The minimum pension in Russia is not defined in uniform monetary terms. The main indicator that influences it is the cost of living, and its value is set separately for each region. This article is about what is the average amount of support for a Russian pensioner and how to calculate it.

- Average Russian pension

- Minimum old-age pension in Russia

- Largest pension amount

- Pension calculator

- Additional payments to pensions

- Pension changes in 2021

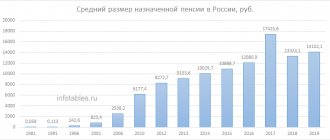

Average Russian pension

According to the pension fund, the average Russian pension due to a citizen by age in 2015 is about 13,900 rubles. As analysts have calculated, this amount corresponds to 40% of the average salary in Russia. Social pension, on average, is close to the amount of 8,300 rubles. Disabled children receiving a pension due to their disability currently have 8,790 rubles. The average pension for citizens who were injured in military service, resulting in them becoming disabled, is 30,700 rubles.

It would not be amiss to note that among the countries of the former Soviet Union, Russian pensioners are the wealthiest. In terms of pension provision, only the Baltic states can compare with Russia. However, in the Baltic region the cost of utilities for pensioners is significantly higher than for Russian pensioners. High utility costs significantly reduce the income of Baltic pensioners.

Analysis of pension policy makes it possible to make a comforting forecast regarding the reduction of the crisis in this area of financial relations. The policy pursued by the Russian Government, which provides for the indexation of pensions twice a year in February and April, makes it possible to effectively combat inflation of pension payments.

How are social benefits calculated?

To calculate the amount of this type of social payment, many different points and parameters are used. Each of them directly affects the level and size of the final amount.

Office management specialists assure that the following data is required to calculate pension payments:

- employee experience;

- the size of his average salary;

- presence of any awards, medals and other significant documents;

- regional coefficients, for example, for living and organizing work in difficult conditions (in such cases they often talk about those who work in the north or in other hard-to-reach areas).

All this data taken together allows us to determine the amount. And you should pay very close attention to all these calculations in order to understand what kind of money you will receive during your well-deserved retirement.

What is social payment

Those who do not have enough experience (the current standard in Russia is at least 5 years, but they want to increase it to 15), or have no experience at all for various reasons, are assigned a social pension. Naturally, it is several times less than labor. But even at the same time it can be different in amount. And many are extremely concerned about the question: what will the minimum social pension in Russia be like in 2021?

Related news:

- Monthly calculation indicator for 2021 in Kazakhstan

- Taxes for 2021 in Kazakhstan

- Average salary in Kazakhstan in 2021

- Taxes for individual entrepreneurs in Kazakhstan 2021

- Holiday calendar in Kazakhstan 2020-2021

- Public holidays in Kazakhstan in 2021

A social pension is a type of payment that is provided for citizens who have not received the necessary length of service to receive an old-age payment. And there can be quite a few reasons for this:

- the person has never worked officially;

- the person receiving the payment is disabled;

- who has lost his breadwinner and has not yet reached the age of 18 years.

The social pension is a kind of support from the state. However, it is worth understanding that if a person, being able-bodied, has not worked officially in his entire life and has not made contributions to the budget, he cannot count on any global payments. The state will not support the dependent. Today the minimum amount of such a pension is 3,626 rubles. It is planned that next year this amount will be increased by 5.5%. Although there is a fairly high chance that there will be no increase in principle, because... There is a crisis in the country and there is simply nowhere to get money for some kind of global indexation.

Minimum old-age pension in Russia

Approaching retirement age, a citizen begins to show interest in the amount of his expected pension. Let us remind you once again that Russian legislation does not contain such a concept as a minimum pension. Its size is influenced by a number of circumstances. The minimum pension cannot be lower than the minimum subsistence level established for a pensioner in the area where he lives. If, after calculating the pension, its amount turns out to be lower, then the pensioner will have the right to receive social benefits. To equate the size of his pension to the regional subsistence minimum. This additional payment is provided based on the application of the pensioner himself. The legislation provides for cases in which the minimum pension amount can be increased:

- a pensioner starts working;

- the pensioner's age exceeds 80 years;

- the pensioner has dependents;

- indexation of insurance pension.

In order to receive the minimum pension in Russia upon reaching a certain age, you must work for at least 5 years. However, not all citizens who apply for a pension have such work experience. In this case, they will be assigned a social pension.

Types of additional payments: how much will the minimum pension by region be along with them?

There are 2 types of pension supplements:

- A federal supplement is made if the amount of a citizen’s pension and other payments is less than the regional subsistence level. Additional payments are made by the Pension Fund branches.

- Regional additional payments are made if the pensioner’s pension and other payments amount to less than the regional subsistence minimum, but more than the same figure for the country as a whole.

The cost of living in 2021, according to paragraph 6 of Art. 8 of the Law “On the State Budget for 2021”, in Russia as a whole is 8803 rubles.

For example, this year the minimum is set in the Kursk region, and the highest in the Chukotka Autonomous Okrug (6,391 and 19,000 rubles, respectively).

To receive a regional surcharge, the pensioner must be unemployed, otherwise the surcharge will not be made.

Largest pension amount

The size of the pension is influenced by a fairly large number of different factors. These include length of service, the age at which a citizen stopped working and retired, the amount of his salary, accumulated pension contributions and much more.

The government's pension reform, which began in 2015, offers a number of mechanisms through which you can increase your pension. Concerned with reducing pension costs and avoiding raising the retirement age, Russian legislators have resorted to encouraging later retirement. This makes it possible to increase its size in proportion to the time worked. Thus, later retirement stimulates its increase.

Old age pension

Citizens who have lost the ability to work due to reaching retirement age can count on a cash payment from the state, called a pension, on a regular monthly basis. Relatives who are unable to work are also entitled to receive a pension in the event of the death of their breadwinners.

The labor pension is divided into:

- reaching retirement age;

- disability;

- death of the breadwinner.

Who can count on receiving the minimum insurance pension? Old-age pensions are received by women who have reached 55 years of age, and male citizens by 60 years of age, if they have a minimum of five years of insurance experience. Disability pensions are received by citizens recognized as disabled. A labor pension in the event of the death of a breadwinner is awarded to family members of deceased citizens who are not able to work independently and were dependent on breadwinners.

Pension calculator

The official websites of the Ministry of Labor and the Pension Fund contain a pension calculator, which allows you to independently calculate your future pension. However, as the Ministry of Labor directly explains, this calculator makes it possible to carry out only very rough calculations in order to predict the size of the pension. It is impossible to determine its exact size using a calculator.

Before making the calculation, the calculator will ask you to enter some data: the amount of your salary, length of service or length of military service and other data necessary for the calculation. It is necessary to take into account that the calculator will make calculations as of today, based on the fact that you will retire tomorrow. In his calculations, he is based on the Federal Law “On Insurance Pensions”, which came into force in 2015.

We must not forget that the pension reform includes tools that can affect the pension in the direction of its reduction - the pension coefficient, which changes depending on the economic situation in the country, demographic situation and other factors. The calculator is available at https://www .pfrf.ru/eservices/calc/

How to calculate the amount of your pension

Every citizen can calculate their insurance pension independently. To do this, it is enough to know the formula used by the Pension Fund and substitute current figures into it.

The calculation formula itself is as follows: SP=X*Y+Z, where:

- SP - the final amount of the insurance pension;

- X is the total number of points earned during work;

- Y is the value of the point at the time of application;

- Z is the guaranteed part, which is due to every citizen even in the absence of insurance experience.

Two points need to be clarified here:

- the cost of a pension point for the current day is 81.49 rubles;

- guaranteed amount - 4,982 rubles.

Both values are subject to mandatory annual indexation, which is guaranteed by the state.

Important! To independently calculate the size of your future pension, you can use an online calculator, which is freely available on the Pension Fund website. The system tool takes into account the key parameters that are used to calculate pensions and produces the most accurate result.

Additional payments to pensions

Pensioners are classified as a socially vulnerable category of citizens, this is due to the fact that due to age, many of them lose the opportunity to work. Therefore, the state has provided for them certain benefits and allowances in addition to pensions:

- Tax legislation makes it possible for pensioners not to pay property tax. Taxation of pension payments is not provided for by law. And the right to receive a tax deduction for pensioners remains.

- In the field of health care, pensioners also have a lot of benefits. They are covered by a health insurance program, which allows them to receive medical care absolutely free of charge; in addition, pensioners, as well as disabled people, have a 50% discount when purchasing medications.

- In the housing and communal services sector, compensation is also provided. If a pensioner is recognized as low-income, he has the opportunity to apply for a subsidy to pay for utility bills. In some regions, pensioners receive additional social support in the form of compensation for payment for housing services.

- Regional legislation provides for discounted travel on public transport for pensioners.

Thus, from the above we can conclude that pensioners, in addition to pension provision, have the opportunity, and the legally established right, to take advantage of a certain number of benefits provided to them by the state.

Who is entitled to Social Security Supplement?

Above we mentioned the Social Supplement to Pension. It is assigned to those whose total amount of material support is below the subsistence level of a pensioner in the region where he lives.

But here it should be noted that the words “total amount of material support” means a whole range of possible payments.

In particular, when calculating the total amount of material support for a non-working pensioner, the amounts of the following cash payments are taken into account:

• the pension itself; • additional material (social) support; • monthly cash payment (including the cost of a set of social services); • other measures of social support established by the legislation of the constituent entities of the Russian Federation in monetary terms (except for those provided at a time).

In addition, when calculating the total amount of material support for a pensioner, the cash equivalents of the social support measures provided to him for paying for the use of a telephone, residential premises and utilities, travel on all types of passenger transport, as well as monetary compensation for the costs of paying for these services are taken into account.

If all these payments and benefits in total amount to less than the cost of living of a pensioner in a particular region, then the state will add up to the “minimum wage”.

Pension changes in 2021

Since the beginning of this year, pension reform has started, based on the new federal legislation “On insurance pensions”. In the new year 2021, it will continue to operate, since it is designed for gradual implementation, which will last for more than one year. This regulatory document has its positive and negative sides.

The positive point is that the pension reform does not provide for an increase in the retirement age. It also does not provide for a narrowing of pension rights for pensioners who retired before 2015. The amount of his pension calculated will remain the same and will not be subject to recalculation.

Among the negative aspects, one can highlight the increase in length of service required for calculating a pension and the recalculation of the pension from the usual ruble equivalent into pension points. The pension reform introduced a new concept of the “annual pension coefficient”, which represents the actual result of a citizen’s work for the year.

Another positive point is the inclusion of maternity leave, which lasts 4.5 years, in a citizen’s work experience. Moreover, it does not matter who was on maternity leave, mother, father or other relative.

The approach to calculating pensions has also changed. The pension now consists of two parts: insurance and funded. From the analysis of the provisions of the new reform, we can conclude that the state is trying to bring pension provision out of the crisis and cope with low pensions of citizens. This is evidenced, for example, by indexation carried out twice a year. It is not yet possible to unequivocally answer the question about the productivity of the new pension reform. A certain amount of time must pass in order to evaluate the results of its action.

The size of the maximum old-age pension in the Russian Federation

It is impossible to calculate the exact amount today. The size of the pension is related to a number of circumstances:

- Salary amount.

- When a citizen retires (his age).

- Length of work experience.

- The amount of monthly contributions to the Pension Fund.

Let's look at innovations in the field of pension legislation, and specifically to the Federal Law “On Insurance Pensions”. Let us immediately draw attention to the fact that the age of the citizen is not taken into account. To save the Pension Fund's expenses, officials decided to take the “original” route. For example, if a man, having reached his 60th birthday (retirement age), does not want to retire, but continues to work, then he will receive a significant increase in his pension, which will be proportional to the time he could have spent on a well-deserved retirement. The same applies to women who are over 55 years old. Conclusion: the longer you work after retirement age (the longer you don't retire), the higher your pension amount will be.

Results

So, the modern pension system necessitates a minimum insurance period for a pension and a sufficient number of pension points in order to assign state old-age benefits. If these two conditions are not met, then an old-age insurance pension is not assigned, but a social pension is paid upon reaching retirement age. The minimum insurance period for a pension after six years will be 15 years. On average, a person begins his professional activity at the age of 20, and ends at 55 or 60 years, depending on gender. The minimum fifteen years of service required to qualify for an insurance pension is not a high bar. This threshold is completely surmountable for all residents of the country. Many of our citizens worked at the same enterprise, factory. Of course, this mainly applies to people of the Soviet era, when students were assigned to factories and remained to work there until they retired.

Of course, pensions in our country have increased over the past decades. Although the question of what minimum insurance pension is due to future pensioners does not lose its relevance. Unfortunately, a decent level of pensions has not yet been achieved.

The minimum insurance pension remains a relative and uncertain concept in our country. The minimum is determined by the cost of living. If the minimum amount of the insurance pension assigned to a citizen is less than the subsistence level, then the state will provide the person with a social supplement.

Social pension

The state-guaranteed amount of state provision for citizens is the social pension. In our country, it is assigned only to citizens who are unable to work and to citizens who have reached the age of pensioners. The legislation of our country provides for types of social pensions, such as pension:

- upon reaching age;

- on disability;

- due to the death of the breadwinner.

Let us list the categories of persons applying for state social security:

- Disabled people.

- Minor children and citizens who are full-time students in educational institutions, not older than 23 years old, who have lost one or both parents. These people can count on a minimum survivor's insurance pension.

- Citizens of our country who have reached the age of 55 and 50 years, respectively, for men and women, living in areas inhabited by the peoples of the Far North on a regular basis for the period of pension.

- People who have reached the age of 65 and 60 (citizens and female citizens, respectively), as well as foreigners and stateless persons who have lived in our country for at least 15 consecutive years and have reached the specified retirement age. They are provided with a social pension.

The minimum pension is the guaranteed amount of state provision for citizens of the country. A civilized country cannot leave vulnerable sections of the population without a means of subsistence.

The minimum social pension for citizens who are unable to work, established for the current year from April last year:

| Category of citizens | Minimum pension amount | |

| 1 | Residents of the North who have reached fifty-five and fifty years of age for citizens and women, respectively. People who have reached the age of sixty-five and sixty years, respectively for men and women. Disabled people of the second group, with the exception of those disabled since childhood. Minor children, as well as citizens studying full-time in educational institutions, not older than twenty-three years old, who have lost one of their parents. | 15 034,25 |

| 2 | Disabled people from childhood of the first group and disabled children | 12 082,06 |

| 3 | Disabled people of the first group, disabled people of the third group since childhood, children of minor age, as well as citizens who are full-time students in educational institutions no older than twenty-three years old, who have lost both parents. | 10 068,53 |

| 4 | Disabled people of the third group | 4 279,14 |

The minimum level of pensions for citizens of our country will continue to be no lower than the minimum subsistence level in the territory where the pensioner lives. If the amount of state support combined with other payments is below the minimum subsistence level, then he will be assigned a social supplement.

As can be seen from the table, the minimum amount of insurance pension for the loss of a breadwinner in our country today is not very large and living on these guaranteed funds is quite problematic. The necessary conditions for calculating a pension in the event of the death of the breadwinner include:

- The deceased breadwinner has at least one day of work experience.

- The death of a breadwinner is not the fault of a disabled family member.