Important! Currently, the Fund is working to merge databases and create a new technological platform for a personal account with NPF Otkrytie. In this regard, the information on your contract on compulsory pension insurance is relevant as of 08/16/2018; it is also possible that the information on the contracts may not be displayed correctly.

After completing the technical work, you will have access to complete information about the status of your pension account. We apologize for the temporary inconvenience!

Currently, a conscientious employer contributes 13% of income tax, and on top of that 22% to a retirement account. Of these, 16% is the insurance part, and only 6% is the savings part, which the Russian can dispose of at his own discretion: leave it in the Pension Fund or transfer it to another fund.

Personal account “Lukoil-Garant” (Non-state Pension Fund) - provides ample opportunities to manage your savings. The company has existed for more than 20 years and serves 3.5 million people. Every year, 250 billion rubles are involved in turnover, and the company’s income is 175%.

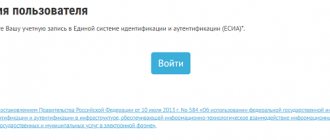

Registration and login to the personal account of the non-state pension fund “Lukoil-Garant”

Click on “Lock”

What you will need to register:

- Date of Birth.

- Optional: passport or SNILS.

To receive an Advanced Profile, you must enter a valid phone number to which an activation code will be sent. Registration will end here.

If the phone number has not been added in advance, this can be done using the State Services portal or the Individual’s Questionnaire.

In the future it can be changed:

- In your personal account with an extended version.

- On the Government Services portal, where you will need a verified account.

- Using the Questionnaire for an individual, available on the company page. It can be handed over in person at the Foundation's branches, where a prior appointment will be required, or sent by mail.

Next, to access the information, you must log in using your existing password and login.

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

The system does not issue a new password if you lose the old one; the only way to recover it is to register again. Be careful about remembering your credentials: if you make 5 incorrect authorization attempts, your personal account will be blocked for a day. Do not share your login information with third parties. Hotline for all questions regarding pensions: 8 800 200 5 999.

It is worth remembering that current information must be confirmed at least once every three years.

Account verification

Pension NPF "Lukoil-Garant" You can find out your savings by ordering a pension account statement.

Option 1. In your personal account. This can be done with an expanded account profile - where your phone number is indicated. To generate an account statement yourself:

- Log in to your personal account at NPF Otkritie (this is NPF Lukoil-Garant) - enter your login and password;

- Open the section “Your savings and payments”;

- We generate an extract and print it out.

Option 2. In any company office. You will need your passport and insurance certificate number.

Option 3. By contacting the quality service of a non-state fund. To find out:

- We go to the service through the official website or via the link;

- We fill out the form and enter the text of the request, where we indicate our desire to learn about pension savings;

- The extract will be sent to the address from the request by registered mail by Russian Post within 10 days.

Option 4. Written application to the bank. To do this you need:

- Send a letter through a postal operator. Recipient's address: Russia, Tula region, Tula city, Radishcheva street, building 8 – Otkritie NPF JSC. Index 300013;

- The extract is sent by registered mail to the sender's address no later than 10 days from the date of receipt of the request;

Option 5. Call the contact center. Phone number to call: 8 800 200-5-999.

Option 6. On the State Services website. Watch video instructions on how to do this.

Features of the personal account of NPF "Lukoil-Garant"

The non-state pension fund "Lukoil" provides access to a personal account for individuals to use the following range of services:

- Monitor your pension account.

- Edit confidential information.

- Apply for a pension.

- Conclude an agreement on the provision of services.

- Monitor your savings growth and know their size.

- Pension calculator.

- Order copies of documents and pension account statements.

- Get answers to your questions.

To gain full access to the service, you will need an Advanced Profile.

Pros and cons of the company

Any fund has its pros and cons. NPF Lukoil-Garant has been representing non-state funds in Russia for many years. The company provides stability for its clients. Although the income is average, the growth is stable.

The disadvantages of the company include difficulties associated with changing personal information. It is impossible to perform the operation yourself.

You will have to personally contact the office or send a letter with certified copies of documents. Reviews may contain indignation about incorrect transfer of funds. This happens when the client did not read the contract carefully.

If the funded part of the pension is in Lukoil Garant, then you can find out the savings in your personal account. Registration is required in advance. Authorization is carried out by entering a login and password. The company has been operating for more than 20 years and guarantees a high reliability rating. All problems are resolved through the support service.

No ratings yet

How to submit an application to NPF Lukoil-Garant for a pension

You can leave an application for appointment at the branches of the Foundation. Documents you will need: SNILS and passport.

The application shall indicate:

- FULL NAME;

- accounts;

- citizenship;

- addresses of residence and stay;

- contact number;

- passport details;

- some other points.

Where can you leave documents:

- personal contact at the service office;

- through the post office;

- using the State Services portal.

How to transfer funds to NPF “Lukoil-Garant”?

You can transfer funds using a standard or early transfer application:

- By default, the transfer occurs 5 years after filing the application, and the risks are minimal.

- Early registration is made annually, once before March 31. That is, if the application was received this year, then next year, before the end of March, the funds will be transferred to the Lukoil-Garant account. This results in loss of investment income. If the company approves the application, a notification of receipt of funds is sent.

To provide services, an OPS agreement is concluded with the company. Before December 31 of the same year, you must send an application for transfer to the Pension Fund. This can be done through the MFC, by mail or using gosuslugi.ru. You will need a passport and SNILS. A third party needs a power of attorney to carry out transactions.

All of the above statements can be found in the Personal Accounts of the Pension Fund and Lukoil-Garant.

Important: the law does not prohibit transferring your funds from one fund to another, but investment income is lost during transfers more than once every 5 years.

Possibility of calculating future pension using an online calculator

The website contains a calculator that allows you to calculate the amount of your pension. To get the result, you need to indicate at the bottom of the main page in the appropriate forms:

- floor;

- month and year of birth;

- salary per month;

- how much money is saved per month.

After entering, the total amount appears on the screen.

The calculator gives an impetus to understanding the required pension in the future and the parameters that can be changed to increase it now.

How to receive the funded part of a pension from NPF “Lukoil-Garant”?

Main criteria for obtaining

Citizens of Russia with pension contributions can receive the funded part. As well as foreign persons who have a document certifying the possibility of receiving pensions. To purchase it you need a residence permit.

Currently, the funded portion is received upon reaching 60 years of age for the male population and 55 for the female population. The law provides for social and professional cases when this threshold is reduced: disability, work experience in the northern regions, workers employed in hazardous industries, and other persons.

The funded part must be at least 5% of the amount of the insurance and funded pension.

Documentation

Important: to receive it, you must submit an application for a funded pension, the form of which is presented on the official source. It is submitted by women over 55 years of age and men over 60 through a Personal Account with an Advanced Profile. Scanned images of the necessary documents are attached to it:

- completed pages of a Russian passport;

- SNILS;

- bank account details;

- if necessary, a document confirming the change of full name.

Important: a certificate with information from the territorial office of the Pension Fund about the pension is not required to be provided, but the application with it will be processed faster.

You can consult with branches of partner banks, information about which can be found in the “Contacts” section on the company page.

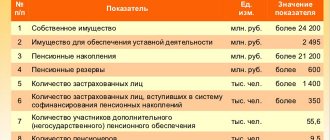

General characteristics of Lukoil-Garant

NPF Lukoil-Garant (NPF LG) is one of the strongest NPFs. The organization has never fallen out of the top ten. It is characterized by stable performance and high profitability. Thanks to competently implemented policies, the popularity of NPF LH among the population is steadily growing.

The fund was created by reorganizing the organization of the same name, which has existed since 1994. The corporatization procedure was carried out, and the rights and responsibilities for pension insurance were transferred to the new company. As a result, OJSC NPF LG appeared in 2014.

The organization has existed for a long time and has gained extensive experience in managing pension savings. She managed to gain a reputation as a reliable and stable partner. NPF works with both private and corporate clients.

Main characteristics indicating the reliability of the organization:

- More than 3.5 million people used the fund’s services

- more than 70 thousand citizens are already receiving payments

- The amount of pension savings is more than 250 billion rubles.

- the total volume of payments under compulsory pension insurance is 5.5 billion rubles.

NPF LG works with all of Russia. Branches are present in 75 major cities. The head office is located in Moscow. If there is not a single branch of NPF LG at a person’s place of residence, then he has the right to contact partner banks. This list includes:

- Alfa Bank

- PJSC Promsvyazbank

- CB "Renaissance Credit"

- Uniastrum Bank

- Bank "Financial Corporation Otkritie"

- OJSC "GUTA-BANK"

- Stavropolpromstroybank and others

Clients can always resolve any issues that arise remotely – by phone or e-mail. Contact details are listed on the official website of the foundation. To effectively manage your own savings, a personal account has been developed.

There is also a convenient function - an online calculator. To find out the size of your future pension, you must indicate your gender, date of birth, salary and contribution amount. In accordance with this information, funded and non-state pensions will be calculated.

At the beginning of 2015, NPF Lukoil-Garant was one of the first to join the program for guaranteeing the rights of insured persons. This means that if the organization experiences any financial difficulties, the citizens’ funds will be returned by the state.

Citizens' funds held in NPF LG go to management companies. They manage them - invest in various projects, as a result of which they receive income. Currently these companies include:

- LLC Management Company "Kapital"

- LLC "Management Consulting"

- LLC UK "Navigator"

The money can also be sent to a depository. It is thanks to these actions that a fairly high and stable profitability is ensured.

In 2021, an interesting survey was conducted, based on which it turned out that 80% of respondents were ready to recommend NPF LG to their relatives and friends for membership.

Let's sum it up

To increase comfort, the official websites of Lukoil and the Pension Fund provide access to services using Personal Accounts.

To register with Lukoil LC, you must enter your passport data or SNILS, date of birth and update or confirm current information every three years by providing supporting documents. You can apply for a pension when you reach retirement age and certain other factors.

Thus, any citizen can decide on a pension in advance and regularly invest funds to increase its size. To do this, he will need a Russian passport or SNILS, and for a foreign person - a document certifying the right to receive pensions.

How to access your personal account?

Citizens who have signed an agreement with NPF LG have the right to register in the “ Personal Account ” tab on the website: lk.lukoil-garant.ru.

To register on the site, you need to complete the following steps:

- Click on the link: https://lk.lukoil-garant.ru/?mode4=CheckForm.

- Provide the following information:

- FULL NAME;

- Date of Birth;

- SNILS;

- passport details;

- contact number;

- Email.

- Indicate the code that was sent to the client’s phone or email.

- To get advice, you can click the “ Help ” button, where the most common list of problem situations is recorded.

It is important to know! Basic information about NPF Promagrofond

Let's highlight the main advantages of registration:

- control over the increase in pension savings;

- Allowed to ask questions online;

- clarification of the size of the funded share of the pension;

- you can order an extract;

- presence of a function – pension calculator.