What is the Pension Fund of Russia

PFR is a financial and credit institution established in 1990. It is responsible for the formation and payment of pensions and benefits to eligible citizens. The pension fund works not only with elderly citizens; young working people also participate in the formation of the Pension Fund. Citizens pay a percentage of their income to the pension fund; from this amount, payments are provided to citizens in need of social support.

Pension funds are divided into:

- State - one, is accountable to the state and belongs to the Russian budget system.

- Non-state – there are many of them, and they are private organizations.

Social Functions of the Pension Fund of Russia

The Pension Fund is a state institution and is a federal system in the field of social security of the Russian Federation. The main function of the Pension Fund is to provide compulsory pension insurance for Russians.

The pension fund has created a unified state register, which contains information about all Russians. Each person is assigned his own individual personal account number, to which the employer transfers insurance premiums. This number is reflected on the green plastic SNILS card. Using it you can find out about the status of your personal account, how much money was transferred to it over the years while the person was working.

The main functions of the Pension Fund include:

- calculation of all types of social support;

- control over the insurance part of the pension;

- accounting of all mandatory insurance contributions;

- registration of participants in the entire compulsory state insurance system;

- appointment and accrual of all types of pensions (labor, disability, social);

- regulation, distribution of pension funds in the system;

- work with maternity capital;

- interaction with employers who transfer funds for their employees.

The program for state co-financing of pensions, which is also part of the functions of the Pension Fund, deserves special attention. According to its rules, any citizen can contribute additional funds to the Pension Fund to increase his future pension (its funded part). The state doubles this amount if it is no more than 12,000 rubles.

Functions of the pension fund

In the pension fund, every citizen of Russia is issued a SNILS - an individual personal account number, according to which a person is linked to a single database. All contributions from the employer are reflected in the account in accordance with Russian law.

The functions of the organization clearly show what the Pension Fund is:

- Assignment and payment of pensions based on age and length of service.

- Control of receipts for the insurance portion of each citizen.

- Social benefits for certain categories of citizens.

- Accounting of all insured persons.

- Working with maternity capital.

- Supplement to social pensions.

Who can access the personal account of the Pension Fund of the Russian Federation?

Any person/organization that pays contributions for compulsory health and pension insurance can open a personal account in the Pension Fund. These categories include:

- organizations;

- private entrepreneurs;

- individuals who make payments or rewards;

- individuals with private practice;

- self-employed payers, etc.

Having opened an account for themselves, each of the listed categories of citizens receives significant time savings when preparing reports and reconciling payments. Additionally, a person can control payments made to the Pension Fund in a form convenient for him (monthly, once every three months, once every six months).

Difference between Pension Fund and Non-State Pension Fund

NPF is a non-state pension fund. The task of a non-state pension fund is to accumulate funds in the taxpayer’s account. Savings can be made by the employer monthly or by the person himself at a selected frequency. NPFs approach each client individually and offer additional pension accumulation programs. When a non-state pension fund is closed or for any other reason, funds can be transferred to the account of another non-state fund.

The basis for the formation of savings is the official salary - the rule applies to all funds, including the state one.

Not the entire amount transferred goes to the account; part of the contributions goes to provide pensions for those who receive it now. You can manage the funds only after retirement.

Personal account in the state fund

What is a personal account in the Pension Fund? Your personal account allows you to perform the following actions without leaving your home:

- Apply for a pension.

- Receive information about the set of documents for obtaining the service.

- Choose a method of receiving your pension.

- Prepare a certificate for submission to the organization.

- Get information on maternity capital, balance amount or apply for it.

- Transfer existing savings to a non-state pension fund.

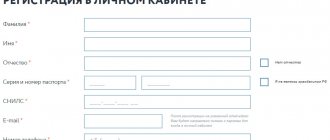

Any citizen can create a personal account on the website of the Russian Pension Fund. To do this, you need to register on the Pension Fund website. If you have an account on the GosElectronic Registration website, enter the data in the window that appears. Registration information must be correct. After this procedure, an SMS with a password will be sent to the phone number specified during registration. A cell will appear on the screen where you will need to enter the code.

After registration, to work with the personal account of the Russian Pension Fund, you will need to enter your passport and SNILS data. After checking the data, you can start working with the service. However, not all functions will be available. To unlock full access to all services, you need to go to the MFC with documents and confirm your identity.

LC capabilities

Visitors to your personal account can use two types of services:

- provided without registration;

- provided after registration.

Without going through the registration procedure, a person can find the nearest PF branch and make an appointment with the necessary specialist. The owner of a personal account can complain about the service and communication with him by inspectors. There is an opportunity to automatically receive a comprehensive answer to it. The visitor can make a printout of payments.

Official website of the Russian Pension Fund: https://www.pfrf.ru/eservices/lkzl/

Watch a video review of a citizen’s personal account

There is also

a pension calculator here. By logging in and entering the necessary data, a person will be able to independently make a preliminary calculation of his pension. Let us note right away that the obtained result is averaged and will differ significantly from the real one. This is due to the fact that the calculator does not take into account changes in salary during career growth.

The pension calculator is not a dogma. It simply allows you to make a preliminary assessment of what pension a person should have and how many years he should work.

Citizen's pension

All questions regarding the assignment of a pension, its changes, etc. a person can receive only after completing the registration procedure and verification of personal data. This is due to the fact that all information about a person is confidential information, the transfer of which is punishable by law.

Only the owner of the personal account can know the size of the pension.

Even before retirement, he has the opportunity to make a preliminary calculation. This will allow him to understand what income he can count on later.

Pension calculation

The pension calculator, which is presented on the website of the Pension Fund of the Russian Federation, does not require mandatory registration. It is enough to load the required data into it, and it will give you the amount of your pension.

Information required for calculation:

- The amount of the official salary.

- Work experience according to work book.

- Retirement age.

There are also additional parameters that allow you to make a more accurate calculation. However, the data listed above will be enough to receive an approximate pension.

Military personnel and law enforcement officers will not be able to use the pension calculator. They are not employees.

The formula for calculating pensions is simple. The number of points accumulated (depending on the size of the official salary) and the person’s work experience. You can find out the necessary data through your personal account of the Pension Fund.

It is important to know! Is alimony paid from a pension?

Submitting applications

One of the convenient and accessible functions of a personal account in the Pension Fund is the ability to submit applications without a queue at a time convenient for him. There is a special form on the official website that must be filled out carefully. It can be sent before the time of retirement, however, not earlier than one month before the appropriate age. The date of submission of the application will be considered the day it was received by email.

In addition to this service, a person can:

- arrange a pension transfer in connection with a change of residence;

- order pension recalculation;

- arrange home delivery.

In addition to a pensioner, this service of submitting an application via the Internet can be used by an adoptive parent, guardian (trustee) of children under 18 years of age or a disabled person.

Using the electronic application form, a person has the right to apply for a survivor’s pension, receive a one-time social payment and order a certificate for maternity capital.

Available information

The convenient design of the site allows even a user with minimal computer knowledge to find all the information he needs on the page. Any life situation in which a person has to apply to the Pension Fund is considered. An algorithm for human actions and options for solving the problem are also presented there.

Whether the applicant worked or became the guardian of a disabled person/minor, it is necessary to transfer or recalculate the pension - all issues are considered. All that is required of a person is to find the desired line and click on it.

If you manage to find a solution, you can always use the help of an online consultant. If he cannot find an answer to the question, he will recommend the nearest PF branch or connect directly with its inspector.

Pension savings management

A couple of years ago, Russian citizens had the opportunity to independently save money for their old age. This program is called accumulative insurance.

People born in 1967 and younger can make this decision for themselves. To do this, they just need to submit an application to the Pension Fund and allocate 6% of their income to form savings. If a person decides to abandon such a program and return to the usual insurance accumulation, he only needs to submit the appropriate application.

When choosing a savings system for yourself, it is worth remembering that its growth depends on proper investment by the management company. The state pension is indexed depending on the level of inflation in the country.

Social payments

In our country, there is a category of citizens who are entitled to social benefits:

- disabled people of group 1;

- elderly people who need constant care according to a medical opinion;

- pensioners over 80 years of age.

The amount of payment to an able-bodied person who is incapacitated depends on the region of residence.

If a child under 18 years of age needs care, then his guardian/parent receives up to RUB 5,500. All other persons are entitled to 1,200 rubles.

For individual regions of the Russian Federation, their own indexing coefficient is used.

What applications can be submitted?

To apply for a care payment, you must submit a corresponding application through your PF personal account. The form is on the official website. It can be filled out online, or you can download and fill it out yourself. Both options are equally valid.

It is important to know! Pension for children of war

In addition to the application, the person must provide:

- consent from the person under guardianship to care for him. If this is a child under 14 years of age and there is an official doctor’s conclusion about his disability, this consent is not required;

- a certificate confirming that the guardian/trustee does not have unemployment payments;

- the corresponding conclusion of the medical institution;

- power of attorney to act on behalf of the ward in relation to monetary payments.

Additionally, the work record of the guarantor and the person in need of care may be requested.

If the ward receives a pension from the law enforcement agencies and the Pension Fund at the same time, then this package of documents can be provided to one of the organizations.

Maternal capital

Only those citizens who adopted a child or gave birth to a child on the territory of the state have the right to receive maternity capital.

The following have the right to it:

- Mothers who gave birth to a baby in 2007 and later.

- The father of the child, provided that he is raising the children on his own or the mother does not have Russian citizenship.

- Minors who have lost their parents. If the child is studying, then until the age of 23, maternity capital is issued to him in certain parts.

The guardian cannot use maternity capital. The amount is redirected to the child's account. He can use it once he reaches 18 years of age.

Obtaining a certificate

The maternity capital certificate is issued in person through the Pension Fund or online through your personal account. After submitting an application (the form is available on the official website), a person should contact the nearest branch. There he provides personal documents, including the child's birth certificate.

After that, an electronic certificate with an attachment is sent to his specified email. The latter contains all the necessary information that you can print or save on your PC.

Account balance

Anyone with family capital can check its balance in two ways:

- through your PF personal account;

- through the State Services website.

Both methods will show accurate data. The person decides which one he chooses on his own.

To check the balance in your maternity capital account through your personal account of the Pension Fund, you must complete the following steps:

- To begin, log in.

- The last name will be displayed in the open window and actions will be suggested.

- All that remains is to choose one of them: print the remainder or display it on the screen.

Disposal of funds

Despite the name, both mother and father have the right to use money from maternity capital. There are certain restrictions on the timing and areas of use.

With these funds it is possible to:

- provide higher education to children in the Russian Federation;

- purchase housing on credit (mortgage) in the Russian Federation;

- form the funded part of the mother’s pension.

Order a duplicate of SNILS

Your personal account allows you not only to get advice on your pension and make a preliminary calculation, but also to order a duplicate of your SNILS in case of its loss.

This document contains a person’s personal insurance account, which is necessary for calculating his insurance and funded pension.

If you lose your SNILS, you must contact the nearest branch of the Pension Fund. A duplicate will be issued there.

Thanks to the capabilities of a personal account, a person does not need to personally visit the pension inspector. Simply fill out the appropriate application form and send it by email. The date of filing will be the day of dispatch. Within a month, SNILS is restored and must be obtained at the nearest branch.

It is important to know! What to choose - NPF or Pension Fund?

Other services and facilities

Citizens of the Russian Federation, using their personal account, can not only control the movement of funds in their pension account, recalculate pensions, etc.

Citizens who have changed their region of residence are experiencing great difficulties. The difference in the calculation of pensions in different areas is associated with working and living conditions. So in the Far North some coefficients apply, and in the middle zone others. Contacting the Pension Fund through your personal account will help resolve this issue. No matter where a person is, his problem will be solved efficiently and on time. Using an online resource will save time and nerves.

In addition to pension issues, having a personal account will allow you to submit an application indicating a specific problem in the field of pension or savings insurance, maternity capital. The deadline for responding to citizens' requests is 30 days from the date of receipt of the complaint.

Citizens of the Russian Federation who worked on the territory of the state but left it can:

- receive comprehensive information about a possible pension and its transfer;

- order a certificate of length of work experience;

- view where the documents sent to the Pension Fund are located.

There are no territorial restrictions on registering a personal account with the Pension Fund.

Who makes contributions to the Pension Fund?

Not only individuals, but also individual entrepreneurs work with the pension fund. What are contributions to the Pension Fund? According to the legislation of the Russian Federation, individual entrepreneurs must deposit funds immediately after registering a business. Contributions are made for yourself and hired workers. Deductions must be made for each employee, even in the absence of evidence of regular activity. Contributions do not depend on the entrepreneur’s taxation system and the terms of the employee’s employment contract.

Under certain conditions, an individual entrepreneur is exempt from paying contributions to the pension fund.

- Citizens called up for military service in the Russian Federation.

- Persons on leave (maternity leave) for up to one and a half years.

To temporarily stop contributions to the fund, you must provide a package of documents:

- Passport.

- Military ID or child's birth certificate (depending on the reason).

- Marriage certificate.

Pension Fund personal account for legal entities

Favorable tariffs for cash settlement services for individual entrepreneurs and legal entities. persons

- The cost of opening an account is 0 rubles !

- Service cost from 0 rubles per month !

- Open an account in 5 minutes online !

Submit your application

Legal entities are required to deduct a portion of their wages to the Pension Fund of the Russian Federation, as well as submit monthly reports in the prescribed form. For ease of interaction, a personal account is also provided for organizations, but registration differs from citizens. To create an account, you must personally submit an application through the territorial office of the Pension Fund. The following documents of the institution are attached to it:

- TIN;

- registration number;

- contact information, including a valid email address.

After checking, specialists issue a card with a temporary password, which you can use to log into the policyholder’s account. You can obtain data in one of the following ways:

- to the organization's email;

- by registered mail to the legal address of the company;

- personally from a specialist at the territorial department.

Reference! After receiving the password, you must log into the policyholder’s personal account within 45 days and change it to a permanent one.

Amount of contributions to the Pension Fund

From January 1, 2018, the amount of contributions to the Pension Fund from individual entrepreneurs will not depend on the minimum wage. This is due to the increase and planned growth of the minimum wage.

Payments to the pension fund for individual entrepreneurs amounted to OPS-26,545 rubles. If the income of an individual entrepreneur for the year was more than 300 thousand rubles, then you need to pay 1% of the amount exceeding this value.

5840 rub. goes towards health insurance.

The maximum amount per year is equal to eight times the amount of pension insurance - 212,360 rubles. Reduced rates can only be used for employees; When paying fixed contributions to the Pension Fund, the entrepreneur takes into account the full amount. Payment occurs regardless of profit, even when working at a loss.

Until 2021, contributions were paid to the pension fund; now payments are made to the Federal Tax Service. Payment is made in one amount until the end of the year or the amount can be divided into quarterly payments.

Contributions to the Pension Fund for individual entrepreneurs are paid only for the period of the current status of the individual entrepreneur, if during the year he only acquired or closed the individual entrepreneur, payment is made for the number of months worked.

Upon termination of activity, a businessman must contact the tax authority to close the individual entrepreneur, because payments to the Pension Fund of the Russian Federation must be paid as long as the status of an entrepreneur is valid.

Reports

The Russian Pension Fund controls personalized accounting. Since 2018, three types of reports must be submitted to the Pension Fund. They are provided quarterly. After the end of the tax period, you are given 30 days to provide data.

- Form SZV-M contains data about the subject’s employees. The form is provided by entrepreneurs who have employees. Personalized records are kept for each employee, and a report is provided monthly by the 15th.

- SZV-Experience contains data about the employee and his insurance experience. The data is recorded for further calculation of the employee’s pension. The report to the Pension Fund is submitted once a year during the first two months of the calendar year. If during the year an application for retirement was accepted from the employee, then it is necessary to transfer the SZV-Stazh to the state fund within 3 days.

- The EDV-1 annual form is submitted to the pension fund along with the SZV-Experience report. When an employee retires, the rules for submitting this report are the same as for SZV-Stazh.

- SZV-ISKH and SZV-KORR – corrective statements.

If there are no employees, the entrepreneur does not have to submit reports to the Pension Fund. If citizens work for individual entrepreneurs on temporary jobs, then information about them is transferred to the pension fund in the prescribed manner.

The entrepreneur is obliged to provide information when changing his personal data.

Main Directorate of the Pension Fund for Moscow

The Russian Pension Fund exists in all regions of the country. Every citizen of the Russian Federation can apply to the department according to their territorial affiliation. By choosing a service on the website, you can receive it at the branch that is convenient. In large cities there are several main customer service departments.

The Main Directorate of the Pension Fund for Moscow and the Moscow Region is located at 115419, Moscow, st. Stasovoy, 14, bldg. 2

In addition to the main department, there are additional branches in every district of Moscow. There are a total of 42 additional controls. To find the desired address and opening hours of the branch, you need to go to the “PFR branches” tab on the website and select the city of interest. The website presents all the cities in which the Pension Fund has a representative office.