file with a report on the necessary data. In addition to your account status, on the government services website you can find out your length of service and the number of points earned. The report will also contain information about which NPF your funds are stored in. If you are an individual entrepreneur, you can find out information about your non-state pension fund on the tax website. For this you need a TIN.

In PF partner banks

To find out which pension fund is yours, you can contact one of the banks that cooperate with the Pension Fund of the Russian Federation.

At the moment there are four such banks:

- Gazprombank;

- Sberbank;

- Uralsib;

- VTB Bank of Moscow.

You can obtain the necessary information by contacting one of the branches of these banks in person or via e-mail if you send a request in advance. In order for employees to provide the necessary information, you will need to present your passport and SNILS.

At the employer's

You can also find out which pension fund your savings are in from your employer. The accounting department handles deductions for each insured employee. Therefore, you can contact an accountant and request information on all transfers and pension savings.

The accountant will also provide information on the pension fund where the money is stored. The search for such information is explained by the fact that some employers transferred the funded part of the pension to commercial funds and did not notify employees about this. Or they gave documents to their employees to sign, but they did not bother to pick up or save their copy of the agreement. Therefore, many employees try to find out information about non-state pension funds through their employer.

In the PF department

You can submit a request to receive information about which pension fund you are a member of by contacting the Pension Fund office in person. You must have with you:

- passport;

- insurance certificate.

In this case, you will need to draw up an application for the provision of data together with an employee of the Pension Fund. The response to the request will be sent by mail. The period for receiving data is up to 10 working days.

- How to write an application to inherit the funded part of a pension through State Services

You will not be able to find out this information over the phone or submit a request for it. If you want to save time, you can submit a request on the official website of the Pension Fund. If you do not have a personal account, then register and log in. The service of submitting a request remotely is available in your personal account.