Non-state pension provision - what is it?

Implemented upon concluding agreements with Non-State Pension Funds or Non-State Pension Funds. Complements the system with support from the state.

Over a certain period of time, the citizen himself transfers specific amounts in favor of a particular institution. The financial activity of the fund provides an increase in amounts or investment income. This is a general rule that applies to all concluded contracts.

To create compensation packages for current employees, non-state pension savings are becoming a very important factor.

Thanks to the opportunity to invest your own funds, several results are achieved at once:

- Additional motivation for employees.

- Strengthening trust in employers.

- Increasing the rating of enterprises.

Reference! The parties to such an agreement are not only investors and non-state pension funds, but also project participants who receive additional profit. In this case, individuals and legal entities can play the role of investors equally.

The Central Bank and the National Fund approve a whole set of rules according to which non-state pension funds must operate, regardless of the scale and scope of activity. The main and additional reasons for payments are described separately.

How can a person increase his income in retirement?

There are several ways for older people to increase their income:

- state pension;

- additional payments from a non-state pension fund;

- endowment insurance;

- deposit deposit;

- ownership of bonds and other income-generating securities;

- renting out your property;

- children's help.

Accumulating money in an account in a non-state pension fund is becoming an increasingly popular way to ensure a comfortable old age. Today, 4.6 million citizens form a private pension for themselves; their savings amount to more than 800 billion rubles. Almost half of this money was invested without the participation of employers and the state, under individual contracts. The remaining agreements are of a corporate nature. The average increase in pension from a non-state fund was 3.3 thousand rubles per month.

According to a sociological survey, after the introduction of the pension reform, more than a third of Russians plan to continue working after reaching retirement age, about 20% rely only on their savings, 3% expect help from their children and count on additional payments from non-state pension funds. Only 16% of Russians agree to live only on a state pension.

Subtleties of NGO agreements - what to pay attention to when signing

The choice of NPF must be approached very carefully.

The most important factors in this case are the following:

- Experience.

- Company reputation.

- Indicators of profitability from investing pension savings.

The website of the Bank of Russia and NPFs themselves usually contains comprehensive information regarding the specifics of the work of specific institutions.

The first step is to study all the rules and select a scheme according to which deductions will be made in favor of the citizen. Most often, the amount of specific contributions or payments is established. The schemes are insurance and savings. There are combined options, when both decisions are made at once, sequentially.

Important! At the same time, the basis of any activity is only funds, the sources of which are citizens.

In the event of the death of a citizen, funds are provided for payment to those who are legal successors. When concluding an agreement, you can immediately indicate those who represent this category. If this information is not in the agreement, the inheritance process is organized according to the general rules.

Information on the status of pension accounts is sent annually, no later than September 1. The results of investment actions are reported.

Retirement planning example

Anton and Svetlana are 37 years old, they have two children. Family expenses amount to 250,000 rubles, or 3,846 USD monthly.

The couple would like to retire at age 60 and have a monthly annuity of $3,000 per month. Anton and Svetlana assume that by the time they retire, each of them will receive 150 USD monthly from the Pension Fund of the Russian Federation; they will have no other sources of passive income.

Then the steps for Anton and Svetlana’s retirement planning will be as follows.

- Desired pension annuity at current prices

3,000 USD monthly.

- The required pension annuity at current prices

Each spouse plans to receive 150 USD monthly from the Pension Fund of the Russian Federation upon retirement. Therefore, we have the right to reduce the rent they need by this amount. Thus, the required pension annuity at current prices will be

3,000 – 2 *150 = 2,700 USD.

- Retirement date

Now the couple are 37 years old, and they would like to stop working at 60 years old. This means that their retirement period is 23 years.

- The required annuity during the retirement period

The spouses are 23 years away from retirement. Over this period, with annual inflation of 3% per annum, the dollar will fall in price by 1.9736 times. This means that the pension annuity required by the spouses will be

2.700 * 1.9736 = 5.329 USD monthly.

After 23 years, the purchasing power of the amount of 5,329 USD will be equivalent to the current value of 2,700 USD. Therefore, starting to receive 5,329 USD monthly after 23 years, the spouses will be able to maintain the standard of living that they plan to have.

- Capital needed by spouses

If Anton and Svetlana plan to transfer capital to their children, then they will only spend interest on their capital. Let's assume that they will invest conservatively during retirement, with a return of 3% per annum in US dollars.

Then, to receive the required monthly annuity, spouses at age 60 will need capital in the amount of:

(5.329 * 12) / 0.03 = 2.131.600 USD

The second scenario that the spouses are considering is the transformation of the created capital into a life annuity. In order to receive an annuity of 5,329 monthly from the age of 60 and for life, the spouses will need capital in the amount of 1,398,688 USD. This amount is determined based on the life annuity table with a yield of 2% per annum:

life annuity table of the American company NWL

How accumulated funds are paid to NPFs

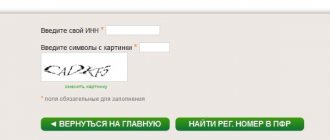

To assign a non-state pension, you must submit an application to representatives of the relevant institution. The list of specific supplementary documents differs depending on where a particular citizen is served.

The non-state payment is assigned on the same day the citizen applies for it. Transfer of money begins a maximum of 30 days after the first request.

As for the size of the future pension, it is determined by several factors:

- The amount accumulated at the time of registration of the pension.

- The pension scheme specified in the contract.

- Rules of the selected fund.

If at the end of the year the institution managed to receive a higher income, this means that the amount of security for the citizen increases.

When the amount has been determined, the citizen is sent a corresponding notification. The document lists not only the amount, but also the deadlines for payment of compensation.

To transfer funds use one of the following methods:

- Postal transfer.

- Bank card with a specific number.

- Bank account number.

Attention! In a written appeal to a citizen, all necessary information is indicated. If a client's personal information changes, he must notify those with whom he interacts about this.

If a non-state pension fund goes bankrupt - possible consequences for investors

The most obvious disadvantage of cooperation with a non-state pension fund is the risk of losing your contributions and investment income if the organization is declared insolvent (bankrupt) and, as a result, liquidated. The second unfavorable scenario is liquidation due to license revocation:

- If the fund participated in the compulsory pension insurance system (responsible for funded pensions), the Deposit Insurance Agency will liquidate the organization.

- If the NPF was engaged only in voluntary NGOs, its founders will liquidate it.

- If a company is liquidated as a result of being declared bankrupt, the procedure is carried out by an arbitration manager.

The liquidation procedure in each case will necessarily include an assessment of the organization’s assets: property, real estate, investments, accounts receivable, etc. and their sale.

When it comes to NGOs, the proceeds from the sale are distributed in strict order:

| First, the money will be received by NPF clients who have already acquired the right to a pension and should receive it for life. | The deposit insurance agency or the founders of the NPF must hold a competition and select another fund that will offer the best conditions for clients of the bankrupt NPF. The funds will be transferred to this NPF and the person will continue to receive it, however, possibly in a smaller amount. |

| Then clients who have already acquired the right to a pension and must receive it within a certain period. | Payment of the remaining pension will be in the form of a one-time payment (all or part of the remaining amount at once). |

| Then - investors who are still accumulating pensions, in proportion to the funds remaining in the NPF accounts | Payment of the remaining pension will be in the form of a one-time payment (all or part of the remaining amount at once). |

| The companies that paid contributions for their employees will be the last to receive the money. |

ATTENTION : If the NPF’s money is not enough to pay off depositors’ claims in full, it will not be possible to get your money back in full.

Is it possible to apply for early retirement if you are a member of a non-state pension fund?

The pension provision itself is assigned if at least one condition is met:

- The occurrence of the grounds specified in the contract.

- A written statement from the client about the emerging right to payment of benefits.

There are situations when money begins to be transferred ahead of schedule. That is, before the age established according to the general rules. Supervisory authorities conduct a special assessment to accurately verify the presence of dangerous and harmful working conditions in a particular position. This procedure replaces the workplace certification that was previously carried out.

Working conditions are assigned one of the hazard classes when the assessment is completed. The third and fourth classes are the most dangerous, for which compensation is given in any case, often increased.

To provide subordinates with funds, employers are granted the following rights:

- Additional transfer of money to non-state funds.

- Payment of insurance premiums depending on the established hazard class, at increased rates.

In the case of the first decision, one cannot do without written consent and confirmation from the employee. The amount of contributions is established by law.

There are two possible situations:

- 2% for employees with hazardous working conditions.

- 4% if working conditions are highly dangerous.

The employer's pension system may include the very ability of a citizen to personally provide for the future. In this case, part of the salary goes towards contributions. But be sure to notify the other party in advance.

The accumulated amounts are invested in any direction when they reach certain limits set by the company. That is, an investment portfolio is formed, which brings profit to investors. This way, the invested money will receive additional protection against inflation. And the pension itself will actually become larger.

The concept of a non-state pension

Corporate and other non-state payments are currently a priority for people who want to ensure a comfortable old age.

Art. 3 of the Federal Decree “On Non-State Pension Funds” establishes the concept of a non-state pension. It should be understood as funds that are paid to the participant on a regular basis in accordance with the terms of the concluded pension contract.

The formation of such payments occurs through contributions transferred by people. In a non-state pension fund, this money can be used for co-financing programs and increased in the future.

Contributions to such funds can:

- employers;

- personal entrepreneurs;

- self-employed persons.

If during the Soviet Union government payments were considered more promising, now it’s the other way around. The size of corporate accruals allows us to draw a conclusion about contentment in old age.

Advantages and disadvantages of non-state pension provision (two pronunciation options: provision and provision)

The pension in a non-state pension fund can increase significantly. In addition, it can be disposed of at your own discretion , with regard to the possibility of lump sum payments. For example, after 5 years you can withdraw the entire amount of savings, including accrued investment income from the NPF.

Due to the interest accrued by the bank for the right to use foreign currency funds, it is also possible to increase the amount . Thus, there will be no risk of losing your own resources.

Also, the non-state part of the pension, or more precisely, part of the contributions for its formation, can be returned to the citizen with the introduction of tax benefits . A nice bonus is the opportunity to return 13% of the amount of contributions paid if you apply for a social tax deduction. The maximum refund amount is 15,600 rubles per year.

Since 2021, adjustments have been made to the law, according to which the age for non-state pension is 55 years for women and 60 for men.

However, in addition to the obvious advantages, such storage of funds has its own disadvantages. These include the need for a high level of awareness from the future retiree

on the formation and mechanisms of accumulation of own funds. A pension agreement, in accordance with which material support is accrued, implies the presence of many schemes and methods for accumulating payments.

Often their size depends on many factors:

- duration of work in the company;

- presence of children, property;

- disability;

- working conditions;

- rank, etc.

Also, these types of payments are characterized by the highest risk of loss when investing funds in other projects. Therefore, you need to carefully approach the possibility of such an investment.

Difference between non-state and funded pensions

The above law contains both the concept of the non-state part of the pension and the funded part. If the first one is paid in accordance with the pension agreement, then savings savings are formed and accrued in accordance with the legislation on funded pensions, on non-state pension funds and the agreement on compulsory pension insurance.

Unlike non-state payments, savings reserves are not the property of people , since they do not belong to them until retirement, and are stored in an individual account.

It is worth paying attention to the following characteristics:

- the procedure for making monthly contributions, their size;

- interest rate;

- the moment or age at which payments begin.

In addition, the accrual of corporate payments itself occurs according to the chosen plan , while savings have a clearly fixed formation mechanism in accordance with the law ( Law (law) - in the narrow sense, a normative legal act that is adopted by the legislative body of state power, regulates certain social relations

).

Important! You can transfer funds from the Pension Fund to the Non-State Pension Fund.

At the same time, a non-state funded pension will have the features of funded savings, since it will be calculated according to the legislation of the Russian Federation, and not an agreed upon agreement.