From all incomes of able-bodied citizens, deductions are made to government bodies that provide social protection for the population. Part of all funds that the employer withholds when paying wages goes to the formation of a future pension and goes to the State Pension Fund. The legislation of the Russian Federation gives individuals the right to independently manage their pension savings. Therefore, one of the most popular questions today is how to change the pension fund through Gosuslugi.

How can you manage your pension?

The pension reform carried out by the Government of the Russian Federation more than 5 years ago allowed citizens of the Russian Federation to independently determine where to store their pension savings, how to independently increase their size and control their replenishment.

Pension savings consist of two parts:

- cumulative (taken into account when determining the amount of future payments);

- insurance (established by the state and at its disposal).

In general, both parts go to the Pension Fund of the Russian Federation and are distributed depending on their purpose. However, recently, all citizens of the Russian Federation receiving wages have received the right to transfer their savings to other structures - non-state institutions that can place them on more interesting conditions.

You can change your pension fund either by contacting a government agency in person or through the government services portal.

Mass statements

In any case, the decision to transfer funds is up to the citizen.

However, in 2016-2017, the PFR office in the Altai Territory began to receive large numbers of applications from citizens. People reported that they did not enter into an agreement on compulsory pension insurance with the new fund and did not sign an application for the transfer of pension savings.

How did this turn out to be possible - after all, in order to transfer savings, a citizen needs to sign an application himself? There are several options here, and all of them, as they say, are on the verge of fraud.

Now there are more than 4.3 trillion rubles in the savings system, belonging to 76 million Russians.

MTR

Statements from citizens are studied by government agency specialists to ensure compliance with the law when drawing up a new agreement. The result of this work may be a decision on:

- satisfying the wishes of the insured person;

- refusal.

Attention: if the form is filled out incorrectly, the application will be left without consideration.

The government agency informs all parties to the relationship about the decision made by March 31 of the year following the date of filing the application.

Written appeal

You can fill out an application for transfer of contributions by visiting a specialist at the territorial office of the Pension Fund in person, which is located in the area of residence of the interested person.

A citizen who plans to transfer his savings must draw up a special application and indicate:

- your initials and surname;

- individual insurance account number;

- TIN number;

- details of the non-governmental organization to which the savings should be transferred.

Decor

It is mandatory to comply with the following rules for registering the transfer of funds from one part of the pension fund to another NPF:

- An application to complete this operation is drawn up and sent to both NPFs.

- Copies of the passport of the person whose funded part of the pension is transferred are sent to both NPFs to confirm the fact of his identity.

- An official referral is submitted to the tax administration at the citizen’s place of residence to clarify the fact of the presence or absence of debts to the country’s budget.

- All the main details of the upcoming funds transfer are agreed upon and documented.

- The specific amount of the upcoming transfer of cumulative pension payments is negotiated.

- A tripartite agreement is concluded on the execution of the type of translation in question.

Do you want to know,

We invite you to read: Academic leave is granted to a student on the following grounds: valid reasons and procedure for registration

What documents are needed to apply for a long service pension for teachers?

? In our article, you will find the most complete and up-to-date information on this issue.

If you are looking for information about social disability pension for foreign citizens, we recommend that you refer to the article.

Transfer to NPF via the Internet

In order not to waste time in long waits, a citizen of the Russian Federation can independently transfer to a new fund through the electronic portal for the provision of services.

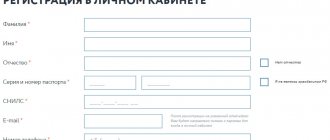

In order to use this service, an individual must register in its accounting system and create an account. To send requests and receive official responses, the citizen will need to confirm his data. This can be done through the tax authority’s website (taxpayer’s account), or through the system of authorized banks (Sberbank, Tinkoff).

Important. Information entered into the State Services account must not contain errors and cannot be unreliable. Otherwise, the user will be denied registration on the portal.

Through Gosuslugi you can move both to a non-state fund and from one non-state pension fund to another.

To apply for the transfer of pension savings through “State Services”, on the main page the user will first have to select the “pension, benefits and benefits” tab from the presented categories, and then “manage pension savings”.

The presented service will contain several transition options:

- from the Russian Pension Fund to the Non-State Pension Fund;

- from a non-state pension fund to another fund (state or private).

After the user has decided on the type of service, a special form will open in the electronic window in which it will be necessary to enter data:

- passports;

- TIN and SNILS;

- an institution that stores savings;

- the organization to which the funds are to be transferred;

- body that will be authorized to consider such an appeal.

Translation rules

Here's the thing. The insurer (NPF or Pension Fund) records investment income received from the placement of funds once every five years.

If the owner of savings changes the fund ahead of schedule (for example, the next year after fixing investment income), he loses the interest accumulated during this time. If the transfer application is written in the year of fixation, then investment income is not lost, savings are transferred to another insurer, taking into account interest.

Let's explain this in a little more detail.

When investment income is lost

If, for example, the last fixation of funds in a person’s account (in the Pension Fund or in the Non-State Pension Fund) occurred in 2021, and he wrote an application for early transfer in 2021 (and the funds will be transferred in 2021), then the person will lose income from 2021 to 2021 years.

When investment income is NOT lost

When a person writes a regular application for transfer (not early). In this case, the money is transferred in the fifth year after filing the application. For example, such a transfer application was written in 2014. The money will be transferred in the fifth year, that is, in 2021. In this situation, it does not matter when the fixing occurred.

How to find out information about savings

All revenues intended for the formation of old-age benefits are taken into account by the state fund. Information about all accruals is available to citizens and can be provided when contacting the fund storing funds.

The savings available to the citizen, as well as the sources of their receipt, are confirmed by a certificate of the state of the account of the citizen of the Russian Federation with the Pension Fund. Such a document can also be provided in electronic form. To do this, in your personal account, you need to click on the following tabs in sequence:

- pensions, benefits, benefits;

- notification about the status of the Pension Fund account;

- receive a service.

Data on deductions is generated immediately and made available to the user within one minute.

The choice of a pension institution to which you can entrust your money must be taken seriously. In order not to lose the cumulative share of payments, users should study in detail all the conditions, rates, and the percentage of their increase offered by non-state structures. In practice, citizens are reluctant to go to institutions unknown to them, and when transferring funds they evaluate the length of time the company has been operating on the market, or the presence of a connection with a large industrial corporation (Gazprom, Rosneft, etc.).

Methods for transferring the funded part of a pension from one NPF to another

The following types of transfer of funds from the funded portion of a pension between a number of non-state pension funds may be established by law:

- Non-cash transfer of funds within a strictly specified time frame between NPF bank accounts.

- Transfer of amounts in cash equivalent using collection when transporting funds.

- Options for transferring funds in installments within a specified time frame and in the volumes strictly assigned to the transfer.

- Other methods stipulated by the rules of the legislation currently in force in the country.

Advantages and disadvantages of switching from one fund to another

The considered procedure for transferring funds between NPFs has its advantages and disadvantages.

The advantages of the scheme for transferring funds between NPFs include:

- An opportunity for a citizen to make transfers of funds without limiting their volume in strict accordance with established rules.

- A variety of ways to transfer funds.

- A simple and understandable scheme for making this transfer.

- Flexible conditions for accruing funds to a citizen for their redirection between two or more non-state pension funds.

- The reality of receiving funds exactly at the appointed time.

- Full documentary support of the entire transaction throughout its entire duration.

Disadvantages of the considered scheme for transferring the funded part of a pension between non-state pension funds:

- Inability to track the correctness of the transfer of funds in the proper amount if the recipient has additional benefits.

- Such operations can only be carried out by Russian citizens.

- The deadlines for completing such translations are strictly limited by law.

- The transfer of funds of this type is available only if there are no claims against the recipient from the tax authorities.

- The scope of the amounts to be paid is regulated by the provisions of the law within strictly defined limits.

- It is impossible to accrue amounts to a citizen for transfer if he does not have registration at his place of actual residence.

Attention!

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

That's why FREE expert consultants work for you around the clock!

- via the form (below), or via online chat

- Call the hotline:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

Of course, changing the fund entails both advantages and disadvantages.

The positive aspects stand out:

- the possibility of increasing account profitability;

- receiving additional services from the new fund;

- direct influence on the formation of your own insurance pension;

- protection of the process by law - no possibility of money loss.

The negative aspects include:

- the possibility of losing income if you transfer to a new NPF incorrectly (and/or untimely);

- inability to influence the fund’s decision to approve or refuse the transfer.

Checked the box without looking

“I took out a loan from a bank. Without looking he signed many different papers. The bank employee explained everything about the loan, but didn’t even dwell on the other details. Then it turned out that I checked the box indicating my consent to transfer savings to a non-state pension fund associated with this bank,” lamented one of the Barnaul residents.

However, citizens often sign transfer applications, one might say, consciously. Barnaul resident Natalya said, for example, that in their house a couple of years ago an agent went from apartment to apartment and persuaded them to transfer their savings to a non-state pension fund.

He introduced himself as an employee of the Russian Pension Fund (although they never visit apartments and do not agitate for changing insurers) and frightened with the fact that the state could allegedly confiscate savings, but investments in non-state pension funds were protected. Natalya herself found the identity of the “employee” dubious; she refused to transfer the savings. But the neighbor, on the contrary, agreed.

And Barnaul resident Alexey B. was forced to sue the NPF. He learned that his savings were transferred from one non-state fund to another after receiving a notice from the previous fund about the termination of the contract. How could this happen? It is possible that one of the agents obtained a copy of Alexey’s SNILS and filled out a transfer application on his behalf.

During the trial, the examination confirmed that Alexey’s signatures under the agreement with the new fund were fake. The Central District Court demanded that the new NPF return savings to the previous fund, pay interest for the unlawful use of funds and pay Alexey legal costs. It took the Barnaul resident 10 months to go to court.

During the trial, the examination confirmed that Alexey’s signatures under the agreement with the new fund were fake.

MTR

Deadlines

The timing of the promotion in question is agreed upon directly between the parties who are directly involved in the transaction.

As a rule, the time frame for making a transfer of funds between non-state pension funds ranges from one to two weeks from the moment a citizen sends an application for such a transfer.

Do you want to know what they are?

additional insurance contributions for funded pension in 2019

? To do this, you should follow the link.

You can read in the article whether it is possible to withdraw the funded part of your pension before retirement.

And you can find out the answer to the question - how to use maternity capital for your mother’s pension using the link provided.

We invite you to familiarize yourself with: Sample application for the issuance of a court order to the magistrate's court

Time to think

The new amendments to the law include three key changes.

Firstly, when submitting an application to transfer savings, the client will be informed of the amount of investment income that he loses when changing funds.

Secondly, the Russian Pension Fund will inform both the old and the new fund about the fact of filing an application for transfer. Representatives of the previous fund will be able to contact the client and clarify whether he understands the consequences of the transition, as well as remind him of the loss of investment income.

Thirdly, the citizen will have the opportunity to think. He must submit an application for transfer before December 1. And until December 31 of the same year, he has the right to refuse his decision; to do this, he must submit to the Pension Fund a notice of refusal to change the fund. In case of refusal, the savings will remain in the previous fund.