If you open a package with personal documents, among them you will definitely find a small green plastic card, which contains the following information about its owner:

- Surname. Name. Surname.

- Gender.

- Date of Birth.

- A unique number of eleven digits.

SNILS functions

This document is very important for any person, since without it it is impossible to perform the following actions:

- Accounting for the length of service of a working person.

- Accrual of Pension Fund points for future formation and registration of pension payments.

- Receiving various government services in electronic form , for example, SNILS is necessary when you need to make an appointment with a doctor or change your old passport.

- Find out about available benefits and how to obtain them.

- Login to the Pension Fund website in your personal account.

- When receiving government services, the presence of this document minimizes the package of documents.

How a plastic card will help you find out your pension accruals

The unique number of this document allows anyone to find out:

- Which Pension Fund does the person belong to?

- Check pension accruals through the government services website.

What are pension contributions and why are they needed?

The employer is obliged to make insurance contributions to the state or non-state pension fund for each employee working for him. There is a tariff set for this contribution - it is 22% of the total employee compensation fund.

What does this tariff include - 22%:

- 6% can go towards creating pension savings.

- 16% – accumulation of an insurance type pension.

Important: any citizen can independently choose to accumulate an insurance type pension and contribute the entire 22% to it.

Where do you usually look for your pension?

A number of bills adopted several years ago approved the possibility of forming one’s pension funds in the accounts of non-state funds. As a result, over a hundred similar funds were formed on the territory of the Russian Federation.

What is noteworthy about this type of pension accumulation is that the payer can independently control the state of pension contributions and the size of his future pension. At the same time, he is free to choose a suitable fund with optimal conditions.

Is it safe to receive a pension from non-state pension funds?

However, the pension reform not only generated obvious advantages, but also created some discomfort for policyholders and insured persons. Moreover, there have even been cases of fraud when payments intended for pension funds were transferred to the accounts of scammers.

In addition, incompetent citizens who do not have access to complete information regarding the procedure for forming a funded pension still do not understand how to find out which pension fund you are a member of. Consequently, they still have no idea which fund will pay their pension.

Ways to check your Pension Fund using SNILS

At the moment, there are several ways to find out which Pension Fund a person is a member of. The convenience of modern online technologies is amazing. But there are many people, old school, for whom it is easier to go somewhere and clarify information. That is why we have made a selection of ways to clarify information about participation, in which Pension Fund a person is a member, based on their convenience for any citizen of our country.

Offline ways to check your Pension Fund using SNILS

- One way to find out this information is to personally visit the Pension Fund at the citizen’s place of registration. This option is the most suitable if a person has lost the necessary documentation.

- On the territory of Russia there is a system of the so-called “one window”. This system is designed for people acting as individual entrepreneurs. When a citizen registers with the tax authority, within five days the information is transferred to the Pension Fund and the citizen receives a corresponding notification by mail.

When an individual business is registered and a notification containing information about the territorial administration is received, a citizen can find out the contact details of his Pension Fund via the Internet.

Online verification methods

Algorithm of actions:

- to go to the website pfrf.ru on the Internet.

- Select the region in which the company is registered.

- Find the address and contacts item in the menu and click on it to open it.

- Next, at the bottom of the page, find the customer service item and select the policyholder item in it.

- In the requested service territory field, select your region, city, and district from the drop-down list.

- When the data is selected and if everything is done correctly, you will be able to see the policyholder’s data.

Another way is to contact your employer’s accounting department. The fact is that an accounting employee makes monthly contributions to the Pension Fund and has the opportunity to provide this information to the employee.

How to find out the Pension Fund by SNILS: Again, contact the Pension Fund at the place of registration. To obtain information you need a passport and SNILS. The information will be processed and provided within 10 days. The notification may come by mail if the person does not have registration on the government services portal. In this case, when you write the appropriate application, a notification will be sent by mail.

If a citizen wants to know his PF, but the state one does not have his data, most likely he has been transferred to a non-state PF.

Fund search methods

So, the payer had a desire to clarify the question of in which fund his pension is calculated. There are several options for obtaining information. Thanks to the developed structure of funds and modern communication technologies, you can find out which fund you are a member of in two ways:

- When contacting directly;

- Through the Internet.

The following is a brief look at both options.

Direct contact involves visiting certain structural institutions. First of all, to clarify this issue, you should try contacting the employer’s accounting department. As a rule, it is this department that is responsible for the movement of funds, including pension contributions. Therefore, it is quite logical to expect that the accounting department will be able to provide correct information about which fund deductions from wages are made.

Most often, this method does not involve any bureaucratic nuances and is accompanied by oral provision of information. In some cases, when an employee is just getting a job, he has to sign various agreements, which may indicate the name of the pension fund to which the employer pays contributions. Therefore, you can simply read such an agreement carefully - perhaps there will be an answer to the question of which pension fund the payer belongs to.

It is a little more difficult for the payer to contact the branch of the Russian Pension Fund at the place of registration or place of actual residence. In this case, you will have to set aside time and pay a visit to the nearest branch. There you will be asked to fill out an application, as well as provide identification documents. Fund employees will report the results of the appeal within ten days. Of course, such an application should be submitted to a branch or department of the state fund - all movements of funds in pension savings are noted there and the details of the funds to which clients are transferred are registered.

In addition, you can obtain information about which pension fund provides services from one of the banking institutions from the PFR partner network. Typically, such information is provided by the flagships of the domestic banking sector - VTB24, Gazprombank, UralSib, Sberbank of Russia, as well as the Bank of Moscow and numerous other institutions. You can make such an application at any branch of partner banks.

For information on how to switch from one NFP to another, see here.

Ways to find out which NPF a citizen is a member of

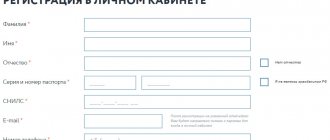

Register on the government services portal and send the corresponding request. Registration on this site may cause some difficulties; you need to obtain an activation code.

Possible ways to obtain an activation code:

- Via mail at the location specified in the request. The delivery time for such notification can be from a week to three.

- Rostelecom. At the nearest Rostelecom service point, upon provision of SNILS, TIN and passport, you can also receive an activation code.

- You can obtain an electronic signature from an accredited certification center , which can also be provided upon receipt of an activation code.

- Using a universal electronic card, it is also possible to obtain an activation code.

After a citizen is registered on the government services website in his personal account, he can send a request to receive data on the Pension Fund.

Find out online

Important! On the Internet, information about your Fund is stored only by the portals of State Services and the Pension Fund of the Russian Federation. Third-party verification services, which may or may not require money but promise “true information,” work to obtain your passport information (and sometimes funds) for their own purposes. Be careful!

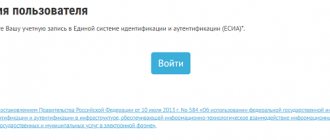

On the State Services portal

The website https://www.gosuslugi.ru collects all current data about you in your personal account for more convenient information. In your State Services profile there is a whole section dedicated to savings that should go towards retirement. It is there that you can see the name of the Fund in which the money is stored.

To do this you must:

- Go to the website.

- Log in to your profile with your username and password - if you don’t have them yet, you will need to register, the button is located under the login form.

- Go to the pensions section.

- There you will have access to information about contributions and the Fund to which they go.

How to find out pension contributions according to SNILS - the main methods

Not so long ago, the amount of pension accruals was sent annually to the place of registration from the Pension Fund. Nowadays this is no longer done, which, of course, is very inconvenient.

How to find out your pension accruals:

- Contact the Pension Fund with your passport and SNILS. It will be possible to find out exactly where the funded part of the pension is located.

- Contacting the tax office and ordering an extract from the Unified State Register of Legal Entities.

- The most convenient and reliable way is to apply through the Unified Portal of Public Services. If you have registration data, this procedure takes up to two minutes.

Which method is more reliable?

If all the applicant’s actions are correct, and the search is carried out exclusively through official channels, then we can confidently speak about the reliability of the information received. The website of the State Services and the Pension Fund is not only reliable, but also a quick way to obtain information. More conservative citizens and those who wish to have confirmation on paper should make a personal visit using one of the options described above - this is also a reliable way. But you should not trust third-party resources on the network and intermediary structures that want to make money on the desire to find out which pension fund the applicant is a member of.

Calculation of future pension

For any person, even a young one, the question of what kind of pension he will have in old age is a pressing question. To calculate a future pension, a citizen can use a special calculator located on the Pension Fund website.

Factors influencing the issue of future pension:

- The total work experience of a citizen.

- The amount of the employee’s salary, based on which the policyholder paid insurance premiums.

- The age of the citizen applying for a pension.

Pension calculation formula: Insurance pension = pension points * cost of one point (the year the pension was assigned is taken into account) + fixed payments.

Formation of pension savings

Contributions to pension insurance are deposited in the individual account of the insured person. Its number is assigned at the stage of receiving SNILS.

Until 2014, the employer contributed 22% of the employee’s salary through a specially created reserve. 16% was credited to the insurance part of the pension, and 6% to the funded pension provision. In 2014, the Government of the Russian Federation decided to temporarily freeze the formation of the funded part of pension provision. Now all 22% contributed by the employer goes to the formation of an insurance pension. Important! An employer does not have the right to charge an employee 22% of his salary for insurance contributions.

What can you do with your savings?

Pension savings have one important feature - they cannot be withdrawn from the fund early. That is, even if the money is kept in a private NPF, he does not have the right to give it to someone who has not yet received the right to do so (and NPFs are interested in keeping the money for as long as possible).

You can manage your savings in several ways:

- transfer them from one fund to another. For example, from the Pension Fund of Russia (that is, the State Management Company of VEB.RF) to the NPF, back or between NPFs. This makes sense if the fixing year has arrived (the next one is 2025), and the current pension fund earns too little;

- choose a different investment portfolio within the same fund. For example, in the State Management Company you can choose a portfolio of government securities (small but reliable income) or an expanded one (more risk, but higher income); other management companies (which work with the Pension Fund of Russia) also have different portfolios. At the same time, you can transfer savings from one portfolio to another, or even change the management company without losing investment income;

- Upon reaching retirement age, receive the entire amount of savings in your hands one time, arrange an urgent or unlimited payment of a funded pension. If the funded pension is less than 5% of the basic (insurance) pension, then the entire amount will be paid in person immediately;

- bequeath savings. This is done simply by application; it does not need to be certified by a notary or otherwise formalized - just fill it out at the Pension Fund. Then, in the event of the death of the insured person, all his pension savings will be paid to those whom he indicated in the application. If there is no application, the money will be inherited in the general manner. True, if the deceased manages to retire and arrange an indefinite payment, the heirs will not receive anything.

Thus, pension savings are an important part of future well-being

for everyone who developed them before 2014. Therefore, it is important to know where they are and in what size they are formed.