NPF "Future" is one of the largest companies in the pension market, with a client base of over 4.5 million people. In addition to the non-state funds “Welfare OPS” and “StalFond”, the organization at the end of 2021 was replenished with two more large enterprises - NPF Uralsib and NPF Our Future.

Thus, the combined group took third position among the leading players. The nuances of the organization’s activities and its achievements will be discussed below.

Official website of NPF "Future"

The company’s Internet resource is located at https://futurenpf.ru/. The site has good functionality; the main menu offers all the sections necessary for interaction with the fund - from pension programs to contacts. At the very top of the page there is a button to go to your personal account, as well as a search engine for site materials.

The approximate size of the future pension and the amount of savings helps to calculate the pension calculator, which opens when you click on the “Calculate pension” button.

The result obtained does not guarantee income, and before transferring your funds to the management of the fund, you must study the charter and insurance rules in detail. All necessary information is available on the official website.

Anyone can become a client of the joint stock company NPF "Future". To do this, you should go to the nearest office with your passport and SNILS or leave an application online. Next, you will need to conclude an agreement, after which you can evaluate the possibilities of online and offline interaction with the fund.

Existing clients can receive a free consultation by calling the hotline, leave a request with a question directly on the website, and receive the necessary information in their personal account. In the “Media Center” section you can follow the latest news from the fund.

How to withdraw from the said fund?

To exit NFP Welfare, you need to make one of two decisions:

- The funds are returned to the Pension Fund. To do this, the insured person must contact the territorial office of the Pension Fund of the Russian Federation with a passport and SNILS card. An employee of the fund will provide the citizen with a form to fill out, where it is necessary to indicate such information as:

- FULL NAME;

- passport details;

- residential address;

- SNILS number;

- contact number.

It is important to know! Basic information about NPF Telecom Soyuz

After filling out the form, you need to fill out an application according to the Pension Fund sample to transfer your funded pension to VEB.

- Savings are transferred to a new non-state fund. When transferring funds from one NPF to another, you need to fill out an application form at the branch of the new fund, where you should indicate your full name, passport details and SNILS number.

- Then the citizen signs three copies of the contract, one of which remains with the insured person, the second for the NPF, and the third for the Pension Fund. In this case, there is no need to contact the previous fund, since the contractual relationship will be terminated automatically when a new document is signed.

In both cases, the accumulated funds are transferred to the new fund from the first day of the new year.

We recommend reading: Useful information about NPF Rosgosstrakh.

An application form for leaving NPF Blagosostoy can be obtained by contacting the nearest branch of the fund.

Pension programs of the Future Fund

Similar to its competitors, the NPF in question offers three main products:

- a program aimed at forming the funded part of the pension;

- corporate security option;

- compulsory pension insurance program.

OPS and the individual option allow future clients to transfer funds already available in the Pension Fund (or other NPF) to the Future Fund.

Thanks to investing funds, each client has a real opportunity to increase the size of their future pension.

A corporate program developed for a specific business makes it possible to retain the necessary specialists in the team and attract new personnel. As an element of the social package, such a fund product allows companies to have tax benefits.

How to find out your savings

You can obtain information on savings in several ways:

- at the nearest branch of the fund;

- on the organization’s website using the “Personal Account” service;

- in the department cooperating with NPF "Future".

In terms of saving time, the most convenient way is to use the “Personal Account” service. You will first need to register. This can be done on the authorization page, where you should click the “Register” button.

In the form that opens, enter personal data - full name, series and passport number, SNILS, email address and telephone number. You should receive an SMS with a confirmation code on your phone.

When filling out the form, you must check the box indicating your consent to the processing of personal data. You can also agree to receive messages by phone or email.

Registered users are authorized by entering their SNILS and password. The service provides access to a personal account, which can be controlled at any convenient time. The profitability provided by the company's investment policy is also visible here. The work of your personal account is constantly being improved.

Login to your personal account

Important: NPF Stalfond is a non-state pension fund that has been operating on the Russian market since 1997. Relatively recently, two large organizations: Stalfond and Future merged. The merger had a positive impact on assets. At the moment, users of the personal sections of both enterprises are authorized through a single service.

To make it easier to interact with the resource, it is recommended to register a Stalfond personal account. After authorization, all offered functions will become available to the company’s client. The authorization procedure is performed on the same service that is used by clients of the Future Fund.

To log into your personal account of NPF Future, you need to follow the instructions:

- Go to the start page of the official website using the link: https://npff.ru/.

- Click the “Personal Account” button located in the upper right corner.

- You go to the page https://npff.ru/personal/, where authorization is offered in three ways: through SNILS, mail address or phone number.

- Enter your login and password.

- Click “Login”.

Attention: it is also proposed to log in to the system using an account on the State Services portal. It is more convenient to use if the entry is confirmed. Otherwise, it is recommended to use traditional login methods.

How to receive the funded part of a pension from NPF “Future”?

Payments may be assigned upon reaching retirement age (or earlier, subject to certain conditions). The procedure starts after submitting an application and a package of necessary documents. The latter, as a rule, is identical to the package of documents for the appointment of an insurance pension.

If a lump sum payment is expected, the processing time for the application may be a month. If we are talking about an indefinite or urgent option - 10 working days.

The urgent option involves individual determination of the duration of monthly payments, but it cannot be less than 10 years. Perpetual benefits are based on life expectancy determined annually.

Last year the period was 20 years. The monthly payment amount is calculated by dividing the entire accumulated amount by 234 months.

Profitability of NPF "Future" by year

Investing citizens' pension savings allows the fund to receive a certain income, which increases the amount of funds in each client's account. In 2014, the percentage of profitability of NPF “Future” was small - only 1.47%. Compared to the profitability of the Pension Fund of Russia, the indicator was lower by 1.21%.

In 2015, the yield was already 5.58%, in 2016 it decreased again - 3.87%, in 2017 - the figure stopped at 1.85%. This picture may indicate the futility of investments. However, this is not entirely true, since the annual profitability figures could potentially change significantly, and therefore grow.

Hole named after Yakunin. Where does the money disappear from the Russian Railways pension fund?

Voluntary-compulsory contributions

The non-state pension fund Blagosostoyanie is the second largest pension fund in Russia after Gazfond.

According to official data from the fund itself, as of September 2021 it amounted to 440 billion rubles. This is the money of 1.3 million investors, most of whom are current or former employees of Russian Railways. The official website of the fund states that Blagosostoyanie is essentially a railway pension fund. However, such popularity of the organization is not explained by the high profitability of its programs or lucrative offers - the transfer of part of the salary for Russian Railways employees is essentially voluntary-compulsory. On thematic forums of railway workers there are posts with complaints that you can only leave the fund by resigning from the corporation, and when applying for a job, management literally forces you to join the fund.

Deputy Head of the Department of Corporate Pension Programs of the Blagosostoyanie Fund, Alexey Martynyuk, confirmed to The Insider that 90% of all Russian Railways employees are members of the fund. “Of course, if someone does not want to participate in the program, no one will force him, but if out of 10 employees 9 are members of the fund, then this one person will simply feel uncomfortable. In addition, the foundation is also a corporate culture.”

This state of affairs in Russian Railways is due to the fact that until 2021 the largest shareholder of the fund was Russian Railways itself, then almost 50% of the shares were bought by Gazprombank, and 25% by VEB. However, according to documents published on the fund's official website, Russian Railways still owns 25% of the fund's shares.

But despite the huge reserves, the fund’s profitability, according to various estimates, does not exceed 6–7% (that is, it is not even in the top thirty in terms of profitability). And the average size of a non-state additional pension is only 9.3 thousand rubles.

Martynyuk refused to answer questions about where and why the fund invests money, explaining that all decisions are made by the investment committee. The fund itself did not respond to The Insider's requests.

Yakunin and his friends

According to official information, the fund has a board of directors and a management board, but the money supply is managed by several management companies, and they are the ones who make decisions in which asset to invest. However, many decisions were influenced for many years by persons associated with Yakunin. In 2013, Yakunin himself served on the fund’s board of directors. And, according to Forbes, most of the assets were then managed by Trinfico, whose general director is still Yakunin’s former advisor, Sergei Orlov. Now she is not listed among the management companies, but remains a shareholder of the fund through several companies. And it can still influence his work.

Five years after Yakunin left Russian Railways, the fund's management companies changed. But the old management still has ownership leverage - for example, which for a long time managed one of the key assets of the fund - Absolut Bank, also belongs to the same company - Investment Management - as RVM Capital.

Pension money

As The Insider discovered, the money from Russian Railways pensioners was used to sanitize Baltinvestbank, which still has problems with capital after non-repayable loans. Companies that have not repaid loans are themselves now on the verge of bankruptcy or have already been declared bankrupt. It is interesting that at least one of these enterprises, the Samara Bearing Plant, was managed by Yakunin’s sons.

In 2013, for €300 million accumulated by future Russian Railways pensioners, Yakunin acquired Absolut Bank from the Belgian KBC group for the fund. At the same time in 2013, Absolut Bank was headed by an acquaintance of Yakunin’s son Andrey, Andrey Degtyarev, who managed the assets of Yakunin Jr.’s Luxembourg company, VIY Managers in Russia (now he is a full-fledged partner of the Yakunin family).

Despite the help of the Central Bank and the investment of tens of billions by Absolut Bank, the amount of non-repaid loans as of August 2021 amounted to 20 billion rubles (according to official reports on the bank’s website).

At the same time, in order to patch up the deficit in their own asset - Absolut Bank, the owners regularly carry out additional capitalization from the funds of the Blagosostoyanie fund. In 2021 alone, they invested an additional 12 billion rubles from pensioners’ money into Absolut Bank.

Loans to your people

The deplorable state of Baltinvestbank, teetering on the brink of bankruptcy, and the purchase of this asset itself may not be a coincidence. Even before the reorganization, this bank began issuing huge loans to factories and companies also associated with the business of the Yakunin family. As a result, the debts were not repaid, and the companies went into bankruptcy proceedings.

Before Absolut Bank came under control, the troubled Baltinvestbank was controlled by a group of entrepreneurs: Vadim Egiazarov, Alexander Shvidak, Yuri Rydnik. In addition to the bank, they owned two groups and VBM Group, to which the loans went, which is why Baltinvestbank ended up in a deplorable state. In particular, Samara Bearing Plant and Volgaburmash received loans. In total, The Insider counted almost 9 billion rubles in unrepaid loans that were issued to these companies.

It is interesting that back in 2012, several years before the reorganization of Baltinvestbank, Yakunin Jr.’s investment fund, VIY Management (VIYM), became interested in these plants. True, the fund did not acquire shares in the companies directly, but bought shares in the Cyprus company Spz Holding Limited, to which the Samara Bearing Plant was registered. And Yakunin’s youngest son, Viktor Yakunin, joined the board of directors of this enterprise. The VIYM investment fund itself then officially explained the purchase of the factories by saying that it wanted to implement a “long-term program for the development of the production of large-sized bearings.”

But in 2015, after the arrival of new owners, the situation in the companies only worsened - some enterprises found themselves on the verge of bankruptcy, including SPZ, Samara Reservoir Plant and Volgaburmash. As former general director of the Samara Bearing Plant Sergey Orlenkov (he was general director from April 2015 to May 2021) told The Insider, the company did not have enough working capital.

And at the end of 2015, Baltinvestbank also came under reorganization. Then, Orlenkov says, the bank froze all credit lines and began to demand only the repayment of debts. “At that time, the plant owed the bank several hundred million rubles. I was asked to increase production volumes and establish production. I did everything I could,” says Orlenkov.

Currently, the SDR is undergoing bankruptcy proceedings and the sale of property at auction. According to the unified official register of bankruptcy information, initially the plant’s debts exceeded 3.5 billion rubles, now - 2.1 billion rubles, of which 423 million rubles are required by Baltinvestbank (follows from the minutes of the creditors’ meeting for July 2020).

On termination of the contract with NPF "Future"

The procedure for terminating the contract is quite simple. Nuances can be specified in the relevant paragraphs of the document. If there are none, you simply need to notify the fund of your intention to terminate cooperation.

Important! Russian legislation prohibits changing funds more than once a year.

If termination occurs for the first time this year, then a written application from the client will be required to implement the procedure. It must contain information about what to do with the amount of funds accumulated in the account.

It can be withdrawn to a bank account (card) or transferred to another NPF. Within three months after submitting the application, savings are transferred to another fund or to the account specified in the application.

It is worth remembering that termination of the contract entails certain consequences:

- loss of income from investing savings;

- taxation of withdrawn funds;

- payment of a commission for transferring the amount to the account.

Features of termination of the contract

If you need to terminate the contract with the Future Fund, you should carefully study all the provisions of this document. If there are no special conditions for terminating the contractual relationship, it is sufficient to notify the organization of your decision. In addition, you need to write a corresponding statement.

In such a statement, the NPF client must indicate where to transfer the accumulated funds. The money can be transferred to a bank account or to another fund, including the Pension Fund. Three months are allotted for the transfer.

Upon termination of the contract, the client loses:

- Profit from profitability for the current period.

- 13% tax on pension savings.

- Money that covers transaction costs.

Important! If the accumulated amounts are transferred to another fund, the 13% tax is not charged.

Hotline number of NPF "Future"

By calling the hotline number 8-800-707-15-20 you can find out all the necessary information on pension issues. Moreover, this applies not only to clients who have entered into an agreement directly with NPF Future, but also to those who have an agreement with organizations that are part of it. Calls within Russia are free of charge.

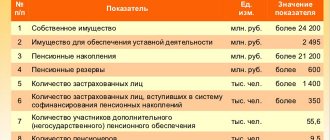

The success of an organization can be indirectly or directly judged by numbers. The volume of pension savings of the company under consideration is 283 billion rubles, which allows it to close the top three leaders in the pension market. And the volume of payments to clients and legal successors, which almost reached 6 billion rubles, indicates a high degree of reliability.

About the system

The non-state pension fund "Future" allows the client to exercise control over personal savings. The procedure is carried out online. The service operates around the clock. You can log into your personal account and find out your savings using any device that allows you to access the Internet.

The Future pension fund system provides the client with the following opportunities:

- adjust your personal tariff plan;

- study data on the account status in the NPF “Future”;

- view the investment results through your personal account;

- Contact technical support for any questions.