Home NPF

NPF Telecom-Soyuz arose before the appearance in the Russian Federation of such a concept as a funded pension. The organization was founded in 1996. She became one of the first to deal with non-state pension provision. The owner is the investment company O1 Group. Telecom-Soyuz is the main industry fund that works on non-state pension provision for representatives of the communications industry. It is in the TOP 10 market leading companies, the organization is considered one of the most reliable. All-Russian fund. There are representative offices in 7 federal Russian districts. The personal account service of NPF Telecom-Soyuz allows clients of the fund to monitor the status of their savings and perform some operations.

npfts.ru - official website of NPF Telecom-Soyuz

About the fund

NPF Telecom-Soyuz, registered in 1996, was considered an industry fund for communications workers.

That's why some consider it a pocket fund of Soyuztelecom, the communications company. However, the non-state pension fund is the property of Boris Mints’ group (FG “Future”). The purchase took place in 2013. NPF Telecom-Soyuz was considered the largest fund in terms of the size of its own assets. But the money was invested in illiquid securities. At the same time, the fund managed to pass the inspection of the regulator (Central Bank of the Russian Federation) and was officially accepted into the guarantee system.

In 2021, FG Future experienced financial problems. Since pension funds have always been viewed as a source of “long-term” (and sometimes free) money, the funds of NPF Telecom-Soyuz investors were directed to risky financial transactions (or fraud).

For almost 3 years there has been talk that the fund’s license will be revoked, but... NPF Telecom-Soyuz works, continuing to distribute losses to depositors’ accounts.

By the way, do not look for this information on the official website: in the “News” section there are standard holiday greetings (sounds like mockery).

Information

| Full title | JSC NPF Telecom-Soyuz | ||

| License | № 94/2 | ||

| head office | Moscow, Tsvetnoy Boulevard, 2 | ||

| Official site | https://www.npfts.ru | ||

| Contacts | Hotline phone number E-mail | ||

| Founders | OJSC Svyazinvest, PJSC Rostelecom, CJSC Telecominvest, OJSC RTK-Leasing, CJSC Gamma Capital, JSC KFP Finance | ||

| Shareholders | PJSC FG Future (99.8591% of shares), PJSC Rostelecom (0.1409%) | ||

| Legal entity | Pension savings | "REGION Trust" | |

| Pension reserves | "REGION Trust", "Agana". | ||

| Depository | JSC "Independent Specialized Depository" | ||

| Managers, "Agana". | |||

| Branches and regional offices |

| ||

| What services does it provide? |

| ||

Statistics

| Volume of pension savings/reserves, thousand rubles. | 1 405 184,00279/20 192 063,13936 |

| Amount of pensions paid, compulsory pensions/NPO thousand rubles. | 4522,83108/785 130,8317 |

| Number of clients | 15 719 |

| Profitability | (-13.05) minus all remunerations (Central Bank data for the 2nd quarter of 2019) |

| Reliability rating | Not ordered |

| Awards mentioned on the official website | From the “Financial Elite of Russia”:

From Expert Ra (2013):

National Business Award “Company of the Year 2010” |

Terms and service

| fund programs | OPS and NGOs are offered for individuals; for individual programs on the official website they are sent to one of the branches. |

| entry conditions | Consent to automated data processing |

| types of payments | Lifetime, fixed-term, to legal successors |

| user's personal account on the official website | https://lk.npfts.ru/auth/ |

| mobile app | Not developed, but the official website template is adapted for smartphones |

How to enter into and formalize an agreement with the fund: application form

Despite the losses resulting from the work of NPF Telecom-Soyuz, work to attract new clients continues.

An agreement with a non-state pension fund is concluded in one of the branches (a passport and SNILS are required). On the official website of NPF Telecom-Soyuz you are invited to use the feedback form (at the very bottom of the page):

- for NGOs;

- for OPS.

TO

Unfortunately, the application form and sample contract are not posted on the official website. You can try contacting the hotline with a request to send sample documents by email. Or take a walk to the nearest branch.

How to transfer pension

Transferring a pension from fund to fund is the same for any NPF.

- You enter into an agreement with NPF Telecom-Soyuz.

- Terminate the agreement with the previous non-state pension fund. Important: read the contract carefully so as not to lose your savings!

- Apply for transfer to the Pension Fund of the Russian Federation at your place of residence.

How to find out your savings

Choose one of the available options:

- register on the official website, track savings in your personal account;

- register on the State Services website and track your future pension there;

- contact the central office of NPF Telecom-Soyuz with a written application to provide an extract from an individual pension account.

How to terminate an agreement with a non-state pension fund

Details about the termination of the contract with NPF Telecom-Soyuz can be found on the official website.

Personal income tax refund

The official website of NPF Telecom-Soyuz published a large amount of information on tax deductions, but forgot to consider the issues of personal income tax refund.

To return part of your hard-earned money, you will have to contact the tax office at your place of residence. It’s easier and faster to register on the official website of the tax office.

Then download the document forms from there, fill them out and send them, attaching the necessary scanned photocopies.

Early retirement

Did you manage to retire early? Congratulations. You will receive a social benefit pension. But the funded one will have to wait until retirement age (unless otherwise specifically agreed upon in the agreement with NPF Telecom-Soyuz).

Payment of fees

Clients of NPF Telecom-Soyuz are required to regularly pay no less than the minimum amount specified in the agreement. If it is possible to increase the payment, you need to apply to the accounting department at your place of work (if the transfers are carried out by the salary department). Or continue to pay yourself through the bank.

Before transferring, I recommend checking the details on the page.

Online services

On the official website (npfts.ru) you can familiarize yourself with the range of services provided by the fund, the procedure for concluding contracts with individuals and legal entities, as well as news, reporting, performance indicators and other materials. The NPF contacts and addresses of its branches are also posted there. Personal account is a service that allows clients to perform some financial transactions and control their savings without leaving home.

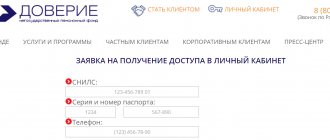

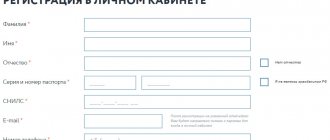

How to log into your personal account

You cannot register in your personal account (lk.npfts.ru) from the official website. First you need to apply for access to your personal account and fill it out. Then you should contact the nearest branch of the NMF (have your passport, SNILS and completed form with you). Fund employees will complete the registration process themselves, and the password for your personal account will be sent by email. After this, you can enter your password on the site and log into your personal account. If for some reason your password is lost or forgotten, you should click the “Forgot your password” button and enter your login again. A new password will soon be sent to your email.

Advantages and disadvantages

Let's hope that NPF Telecom-Soyuz is going through temporary difficulties. And it has pros and cons.

| + | — |

| NPF Telecom-Soyuz is part of the Future Group and receives financial subsidies | Requires cash injections |

| Continues to pay pensions | Losses will again be posted to customer accounts |

| There is a personal account on the official website | The information on the official website is not provided in full, there is no search |

| There is a toll-free hotline |

Foundation website

Corporate and private clients can use it. All necessary information can be found on the website www.npfts.ru. For companies, it is proposed to develop pension programs taking into account the characteristics of the organization. This approach helps motivate staff and receive tax benefits.

Helpful information! Legal entities interested in cooperation with NPFs must fill out a form. It can be found in the corresponding section of the site along with instructions for filling it out.

Profitability and reliability

Profitability shows the effectiveness of the fund's investment portfolio: how profitable the projects in which the company invested were. Using statistics over several years, you can evaluate the results and possible prospects.

The table shows the years and profitability of Telecom-Soyuz as a percentage.

| 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 (March) |

| 10,09 | 0 | 25,74 | 14,91 | 2,25 | 8,45 | 5,6 | 2,29 | 8,42 | 9,05 | 0,12 | 11,57 |

For reference.

Unstable profitability caused an outflow of customers. In 2010, the number of insured persons was 19.7, in 2021 - 17.4. The total number of clients decreased from 458.4 thousand to 309.6 over the same period of time. Reliability of NPF "Telecom-Soyuz" by year (assessments of the rating agency "Expert RA"):

- 2010: A+. The mark confirms a very high level of financial reliability.

- 2011: rating upgraded to A++ “Exceptionally high”.

- 2012: A++ Forecast “stable” - the mark will remain in the near future.

- 2013: A++. The forecast is “developing”. This means that the valuation will remain the same or decrease in the future.

- 2014: withdrawn.

In 2014, the fund refused to provide information to maintain the rating.

Reviews

NPF is not very popular among insured persons, so it is difficult to find reviews about the work of this fund on the global web. Therefore, we recommend leaving comments so that potential clients are aware of positive and negative situations in the activities of NPFs.

In conclusion, I would like to remind you that one of the significant advantages of NPFs is their long period of work in the pension market. This indicator plays an important role when choosing a fund. However, it is worth remembering that all factors must be analyzed as a whole. To do this, read our material.

Features of NPF "Telecom-Soyuz"

Main advantages of the fund

- Long work;

- High reliability indicator;

- Possibility to choose the method of receiving money;

- Selecting an accrual scheme.

Disadvantages of the fund

- Low profitability indicators;

- Inability to determine the amount of future payments;

- Investment risk.

Today, the work of non-state pension funds is an important requirement of the Russian population. Many people want to choose their own retirement savings methods. The modern NFP market is unstable, however, large organizations have an increased likelihood of successfully continuing their work and paying savings to participants.

Foundation programs

Today, the organization in question offers citizens various programs and services to use. In particular, programs can be both individual and corporate. When a citizen applies to a non-state fund, he has the opportunity to receive an increased amount of payments upon retirement.

It is necessary to select a program, the use of which will accumulate funds in a citizen’s account, while the citizen is working. To clarify the options for current programs, a person can personally contact the branch of the fund in question and obtain data. In addition, an agreement can be concluded so that the citizen’s close relatives begin to formulate a future pension.

You can choose:

- the time period during which contributions will be made;

- terms of payments when using funds from the fund;

- the period of time when a citizen receives benefits.

To take part in a program developed by a non-state foundation, you need to go to the foundation’s office. You need to contact your regional office. In particular, this could be JSC NPF Telecom-Soyuz, which is located in Cheboksary. The program is selected on an individual basis, taking into account the wishes of the citizen.

After this, an agreement is concluded with the fund. Further, nothing else will need to be done; all the person’s funds will be transferred to the organization that manages them.

The NPF system has certain positive aspects:

- amount and time of accumulation;

- the optimal way to transfer finances;

- the possibility of obtaining a tax deduction;

- program selection.

Organizations have the option to select a specific program to apply to employees. This option allows you to unite employees. Through the use of these programs, it is possible to establish a decent level of earnings for workers and take care of pensions.

If the company’s management cares about its staff, then a corporate fund accumulation program will be chosen, which is constantly developing. This option has certain advantages, including the duration of employee motivation and increasing the company’s reputation.

How to terminate the contract?

In order to stop cooperation with a non-state pension fund , a citizen must do the following:

- Choose another NPF or return savings to the Pension Fund.

- Fill out an application at the selected fund. The insured person must have an identification document and insurance certificate number (SNILS).

- Submit an additional application to the Pension Fund if this function is not performed by employees of the selected NPF. When returning funds to the Pension Fund, a citizen writes one application instead of two.

- Signing a new OPS agreement - when transferring savings to another NPF (there is no agreement in the Pension Fund of the Russian Federation). It is necessary to indicate the heirs in the document.

It is important to know! Basic information about NPF Promagrofond

NPF clients should not notify this fund about the decision to transfer savings to another company. This function is performed directly by the Pension Fund.

The best time to transfer the savings portion is the end of the year in order to maintain investment profitability from the Telecom-Soyuz NPF.