Not so long ago, one of the main pension reforms took place in the Russian Federation, thanks to which the majority of citizens decided to reconsider their attitude towards their future pension. An ordinary pension paid by a pension fund is only enough to cover food and pay for utilities, which is why many people decided to take care of their pension savings and transfer to non-state funds.

Non-state pension funds are special organizations engaged in their legally designated activities. The main service they provide is social security for citizens. The history of the creation of pension funds goes back to the distant 90s after the decree number 1077 appeared. In modern times, the activities of non-state pension funds are based on Federal legislation. The main regulatory act is numbered No. 75 and fully describes the activities of the fund.

According to this Federal Law, every non-state fund must obtain a license. Currently, more than 130 organizations have it. The activities of NPFs are very similar to those carried out by a regular Pension Fund. They also accumulate funds provided by clients who have entered into an agreement and invest them, receiving a profit for this and distributing it among clients. After which it is paid.

The pension fund, in turn, also deals with the accumulation, calculation and payment of pensions, and also collects funds provided by employers, pays funds under the maternity capital program, regulates the entire pension system in the Russian Federation and implements government programs.

From the very beginning, all pension contributions are made to the pension fund until the citizen writes an application to transfer to the NPF. The standard rate in the Pension Fund is 22%, of this amount 16% goes to further accumulation of pensions, and the remaining 6% constitutes the insurance part.

Further in the article, the main differences between these two organizations will be considered, and their comparative analysis will be performed.

What is the difference between NPF and Pension Fund?

There are two types of pension funds in Russia – state and non-state. Their distinctive features are that the state pension fund is subordinate only to the state, and the non-state one is one of the private organizations. It should also be noted that the Pension Fund, unlike the Non-State Pension Fund, is part of the country’s budget system. No non-state fund can be included in it. These two differences are the main ones when distinguishing between these two structures and are decisive when choosing one or another fund.

But the differences don't end there. The second distinction is the goals and objectives set, as well as the path that needs to be taken to get there. NPFs and Pension Funds have a common task - to accumulate pension investments for their further increase and payments to citizens upon retirement. But non-governmental organizations can also engage in other tasks that are not faced by the state fund.

The third distinctive feature is the founders of organizations. The founder of the state pension fund is the State Management Company, and all investments are made exclusively thanks to it. The NPF, in turn, can interact with one management company or select several. This significantly reduces investment risks and allows you to choose a profitable strategy of action. Whoever will be the founder is to a greater extent the determining factor for citizens who decide to choose a non-state pension fund. After all, it is he who will formulate benefits for payments in the future. These factors determine the profitability of both funds, and in the long term it shows that it is higher in NPFs.

Main differences between the funds

The Pension Fund of the Russian Federation reports exclusively to the state, but non-state pension funds are commercial structures created to make a profit. Part of the profit is transferred to investors, since from their savings the company can receive funds by investing them.

The Pension Fund cannot invest in high-risk securities. There are several types of securities in which you can invest, as a result of which the profitability of the Pension Fund is minimal. Non-state pension funds diversify their income by investing money in various securities with different levels of risk. Thus, they receive an income of up to 20%. This is a really high figure, usually it does not exceed 12%. Difference between Pension Fund and Non-State Pension Fund

It is necessary to approach the issue of choosing a pension fund seriously, having studied its profitability and level of reliability. At the same time, it is important not to show your SNILS to anyone again, so that scammers do not transfer your money to another fund. Before signing the contract, you can request full information about exactly how capitalization occurs and ask the company representative all your questions. It is not profitable to remain in the state pension fund today.

Video - Scheme of activities of a non-state pension fund

Where can I transfer?

The choice of options where you can transfer your pension is quite large. But out of all this diversity, it is worth noting the two most popular options that citizens now use for translation. These two options include:

- Non-state pension fund - most often formed on an existing basis from a banking institution or credit organization. Their activities are fully regulated by the legislation of the Russian Federation, in particular the Federal Law numbered 75-FZ with the latest amendments made in December 2015.

- Management company - its activity is to manage assets, deposits and property that they receive from their clients. Their activities are also enshrined at the legislative level of the Russian Federation and are carried out in accordance with the Federal Law numbered 156-FZ, which, like the previous one, underwent major changes in December 2015.

Among these organizations, there is one difference, which is how the insurance contract for citizens' pensions will be concluded. In a non-state fund, concluding an agreement is a mandatory procedure, but in a management company this is not necessary. She just needs the citizen to send an application to the state pension fund, an application in which he asks to transfer the funded part of the pension to the account of the management company.

The organizations presented above (Management Companies and Non-State Pension Funds) operate programs that provide customer deposits in the form of a savings portion with interest rates.

Among the Management Companies there are those that are among the most reliable. These include the State Management Company (abbreviated as GUK) - Vnesheconombank.

Every citizen has the right not to transfer his funds to the Management Company or Non-State Pension Fund. In such a situation, all funds will be in Vnesheconombank, which will retain minimal capital for future pension payments.

At the moment, the funded part of pensions has been frozen for an unknown period. Therefore, all contributions made to employers will be transferred automatically to the insurance part of the pension.

Most people prefer two possible options. The first of them is to leave your savings in the Pension Fund and not change anything. In such a situation, citizens will not have to spend additional time choosing a non-state fund and completing documents for it. However, its accumulations occurring in the Pension Fund will not change. The thing is that VEB only takes into account indexation, which in turn does not exceed inflation. Another disadvantage of this option is the impossibility of leaving accumulated funds as an inheritance to a certain person, and part of these funds will decrease every year due to inflation.

The second option is to transfer to a non-state fund. This decision of a citizen is considered more correct because in such a situation there is a profit for each year of up to 15%. It directly depends on the non-state fund and its main characteristics. Another advantage of this method is the possibility of inheriting your savings. However, among the advantages there are also disadvantages, which include possible risks of closing the organization in connection with the implementation of reforms, of which quite a lot have taken place recently, and a constantly unstable percentage, which is not fixed in any way in the contract. Therefore, when choosing a non-state pension fund, you should carefully study its main indicators and reviews of existing clients. You should also think about transferring to a non-state fund in advance because... otherwise, the amount of savings will be insignificant.

Advantages of working with NPFs and Pension Funds

Each pension fund has its own advantages and disadvantages. It is worth considering them in more detail to understand with whom it is more profitable to cooperate.

| Benefits of the Pension Fund | Benefits of NPF |

| High level of stability | Individual approach to the client and full information support at any stage of cooperation |

| A large number of branches throughout the country | High level and speed of service |

| Full integration into the public financial system | The ability to independently decide at what age to retire |

| There are no problems with transferring money to the Pension Fund account from the employer | The money in the client’s account is his property; after his death, the heirs can receive the funds |

| There is always the opportunity to contact PFR specialists to receive full information support | When closing a non-state pension fund, the client calmly transfers his savings to another company |

| The branch in your city will definitely not be closed | There is capitalization, which allows you to increase the client’s profit |

How to change a pension fund

Today, the profitability of the Pension Fund is about 7%, so inflation “eats up” all your savings. However, you are guaranteed to receive them. Thus, only you can choose with whom to cooperate. But before you make a decision, it is recommended to learn about the disadvantages of non-state pension funds.

Comparative analysis

In order to compare the Pension Fund of Russia and the Non-State Pension Fund, one should consider what positive and negative aspects these two organizations have.

Positive aspects of NPF:

- all activities of NPFs are based on the legislation of the Russian Federation and these organizations are constantly monitored (the strictest among all non-profit organizations)

- a large number of organizations and their branches throughout Russia, which will not make it difficult to find the fund you are interested in

- all companies present their “tools” for making money, as well as a list of management companies

- all agreements between the NPF and the client are specified in the contract, thanks to which the company will not be able to carry out any fraud with the citizen and his funds

- In order to carry out its activities, a non-state pension fund must obtain a license, without which it cannot carry out its work

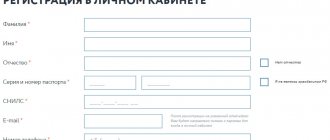

- Almost all non-state pension funds offer the possibility of remote control over your savings thanks to the Personal Account service

- the ability to receive payments monthly or the entire amount at once

While there are many advantages, NPF also has disadvantages:

- significantly greater risks because the fund can choose a strategy, implementing which it will lose money

- Due to the high prevalence of non-state pension funds, the central bank began an active fight against them. In this regard, many checks are carried out and if even a minor violation is detected, the organization’s license is taken away. All savings in such a situation are transferred to the Pension Fund, and all accumulated income is lost.

- Frequent changes of NPFs lead to a possible loss of all income. To avoid this, it is recommended to change the non-state fund no more than once every 5 years

Now let’s look at the main advantages of the Pension Fund over the Non-State Pension Fund:

- The Pension Fund of Russia is a state structure and is under constant control and in the department of the state

- the state fund often implements government programs

- in the Pension Fund, his accounts can simultaneously contain a funded and insurance pension

- The State Fund is trying with all its might to protect citizens’ savings from inflation

Just like NPFs, the State Pension Fund has disadvantages:

- ineffective operation of the entire fund because the organization selects the least profitable “tools” for making money

- if the client did not have time to use his savings (due to death), then all his savings remain in the state treasury

- the client does not enter into any agreements with the fund

- The public fund can carry out any changes or reforms without asking the consent of its clients

Having looked at all the advantages and disadvantages of these two organizations, each citizen can draw certain conclusions and choose the fund that is right for him.

Pros and cons of a non-state fund

The population's attitude towards non-state pension funds is more negative than positive, which contradicts common logic. The reason seems to be one thing: poor knowledge of the legislative framework and lack of explanatory work through the media.

But here everything is clear: they cannot spend their own savings on advertising NPFs - it’s expensive, and the state is not ready to cut the branch on which it sits, i.e. is not interested in explaining to the population the pros and cons of non-state structures in the field of pension provision.

Let's try to explain how a non-state pension fund differs from a state one based on the advantages of the first:

- total control by government services. This is, firstly, the fight against a competitor, and secondly, the protection of the interests of the country’s citizens;

- high-quality service - no one will go to employees of a non-state fund who scream or do not notice the client;

- the possibility of transferring unspent amounts to pay pensions to heirs;

- the existence of an agreement between the fund and the client, which transfers all relationships to the legal plane;

- the accumulated amount can be received in full upon retirement;

- high yield, significantly increasing the amount of savings;

- the ability to change the fund once every 5 years;

- protection of deposits in several ways at once;

- transparency of the entire work of the fund - through your personal account you can get all the necessary information: placement of savings, movement of amounts on your personal account, etc.

For some reason, the disadvantages include:

- the possibility of bankruptcy with loss of income received;

- high probability of license revocation.

Let's see how these disadvantages really are the weak side of non-state structures in providing pensions to citizens.

1. There really are risks of going bankrupt or losing your license. But no one says how they affect specific Ivanov, Petrov, Sidorov.

Let's start with the fact that pension savings are protected:

- reserves for compulsory pension insurance (OPI);

- a national guarantee fund, which, by the way, includes the Pension Fund.

This means that in any case, the pensioner will receive the amount transferred to the non-state fund during his work. Only accrued income will be lost.

2. The profitability of the Pension Fund does not in any way affect the final size of the pensions of Ivanov, Petrov, Sidorov. This means that the transfer of pension savings to the Pension Fund in the event of bankruptcy of a non-state pension fund or revocation of a license will not be able to reduce the accrued pension of clients of a non-state structure, i.e. they would receive the same pension if the funds were transferred immediately to the state fund. So what risks are we talking about? About those who could, but did not receive higher pension payments?

Let's summarize: regardless of where pension savings are accumulated, the future pensioner is guaranteed to receive a pension in the amount calculated by the state. But when working with a non-state entity, payments can be significantly higher.

The editors of the site hope that the information provided is enough to understand how the NPF differs from the Pension Fund.

What is more profitable - Pension Fund or Non-State Pension Fund of Sberbank?

In order to decide between the Pension Fund of Russia or the NPF of Sberbank, you should consider their characteristics and compare them. Data about these two organizations is publicly available on their official websites. To begin with, you should pay attention to such a basic characteristic as the history of organizations. It can be noted here that the state fund began its activities in 1987, which is 7 years longer than the Sberbank NPF. This indicator is not very different for both companies, but in itself is quite serious, because over a career of more than 20 years, both organizations have demonstrated their reliability to clients.

The next indicator you should pay attention to is profitability. For the Pension Fund, it averages 11% per annum. NPF Sberbank is the leader in this indicator. Its indicators average 13% per annum. But according to some analysts, the difference in the profitability of these two organizations will decrease and will not differ significantly from each other. Also, according to the indicators for 2017-2018, both organizations will be able to overcome inflation.

In terms of reserve funds, it is significantly ahead of the Pension Fund. The size of its reserve funds is 290 billion rubles. For Sberbank NPF this figure is only 695 million.

Comparing these two organizations, we can come to the conclusion that Sberbank NPF is slightly more profitable than the state fund. At the same time, the NPF is still a private organization and has certain risks associated with the loss of its license. The final choice of this or that organization lies with the citizens. You should very carefully review all the indicators of organizations and choose the right one for yourself, because most citizens have not yet done this. And, as you know, in this case, all funds are located on the Web, where they are only accumulated, without any special benefits for the client.

Change of insurer

You should change your insurer no more than once every 5 years. Otherwise, there is a risk of losing accumulated investment income. At the same time, it is important to correctly calculate the five-year period, since it is individual for each citizen and depends on the year in which he/she last changed insurers.

Example 1. Citizen D. submitted an application to transfer funds to NPF 1 in October 2015.

The application is subject to consideration the following year after its submission. His application was considered in 2021, in the same year the pension savings were transferred to the NPF. Therefore, 5 years must be counted from this year. The expiration of 5 years will occur in 2021. Thus, it is in 2021 that a citizen can write a new application to change the insurer. If this condition is met, there will be no loss of investment income. If he applies for the transition in 2021, the citizen will lose income for 3 years (2016, 2021 and 2021).Example 2. Citizen M. submitted an application to transfer a funded pension to a non-state pension fund in March 2012. Her application was considered in 2013, and in the same year the funds were transferred to the management of the selected NPF. Therefore, her 5 years expired in 2017. The most profitable year for her to change insurers was 2021. If she submits an application in 2021, she will not lose much - only investment income for the current year.

But when changing the Management Company, investment income is not lost. If you change one Management Company to another, you do not lose the accumulated investment return, so you can change annually if you wish.

Transfer from NPF to Pension Fund

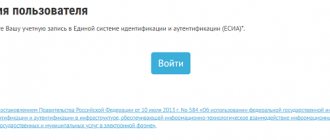

Transfers between NPFs or from a Non-State Fund to the Pension Fund of the Russian Federation, according to the law, are permitted no more than once a year. The transition procedure is quite simple; all you need to do is select a Management Company, which will subsequently invest your funds, and also decide on the investment profile offered by the company. The list of companies and profiles are provided on the official website of the state fund.

The next step is to write an application for the transfer of their NPF to the Pension Fund. A sample application can also be downloaded from the official website or contact one of the branches. The Pension Fund accepts applications both electronically and in person to the organization. Simultaneously with these procedures, a citizen can contact the NPF and notify it of the desire to transfer to the Pension Fund.

An application must be submitted to the Pension Fund no later than December 31 of the current year. In case of early transfer, the transfer to the Pension Fund will be carried out at the beginning of the next year after submitting the application. The normal transfer occurs after five years from the date of application.

Funds are transferred from the NPF to the Pension Fund no later than March 31, and the Pension Fund, in turn, transfers these funds to the Management Company no later than a month.

In Federal Law No. 75-FZ, there are other grounds under which a non-state pension fund is obliged to transfer all savings to the state fund (death, court decision, revocation of a license from a non-state pension fund, and others).

How to transfer to a non-state pension fund or return to the Pension Fund of Russia

You can switch from one fund to another at any time. However, you need to remember the 5-year rule, according to which a transfer while maintaining the funded part of the pension is possible only once within five years. If the condition is violated, only the part of the money transferred from the salary will be transferred, without income. This is the same as withdrawing your deposit early.

True, it is not clear how the provisions of the law are implemented during the transition from the Pension Fund to the Non-State Pension Fund. In reality, no one there charges interest on amounts stored in a personal account - there is no point. All the same, the pension will be calculated according to different rules.

To transfer, you need to submit a corresponding application to the fund directly or to the MFC. The law allows you to submit documents in person, online or by mail. In the latter case, the application must be notarized. The role of a notary can be performed by law and other representatives of government bodies.

Documents on exit (transition) are accepted from January 1 to December 1. A month is given for the final decision. It's like a divorce - a probationary period. What if he changes his mind?

What is better: Pension Fund or Non-State Pension Fund

The question of whether to choose a Pension Fund or a Non-State Pension Fund should be decided by each citizen personally for himself. All the advantages and disadvantages of the state and non-state pension insurance fund were discussed above. When choosing, you should also consider your own priorities. When deciding to get greater profitability, the best solution would be to choose a non-state pension fund, and if you want practicality and reliability, the organization should opt for the Pension Fund.

To summarize, we can conclude that you should think about choosing a Pension Fund or Non-State Pension Fund in advance. You should not leave everything as it is and think that retirement is not soon and there is a lot of time to make a decision.

Main provisions of the current pension reform

Since 2002, citizens born in 1967 and later have a choice of whether to cooperate with the Pension Fund of Russia or the Non-State Pension Fund. Also, the working-age population independently determines the size of the insurance part of the pension. There are several fundamental differences between state and non-state pension funds when working with the population’s money. Here are the main ones:

- NPFs can use investors’ money to increase their own earnings by investing in securities and other commercial projects that can generate income.

- If a company does not receive income at the end of the year, then it cannot compensate for losses from investors’ money.

- It is possible to independently replenish your pension account in both types of pension funds.

- The insurance part of the pension can be received by the heirs after the death of the insured.

- It is possible to receive the insurance portion for a certain time or at a time.

- The Pension Fund of the Russian Federation may refuse to provide an insurance pension if a citizen has an insufficient number of pension points upon retirement.

According to Decree of the President of the Russian Federation No. 1077 of September 16, 1992, non-state pension funds can operate in Russia. However, they gained great popularity only in 2002 during the next pension reform.

Decree of the President of the Russian Federation of September 16, 1992 N 1077 (as amended on April 12, 1999) “On non-state pension funds”

The essence of this reform is to shift the responsibility for caring for elderly citizens from the state to the citizens themselves. Now they are required to decide in advance where to store their pension money, when and in what amount to receive it, and so on.

What to expect from the pension system

According to statistics, almost 65% gave preference to the Pension Fund, that is, they ignored the changes taking place. However, the situation is taking a different turn, and in 2021 alone, 2.9 million Russians (“silent people”) transferred their savings from the state Pension Fund to the NPF. The total amount of savings in non-state pension funds reached 2.7 trillion rubles. Only 76.7 thousand returned in the opposite direction. The numbers seem huge, but a year earlier, twice as many applications were submitted. The bulk of clients were attracted by pension funds owned by state banks. The leader among them by a significant margin is Sberbank NPF (52% of applications). Their private competitors, on the contrary, are suffering losses. What is happening fits into the general process of market redistribution in favor of state banks.

I also recommend reading:

Quote charts: educational program for a beginner

How to read quote charts correctly

Obviously, the consolidation and nationalization of the pension fund industry will continue. This process replicates what happens in the banking system. For example, it became known that in 2021 NPF Lukoil-Garant, NPF RGS, and NPF Elektroenergetiki will be merged under the brand of the state-owned Otkritie. The combined assets of the fund will amount to 570 billion rubles. The largest NPF “Future” is also looking for a buyer.

What to do if you have not yet decided on the choice of NPF or have doubts about its sustainability? The criteria for choosing NPFs are similar to the rules for choosing a bank, broker or insurance company.

- We look at information in the media about the reputation of the fund and its founders;

- Age (date of creation);

- Volume of funds raised, average bill, number of insured persons;

- Profitability or loss over the past few years, in comparison with other NPFs;

- Transparency of the fund’s activities, i.e. the availability of information in the public domain;

- Belonging to large financial groups, including state banks;

- Fund rating assigned by leading agencies.

You can find and compare data on the website of the fund itself or on the website of the Central Bank, which is based on statistics from the Federal Service for Financial Risks. Resources where you can check ratings for reliability, profitability, number of insured persons: https://npf.investfunds.ru/ratings/, https://raexpert.ru/ratings/npf/, https://www.pensiamarket. ru/, https://pensiyaonline.ru/ratings/. On the last of these sites it is convenient to obtain information about your future pension using your SNILS number.

To transfer from the Pension Fund to a Non-State Pension Fund, you need to conclude a trust management agreement with the Non-State Pension Fund and submit an application to the territorial body of the Pension Fund for transfer to the Non-State Pension Fund of your choice. To return to the Pension Fund, you need to do the same thing, just fill out another application form and wait until the Pension Fund considers it. The transition to the Pension Fund takes much longer.