The taxpayer identification number (TIN) is one of the identifiers of legal entities and individuals. Previously, it was possible to obtain a certificate of assignment of an identification number only at the branch of the Federal Tax Service (FTS), but now this can be done online. Let's look at how to get a TIN through State Services.

Why do you need a TIN?

The taxpayer identification number is presented as a digital code. As the name suggests, this detail is assigned when a legal entity (LE), individual entrepreneur (IP) or individual is registered for tax purposes. The need to register for the purpose of conducting tax control of organizations and individuals is enshrined in Article 83 of the Tax Code of the Russian Federation of July 31, 1998 (as amended in 2021) No. 146 FZ.

The identification number is used to calculate and pay all taxes and fees and is unique, which avoids possible confusion caused by the coincidence of first and last names of individuals or names of legal entities. The TIN is assigned once.

Methods for obtaining a TIN without registration

In such a situation, you need to build on the norms specified in Article 84 of the Tax Code, which states that a TIN certificate once issued does not lose its validity, regardless of the region in which its owner is located, and it needs to be changed only in that case , if a person loses a previous document, as well as if he changes his gender or full name.

You must submit an application to the tax office in accordance with Form 2-2-Accounting, so it is best to prepare it in the presence of tax officials directly at the office. It is worth noting that the applicant must have a mark on the presence of registration in his passport, otherwise, along with other documents, he will need to provide a certificate of temporary registration.

We recommend reading: How to sell a privatized apartment with shares

We collect documents for registration of TIN

The rules for registering organizations and individuals with the tax authorities are described in Article 84 of the Tax Code of the Russian Federation and in the Procedure approved by order of the Federal Tax Service dated June 29. 2021 No. ММВ-7-6/435.

According to these documents, when registering individuals, the following personal data is required:

- FULL NAME;

- Date and place of birth;

- place of residence/stay;

- details of an identity document (passport, birth certificate);

- citizenship.

The listed information is available in the passport, international passport (for foreigners) or birth certificate if we are talking about minor children. If for some reason the necessary data is not in the passport, additional documents will be required:

- citizenship insert;

- document confirming place of residence;

- marriage certificate when changing surname and others.

Original documents are provided with copies.

The basis for tax registration is an application for a TIN (form No. 2-2 Accounting). Its form was approved by order of the Federal Tax Service dated August 11. 2021 (as amended on September 12, 2021) No. YAK-7-6/ (Appendix No. 6), and the filling requirements are set out in Appendix No. 15 of the same order.

Where can a foreigner obtain an Inn at his place of residence in Moscow?

Home page / Individuals / I am interested / INN / The tax authority is obliged to register an individual on the basis of an application from this individual within five days from the date of receipt of the said application by the tax authority and, within the same period, issue him a certificate of registration with tax authority (if the specified certificate was not previously issued). If an individual’s application is sent by registered mail or transmitted electronically via telecommunication channels to the tax authority, the tax authority shall register the individual on the basis of such an application within five days from the date of receipt from the authorities specified in paragraph .

- color photograph 3.5 x 4.5 cm, on a light plain background, without corners and ovals (in some countries 2 photographs are required);

- a visa application form filled out online on the website of the Consular Department of the Russian Foreign Ministry. After filling out the form, you must print it out and sign it;

- a voucher or contract for tourist services and confirmation of the reception of a foreign tourist by an organization carrying out tour operator activities in the territory of the Russian Federation on a standard form (form “on the reception of foreign tourists”).

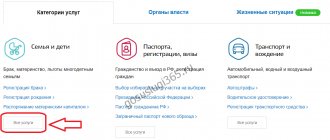

Getting a TIN through State Services: follow the instructions

Registration on the State Services website provides many advantages in receiving government services. Currently the portal operates in two versions. Unfortunately, the new full version of the site in 2021 only allows you to find out an existing number and request an extract from the Unified State Register of Real Estate (USRN), but does not make it possible for an individual to obtain a TIN.

The assignment of TIN and registration of taxpayers is within the competence of the Federal Tax Service. In most cases, a taxpayer number is assigned immediately after the birth of a child or, in some cases, by the employer.

If you still need to obtain a certificate of TIN assignment, follow the instructions:

- Log in to your personal account using the login and password specified during registration.

- Go to the “Services” section and find the “Taxes and Finance” subsection.

- Select.

- Study the information about the provision of the service and choose the option that is convenient for you to obtain a certificate.

- Read the agreement. If you accept the terms, check the special box and click on the “Next” button.

- Fill out the application, using the prompts if necessary (first of all, the details of the applicant’s identity document are required).

- After filling out the application, click on the “Next” button, enter information about your place of residence and click on the “Continue” button.

- Indicate the recipient's contact information and how to receive notification that the document is ready.

- Complete the process by clicking on the “Submit Application” button.

Once your application has been processed, you will receive a notification that it is ready.

Obtaining a TIN from a foreign passport or ID card

When applying for a job in St. Petersburg, they required an INN. I myself am a citizen of the Russian Federation, but with registration in Estonia. You have temporary registration, a foreign passport, and an ID card in your hands (which is an internal document of Estonia - an internal passport). I don’t have an internal Russian passport. Is it possible to somehow obtain a TIN using existing documents? If not, is there any way to officially get a job while the necessary documents are being prepared?

We recommend reading: Sample property tax refund for pensioners

How long does it take to issue a TIN?

Regardless of how you applied for a TIN, the processing time will be the same. It is approved by tax legislation (Article 84 of the Tax Code of the Russian Federation). The identification number will be ready within five working days. Additional time may be required to deliver the certificate to the issuing point if the application was submitted at a multifunctional center (MFC).

Where to get an inn at your place of residence in Moscow addresses

Where to get a TIN for foreign citizens 2021: registration with the tax office. Moreover, from 2021, migrants are required to personally submit documents for registration of a patent - no intermediaries are allowed. To obtain a patent, a migrant worker must first acquire a TIN - an identification code that foreigners receive in the same tax structures as Russians.

Indicate your email address in the Application and you will receive messages about the status of your application to your mailbox. After filling out the Application for a TIN and sending it through the online service, the Federal Tax Service of Russia is responsible for the safety of the information after it is received. how to obtain a tax identification number for a child The legal representative (parent) of a child under the age of 14, in order to obtain a document confirming the assignment of a taxpayer identification number, must contact the tax office at the place of residence and provide:

Obtaining a TIN via the Internet: other methods

Another online source for obtaining a taxpayer identification number is the official website of the Federal Tax Service (FTS). Among the electronic services offered by the service, in the “Individuals” section you need to select “TIN”, and in it indicate “I want to register with the tax authority (receive a TIN certificate).”

Next, the service will offer to submit an application for registration. You can submit an application directly on the website. In the form that opens, you need to fill out the form, then register it and send it to the tax authority at your place of residence or stay. To receive a certificate, you need to appear at the appointed time with your passport at the territorial tax authority specified in the application. If the application was sent on paper, then you will receive the certificate by mail.

How to find out your TIN through the Federal Tax Service

This service will quickly help you find out your/someone else’s TIN online. You just need to do the following steps:

- Go to the Federal Tax Service website - nalog.ru

- Click on “Services and government” at the top.

- The system will request your full name, full date and place of birth, passport number and the department that issued it. This will be followed by confirmation using the sent antispam code and the request will be sent.

- The TIN will be provided almost instantly, provided that the person is registered with the tax authority.

Video instruction

We answer questions

In this section we have collected the most frequently asked questions regarding obtaining an identification number.

Do I need to change the TIN when changing my last name?

The TIN remains unchanged throughout the life of the taxpayer. A change of first or last name, change of family status, registration or work does not entail changes in the structure of the TIN. If necessary, you can change the TIN certificate, and then only if your full name has changed. Only this information changes in the certificate.

To replace a document, you must contact the tax office at your place of residence or stay and submit an application using form No. 2-2-Accounting. Important: you will need a passport with a new last name.

How to order a TIN if lost

The identification number exists as a digital code in the tax service database. It is impossible to lose it, unlike the tax registration certificate. You can obtain a duplicate certificate on the website of the Federal Tax Service of the Russian Federation. Important: the service of re-issuing a certificate if lost is subject to a state fee of 300 rubles. Online payment is possible on the Federal Tax Service website.

Is it necessary to obtain a TIN for a child?

A TIN must be issued for a child if he is the owner of taxable property. Registration and assignment of a TIN to a minor occurs on the basis of an application from his parents or guardians. A child over 14 years old can independently obtain a number by filling out an application from his personal account on the Federal Tax Service website.

How to find out the TIN on the State Services portal

An identification code is assigned to each individual who gets a job or owns taxable property. An application for assignment of a TIN to an individual can come from the employer, the civil registry office and those carrying out state registration of property. Often, until a certain time, until the TIN is required, the citizen does not know it.

You can check the availability of a TIN and find out its number on the State website. Passport details will be required. The service is free.

How to obtain a TIN certificate

If an individual independently initiates the process of assigning a TIN, then he receives a tax registration certificate in one of the ways chosen at the application stage (personal visit to the Federal Tax Service, MFC or by mail). You can obtain a TIN certificate, if you already have a number, in paper or electronic form.

TIN - how to find out and where to get it in Moscow

For legal entities, the digital sequence is slightly shorter and consists of ten characters. For individuals and individual entrepreneurs, the sequence is 12 Arabic numerals. The first two digits are the code of the subject of the Russian Federation, the next two digits are the tax office department number, the next six characters are the taxpayer’s record number, and the last two are control ones to check the correctness of the entire combination.

We recommend reading: Where to file an appeal

If you do not have an electronic signature issued by an organization accredited by the Ministry of Telecom and Mass Communications of Russia, then in any case you will have to visit the tax authority, at least to obtain a certificate. The application can be submitted online using the service on the Federal Tax Service website: service.nalog.ru/zpufl/ To submit an application via the Internet, you will have to fill out the registration form and attach copies of documents in electronic form.

What can you do without registration and residence permit? We'll tell you in detail

You also need to be aware of the consequences that not registering your place of residence may have on you. And although in the case of employment the law is on the employee’s side, the worker may also face certain difficulties. These include:

It is worth saying that pensions are accrued to citizens at their registration address. If a pensioner has registration in one place of residence, but in fact he is in another, then he retains the right to make a request to transfer the pension to the place he needs. For this procedure, both permanent and short-term forms of registration are suitable. If there is no registration at all, then, unfortunately, it will be difficult to get the money due. The best way out of this situation would be to obtain a temporary registration. It is highly not recommended to delay this event, as this may become a reason for non-payment of a pension for the entire period of time during which the pensioner remained without registration.

We recommend reading: Registration number of the FSS policyholder according to INN 86150004595900610393