Today we have to find out what NPF Promagrofond CJSC is. Reviews, ratings, profitability - all this is extremely important for the population. It is precisely on the basis of these components that many often make the final decision regarding issues of cooperation with pension funds. I want my money to be stored in a safe place. Because of this, each NPF has to be considered in great detail. Customer opinions help accurately judge what a particular corporation is about. What can you say about NPF Promagrofond?

About activities

First you have to understand what this organization does. Maybe she is pursuing some kind of shadow politics? Or is he carrying out fraudulent activities?

Not at all. Promagrofond is a non-state pension fund that has been operating in Russia for a long time. It was created back in 1994. For the past 22 years, the organization has been providing pension insurance to the population.

It turns out that this corporation is a place to save money set aside for old age. An excellent way to form the funded part of a pension. No shadow politics, only “transparent” activities that are understandable to everyone. And for this, NPF Promagrofond CJSC receives positive reviews. People know exactly under what circumstances they can contact the organization.

Prevalence by country

The next nuance is distribution throughout the country. The thing is that in recent years, non-state pension funds have been opening in large numbers in Russia. And they often close quite quickly. Such changes do not primarily affect large companies. What can you say about the fund being studied?

Promagrofond is a non-state pension fund, which, as already mentioned, is distributed throughout Russia. There are branches of this corporation in every locality. In large cities you can find several branches of the organization.

It is also worth paying attention to the fact that the company has existed in the country for a long time. This means that there is every reason to believe that we are talking about a sustainable corporation. This is precisely the opinion that many citizens hold. NPF Promagrofond is a large and widespread company throughout the country. It will not be closed suddenly. It has been operating for 22 years with particular success. An excellent reason to take a closer look at the corporation.

The main branch of NPF Promagrofond is located in Moscow. More precisely, there are several of them. The first is located on Iskra Street, building 17-a, building 2. The second is on Kozhevnichesky Lane, building 8. The exact addresses of the fund’s branches in each city of the Russian Federation can be found on the company’s official website. Many customers indicate that it is very convenient!

NPF Promagrofond

It is important to understand that the article describes the most basic situations and does not take into account a number of technical issues. To solve your particular problem, get legal advice on housing issues by calling the hotlines:

Attention! If you have any questions, you can consult with a lawyer for free by phone in Moscow, St. Petersburg, and all over Russia. Calls are accepted 24 hours a day. Call and solve your problem right now. It's fast and convenient!

This is interesting: What are the amendments to the Criminal Code of the Russian Federation in 2021

Rating

Now we can talk about the main components that potential investors pay attention to. The thing is that there are quite a lot of evaluation criteria. The first thing all clients look at is the rating. In Russia, special databases have been created that help to see the success of a particular NPF.

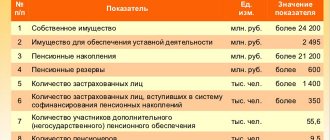

NPF Promagrofond CJSC has a good rating. It is noted that this organization is among the top 5 leaders of non-state pension funds. Most often found in positions 1-3 in lists. Some sources indicate that this company is in the top 10 best non-state pension funds in the country.

In any case, the corporation under study occupies a leading position in the All-Russian rating. Most clients notice that this phenomenon inspires trust. And that’s why many are looking at the fund. It’s not for nothing that he is among the leaders! What other nuances need to be looked at before making a final decision?

Contacts and support phone number

Official website "Promagrofond" : https://www.promagrofond.ru Personal account : https://lk.promagrofond.ru Hotline phone : 8 800 775-90-20

Consultation with a pension lawyer by phone In Moscow and the Moscow region 8 St. Petersburg and the region 8 Free in Russia 8 (800) 350-57-92

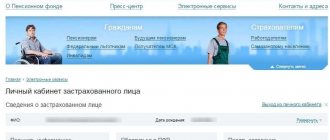

The NPF Promagrofond has an official website and a personal account on this resource that will help you check your personal savings. Registration is simple. You just need to prepare scans of your passport and SNILS. The function will be available after signing the contract and entering the client into the fund’s investor database.

You can go through the stages remotely or immediately on site together with an employee. Professional consultation will help you do this very quickly. You will not need the entire passport - only the 2nd and 3rd pages.

If it is not possible to make a copy, then the attached photo will also work. The main thing is that the quality is good, so that personal information, numbers and letters are visible.

After clicking the “Registration” button, the client sees:

- field for entering SNILS;

- indication of a current mobile phone number;

- entering email (active);

- postal address information;

- some personal information.

All specified information will not be provided to third parties in accordance with the terms of the agreement. The very last step is to upload your identity verification files. After sending all the information, you must wait up to 10 days for confirmation.

A message is sent to your phone and email containing a temporary password. It is advisable to change it to your own, secret one after logging into your personal account.

Authorization is then displayed on the official website of NPF Promagrofond. To log in, you need to enter your SNILS (login) and your password. In your personal account, many functions are available to the user. Eg:

- tips;

- access to personal data correction;

- viewing transaction history. Information can also be downloaded to the device;

- sending a letter or application to the Fund;

- setting your own savings schedule;

- selecting a filter in the list of operations. It can be by period or type;

- current questions and answers.

Trust level

For example, at the so-called trust level. This is a kind of indicator that indicates the population’s predisposition towards a particular company. The level of reliability of NPF Promagrofond is high. Different sources provide a variety of information, but nevertheless the trust still remains in fairly high positions.

It is quite common to see that the trust rating is at A++. This is the trust's highest figure to date. According to some reports, trust is slightly lower. It is located at level A+. Stands for "High Trust".

In any case, based on the information provided, we can conclude that the closed joint-stock company “Non-state pension fund “Promagrofond” is trustworthy. The population is confident that this particular company will help preserve their pension savings.

Profitability

NPFs are often looked at not only for the safety of pensions. The thing is that such companies offer to increase pension savings. Therefore, many pay attention to such a component as profitability. Non-state pension funds with high returns attract more clients.

Promagrofond receives mixed reviews in this area. Why? This is because the organization’s promises and the actual situation are different from each other. The administration promises high returns - about 15-18% per annum. But in practice it is 5-7%. The difference is huge.

Because of this, NPF Promagrofond CJSC earns both positive and negative reviews. The population remains dissatisfied that promises are not kept. Although the low level of return is easily explained. It's all due to inflation. Similar discrepancies now exist in all non-state pension funds in the country. And this fact will have to be taken into account.

Along with this, it is noted that the pension fund still has profitability. Not very big, but it is higher than many competitors offer. Accordingly, there is a small return. Not as high as we would like, but it is there. Moreover, the organization has good profitability. NPF Promagrofond is also in the leading position in the rating according to this indicator.

NPF: which one to choose? Rating, reviews

- those born before 1967 do not have the opportunity to change the size of the insurance portion; they have access to private programs concluded as part of the co-financing of pensions, which can be connected to at the branch of the Pension Fund of the Russian Federation or from private companies;

- The rest of the age categories have the right to choose: remain “silent” or take the future into their own hands by studying the NPF profitability rating and choosing a fund that inspires confidence.

In order to conclude a mandatory security agreement with a non-state pension fund, you must contact the office of the non-governmental organization at the place of registration. The only documents you need to take with you are your passport and SNILS. After completing the documentation, the client is given a copy of the agreement confirming the desire to transfer pension savings from the Russian Pension Fund to the Non-State Pension Fund.

This is interesting: Benefits for meals in schools in Veliky Novgorod

Service

What about customer service? This question is also important. And it is not clear about the company being studied. Why?

NPF Promagrofond CJSC receives varied reviews. Good because the staff tries to devote time to each client. All questions are answered in a clear manner, all terms of cooperation and payments are explained in full. Also among the advantages is the possibility of remote maintenance. Promagrofond has a “Personal Account” for each client. With its help you can track the status of your personal account.

Despite this, negativity is still expressed towards the corporation. For example, due to the fact that service in the organization’s branches is slow, there are constant queues. And the “Personal Account” works intermittently. Not the most important, but nevertheless existing shortcomings. And you will have to remember them when choosing a non-state pension fund.

Registration in the account

To register in your personal account, you must conclude a pension insurance agreement with the Fund and wait until it comes into force.

It should be taken into account that after the reorganization, contracts are concluded with NPF Gazfond.

Registration in the personal account of NPF "Promagrofond" occurs in remote access mode. To register, you must prepare scans of the following documents:

- passport (page 2 and 3),

- SNILS.

Scans can be replaced with photo copies. It is important that their quality is high: all symbols and photos on the passport must be clearly visible.

Registration begins with the “Registration” button on the official website. And sequentially, step by step, entering the required information:

- SNILS number.

- Mobile phone.

- Email.

- Mailing address.

- Personal data.

The last step involves uploading scanned copies of documents as separate files.

Within 10 working days, a notification will be sent to your email and phone indicating a temporary password.

Surprises

The next nuance emphasized by clients is unexpected cooperation with the corporation. Some clients accidentally find out that their pension savings are stored in Promagrofond. However, no agreements were concluded personally. Is it worth refusing to cooperate with an organization because of such surprises?

Not at all. Lawyers say that NPF Promagrofond operates absolutely legally. This phenomenon is explained by the fact that the fund enters into contracts with different employers. And then all employees of a particular company automatically become investors. It is not the Promagrofond employees who should notify about this, but the direct employer. Therefore, there is no need to be surprised by unexpected cooperation. This is not a scam, everything is legal. Moreover, this feature is found in many NPFs.

Reviews

Negative reviews about the work of the Promagrofund before its merger, in 90% of cases, are associated not with the work of the fund and the quality of payments, but with the methods of concluding contracts carried out by the company's employees. Pension agents did not always enter into contracts, explaining to pensioners all the specifics of the fund's work. People were often promised payments several months after payments began.

As for clarity in fulfilling obligations, Promagrofond had no complaints from its clients.

In 2021, during the transition of the structure to the Gas Fund, the rules of information policy were not followed. Many investors could not contact their managers and receive legal support, hence the panic and preconditions for accusing the non-state fund of fraud.

Beware, scam

But that is not all. There is another rather important point that is emphasized by clients. NPF Promagrofond CJSC receives negative reviews for the way the organization searches for clients. Some point out that official representatives of the NPF go door to door and attract the population to cooperate. This situation makes us think about the integrity of the fund.

There's really nothing to fear. Promagrofond strongly recommends not communicating with those who go from door to door and introduce themselves as employees of a non-state pension fund. Often these are scammers. It is better to find out about all the features of cooperation by calling branches in certain cities or in person.

How to apply

There are two ways to enter into an agreement for individuals:

- by directly contacting the fund in person. The documents required to conclude an agreement are a passport and SNILS;

- remote execution of the contract.

To do this, you need to fill out a form online, which, together with a copy of your passport and SNILS, must be sent to the NPF using a registered letter, fax or e-mail.

The Fund, in turn, based on the information provided, will prepare and send the following documents:

- 2 copies of the contract;

- consent to the processing of personal data;

- application forms and bank details for transferring contributions.

The client will only need to sign the documents and send them back to the NPF in a convenient way.

The above methods of concluding an agreement are possible only for individuals, and as for a corporate pension agreement, for this you should seek advice from the fund’s specialists in corporate programs. This can be done by phone, by fax or by email to the NPF.

conclusions

From all of the above, we can conclude that NPF Promagrofond is a large non-state pension fund distributed throughout Russia. It is quite stable and offers good returns. Customers are treated here with understanding and attention. This organization is ideal for both increasing pension savings and storing them.

NPF Promagrofond has some shortcomings, but they are not significant enough to refuse cooperation. This organization is one of the leaders of non-state pension funds in Russia. This means that it is worth considering it when looking for a place to store and form pension savings.

Merger with the gas fund: fact or fiction?

The decision to merge the non-state pension fund with one of the largest funds, Gazfond, was made in 2021. By 2021, all reorganization measures related to the entry of Promagrofond into the Gazfond have been completed. Clients of Promagrofund who have entered into an insurance contract do not need to renew the contract with a new entity.

All obligations for payments and accrual of income are carried out within the framework of the reorganization project; all obligations to depositors from 2021 are performed by the management of the Gas Fund.