NPF "" was founded in 1996. Since 2021, this structure has been affiliated with the Future Fund (formerly NPF Blagosostoyanie).

Both of them belong to the investment company O1 Group, which manages about 13% of the total pension savings of Russians. The company invests in the development of financial services, industrial sector and real estate.

About the fund

“Stalfond” is a fairly large organization, and this increases the level of citizens’ trust in it. The structure sets itself the task of improving service for clients and maintaining the position of one of the leaders in its segment.

Initially, the organization was called “Sheksna-Hephaestus” and was known as the “metallurgists’ fund.” This is due to the development of pension programs for industrial enterprises of Severstal, with which the work of this structure began. But after 5 years, branches began to open in different regions of the country, and 40 thousand people became clients of the fund.

The name “Stalfond” appeared in 2004; a special competition was even held to select the name. At the same time, pension reform took place, and new opportunities opened up for organizations in this area. This concerns, first of all. provision of OPS services.

During 2007-2014, Stalfond managed to increase the number of contracts for compulsory pension insurance by more than 33 times to 1.002 million. The volume of pension savings increased to 34.8 billion rubles, i.e. 86 times. The foundation has been repeatedly awarded prestigious awards, including international ones, and high ratings.

What does the fund promise to pensioners?

Like any other NPF, “FUTURE” strives to attract as many clients as possible, therefore it declares the reliability of investment instruments, the reliability of deposits and high profitability. Whether this is really so, we will consider on the basis of specific indicators, which, in accordance with the law, are open information and are subject to disclosure (periodic publication).

Reliability and profitability rating

The main indicators on the activities of non-state pension funds are checked and published on its official website by the regulator, the Bank of Russia. One of these indicators is the profitability of placing funds from pension reserves minus remuneration to management companies, a specialized depository and a fund.

According to the information posted by the Central Bank, it is clear that in 2021 the efficiency of placing funds in this fund went into the negative . The return on savings management became negative and amounted to -13.35%. This is one of the worst indicators among all non-state pension funds; according to it, “FUTURE” takes 6th position from the bottom of the list.

During the 1st half of 2021, the fund’s investment activities were also unsuccessful. According to the interim information provided, the loss in placing citizens' savings amounted to 7.43%, i.e. The fund again turned into a major minus.

There are no official ratings of the reliability of a particular fund in Russia, therefore this indicator can only be assessed by ratings of independent agencies established on the basis of various indicators of their performance.

Unfortunately, the only major rating agency in the country, RA Expert, due to the refusal of the fund itself, does not evaluate its performance indicators. The latest NPF rating was assigned in 2021, according to the national scale - ruBB- with a stable outlook.

Personal account on the official website

A personal account on the Internet resource of NPF “FUTURE” opens up a standard list of opportunities for the owner:

- familiarization with the accumulated amount;

- studying the results of deduction management;

- correction of personal data if they change;

- calculation of the potential size of a funded pension, etc.

How to create a personal account and how to use it

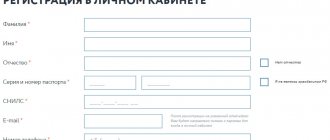

The personal account of the insured person is created on the official website. To do this you need to follow a few simple steps:

- In the upper right corner, click “Personal Account”.

- On the login page to your personal account, select “Register”.

- In the window that loads, enter the necessary data (full name, passport number and series, SNILS, email address and phone number).

- Agree to the processing of the submitted data.

- Enter the so-called captcha, referred to here as the “verification code”.

- Click the “register” button.

After sending the data, the user will receive a password to log into the system.

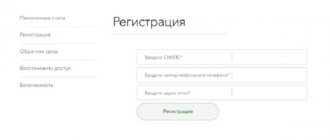

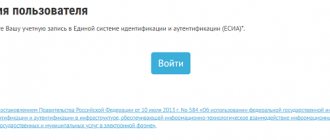

After registration, the client has all the opportunities to control and manage the account, edit his data, interact with the fund manager, etc. To do this, from now on, on the main page of the site, you will also need to click on “Personal Account” and log in using any of the presented methods (SNILS, e-mail or phone number with a password).

Official website

The official website of NPF "Stalfond" futurenpf.ru provides access to information about the work of the fund, areas of activity, cooperation with partners. Here you can:

- Calculate pension according to compulsory pension insurance;

- Submit a request for information;

- Choose an individual pension plan;

- and necessary documents;

- Learn about the procedure for inheriting funds.

On the official website of OJSC NPF Stalfond there are complete conditions for registering an individual pension plan. Moreover, clients of the fund can fill out an online application for the development of such a plan by specialists. In this case, all the capabilities and needs of the citizen will be taken into account.

Trust

It is worth noting that the level of trust also plays a role. It indicates how strongly the population believes in the stability of the organization. At the moment, JSC NPF "Stalfond" is not in the highest place in terms of trust level.

However, trust is still high. According to statistics, it is rated A+ or AA. This is a characteristic that reflects the “High Trust” status. However, the best rating for a trust is AAA or A++. "Stalfond" did not reach him. And during its entire existence, such a mark has not been achieved.

This is not a reason to refuse investments. After all, public confidence is still quite high. This means that you should not be afraid of cooperation with the organization. If anything, it gives its clients a sense of security for their money's worth. This is exactly how some investors put it.

Only one thing is certain - the Stalfond pension fund really increases savings. Not too strong, but there is still recoil.

Pension plans

According to the plan, upon the occurrence of appropriate grounds, the NPF client receives a non-state pension plus income from the investment of funds that he contributed in the form of contributions.

Important! Additional income is a social tax deduction - 13% of the amount of contributions for the year. This rule applies to amounts within 120 thousand rubles.

When making contributions, the frequency can be any. The first payment is from 1 thousand rubles. This approach allows you to effectively manage savings and provide additional protection in retirement age. There are various ways to deposit funds, from enterprise accounting and Sberbank branches to online services.

Helpful information! You can become a client of the NPF at any time. To do this, it is enough to transfer the pension savings collected in the account until the end of 2015 to a non-state fund. The funded pension will be paid from this amount.

The fund's clients are given the opportunity to increase their pension. The employer transfers to the Pension Fund 22% in excess of the salary, of which 6% are savings until the specified date, 16% are deductions towards the insurance pension, formed in points.

NPF rating

Earlier, RA “Expert” confirmed the rating of “Stalfond”, assessing its reliability at the “A+” level. This is a high figure, and the forecast for it was stable. After the reorganization, the rating was withdrawn. The fund received an 'AA' rating from the National Rating Agency in 2011, but this was withdrawn after the end of the contract period.

Contact Information

All clients who have entered into contracts with NPF "Stalfond" are currently serviced by the "Future" fund.

Important! All agreements remain valid and there is no need to re-issue them.

In Moscow, the fund's representative office is located on Tsvetnoy Boulevard. D.2, checkpoint D. You can contact the unified information service by phone: 8-800-707-15-20, the call is free from anywhere in Russia. Customer requests are accepted at:

Offices and branches operate in other cities of the country. You can find your nearest representative office on the official website of NPF "Stalfond".

Around the country

The next nuance that is taken into account is the distribution of the fund throughout the country. Large organizations are more trustworthy. This is exactly what the Stalfond pension fund is.

It has been working since 1996. The company has branches in almost every city in Russia, even in the smallest towns. On the official page of Stalfond you can see the exact addresses of the organization in a particular region. There are no problems with this.

Many are pleased that Stalfond is a large company. This, as potential and actual clients assure, inspires confidence. In any case, a large pension fund is unlikely to be closed quickly. This means that money will not be lost. This opinion is shared by many residents of the Russian Federation. Thus, the scale of the organization indicates that you will not have to work with scammers

Personal Area

To register a personal account, you will need to pass authorization. To do this, you need to enter your passport and SNILS details, as well as contact information. After registration, the fund's clients have access to:

- Information about the account status (provided within a few seconds);

- Free consultations for employees of the organization;

- Intuitive interface;

- Interest rate data.

By providing the required information, the client agrees to the processing of his personal data.

Service

Another component is the quality of customer service. This factor plays an important role in the direct assessment of the work of the “Personal Account”. It allows you to work online with the organization’s services without any problems. If necessary, you can order a certificate of the status of your personal account. Or even get advice from employees. Only, as many clients say, “Personal Account” works with some interruptions. Certificates take a long time to prepare, and authorization is not always possible. Small, but still shortcomings.

But in the offices of Stalfond things are different. The speed of service leaves much to be desired, but if you believe the opinions of visitors, the employees answer all questions. They are trying their best to attract new investors. To some, such initiatives seem suspicious. But no direct negativity is expressed.

The conclusion of contracts occurs without any problems. Only, as some claim, “Stalfond” does not explain the rights of depositors in the best way. Because of this, there are opinions according to which the pension fund being studied is a scam. At the same time, we should not forget that the organization has won the trust of visitors and has been working in Russia for a long time. This means that such accusations are unfounded.

From now on, it is clear how NPF “Stalfond” “Personal Account” works, as well as offices. Overall, there are no serious complaints. But the population draws attention to some shortcomings.

Reviews about the fund

Reviews about the work of NPF "Stalfond" are quite contradictory. You can often find stories about fraudulent methods of concluding contracts.

It happens that agents introduce themselves as employees of the Pension Fund and do not clearly explain to people the conditions for transferring funds to the fund. However, such costs are more likely associated with the lack of competence and integrity of the agents themselves.

In general, the fund fulfills its obligations and pays all amounts on time. This is confirmed by many years of successful work in this market and not the last positions of “Stalfond”.

(

6 ratings, average: 3.33 out of 5)

Profitability

The next evaluation criterion, which often turns out to be decisive, is the return on investment. What is the profitability of NPF "Stalfond"? This question interests most potential clients. After all, not everyone has the sole goal of preserving their pension savings. Some people want to receive a good return when opening a deposit.

In this area, “Stalfond” earns very mixed reviews. There are even negative opinions. Why? This is all due to the fact that initially JSC NPF “Stalfond” promises an annual return of 18%. But in practice it turns out that the annual increase is about 8-8.5%. The difference between the real picture and the promises is serious. This turns some people off.

However, this phenomenon is easily explained. It's all about inflation. In the current crisis, it is not possible to provide the desired profitability. All non-state pension funds have a similar situation with profitability. Only one thing is clear - the Stalfond pension fund is really increasing savings. Not too strong, but there is still recoil.