Future pensioners are increasingly interested in how pensions are calculated and accrued. It is very difficult for an ordinary person to understand its size based on current laws.

Now you can get detailed information about your future pension without leaving home, and think about how best to structure your working life in order to earn a decent pension in old age.

How to check the status of your retirement account

Pension provision consists of three parts:

- fixed – indexed on January 1 of each year;

- insurance – formed on an individual basis;

- cumulative - made up of free contributions.

When calculating the amount of benefits, for example, due to a software failure, it is possible that payments will be assigned incorrectly. You can check the correctness of pension calculations and correct inaccuracies by submitting a corresponding request to the Pension Fund. This can be done in the following ways:

- contact the district office in person;

- use the State Services website;

- submit an application through the Internet portal of the Pension Fund.

You can also calculate the amount of the monthly payment yourself and, if any inaccuracies are found, apply for recalculation.

Learning information about the size of your future pension

If a citizen works officially, the employer pays 22% of his earnings to the Pension Fund. But they are not deducted from it, since they have nothing to do with the 13% VAT. 22% is compensated by the company where the person works. Until 2014, this 22% was divided in a ratio of 16 and 6% between the parts of the pension: insurance and funded. Now that the “savings” part is frozen, all 22% of contributions are transferred to pension insurance.

The person's future pension is formed from the transfers paid by the employer. In connection with the new reforms, it became clear that the primary task of every officially working person is to earn as much as possible. The amount of future pension provision for each citizen directly depends on the amount of income.

How to check the correctness of pension calculations

According to the Federal Law “On Labor Pensions” No. 173-FZ, in order to verify the correctness of the transfer of pension contributions, a citizen must provide the following documents to the regional office of the Pension Fund:

- statement;

- passport;

- SNILS.

The application does not have a unified form and is filled out in free form in compliance with the rules for drawing up official documents. It contains the following information:

- personal data of the citizen (full name, age and date of birth, passport details, SNILS number and pension certificate);

- the essence of the appeal;

- Date of preparation;

- applicant's signature.

IMPORTANT! The application can be sent by mail. In this case, notarized copies of documents are attached to the letter.

The processing time for the application is 5 working days. The period starts counting on the next day after submitting the application. The official response contains the following information:

- inspection notice;

- information about the calculation performed;

- the state of the personal account of the insurance and funded part of the pension.

Pension Fund employees send notification of the results of the inspection by mail or in any other way specified by the applicant.

Online application

To find out about the calculation of a pension via the Internet, a citizen needs to act in the following sequence:

- Go to the official portal of the Pension Fund.

- Log in to your account or register it. You must indicate your full name, passport details, contact phone number, SNILS number.

- On the main page, go to the user’s personal account and click on the “Pension savings” tab.

- Create an application and send a request.

An alternative method is to obtain an extract through the State Services service. To use it you need:

- Go to the State Services portal.

- Register in your personal account.

- Find it in the search and use it.

The report presented to the citizen contains the following information:

- duration of insurance period;

- the number of savings and the name of the organization managing them;

- a list of contributions made, indicating the persons and companies who made them;

- number of pension points (individual pension coefficient).

If there is an inaccuracy in the statement, you must print the report and provide it to the Pension Fund as an attachment to the application.

Rules for using the pension calculator on the Pension Fund website when checking pension savings

The pension calculator is very easy to use, and everyone can understand how it works. This service has been successfully operating since 2015. The new pension system is based on a system that operates on the principle: the more you work, the more you will receive later. The work of the pension calculator is based on it.

It also takes into account the time spent on military service and maternity leave, that is, payments will also be accrued on them. The service includes the principle that the longer a person does not receive a pension and accumulates work experience, the larger the amount of future pension payments he can count on.

To predict the size of your future pension, you will need to go to the website of the “Pension Fund of the Russian Federation”: https://www.pfrf.ru. On the main page of the site you will be asked to familiarize yourself with the latest news and changes in laws relating to pensioners, and at the end of the page you can see a clickable button: “Pension calculator”.

The service visitor does not need to register, confirm his identity or waste time on other formalities. Anyone can calculate their pension savings.

The procedure itself takes no more than five minutes. On the downloaded page, you must enter your year of birth, gender, the number of years spent serving in the army or maternity leave, as well as indicate how many more years you plan to work and the amount of your monthly salary.

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

In addition, if the user plans to retire later than the legal age, this also needs to be recorded in the calculator. There is a special column for this.

You will also need to provide additional information such as:

- How many years do you plan to care for disabled relatives (disabled people or elderly people over 80 years old) without working?

- In what form do you carry out your labor activity (self-employed or hired worker; combination of hired labor and independent work).

After entering all the data, the user will see the size of his future pension, the number of individual pension coefficients and total work experience. It will also be possible to obtain detailed information regarding all the nuances and algorithm for forming pension savings.

Why didn't my pension arrive?

Such a story is not uncommon, and it can be related to several reasons. Let's consider what may affect the fact that the pension payment has not been received to your address:

- It is rare, but it happens that the Pension Fund does not have money to transfer it to banks and post offices in a timely manner.

- Payment delays occur in January and December for technical reasons related to indexing and updating documentation. This takes several days.

- Bank holidays when financial transactions cannot be processed and are delayed by 1-2 days.

- Delays in document flow often occur during the first pension payment due to the fact that the Pension Fund did not have time to process all the documents between its own and the banking structure.

- Delay in pension payment due to re-certification of beneficiaries. The Pension Fund takes time to process newly received certificates.

Note! If there are long delays in pensions of up to 7 days, contact the bank, post office or pension fund branch to find out the reason yourself.

If the money has not arrived on the card, contact your bank; perhaps you did not fill out the documents correctly, or the Pension Fund of Russia employees made a mistake. If you receive a pension at the Post Office and there is a delay in payment, check the reason with the Pension Fund.

What date does the pension arrive on the card?

It is the Pension Fund that determines when funds will be credited to the pensioner’s account or card. In this case, the bank is an intermediary, it does not deal with the accrual, and the issuance schedule does not depend on it. Features of payment through the bank:

- receipt of funds to the card/account on a fixed date;

- in some regions you can find out more information on the Pension Fund website;

- the payment date depends on the region due to the uneven distribution of cash flows;

- Usually the pension arrives before the 15th, but in some cities the period has been extended to the 21st.

How to check SNILS online using the pension fund database

Let's start with the fact that SNILS is the number contained on the “green card” issued upon registration in the Russian Pension Fund system. This number is unique and is assigned to a citizen’s individual personal account in the pension system once and for life. Is it possible to check SNILS using the pension fund database online?

The position of the Russian Pension Fund itself on this issue is clear: no! Information about SNILS is classified as confidential information, since this insurance number is also an individual account number. It contains information about the citizen, his length of service, earnings and contributions made by the policyholder (the organization where the citizen works) for him to the pension insurance system. Confidential information is closed from third parties, is not available on the Internet and is protected by law. Therefore, the SNILS check against the pension fund database is carried out personally by the citizen directly at the territorial body of the Pension Fund upon presentation of a passport.

Read more: What are the payments for a second child in 2020?

If my savings are in NPF

If your funded pension is stored in a non-state pension fund, then you can obtain information on it from Sberbank and Lukoil Garant. It would be useful to find out how the funded part of the pension is calculated. According to Art. 7 of Federal Law No. 424, the funded part is calculated by taking into account:

- employer contributions;

- additional insurance premiums;

- contributions to co-finance pensions;

- maternity capital funds;

- invested funds.

The amount of pension savings is divided by the payment period, which is determined by law each year. Today it is equal to 246 months. When calculating a funded pension, the payment period must be at least 168 months. For urgent payment, the minimum period is reduced to 10 years.

The change in the amount of the urgent payment is carried out on August 1 of each year by summing the current payment amount and the quotient obtained by dividing the amount of pension savings (as of July 1) by the payment period.

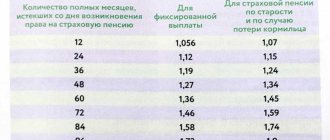

The amount of pension provision will be greater if a citizen submits an application for payments several years after the right to them arises. In this case, the payment period will be reduced by one year for every 12 months that have passed since the date of retirement.

Reference! The advantage of a funded pension is that it can be transferred to a non-state pension fund. However, it is not indexed once a year, therefore, citizens cannot count on its increase when stored in the Pension Fund.

In Sberbank and Lukoil Garant

In order to check the amount of pension savings through Sberbank, you need to visit any bank institution with a passport and SNILS. A bank employee will provide you with all the necessary information within 15 minutes. Another option is to control your savings through your personal account.

NPF Lukoil Garant was recently renamed NPF Otkritie. If your funded pension is stored in this fund, then you can obtain information on it on the NPF website.

To do this, follow this algorithm:

- Go to the Otkritie NPF website

- Click on the “Request copies of documents online” button.

- Authorization in your personal account. Authorization through the government services portal is allowed.

After authorization, submit your application. The data will be provided to you within a minute.

Clients of NPF Otkrytie have 2 more ways to check their funded pension. They can write a letter requesting information and send it to the address: 300013, Tula region, Tula city, Radishcheva street, building 8. You can also call the phone number +7-800-200-59-99 and the operator.