Transfer of pension to a non-state pension fund

To transfer your pension to a private pension fund, you must first decide who you are willing to entrust your savings to. First of all, you need to consider several funds to determine their pros and cons and make a choice in favor of one of them.

Criteria by which you need to choose an organization:

- Profitability . Each pension fund invests savings in certain assets: stocks, metals, and so on. How savings in the fund grow, and whether the return exceeds inflation, can be found out from the reports of the Bank of Russia.

- Reliability . This criterion is formed from two factors: the direction of investment and the operating time of the non-state pension fund. The longer an organization exists, the more reliable it is. Also, you should not transfer savings to funds that invest in unreliable assets (digital currencies, oil).

- Reputation . On independent resources you can find reviews of all non-state pension funds. Based on their ratio, you can draw certain conclusions about the fund’s performance and decide whether you are ready to transfer your pension savings there.

There are two options for transferring to a non-state pension fund:

- Urgent : after the end of the calendar year, another 4 years pass, only then the savings are transferred from the Pension Fund.

- Early : savings are transferred before March of the next calendar year, while the insured person loses part of the investment income.

Attention! From 2021, you can transfer to a non-state pension fund only by contacting the Pension Fund in person or through State Services. To transfer, you must submit an application before December 1 of the current year, while the right to withdraw it and refuse to transfer savings is retained until December 31.

The procedure for transferring from a non-state pension fund back to the State Pension Fund

After the Pension Fund has approved the applicant’s request to transfer funds, the agreement with the non-state fund is subject to cancellation. It is worth noting that all changes regarding the calculation of funded pensions should be entered into a single register.

- Contact the nearest GPF branch. Another relevant body is the MFC. Pension Fund or MFC employees will have to carry out identity verification work.

- Postal forwarding. In this case, verification of the person’s authenticity is the responsibility of the person (Article No. 185 of the Civil Code of the Russian Federation). This can also be done by an authorized person of the Russian consulate if at the time of filing the application the interested person is outside the country.

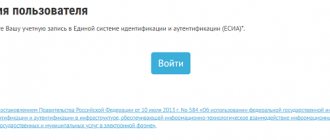

- Online electronic submission. To submit an application signed with an electronic signature for the transfer of funds, you must use the State Services website, which is located at gosuslugi.ru.

We recommend reading: What is the name of the pension fund in Russia

Is it worth translating?

The question of the advisability of transferring to a non-state pension fund is acute for those who are thinking about transferring savings to a non-state pension fund. You can decide whether to switch by weighing all the pros and cons. In addition to transferring your pension to a private pension organization, there are two more options:

- Formation of a second pension in the NPF . An agreement is concluded, the insured person contributes funds at will and forms his future “second pension”, while the fund ensures their safety through investment.

- Transfer only the funded pension to the NPF . If you have some amount in the Pension Fund aimed at forming the funded part of your pension, you can transfer it to a non-state pension fund and continue investing. At the same time, you don’t have to switch completely to a private fund.

On the one hand, the state fund seems safer to us. But if you look at it, insurance and investment of funds occurs in both public and private funds according to the same system. That is, the degree of protection of funds is approximately the same.

In addition, NPFs are not registered just like that: they are subject to very serious requirements, and after registration they are controlled by government agencies and periodically provide reports.

In addition, private pension funds have their own advantages :

- the ability to independently form a future pension and determine the amount of contributions paid;

- protection from reforms by the state;

- the ability to inherit savings, which is very important, because the Pension Fund does not provide such a right.

What documents are needed to transfer from one NPF to another through the MFC

In any case, a person who has a sufficient number of so-called pension points and sufficient insurance experience, in addition to payments from the NPF, will also receive the age insurance pension required by law. A person who does not have sufficient insurance experience to receive an insurance pension still has the right to receive his part of the funded pension according to its size, and can also apply for a state social pension upon reaching the appropriate age. The procedure for transferring from the Pension Fund to the NPF In order to transfer the existing funded part of the pension from the Pension Fund to the NPF, you need to prepare a certain package of documents and contact the territorial division of the Pension Fund or the multifunctional center (MFC) operating at your place of residence.

When making the first calculation of insurance contributions and for five years after it, a citizen has the right to independently choose the pension calculation mode that is suitable for him - to count exclusively the insurance part, or the insurance and funded separately. If a citizen does not express a desire to accumulate his funds exclusively in the form of an insurance pension, then by default 27.5% of his pension contributions will be allocated to the formation of the funded part. It should be noted that the insurance pension is more beneficial for persons with a short total work experience and low income, since it is guaranteed by the state. At the same time, if a person’s earnings exceed the minimum wage, then the formation of the funded part of the pension, even without applying to a non-state pension fund, will be more profitable and effective.

We recommend reading: One-time payment to Chernobyl victims in 2021 in Moscow in April

Disadvantages of NPF

Naturally, non-state funds also have disadvantages:

- It is often not possible to withdraw funds early. NPFs usually provide the opportunity for early withdrawal of savings only in exceptional cases: death of the insured person (withdrawal by heirs), transfer to a state pension fund.

- Only national currency. Private pension funds of the Russian Federation can only store funds in Russian currency. This is a significant disadvantage for those who do not trust the ruble and prefer to ensure the safety of their savings by converting them into international currencies.

- There is no guarantee of profitability. The profitability of savings in NPFs is not guaranteed, so there is a possibility of losing part of your savings due to inflation, crisis, and so on.

- Commissions. Private pension funds charge fees for managing depositor funds. Sometimes they can be extremely disadvantageous for future retirees.

- Inability to influence investment directions. Non-state pension funds independently form an investment portfolio and choose investment directions. The investor can only either agree to the terms and transfer savings, or refuse and choose another fund.

How to transfer from the Pension Fund to the Non-State Pension Fund: transition procedure

To transfer to a non-state pension fund, you need to take several steps.

Firstly, enter into an agreement with the selected fund.

It is concluded in accordance with the provisions of No. 75-FZ and contains the following information:

- NPF name.

- Full name of the insured person.

- Subject of the agreement (what actions the organization will take with savings).

- Number in the personalized accounting system.

- Basic rights and obligations of the parties, conditions for termination of the contract.

- Procedure and conditions for making contributions and paying pensions.

Secondly, you must submit a corresponding application to the Pension Fund. This can be done by personally visiting the territorial office, or through the State Services portal.

Thirdly, you need to wait for the decision of the Pension Fund on the application. The Pension Fund is obliged to consider it before March 1 of the next year (in case of early transfer). And within 30 days, if a positive decision is made, the savings will be transferred to the NPF.

They may refuse in the following cases:

- the procedure for completing or submitting an application has been violated;

- The NPF specified in the application has been deprived of its license.

When deciding to refuse, the Pension Fund sends a corresponding notification.

Procedure for transferring funds to a new fund

To transfer to a new NPF you must do the following:

- Step. Choose a new fund. When choosing, you should pay attention to the profitability of non-state pension funds, as well as the following criteria:

- number of insured persons;

- volume of own funds;

- the amount of net profit;

- volume of financial reserves.

A complete list of current funds can be found at the link: www.pfrf.ru.

- Step. Fill out an application. The form of the form differs depending on the method of transfer: urgent or early.

In case of an urgent transfer, savings are transferred to the NPF 5 years after the previous agreement with the NPF.

And in case of early transfer, finances are transferred to new NPFs next year after submitting an application to the corresponding fund, if the application was submitted later than March 1 of the current year. For example, the application was submitted on April 10, 2021. Consequently, the funds will be transferred to the NPF from January 1, 2021.

- Step. Submitting an application to the NPF. To transfer to a new NPF, the application must be submitted no later than March 1 of the current year or before December 31, so that the savings are transferred to the NPF from the beginning of the next year. A sample application can be found at the link: www.pfrf.ru.

It is important to know!

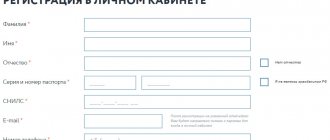

NPF Electric Power Industry - basic information When submitting a document in person, you need to have a passport and SNILS with you. In addition, the application can be sent by mail, by e-mail (the agreement must be signed electronically).

If a citizen has changed his decision to transfer to a non-state pension fund, he must send a notification to the local Pension Fund of Russia by December 31 to change the selected fund.

- Step. Review of the application. Based on the results of the review, the NPF inspector makes one of the following decisions:

- Consent to transfer funds. In this case, NPF employees create a separate account for the insured person, and also transmit data to the Pension Fund so that changes can be made to the register, and at the end they send a letter to the actual address of the insured person.

- Refusal to transfer to another fund. In case of a negative decision, the changes are not made to the register of the insured person, and the agreement with the existing NPF does not cease to be valid. The citizen is sent a notice of refusal indicating the reason.

The determining factor in the relationship between the insured person and the NPF is the compulsory insurance agreement.

To prepare the document, you will need a passport, as well as SNILS, pension certificate (if available).

Before signing the relevant documentation, you must carefully read all the clauses of the agreement, enter the heirs, and also study the rules of a particular NPF.

The purpose of the document is to transfer the pension savings of the insured person to the accounts of non-state pension funds, which upon retirement are returned to its owner in the form of a decent supplement to pension contributions.

You may be interested in learning important things about compulsory pension insurance.

After the contract comes into force, a personal account is opened for the insured person. The NPF has the right to invest funds in shares - no more than 75% of the total amount and 80% - in bonds and deposits.

If a non-state pension fund does not justify the invested funds, then it is obliged to compensate for losses from its own financial reserves.

The main disadvantage is that the insured person cannot independently choose the area of investment for his future pension.

Which NPF to choose

In order to select a specific non-state pension fund, it is necessary to collect information about organizations existing on the market. Let's look at a brief description of some of them.

- "Surgutneftegaz". The fund began its work in 1995. The return on investment is, according to 2021 data, 13% per annum (one of the highest). By 2021, NPF "Surgutneftegas" has about 95,000 clients, of which a third are already receiving pensions.

- "Opening" . The return on savings is almost 12% per annum. As of 2021, about 60,000 people are receiving pensions. The fund has not been operating for long, but has managed to establish itself as reliable and successful.

- "Agreement". NPF Soglasie began its activities in 1994. In 2021, the return on savings was 10% per annum.

- NPF Sberbank. Sberbank NPF serves pension savings for more than 7 million clients. Yield for 2021 is 9.89% per annum. More than 100,000 people will receive a pension in 2021.

- "Transneft". In terms of the volume of pension reserves, the fund is the third in the Russian Federation, and in terms of profitability it is in 11th place (10.85% per annum).

- "Volga-Capital". NPF with high yield (11.37% per annum), began operation in 2007.

- National NPF. The fund with a return on savings of 10.83% has been operating since 2007. As of 2021, the number of clients has reached 400,000 people.

- "Hephaestus." It has been operating since 1993 and has the highest yield (15.33% per annum) due to large shareholders and proper investment of funds: the company invests in securities of Gazprom, as well as other industrial, OMK JSC).

- "Welfare". Also a fairly old organization, it has a good reputation and a high return on investment (11.68% per annum). The Blagosostoyanie pension fund has been operating since 1996.

- "Evolution". Extensive work experience, high profitability (11.64% per annum) and good reviews - this organization meets all these criteria. NPF Evolution opened in 1999.

If you want to switch from the Pension Fund to a private pension fund, it is better to give preference to one of those listed in the rating above. In this case, it is necessary to take into account reviews, evaluate the investment portfolio and the quality of customer service.