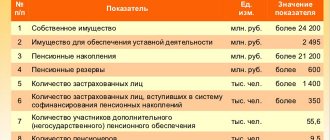

Foundation statistics

All graphs and tables are based on data and reporting from the website of the Central Bank of the Russian Federation cbr.ru. 2021 data available for 9 months

In 2021, the fund ranked 10th among other funds in terms of income. By size of assets 7. By number of participants 15.

| Year | Assets | Number of participants | Profitability |

| 2020 | 277,563,382 t. rub. +6% | 77 452 | 7.71% |

| 2019 | 260,367,611 t. rub. +23% | 69 720 | 10.21% |

| 2018 | 200,019,397 t. rub. +26% | 65 214 | 7.13% |

| 2017 | 147,361,956 t. rub. +12% | 61 689 | 9.68% |

| 2016 | 130,364,865 t. rub. +13% | 52 394 | 9.66% |

| 2015 | 113,098,546 t. rub. +37% | 36 884 | 11.89% |

| 2014 | 71,301,099 t. rub. +5% | 33 601 | 0.66% |

| 2013 | 68,053,511 t. rub. +45% | 30 841 | 7% |

| 2012 | 37,640,493 t. rub. +55% | 26 384 | — |

| 2011 | 16,777,233 t. rub. | 21 749 | — |

Profitability

Detailed statistics

Personal account functionality

The main task of the personal section is to provide information to every citizen. An open financial policy is the key to customer trust. Therefore, the LC proposes:

- Receive information about your pension savings;

- Maintain several retirement accounts at the same time for insurance. Unlike the state program, here you can independently choose the amount of contributions in order to increase or decrease the efficiency of the funded part of the pension;

- View information about maternity capital, as well as about accruals on it, if the funds were not used immediately, but were invested;

- View the results of pension investment, control the level of pension increases.

In addition to the fact that deferred savings can be used by a person who is a client of the VTB Fund, after his death the money goes to his heirs. Such conditions are not offered by government programs.

Branches

Moscow, st. Vorontsovskaya, 43, building 1, phone:

Voronezh, st. Friedrich Engels, 25 B, off. 402., phone:

Kazan, st. Ostrovskogo, 87, phone: 8(843)570-66-48

Krasnodar, st. Krasnoarmeyskaya, 43/Gogolya, 68, office 530, phone:

Krasnoyarsk, st. Lenina, 56, phone: 8 (391)200-20-12

Novosibirsk, st. Kommunisticheskaya, 48 A, telephone:

Perm, st. Lenina, 26, phone: 8(342)212-41-18

St. Petersburg, Degtyarny per., 11 A, phone:

Khabarovsk, st. Moskovskaya, 7, phone: 8(4212)910-284

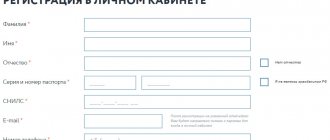

How to register on the site

Register your personal account

Anyone who uses the company’s services, buys goods, opens an account, or enters into an agreement with it can go through the registration procedure.

To register, you must complete the following steps:

- Go to the company website;

- Select the “Register” button

- Fill in the fields provided by the site (first name, last name, login, password, possibly date of birth and other data depending on the user’s status and the purpose for which registration is being carried out);

- Confirmation of data (it is recommended to check the correctness of the entered information);

- Login to your personal account for verification (enter login and password).

Registration usually takes no more than five minutes, so the process is as simple as possible and understandable even for users with a low level of computer and digital skills.

Opportunities of the account of NPF VTB

Main features of your personal account:

- Checking the account, balance, expenses. Before paying for a service or transferring funds for any goods, you can check how much money is available in your personal account.

- Tracking data on orders, purchases or other actions that were performed through your personal account.

- Receive notifications, view promotional offers, special features (permanent and temporary).

- Analysis and tracking of current prices in real time.

- Communication with other users or with the company's representative office. More often, there are instant messengers built into the service, reminiscent of those that work on social networks.

- Changing personal settings. For example, login, password, PIN code for using services, viewing information and correcting it.

Your personal account has many features and tools that are available only to registered users.

Transfer of the funded part of the pension to VTB 24

The main advantage for holders of the funded part of a pension at VTB Non-State Pension Fund is the openness of data. Each investor can find out the size of their savings and constantly monitor their increase in the fund’s online service.

Here users can find out in detail:

- current account status;

- level of income received from depositing funds.

The average return on pension savings invested in VTB is lower than that of some competitors.

Please enter information for calculation: 1.Your gender, m, f 2.Your age, years 3.The average amount of your salary for the last 3 months, rub.

4.What year did you start working? (not earlier than 18 years old) 5. How much do you transfer under the co-financing program per year, rub. You are a “Silent Man” who has not exercised the right to transfer to a non-state pension fund or to choose a management company.

The employer’s funds go to the insurance part of the pension.” You delegated the formation of the funded pension to JSC NPF VTB Pension Fund

Funded pension, rub./month. Number of pension points (individual pension coefficients) Insurance pension*, rub./month.

For private clients In this section you will find answers to the most frequently asked questions about:

- compulsory pension insurance;

- non-state pension provision.

- State pension co-financing program;

Mandatory pension insurance Can I be sure of the safety of my pension savings in JSC NPF VTB Pension Fund? Non-state pension funds are reliable financial institutions.

They are subject to a multi-level control system from: the Bank of Russia, the Ministry of Finance of the Russian Federation, the Ministry of Labor and Social Protection of the Russian Federation, the Pension Fund of Russia (PFR), as well as a specialized depository, actuary, auditor, and audit commission.

If we talk about JSC NPF VTB Pension Fund, then control by the shareholder – VTB Bank (PJSC) – is added to this system.

This method is considered one of the most

After this, you will be given limited access to the portal's capabilities.

Then you will be assigned an account on the State Services website. But that is not all. Verification of your identity will be required to receive full registration.

You will need to come to a branch of the Russian Post, Rostelecom, MFC or other government service center with a passport.

Which fund contains pension savings?

Sometimes citizens forget the name of the NPF organization, so below we highlight 4 ways to determine the fund:

- Personal application to the PRF at the address of residence - when filling out the application, indicate your passport data and SNILS number. A state fund employee will tell you the name of the NPF 10 days after submitting the application in person or by mail.

- Obtaining information from the accounting department - during official employment, the accounting department allocates funds monthly to replenish employee pensions, so they are required to know which non-state pension fund the funds are sent to.

- Submitting an application to credit organizationsthat officially cooperate with the Pension Fund - such banks include Sberbank, VTB 24, Uralsib, Gazprombank.

It is not necessary to be a client at a branch of the above banks.

- Request through the government services portal - the government’s electronic website allows citizens to access personal data contained in the PRF. The main difficulty is the lengthy registration process; identity verification can take up to 10 days. Above we talked in detail about the registration procedure on the government services website. If you are registered on the portal, then you will receive the data in a few seconds by selecting the “Check pension savings” tab.

It is important to know! Social card for pensioners

How to transfer funds to this NPF

To transfer a funded pension to this fund, you need to visit the establishment of NPF VTB 24 or the corresponding banking organization, taking your passport and SNILS with you.

If there is no bank branch or non-state pension fund near you, you can fill out an online application. The organization's employees will prepare a set of papers and contact you by sending an application to the fund via the postal service (the document will be certified by a notary office).

When filling out the online form, you will need to provide the following information about yourself:

- Full name (middle name may be absent);

- gender;

- date, month, year of birth;

- series and number of the identity document;

- date of passport issue;

- the institution that issued the passport;

- the locality in which you were born;

- TIN;

- SNILS;

- phone number;

- Email.

How to find out online through the Pension Fund website: instructions

Having received an insurance number for an individual personal account, each person has the opportunity to accumulate experience or points over time, which will then be converted into a pension payment. Using SNILS, the employer automatically transfers contributions to a future pension. A single insurance number helps reduce the number of documents that may be needed to obtain services from a government organization.

To determine the amount of pension savings, it is not necessary to visit the local representative office of the Pension Fund. Now it is possible to obtain useful information via the Internet. There are two websites available for the user to choose from – the Unified Portal of State Services and the official website of the Pension Fund . Instructions for using the latter are available below.

- Go to the official website of the Pension Fund and register. Make sure you have access to your personal email.

- After completing the registration of your new account, complete the survey. In the form you must indicate the current SNILS certificate number, as well as your passport details.

- As soon as you gain access to your personal account, go to the “Russian Pension Fund” section. There is a corresponding section where information about current pension savings is provided.

If difficulties arise with registration and other organizational issues, it is strongly recommended to contact representatives of the Pension Fund by phone. Contact information for feedback is listed at the top of the official resource. Calling the hotline is free. You can get answers to your questions around the clock.

Obtaining information via the Internet is the easiest way to find out the current savings amount. On the official website of the Russian Pension Fund, the section “Get information about the insurer for the formation of pension savings” is available. Here all the information is conveniently divided into several sections in a single table. The result is a simple and quick access to the required information without visiting the official representative office of the Pension Fund of Russia in a particular region.

From the above, the following conclusions can be drawn. Obtaining information regarding pension savings has become easier thanks to the introduction of a corresponding function on the Internet. To use it, you just need to register on the official website of the Pension Fund or State Services, and then go through verification (identity confirmation).

Features of registration for legal entities in NPF VTB

Registration for legal entities is the same as for individuals. When changing confidential data, you will need to fill out a form with current information and send it to the bank.

Conditions and benefits of pension programs of NPF VTB 24

The organization offers pension programs not only for ordinary citizens of the Russian Federation, but also for legal entities.

Information on the fund

Detailed statistics

For individuals

Pension programs of NPF VTB 24 for individuals have the following features:

- You can form an NGO for yourself and your own relatives, regardless of the fact of receiving a state pension.

- The client can determine the amount of contributions, the frequency and timing of their enrollment, the amount of NPO and the duration of its payment.

- The funds invested by the company's employees bring profit to clients both at the accumulation stage and during payment.

- An agreement with a non-state pension fund can be canceled at any time and you can receive the redemption amount specified in the terms of the agreement.

- You can receive information about your account status in your account on the website or via e-mail.

- You can return 13 percent of the completed contribution, according to Art. 219 Tax Code of Russia.

Table of examples of NPO calculations from NPF VTB 24:

| Duration of provision of NPO to NPF client, years | Amount of monthly contribution, thousand rubles. | Total amount of contributions, thousand rubles. | The total amount of NPO that the client will receive from the fund, million rubles. |

| The monthly amount provided to NGOs is 10 thousand rubles. (man) | |||

| 10 | 0.98 | 352.643 | 1.2 |

| 15 | 1.469 | 528.965 | 1.8 |

| The monthly amount provided to NGOs is 10 thousand rubles. (woman) | |||

| 10 | 1.475 | 442.422 | 1.2 |

| 15 | 2.212 | 663.633 | 1.8 |

For legal entities

A corporate pension program is one of the types of non-profit pension programs for company employees, a means of solving the organization’s problems related to finance and personnel.

The advantages of programs for legal entities in NPF VTB 24 are as follows:

Financial

- the employer is freed from financial motivation of employees, replacing it with the provision of social guarantees;

- income tax is reduced because pension contributions are regarded by the Federal Tax Service as funds for wages;

- the employer is exempt from insurance contributions for pensions to the Pension Fund;

- You can receive income from the investment activities of the fund, which finances social programs to support pension recipients.

Personnel

- the company's employees are additionally motivated;

- new highly qualified personnel are attracted;

- key specialists of the company are retained.

Social

- ensuring the financial well-being of employees in the future;

- increasing the social status of the organization;

- caring for employees.

An NGO is funded from the organization's net profits after all income taxes have been paid. At the same time, deductions from salaries do not exceed 12 percent, and contributions are distributed according to the personal pension accounts of those participating in the program. NPO is provided for life or for at least 5 years until the funds in the accounts are exhausted.

Features of corporate programs:

- the employer significantly saves on tax payments due to the special procedure for taxation of pension contributions;

- employees of different positions and categories receive different rights to the money accumulated in their accounts;

- work experience, qualifications, position held by the employee - the possibility of increasing pension contributions to NGOs depends on all this;

- if employees do not fulfill their obligations, the employer has the right to suspend or terminate the payment of pension contributions, exclusion from participation in the program with a complete loss of the opportunity to receive accumulated money;

- You can return personal income tax and further increase the efficiency of the corporate program.

The corporate program can be basic or parity. The basic one is financed by money deposited by the legal entity into the accounts of its own employees, which are formed in the fund. Contributions can be made monthly, quarterly, or annually.

The parity program is financed by both the employee of the legal entity and the employer (share basis). They make equal contributions, which go to the accounts created in the NPF. The amount of employee contribution is not limited. The amount of the legal entity’s contribution is established in accordance with the monetary standard that is allocated for NPO of employees.

The amount of NPP depends on the amount of money accumulated in the employee’s personal and corporate accounts by the date of registration of pension payments.

You can learn more about pension programs by calling the hotline 8-800-775-2535.

Who is entitled to pay the funded part of the pension and how to receive it in 2021

Completing the transfer does not take much time - you just need to submit an application with documents and wait for the data to be verified. This takes 3-5 days. Immediately after the verification, a bank employee contacts the applicant and tells him about the decision made.

Advantages and disadvantages

As in every agreement, the presented actions have pros and cons from cooperation on the formation of the funded part of the pension at VTB 24 Bank.

First of all, you can personally contact the Pension Fund. The last time he notified Russian citizens about the status of pensions was in 2012, but today, in order to receive a report from him, it is necessary to send him a written application. To fill out this form, you must come to the organization with a passport and SNILS.

How can I find out where my funded portion of my pension is? This question is asked by many Russian citizens.

Separately, it is worth mentioning the possibility of finding out where the funded part of the pension according to SNILS is. Today there are many services on the Internet that provide this opportunity. But it is important to remember about safety, because you do not know who created them and for what purpose. The personal data you enter into such a service can be used by scammers. Therefore, if you are not sure of its safety, it would be better to use the official sources of information listed above.

- You regularly deposit money into your account and do not spend it until you retire. The first contribution is at least 3,000 rubles, then there are no restrictions. It is NOT necessary to save every month. It all depends on your desire

- NPF VTB Pension Fund increases the amount of your savings every year due to the investment income earned for you