General information about maternity capital

Maternity capital is a federal program to help families with children, launched in Russia in 2007. It involves the allocation of a certain amount to a family that meets the conditions stated in the law, which cannot be cashed out, but can only be spent in a limited list of areas.

The assistance is allocated at a time - those who received capital cannot apply for it a second time. All this is controlled by government agencies.

The assistance is called “maternal”, so it is logical that the main category of its recipients are mothers. And yet, fathers can also receive it - it all depends on whether they have children and with whom they are raising them.

Maternity capital is assigned to men if they are the only adoptive parents of children or the mother has lost the right to issue a certificate.

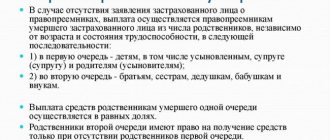

In some cases, the right to dispose of the certificate is given to the children themselves or their guardians/trustees.

Find out more about what maternity capital is and its size.

For what purposes can maternity capital be spent?

Having received funds from maternity capital, the child’s parents will be able to spend it only on a limited number of purposes. Among them the following can be noted.

Building a house or buying an apartment

The amount of money paid is quite large, so it can be used as a significant help in improving housing. In this case, the amount can be used not only directly to purchase materials during construction or to contribute to the total amount when purchasing a home, but to repay the loan.

The main condition is that the purchased object be registered as property not only for adults, but also for minor children. It is for this reason that parents will not be able to sell the purchased property without first obtaining permission from guardianship officials. This condition is necessary to protect the rights of children.

If it is necessary to build a residential building, money is allocated in two stages. When attracting an organization, the funds are simply transferred to the account of the selected construction company.

Cumulative part of pension

Increasing the funded part of the mother's pension. In this case, the funds can be sent to a personal NPF account, thereby increasing future payments for the woman. At the same time, you need to understand that if a woman was deprived of parental rights through the court, she will not be able to use this method of using maternity capital.

Support for disabled children

Capital can be used for goods needed for children with disabilities. We are talking about such services and various devices that are necessary for the adaptation and rehabilitation of the child.

Their choice is not made independently and at will. The list of funds acceptable for compensation is specified in special legislative documents. In addition, in order to receive payment for previously purchased goods, you will need to write an application and attach to it all payment documents proving the fact of the purchase.

Education

Maternity capital money can be used to pay for the education of minors. This means not only paying for the university, but:

- children's preschool institutions;

- circles and sections;

- colleges and lyceums.

In order to transfer funds from maternity capital to the account of the selected educational institution, it will be necessary to submit an agreement signed with the head of the organization to the Pension Fund. Additionally, you will need to provide a payment schedule and account details of the applicant.

Important . Cashing the certificate is strictly prohibited by law. Money should be spent only for purposes established by modern legislation.

Neglect of such a rule can lead to the recipient being forced to return the funds, and in particularly difficult situations, being held accountable.

Konstantin Frolov

Lawyer, ready to answer your questions.

If you have any doubts about where to spend funds from maternity capital, consult with our qualified lawyers. They will answer all questions and provide free professional legal assistance. They will tell you where to spend maternity capital and what documents are needed for a particular purpose.

Legislation on maternal capital

The main regulatory act that can answer the question of whether maternity capital is due at the birth of a third child in 2021 in Russia is dated December 29, 2006. This law introduced the state assistance program and regulates it, defining:

- who is entitled to maternity capital and in what cases;

- what is its size and for what purposes can it be spent;

- the procedure for managing the allocated money and on what conditions it is allocated, and so on.

For example, the answer to the question of whether maternity capital is paid for a third child can only be given by Art. 3 laws. The ability to receive money depends on when the third child was born (before or after 2007), as well as on whether the certificate for maternity capital was used earlier, at the birth of previous children.

Please note that since 2014, attempts have been made to amend federal legislation. For example, Belgorod deputies sent a draft law to parliament, amendments to which suggested establishing maternity capital for a third child in the amount of 1.5 million rubles. However, the State Duma of the Russian Federation rejected this project, so Federal Law No. 256 remains the only valid federal law on maternal capital.

Support programs for families with children also operate at the regional level. They are also called “maternity capital”. Only the legislation of the constituent entities of the Russian Federation determines whether maternity capital is given for the 3rd child at the regional level.

Given the variety of such programs, below we will talk about them in more detail. For now, let’s look at when the right to help arises.

Maternity capital for a third child: what is it and how to get it

- purchase of residential premises

- construction or reconstruction of an individual housing construction project (IHC) with the involvement of a construction organization;

- construction or reconstruction of an individual housing construction project without the involvement of a construction organization;

- compensation of costs for a constructed or reconstructed individual housing construction project;

- payment of a down payment when receiving a loan (loan), including a mortgage, for the purchase or construction of housing;

- repayment of the principal debt and payment of interest on loans or borrowings for the purchase or construction of housing, including mortgages;

- payment of the price under the agreement for participation in shared construction;

- payment towards payment of the entrance fee and (or) share contribution, if the owner of the certificate or his spouse is a participant in a housing, housing construction, housing savings cooperative.

Those Russians whose third baby was born, adopted or taken into custody from January 1, 2021 to December 31, 2022 can apply for payments under the presidential program.

A prerequisite for their appointment is that all children must be minors at the time of submission of documents. If the eldest is already 18 years old, parents will not be able to apply for financial assistance under the program.

Authorities in some regions are introducing additional payments for mothers and fathers with many children. Which ones exactly, applicants need to check with the district social protection departments. Muscovites receive:

- 50 thousand rubles at a time for the birth of triplets.

- A benefit in the amount of 10 subsistence minimums when a third child appears in the family. True, if the parents are under 30 years old.

- Financial compensation when the consumer basket grows. The amount of compensation is calculated based on the number of children. In 2021 it is 1.2 thousand rubles.

The authorities of the Krasnoyarsk Territory have introduced a one-time payment for families who have twins and triplets. This year it amounts to 72.9 thousand rubles for each child.

The 20th century brought a lot of troubles and almost led the country to a demographic catastrophe. Wars, difficult recovery after them and protracted economic crises have led to the fact that mortality began to significantly exceed birth rates. Many children of the 90s remember with horror those hungry years, when many families were literally on the brink of survival, and do not want a repeat of those years for themselves and their children. At the same time, statistics show that the country is gradually emerging from a demographic catastrophe.

According to sociological surveys, more and more young families are ready to have more than two children. This encouraging trend is largely the result of the adopted set of social support measures. The amount of financial assistance for large families varies depending on the region, but in general it is a good help for many people. Preferential mortgages for the purchase of housing in the city and rural areas, mortgage holidays for those in difficult life situations, additional tax benefits, a discount on the purchase of a Russian-made car on credit worth up to 1 million rubles, the possibility of obtaining a free plot of land for subsequent construction, guaranteed vacation without taking into account the drawn up schedule, if none of three or more children has reached the age of 12, early retirement for mothers with many children, free meals and school uniforms, subsidies for housing and communal services, free travel on public transport, and so on.

However, maternity capital is considered one of the most effective measures to support the population. The law on the appointment of new financial assistance for families raising two or more of their own or adopted children was signed by Vladimir Putin on January 1, 2007. The president's initiative was fully supported by the Federal Assembly, which the head of state addressed several months earlier. This moment became a turning point in Russia's demographic policy. Initially, the amount of payments was 250,000 rubles, and this amount could only be spent on improving living conditions. However, over time, the program proved its effectiveness, and it was decided to periodically index the target payment and increase the list of opportunities for its use.

In order to receive maternity capital for 3 children, the following conditions must be met:

- A person who applies to receive maternity capital must necessarily have Russian citizenship precisely at the time of the birth/adoption of the third child;

- The third child born/adopted must become a citizen of the Russian Federation immediately after birth;

- The third child must be born/adopted no later than 12/31/2019, but not earlier than 01/01/2007.

The conditions for receiving maternity capital for a third child in 2021 remain the same as last year. This should be remembered by those who are just planning to apply to the Pension Fund for state support.

Who is eligible to receive

The following categories of citizens have every right to receive family capital upon the birth/adoption of a third child:

- Women who gave birth to a third child and women who adopted a third child;

- Men who are the sole adoptive parents of a third child;

- Father/adoptive parent of the third child, in cases where the child’s mother has lost her right to capital;

- The child himself, if his parents/adoptive parents are not entitled to capital.

If a family decides to register family capital at the birth of a third child, it is expected to apply for the issuance of a capital certificate to the territorial branch of the Pension Fund (that is, at the place of residence/actual stay). You will need the documents listed below:

- Application for issuance of the appropriate certificate;

- Birth certificates of the first, second, and third child;

- Court decision on the adoption of a third child (in case of adoption);

- Passport of the person who has the right to capital;

- Certificate of compulsory pension insurance (the so-called “green card”);

- Documents that confirm the Russian citizenship of the third child, as well as the person who has the right to receive family capital.

It is possible to receive family capital in material form for a third child only after 3 years from the date of his birth/adoption. However, if you need to repay a loan issued for the purchase or construction of housing, then you do not need to wait 3 years.

Second Maternal Capital for Third Child in 2019

Fresh changes in maternity capital in 2021

Medvedev noted that the signed resolution makes it possible to use funds from maternity capital for refinancing and on-lending. Mortgage is suitable for the types of loans. Obtaining this right is no longer tied to the date of birth of the child. “People need more freedom with their money,” the Prime Minister said.

You cannot spend maternity capital funds on home renovations, which involve minor cosmetic changes in the appearance of a house or apartment. Buying a car is prohibited

, despite numerous requests from certificate holders. It is impossible to buy household appliances or repay a consumer loan. Use the money for treatment of parents, vacation in a sanatorium and health camp.

- In 2021, Russians have the opportunity to build residential buildings on dacha plots and register there for permanent residence. The very concept of “dacha” will be abolished, and dacha plots will become garden plots of land (GPL). The corresponding law No. 217-FZ dated July 29, 2017 came into force on January 1, 2021 .

When does the right to maternal capital arise?

In accordance with Art. 3 Federal Law No. 256, the right to financial support from the state is made dependent on the number of children. This principle usually applies to both federal and regional maternity capital.

And if the federal program applies to everyone equally and on equal terms, then with programs from the constituent entities everything is not so simple.

There are interesting examples in the regions that, together with government support, provide a significant contribution to the development of demography and assistance to families with children. For example, maternity capital is given even for first children.

Maternity capital for the first child

It is generally accepted that family capital is assigned only for the second and third child. But on January 1, 2018, changes to the legislation came into force. In particular, it came into force on December 28, 2017, Art. 1 of which gives the parents of the first-born the right to receive a monthly benefit in the amount of the subsistence level (SL) in the region of residence.

The benefit is paid monthly for 1.5 years from the date of the birth of the first child in the family. The size of the benefit differs from region to region, but if we take the national average, the total amount of assistance for 2018-19 was almost 186 thousand rubles. The only condition: the average per capita income per family is below 150% of the subsistence minimum in the region of residence.

In addition to state benefits, regional payments are also possible. Find out if they are given in your region at the regional USZN. For example, on Sakhalin, in accordance with 03/09/2011, all women who gave birth to their first child at the age of 19-25 years after 01/01/18 can claim regional maternity capital of 150 thousand rubles.

From 02/01/20, in connection with the changes proposed by the President of the Russian Federation in the annual Address to the Federal Assembly of 01/15/20, families with one child will be able to receive maternity capital in full. And its amount for the second, third or subsequent ones will be increased by 150 thousand rubles. At the same time, indexation of the base amount is being resumed and in 2020 it will amount to 466,617 rubles.

Matkapital for a second child

Maternity capital for the 2nd and 3rd child is the basis of the program from which the main demographic initiatives in the country began. It is after the birth (or adoption) of the second baby, according to Art. 3 Federal Law No. 256, Russian families until 01.01.20 had the right to receive maternity capital in its traditional meaning - as federal assistance to families with children.

True, there are some exceptions. For example, the law excludes the possibility of issuing maternity capital for a second child if:

- parents in relation to this child are deprived or limited in parental rights;

- the adoption has been canceled in relation to such parent;

- it is on state support;

- at the time of adoption, the minor was the stepson or stepdaughter of the adoptive parent.

At the same time, we must not forget about the regional programs that operate along with the federal ones. For example, in accordance with February 28, 2008, maternity capital in the amount of 163 thousand rubles was paid for the second baby born in the Smolensk region from 2008 to 2021 inclusive.

Matkapital for the third

Now let’s figure out whether maternity capital is issued for the third child. According to Art. 3 Federal Law No. 256, the right to state support measures arises equally upon the birth/adoption of both the second and third baby or any subsequent one.

In some cases, the appearance of a third child gives rise to the right to receive a family certificate.

Thus, those who are entitled to maternity capital for their third child, in particular, include mothers who gave birth to their two older children before December 31, 2006, and the third after January 1, 2007, that is, after the start of the federal program.

Otherwise, the conditions for issuing a certificate for family capital when a third son or daughter appears are absolutely no different: only the Russian citizenship of family members is mandatory. Their place of residence does not matter.

Family capital for a third child traditionally operates at the regional level. The corresponding regulations have been adopted in approximately 80 constituent entities of the federation. Moreover, in most of them, the opportunity to receive regional assistance is tied specifically to the birth of the third and subsequent children. The conditions and procedure for allocating assistance are not the same across regions. The amount of the allocated amount may differ several times, which is often due to the financial capabilities of the subject.

Regional maternity capital in 2021 for the third child is usually allocated provided the family has lived in the region for at least one year, although in some regions more serious requirements may be established.

In some regions, for example, in the Kurgan region, not a specific amount is allocated, but a monthly allowance if the average per capita income in the family does not exceed the average income in the region. In other regions, it is also possible to provide maternal capital in the form of a subsidy for the purchase of mortgage housing.

Use of maternity capital funds for 3 children

Legislation allows only targeted spending of public finances. Matkapital cannot be cashed out. Individual families can receive monthly payments from “children’s” money by non-cash transfer, in an amount not exceeding the subsistence level in the region of residence of the parents. The remaining amount of maternity capital can be spent after the third dependent turns 3 years old. It is allowed to spend funds for the following purposes:

- Improving and updating living conditions. Citizens can buy an apartment, a house, build a new home or completely reconstruct their existing place of residence. "Children's" money can be used as mortgage payments or added to your own funds used to purchase or build real estate.

- Replenishment of the personal pension account of the baby’s mother, formation of the funded part of the future benefit.

- Payment for education for the eldest offspring, compensation for the costs of training and raising a dependent in a kindergarten, university, college, and other institutions that have the right to provide this type of service.

- Reimbursement of expenses for the purchase of rehabilitation means for a disabled child in need of adaptation, provision of services to a minor by specialized medical institutions.

It is allowed to use “children’s” products without waiting for the baby to reach the age of three. If, by the time the baby is born, the parents have a mortgage loan agreement, or they took out a housing loan after the birth of their son or daughter, then the funds can be spent on the following purposes:

- execution of repayment of the main body of the loan, or interest on the loan (penalties for late regular payments cannot be paid when using the certificate);

- making the first mortgage payment.

Receiving capital again

Ordinary people are wondering whether it is possible to receive maternity capital a second time: for the third child or for all subsequent ones. The law excludes this possibility: reapplying for maternity capital funds is excluded. So, in accordance with paragraph 6 of Art. 5 Federal Law No. 256, the use of maternity capital funds in the past is grounds for refusal to issue a certificate, regardless of how many children there are in the family and how many of them were born after 2007.

Taking this into account, the law allows you to receive and use maternity capital for your third child if you did not receive it for your second. But if there are second and third children born after 2007, it does not matter for whom exactly the certificate will be received. For the appearance of each of them, the right to federal assistance arises, but it can only be used once.

The personality of the child does not matter - the money is allocated not for children, but as help for parents.

However, maternity capital for the third child, if you have already received it from the state for the second, can be issued at the regional level. The laws of the constituent entities of the federation do not link state and regional assistance. Therefore, it is quite legal for the situation when, after the birth of the second newborn, assistance is received from the state, and after the birth of the third, from the subject of the federation.

Regional capital is also used only once.

Differences between regional and federal maternity capital

Payments offered at the federal level can be issued by every citizen of Russia. His place of residence and status do not matter. Matkapital is paid in the same amount for all categories of citizens. It is drawn up according to one unified scheme.

Important . The amount can be directed exclusively to a fixed, limited number of purposes.

As for payments assigned at the regional level, this kind of second maternity capital is assigned when a second, third and subsequent child appears in the family. Such payments, unlike federal ones, can be of completely different amounts and purposes.

In addition, the rules for their registration and requirements for applicants may differ. It is for this reason that citizens must independently contact the administration of their localities to find out what payments they are entitled to for the birth of children.

But you can do it easier. If you are interested in any questions related to the calculation of maternity capital, you can always contact our experienced, qualified lawyer. There is no need to visit the city administration; just ask a question and get an answer quickly and free of charge.

If you encounter difficulties and need free legal advice to clarify your specific case, call any toll-free number or leave a request on the website. Moscow and region: +7

St. Petersburg and region:+7

Federal number:+7

It is worth noting that on average in Russian regions, the amount of maternity capital upon the birth of a third child ranges from 50 to 150,000 rubles.

Here are some examples of charges that are relevant today:

- St. Petersburg - 47,000 rub. for the third child.

- Ufa and Bashkortostan - 453,000 rub. significant payout.

- Nenets Autonomous Okrug - 336,000 rubles, but strictly on the condition that citizens have lived in the region for at least three years.

- Kostroma - 300,000 rub.

You can use the funds to pay off a previously obtained mortgage or for a down payment when applying for one.

It is worth understanding that large amounts of regional capital are most typical for regions with low birth rates . In this way, the authorities encourage families to have children.

In some regions, not only a lump sum payment is provided for the birth of a child, but also monthly benefits. In almost every region, single-parent or low-income families can apply for such additional accruals.

Maternal capital size

We have already mentioned how much maternity capital is for a third child. Regardless of the size of a large family, from 01/01/20 this amount will be equal to 466,617 + 150,000 = 616,617 rubles.

By the way, the amount of the certificate in 2007 was 250 thousand rubles. During the period from 2007 to 2015, it was indexed annually and gradually reached the specified amount.

From 2015 to 2021, indexation was not carried out, so the amount was frozen until 2020. But this year the indexation of the size of maternal capital has resumed.

As for the average regional payment, it is usually 150 thousand rubles, although there are regions with both larger and smaller amounts.

The amount of maternity capital in 2021 in your region should be found out at the Pension Fund of Russia or USZN branch at your place of residence. A few examples:

- in the Oryol region, in accordance with October 2, 2003, – 130 thousand rubles;

- in St. Petersburg, according to December 6, 2011, – 148 thousand rubles;

- in the Yamal-Nenets Autonomous Okrug, according to July 1, 2011, – 350 thousand rubles;

- in the Krasnoyarsk Territory, in accordance with 06/09/2011, – 137 thousand rubles;

- in the Tyumen region from December 27, 2011 – 40 thousand rubles;

- in the Sverdlovsk region, according to October 20, 2011, - 126 thousand rubles and so on.

The amount of regional assistance is often, although not always, indexed. As you can see, the amount of capital from region to region can vary greatly.

Interesting: the higher the amount of maternal assistance is set, the better the results. Thus, according to the data, in regions where assistance exceeded 150 thousand rubles, the growth in the birth rate is higher than in regions where it is less. So, the amount of aid directly affects the birth rate.

Regional features of the program

Federal assistance is issued one-time, at the birth of the second baby. If a third baby appears in the family, you can receive financial regional support. Financing and the amount of assistance depends on the desire of local authorities to increase the birth rate. In the Sverdlovsk region, families with 3 dependents are entitled to a one-time payment of 100 thousand rubles. Residents of St. Petersburg can receive social assistance. Its value is indexed, and by 2021 it will be 148 thousand rubles.

Muscovites who have a son or daughter by 2021 cannot receive regional maternity capital. The program was discontinued in 2021. Moscow residents are provided with other compensation subsidies, which are divided into one-time, regular and monthly, depending on the status of the family applying for regional assistance. Citizens with 3 children can receive “Luzhkov” payments from the capital government. The amount of monetary support in 2021 is identical to 10 subsistence minimums, or 173 thousand rubles.

How to get help

It's time to figure out how to get maternity capital in 2021 for your third child. To obtain a certificate, you must collect a minimum package of documents: passport, SNILS, child’s birth certificate and application.

These documents must be submitted to the Pension Fund office at your place of actual residence. At the designated time, if officials have not found reasons for refusal, you should appear at the Pension Fund and receive a certificate.

A similar procedure is provided for regional assistance. In the regions, registration is carried out at the USZN.

Obtaining a certificate is only part of the story, so let’s look at how maternity capital is paid at the birth of a third child. To receive money, the parent needs to re-apply to the Pension Fund by submitting an application for disposal of funds.

We remind you: money cannot be cashed out. They are transferred to the account for specific needs.

Conditions for receiving maternity capital

First of all, it is worth recalling that families who have given birth to a second and each subsequent child are entitled to apply for support from the state.

This applies not only to the birth, but also to the adoption of children according to the established procedure. It is important that the adoption court decision is made after January 1, 2007.

Maternity capital funds can only be used in several areas. These include:

- solving housing problems, which means purchasing or building real estate, as well as obtaining a mortgage on it;

- payment for the child's future education;

- formation of the funded part of the mother’s pension;

- If a child is born with a disability, then maternal capital can be used for his rehabilitation.

Payments from the state can be used for several of the listed points at once. The law does not prohibit this. In addition, maternity capital can be used in parts. For example, you can pay annual fees to pay for your child’s education.

Maternity capital is not issued in real money. There are descriptions on the Internet of many possible ways to turn it into cash. However, all these ways do not comply with the law and are fraught with liability.

As a rule, maternity capital is registered in the name of a woman. However, there are several situations when the father of the child has the right to claim it. For example, a man can draw up all the documents in his name in the event of the death of the baby’s mother, declaring her dead, or depriving a woman of parental rights.

In addition, a woman can be deprived of her right to maternity capital if there is evidence of a crime committed against a child.

By the way, the situation related to deprivation of parental rights should be discussed separately.

If one of the parents has been relieved of parental rights, then this child is not taken into account when registering maternity capital.

For example, two children are growing up in a family, but in relation to one child the court has deprived the mother of parental rights. Then the woman no longer has the right to register maternity capital for herself. But then all the documents can be done by the father of the child.

There is one more important nuance. Maternity capital can be issued when the child is 3 years old. The exception is when it comes to housing, and it was purchased on credit.

Then the subsidy can be used both for current payments and for the down payment on an apartment loan.

Maternal capital is aimed at improving the life of the baby and his parents. Payment of benefits is controlled by the state, and negligent use of these funds is punishable by law. Many categories of the population can use maternity capital:

- women who had no payments previously and gave birth to a third child;

- stepparents who adopted the baby;

- men who are the fathers of a child.

To receive financial assistance, a number of conditions must be met. Not only the presence of a third child is taken into account, but also other requirements.

One of the conditions for receiving a one-time benefit is Russian citizenship of the mother and child.

Other conditions ensuring receipt of financial assistance from the state:

- Honesty and decency of parents in relation to the law, lack of criminal record, legal right of paternity and maternity.

- If the baby’s parents have different citizenships, in order to receive a one-time benefit it is necessary that at least one of them have Russian citizenship.

What requirements are put forward to an applicant for maternity capital for a third child:

- Russian citizenship of the recipient and the child for whom the subsidy is given;

- the presence of two or more children in the mother;

- the family receives it for the first time.

Maternity capital funds can only be spent on needs specified by law. Their list is small:

- an increase in the mother’s future pension, both its funded part and the insurance part;

- education of a child at any level from preschool to higher professional, the main requirement for an educational institution is location on the territory of the Russian Federation and availability of accreditation;

- improving the family’s living conditions: you can buy an apartment, a house, or use funds to pay off a mortgage loan;

- construction of an individual residential building or investment in an apartment under construction;

- reconstruction of existing housing;

- rehabilitation of a disabled child, carrying out special medical procedures, purchasing prostheses.

clause 3. Persons who have received the certificate can manage maternity (family) capital funds in full or in parts in the following areas:

clause 4. The disposal of maternal (family) capital funds can be carried out by persons who have received the certificate simultaneously in several directions established by this Federal Law. |

The most popular use of family capital among Russians is to improve living conditions, which is understandable - the amount of the subsidy covers the amount of the down payment on a housing loan. It also makes it much easier to pay off the family’s existing mortgage.

The second most popular use is child education. As you know, most universities have become paid, and education costs a lot of money. Matkapital has become a good help in resolving this issue.

In most cases, to receive family capital, you must wait until the child turns 3 years old. The only exception is repaying an existing mortgage loan or obtaining a new one with a down payment certificate.

When the holder of the capital has decided on its intended use, it is necessary to submit documents for verification to the Pension Fund. Only after this the funds are transferred. You need to understand that the subsidy is not issued in cash and all proposed cash-out schemes are illegal.

We invite you to read: The Federal Migration Service refuses to provide documents for children

Purposes of using maternal capital

The directions for how maternity capital can be used in 2021 are defined in Art. 7 Federal Law No. 256. It is permissible to spend state support funds for the purposes of:

- acquisition, construction or reconstruction of residential premises, including on credit;

- children receiving education: paying for kindergarten, additional clubs, studying at a university and living in a hostel;

- formation of pension savings for mother (the goal can subsequently be changed);

- social adaptation of a disabled child;

- receiving a monthly benefit.

This is all you can spend maternity capital on for a third child. At the same time, the law does not oblige spending money only in the interests of the baby, whose birth gives the right to help. The money is allocated for the family as a whole.

As for the purposes of spending funds allocated at the regional level, they are more diverse. In some regions they are not installed at all (for example, in the Tyumen region), in others they are exclusively an improvement in living conditions.

general information

Families where a second or third child was born, also if it was stopped, can count on different options for government support. One of the most significant methods of providing financial assistance is the well-known maternity capital .

For many years, it was received by families in which a second baby was born.

But from recently it will be charged for the first child and the third. This does not mean that with each birth families will receive a certificate for maternity capital. It’s just that the amount due from the first birth will increase due to additional payments. Expert opinion . If parents have not registered maternity capital for their second child, they are guaranteed to receive it for their third. But it is impossible to issue such a sum of money twice or more. Capital is issued only once in a lifetime .

Having received a special certificate once, it will be impossible to use the money capital again. And the number of children does not matter here.

When can you use a certificate?

You can receive a certificate at any time from the moment the child is born. Parents are not limited by the time period from the moment of birth. But in general cases you can use it no earlier than 3 years from the birth of the baby.

However, exceptions are also possible. Thus, disposing of money immediately after the birth of a child, in accordance with clause 6.1 of Art. 7 Federal Law No. 256, perhaps when:

- parents purchase housing with a mortgage or build a house on credit;

- the money is used to purchase goods necessary for the socialization of a child with a disability;

- funds are spent on paying for kindergarten and related expenses;

- Maternity capital is being replaced in 2021 for the third child with the payment of a monthly benefit.

In other cases, you will have to wait three years.

Differences between payments for the first and second child

In 2021, the President of Russia proposed introducing a new rule on the basis of which maternity capital would be issued to large families. It was planned to introduce certain benefits for such units of society.

The main amendments adopted include:

- Maternity capital will be issued immediately at the birth of the first baby in the amount of 466,000 rubles.

- When a second child is born, an additional payment is assigned - 150,000 rubles. Accordingly, a total of 616,000 rubles is issued for two minors.

- Parents who have a third child will receive a mortgage repayment benefit in the amount of RUB 450,000.

- It was decided to extend the program itself until 2026, whereas it was planned until 2021.

All adopted changes and amendments to legislation are intended to increase the birth rate in the country. Thanks to the listed accruals and fairly significant amounts of government support, parents will be able to improve living conditions or provide their child with other benefits.

Procedure for registering maternity capital

In order to receive a certificate, the mother or father of the child must contact the Pension Fund office at their place of residence. There you need to fill out an application in the prescribed form. However, that's not all.

Of course, you will need a personal passport, copies of children’s birth certificates, and a court decision on adoption.

Further, the package of documents may involve the provision of additional materials depending on the situation in which maternity capital is issued.

So, if a man applies to the Pension Fund, then he must provide evidence of the death of his wife, declaration of death, or deprivation of her parental rights. A court decision regarding the adoption of a child may also be necessary.

Please note that the contents of the document package may differ in each region. Therefore, everything should be clarified in advance with the Pension Fund.

The certificate takes about a month to complete. When it is prepared, the applicant will be notified without fail. In this case, there is no need to make payments in the form of state duties and other similar expenses. You can also arrange in advance for the document to arrive by mail.

To obtain a certificate, you must contact the territorial department of the Pension Fund at your place of residence. This is the fastest and most reliable way. You also have the right to submit documents through the MFC, by Russian Post or on the State Services portal.

You must fill out an application and expect a response from the Pension Fund within 5 days. If there are errors in the documents or you are denied, a government agency employee is obliged to notify you about this.

What documents are required to be attached to the application:

- applicant's passport;

- birth certificates of all children;

- court decision on adoption;

- pension certificate (SNILS);

- registration document, including temporary registration (or a stamp in the passport).

Failures occur very rarely, but still occur for the following reasons:

- re-applying for a certificate;

- the applicant or his child does not have Russian citizenship;

- deliberately false information is submitted;

- the mother has been deprived of parental rights to her eldest child.

After receiving the certificate, you should decide on the use of maternal capital. You don’t have to rush - your right to a subsidy is enshrined in law, and you can use it when you are ready.

Before making any transactions using family capital, consult with a Pension Fund specialist about the possibility of using it for your needs. Thus, when receiving a loan from microfinance organizations or consumer cooperatives for the purchase of housing, the Pension Fund of the Russian Federation often began to refuse the subsequent transfer of funds to repay the loan.

When you are completely confident in your decision regarding the purpose of spending the funds, go to the Pension Fund and write an application for their transfer. Check to see if you must wait until your child is 3 years old to use the subsidy. They will tell you what supporting documents you still need to provide to verify the intended use and its legality.

clause 2. An application for disposal may be refused in the following cases:

|

Transferring funds to repay the mortgage takes about 1.5 months after submitting the relevant application. Consideration of a request for other needs should take no longer than 10 working days. You will only receive a response from the Pension Fund about a positive consideration of your application. You will not be informed whether the money has been transferred or not. You will have to find out this from the recipient of the non-cash transfer (seller of the apartment, creditor bank, educational or medical institution).

Amount allowed for payments

The maternity capital program is quite widespread in the Russian Federation; it has been in effect since 2007. During its existence, about 6 million mothers purchased certificates for a one-time payment of funds for their second and subsequent children.

If we consider the amount of regional maternity capital, it depends primarily on the socio-economic situation in the region. In most constituent entities of the Russian Federation, the amount to be paid does not exceed 100 thousand rubles. Only in rare exceptions is it possible to increase the amount of financial support.

At the very beginning, the amount of maternity capital funds was 250 thousand rubles; over the course of 10 years it was indexed several times. In 2018, this amount is 453,026 rubles.

The amount of the subsidy for the third child does not differ from the payment for the second child. No changes in the size of family capital are expected in the near future, although corresponding proposals are being submitted to the State Duma.

The amount of maternity capital is not a constant value; it changes over the course of the year. Inflation has a big impact on the amount of cash benefits. As the dollar increases, the amount of financial assistance also increases.

Initially, a one-time benefit for the third child was paid in the amount of about 250 thousand rubles. Later, the amount of financial assistance increased. Now the amount is about 500 thousand rubles.

There is an assumption that the amount of maternity capital will continue to increase and will ultimately reach more than 1.5 million rubles.