Official company page on the Internet

The non-state pension fund "Safmar" has its own resource. NPF provides services in the field of compulsory and non-state pension provision. Additionally, a merger of several funds was previously carried out. As a result, a large customer base has emerged, which includes over 2.3 million people. The organization manages over 200 billion rubles. pension assets. NPF takes part in the system of guaranteeing the rights of insured persons. This increases the fund's reputation among potential clients.

On the main page of the official website there is a menu with all the necessary sections. There is a personal account, a general information block and other online tools that clients may need.

By registering on the site, a citizen will be able to:

- control your retirement account;

- monitor the receipt of funds;

- watch the increase in pension savings.

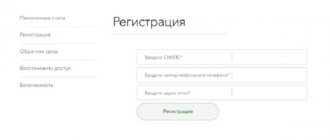

Only participants in the compulsory pension insurance program have the right to register in the system. The citizen must have SNILS. Additionally, you will need to provide your email address and mobile phone number.

Once registration is confirmed, the person has access to all information regarding the pension amount. Additionally, the site contains a calculator that allows you to determine the amount of payments. An example of a product from npfsafmar is the Online Financier program.

Please note: One of the advantages of the institution is the accrual of income from investment programs and the opportunity to take advantage of social tax deductions. A person has the right to independently determine the amount and frequency of contributions. By making monthly contributions, a person will be able to accumulate a fairly impressive amount by the time he retires.

The fund also operates a number of corporate programs. They are suitable for representatives of enterprises wishing to provide pensions to employees.

Rating

What is the rating of NPF Safmar? This is an important nuance that many potential clients pay attention to. I don’t really want to cooperate with an organization that is closer to the bottom of the ratings of non-state pension funds in Russia.

Today, Safmar does not have the highest performance. Among non-state pension funds in terms of capital and reserves, the organization ranks 28th. If we talk about the volume of pension reserves, we can see that the fund is in 17th place. But that is not all.

Safmar (NPF) does not receive the best reviews due to the fact that the company is in 15th place in the ranking of pension funds in terms of pension savings. This is the data that is relevant today. In general, we can say that Safmar is far from a leader. And this does not suit many clients. They begin to doubt the integrity and reliability of the organization.

How reliable is the organization?

The activities of the funds are monitored by the Central Bank of the Russian Federation. Summing up the results for the 2nd quarter of 2021, the organization also mentioned NPF Safmar. In total, the rating included 66 participants.

The Safmar pension fund managed to take worthy places:

- first place among top non-state pension funds according to the criterion “size of average growth of OPS account”;

- fifth place in total savings;

- sixth place in terms of number of clients served.

The fund is showing good results, which indicates confidence in it. In accordance with the assessments of rating agencies, the fund has been assigned the highest level of reliability A++. This suggests that the closure of the fund will not be carried out overnight. The client can entrust his pension savings to the institution. Detailed information is important because it makes it possible to decide whether to enter into a contract.

Login to your personal account

Go to your personal account

Login to your personal account on the website of the European Pension Fund and the Safmar Fund:

- Follow the link: https://my.npfsafmar.ru/client/auth.

- In the form on the left, enter your login information: login and password. They must be specified in the contract that you entered into with class=”aligncenter” width=”421″ height=”456″[/img]

- Enter the characters from the picture to convince the system that you are not a robot.

- Click "Login".

Data from the NPF “European Pension Fund” and “REGIONFOND” will also be suitable for logging into your account, since these companies became part of Safmar in 2021.

If you have an account on State Services, you can use it for authorization. To do this, click on the link “Log in via State class=”aligncenter” width=”429″ height=”310″[/img]

The State Services page will open. On it, enter the data: login and password for your account. Click "Login".

Profitability level

The profit that a fund can bring to investors directly depends on the situation on the financial market. Moreover, the state of affairs in both the stock and debt markets is taken into account. The latter is tied to a reduction in the key rate, which is determined by the Central Bank. Such a decision may become a reason to reduce the profitability of non-state funds. The stock market has recently experienced negative dynamics. There are many reasons for this phenomenon. The first of these is the events taking place in the banking sector. Due to the fact that there is an outflow of part of the capital, constant sanctions, and a slowdown in the country’s economic development, the positive dynamics are changing to negative. However, such a phenomenon is not considered unusual. From it you can get an idea of the real state of the economic sector. So far there is no growth in the trend. However, it is possible that the picture will change soon.

If we talk directly about NPF Safmar, the fund’s level of profitability cannot be called high. However, clients of the institution still say that their savings are increasing. The yield of non-state pension funds was able to outpace inflation and amounted to 3.8%. If the payments that were provided to management companies are not subtracted from the amount of earnings, the result of earnings was 4.6%. The placement of reserves made it possible to achieve a yield of 4.3%, taking into account the remuneration paid. Modern pensioners are interested in the stability of payments and the reliability of increasing their future pension. However, the situation may change to growth next year.

Profitability of NPF “Safmar”

One of the indicators that is looked at when choosing a non-state fund is the profitability of the organization.

The profitability indicators of JSC NPF Safmar are low, at the level of 8.87% (according to the first half of 2021). At the same time, experts assess the stability of the increase in pension savings. Cooperation with the company will not bring big profits. The increase in deposits does not occur quickly, but the process is marked by reliability and stability. This is exactly what future Russian pensioners need.

How to submit an application to the non-state pension fund "Safmar" correctly?

You can familiarize yourself with the specifics of submitting an application through the official website npfsafmar.ru. There is a “Submit an Application” section here. The procedure may vary depending on what exactly the client requires. The fund is ready to assign pension payments, accept applications for correction of personal data, etc. A person is required to prepare a package of documents. The list is also provided on the official website. A total of 14 different documents may be required. However, it is not always necessary to provide a complete list. It all depends on the specifics of the current situation. It is acceptable to submit an application in person or through a legal representative.

The appeal can be made using one of the following methods:

- by sending documentation by mail. In this case, you will need to have a copy of the papers certified by a notary;

- during a personal visit to the NPF office;

- through partners in Raiffeisenbank branches. In this case, you will need to submit a preliminary electronic application.

If a citizen contacts an institution in order to receive payments, the person will be provided with a written response by mail. The decision will be communicated after reviewing the documentation. If the papers are completed correctly, you can receive the first payment within a month after the relevant verdict is made.

What to do if you have problems logging in

Safmar has detailed instructions on how to log into the European Pension Fund through your personal account if certain problems arise.

Important! If the client does not remember the email, then it is required to fill out an application “On making changes to personal data” and take it to the branches of PFU or the partner bank of JSC Raiffeisenbank with a Russian passport and SNILS. Another way to send: via mail. To do this, you will need “Consent” and photocopies of the pages of the Russian passport, on each page of which a signature and the mark “Copy is correct” are placed.

Important! If you lose your password, you need to click on “Forgot your password?”, and you will receive instructions on how to recover your data by email.

Information about pension calculation

You can find out the data by contacting the office, using the hotline or the “Personal Account” service. You can access it through the official website of the fund. The latter method is convenient due to the fact that it can be implemented without leaving home.

Please note: Only registered users have access to their personal account. In 2021, only citizens participating in the pension insurance program can use the method. The fund’s website states that clients who cooperate with the institution in the field of non-state support will have the opportunity to register later.

About service in general

What do they say about the organization being studied in general? How conscientious it is receives varied reviews. From all of the above, we can conclude that the fund has many shortcomings. Nevertheless, the majority of citizens emphasize that the organization as a whole offers the highest level of service. Managers have high demands on their subordinates. Sometimes because of this, Safmar (NPF) does not earn the best reviews from employees. After all, for subordinates, this is the same employer as everyone else. This must be remembered.

Sometimes you can notice that the population complains about slow service and constant queues at branches. No one is safe from them. However, employees try to pay due attention to all visitors. When compared with other non-state pension funds, Safmar is not much different from them. Every potential visitor should remember this. You should not expect too good and fast service from the organization; the company still has shortcomings.

Receiving a funded pension

If a citizen wants to contact an institution to arrange a payment, the package of documents may vary significantly. The application is made through a personal visit or by transferring papers through a legal representative. Information on the issue is presented on the institution’s website.

Having prepared a package of documentation, you can contact NPF Safmar. If the papers are filled out correctly, you should receive a notification by email within 5 business days that your application has been accepted for consideration. The decision to provide a funded pension is made within 10 days. The response will also be sent by mail. Payments are scheduled within 1 month. The period begins to be calculated from the moment the relevant decision is made.

Rules for submitting applications to the fund

To become a client of the company and receive payments from NPF SAFMAR, just fill out an application on the company’s website. It must indicate:

- personal data;

- passport details;

- payment parameters;

- payment method.

If this option is inconvenient for some reason, you can order a call to an operator or contact one of the NPF offices to solve all problems on the spot.

Office location

The foundation is located in Moscow at the address Zavoda Serp i Molot proezd, building 10. The business is located in this location on the eleventh floor. The main office of the organization is located here. Previously, several non-state funds were reorganized. All this led to the fact that NPF Education and Science became a branch of Safmar JSC. The procedure was carried out in September 2016. All this allowed clients to have the opportunity to contact the MFC at another address - Leninsky Prospekt, building 42, building 2. A representative office of the pension fund is also present in Saratov.

Head office address

Some are interested in where the main branch of Safmar is located. It's not that hard to guess. The city in which the non-state pension fund is located is Moscow.

The legal address of the company coincides with the actual one. More precisely, Safmar is located at the following address: Plyushchikhina Street, 44/2. This is where the head office is located. You can contact the specified address if you have any global complaints or wishes.

Hotline

During interaction with the fund, the client may have questions. If you need to ask them, the contacts of the Safmar pension fund will help.

Important! Calls are accepted to the hotline number 8 800 700 80 20 and. The fund's specialists will advise on pension issues. You can contact NPF Safmar daily from 8 am to 8 pm.

In general, the pension fund is one of those that can be entrusted with pension savings. Customer reviews are good. Profitability varies depending on the situation in the financial market. However, all this does not affect the overall positive trend in the development of the organization. If a person wants to invest money not in top NPFs, it is recommended to pay attention to the Safmar fund.

NPF Safmar - profitability rating and customer reviews

There are a lot of agents, Pension Funds too, and everyone wants to eat. When an agent is sent “far and away” 100 times, refusing to renegotiate the contract, at 101 he begins to invent such schemes. I in no way justify their actions, it’s just that when they don’t have the brains to describe the advantages, they begin to deceive. 2 incidents that happened to me: 1) Call. I open it. A smiling couple (a guy and a girl) is standing. The following dialogue follows: Agents: Good afternoon. We are from a pension fund. Which one are you a member of? Me: “European” A: Have you heard that “European” has merged with the “Other Fund” and it is necessary to renew the agreement, can I have your SNILS and passport data? Me: Who exactly are you? The guy hands me an agent card, on which the third fund is indicated. Me: Here you write “Third Fund”, what does it have to do with “Other”? A: This is one of the divisions of “Other”, but it is now the same fund and you need to renegotiate the contract. It won't take much time... Me: Sorry, but I haven't heard anything about a merger or the need to renegotiate the contract. Where can I read about this? A: There is an internal order. Me: Can I take a look at it? A: We don’t have it with us, it’s in the office. Me: That is. Should I take your word for it? Show me this order and we will sign the agreement. A: We have an office on the other side of the city. We will spend half a day driving there and back. There is nothing more we can do. Me: That's your problem. Without this order, I will not sign anything... After which they turn around and go knocking on other apartments.

2) Call. I open it. An unsmiling guy stands: A: Good evening. Have you heard that the Pension Fund of Russia database crashed and more than 70% of the data was damaged? I need to check your SNILS in the database for availability. If not, you will have to enter it again. Me: Who exactly are you? He hands me the papers from “Some Fund.” Me: Excuse me, but what does “Some Fund” have to do with the Pension Fund and checking the database? A: On their instructions, we are conducting an inspection. Me: The Pension Fund website doesn’t say anything about this. Where can I find out about this? A: They do not publish this publicly, this is only an internal notification. Show your SNILS. Me: Can I see him? A: I don’t have it with me, there’s no time to take it now, I still have many people to check. Me: Sorry, but without this notification I won’t show SNILS. After that, he begins to scare me with the fact that my money may “freeze”, “burn”, etc. to which I answer him that he “has a lot of work” and therefore the faster he brings me the paper, the faster we will do everything. After that, he simply turns around and leaves.

Why did I write this? "Trust but check". Therefore, when they start asking you about “checking SNILS”, the need to fill out something there, etc., don’t be lazy, ask the agent for an identification (they must have it) and confirmation (preferably on letterhead with a blue stamp), On what basis do you owe anything to anyone?