Legislative basis for calculating seniority

Citizens of the Russian Federation calculate their length of service according to the Federal Law “On Labor Pensions in the Russian Federation” No. 173, which entered into force on January 1, 2002.

Currently, the law does not have the concept of “work experience”; since December 31, 2001, it has been replaced by the clarified term “insurance period” , that is, the period during which a working citizen made contributions from his salary to the Pension Fund of the Russian Federation, and added other periods are legally justified for them. However, the phrase “seniority” is often used synonymously.

The insurance period is the duration of periods of work and other activities during which insurance contributions were paid to the Pension Fund of the Russian Federation.

Do not confuse insurance and work experience

The concepts of insurance and work experience are often confused, but they differ fundamentally:

This is also important to know:

At what age do people retire?

The insurance period is the time when insurance premiums were paid for the employee (plus the periods listed above).

Work experience is the sum of all periods of an employee’s work activity.

The main difference is that the length of service includes all vacation periods at your own expense. They will not be included in the insurance period, because at that time no insurance premiums were deducted for the employee.

Concept

The phrase “insurance period” means the duration of the production activity of the person performing it. It reflects any type of activity, including entrepreneurial and copyright.

In accordance with the definition of the Federal Law “On the Fundamentals of Compulsory Social Insurance,” the insurance period is the period of time during which insurance premiums are paid. It was issued by the legislator on July 16, 1999.

Any citizen is obliged to conduct socially useful activities aimed at ensuring normal life. At the same time, it is counted towards the length of service, which allows you to obtain a certain right.

But an officially employed person must be insured in accordance with the standards of the Federal Law “On Compulsory Social Insurance in Case of Temporary Disability and in Connection with Maternity.” It was issued on December 29, 2006 under the number 255-FZ.

These include the right to receive compensation from the state:

- for lost income due to old age;

- receiving a disability of various groups, regardless of the reasons;

- upon the loss of the sole breadwinner.

The regulations on the insurance period were approved by the Federal Law “On individual (personalized) accounting in the state pension system,” which was issued on April 1, 1996.

But it should be noted that the insurance period began to be used after the publication of the Federal Law “On Insurance Pensions”. The act was issued by the legislator on December 28, 2013 under the number 400-FZ.

In accordance with its instructions, pension provision for Russian citizens is established under a mandatory condition, which provides for the presence of an insurance period and payment of insurance contributions to the Pension Fund of the Russian Federation and taxes to the Federal Social Security Service.

As a rule, an insurance pension is assigned to citizens who have reached the retirement age established by the legislator:

| For males it is equal to | 60 years old |

| female | 55 years old |

The insurance period is confirmed by a work book, which serves as the main supporting document. According to generally accepted rules, all periods of labor activity are calculated according to the records made in it.

Seniority

We are accustomed to the fact that we can find out information about our future pension only when it is inexorably approaching. But today a pension fund can help calculate a pension for a person, even someone who has just started working. You can also calculate your pension yourself if you know a number of important concepts.

The first of these is the determination of length of service . How to calculate work experience using a work book?

Few people know that work experience means all the time spent on work, that is, on official work, as well as on other activities that, according to general rules, are socially useful.

Work experience includes studying at a higher educational institution, military service for more than six months, studying at a secondary specialized educational institution and maternity leave.

Thus, your length of service may slightly exceed the actual terms of your work under the employment contract, but this should not upset you at all.

Insurance experience

The second important concept that a citizen should know when calculating length of service and pension is insurance length.

The insurance period is understood as the time during which the employee had life and health insurance, which was paid for by the employer.

That is, it includes the direct work activity of the employee, because during studies or military service such deductions do not go. But the maternity leave applies to the insurance period.

Types of pensions

The pension system in the Russian Federation is based on insurance principles. It includes four types of pensions:

- Insurance. This is a monthly payment made upon reaching retirement age. There are the following types of insurance pension:

- by old age. Paid to citizens of retirement age if they have sufficient work experience and have accumulated the number of individual pension coefficients (points) sufficient to assign a pension;

- on disability. Appointed in case of loss of ability to work due to injuries and illnesses, regardless of length of service;

- for the loss of a breadwinner. Assigned to disabled dependents of a deceased pensioner if they are members of his family.

- For state pension provision. Paid to employees of federal government agencies, military personnel, law enforcement officers, and other government service employees.

Future recipients of state pensions

Divided into the following types:

- for long service. Assigned to employees of the mentioned bodies for the period of work in these structures;

- state old age pension.

- state disability pension. Appointed to military personnel and citizens equivalent to them in connection with illnesses and injuries;

- State survivor's pension. Assigned to disabled family members of deceased or deceased recipients of state pensions.

- Social pension. Appointed if the required age has been reached, but there is no minimum number of pension points and there is insufficient work experience. There are social pensions for old age, disability, and loss of a breadwinner.

- Funded pension. Composed of accumulated insurance premiums paid by employers and investment income.

Until 2014, mandatory contributions to the Pension Fund for persons born in 1967 were paid partly for the insurance part and partly for the funded part of the pension. Then all contributions began to be paid only for the insurance part.

Accumulated contributions are saved, and income from investment is included in the calculation of the pension. At the request of the policyholder, they can be transferred to non-state pension funds and management companies. In this case, the funded part is not included in the calculation and is paid by a non-state fund. The savings portion can only be increased through voluntary contributions paid from the policyholder’s income.

Types of total length of service that affect the calculation of pensions

Differences in establishing the estimated size of a labor pension are not limited to the difference in the formulas for their calculation: the lists of periods that form the total length of service involved in them also differ.

For calculations according to clause 3 of Art. 30 of the law of December 17, 2001 No. 173-FZ, the total length of service consists of the periods:

- any types of work (including creative activities) in the Russian Federation or abroad;

- military service;

- illness that occurred during work, or disability of 1-2 groups related to work;

- unjustified excessive detention;

- registration with the employment service in connection with unemployment.

For calculations according to clause 4 of Art. 30 of Law No. 173-FZ of December 17, 2001, the total length of service, in addition to the above periods, additionally includes the time:

- vocational training;

- caring for a disabled person;

- maternity leave and child care up to 3 years (but not more than 9 years);

- lack of opportunity to work for the wives of military personnel staying with their husbands at the place of service, and the wives of persons sent to work abroad. In the latter case, this period should not exceed 10 years;

- being in the occupied territories, in concentration camps or in besieged Leningrad during the Second World War.

Why calculate the insurance period?

The insurance period requires calculation when a person is about to retire or applies for sick leave. Depending on the purpose for which the calculation is carried out, the legal framework and processing rules are determined.

In certain cases, data on a particular type of activity, unemployment or informal employment is recorded or eliminated. In any case, the calculation principle will be different for each case and type of payment processing by the state.

For retirement

The insurance period for pensions is calculated in points

For the calculation of pension payments, the calculation scheme is individual, but has a clear structure, which is based on legislative documents.

The basis for the calculation is all the calendar frameworks prescribed by the law of the Russian Federation.

In this case, the calendar periods prescribed by law may vary due to certain working conditions:

- When calculating the insurance period, work during a certain season of the year is counted as 1 full calendar year.

- Since 2015, the insurance period has been calculated in points, which are subsequently converted into monetary equivalent.

- Peculiarities in calculating the insurance period apply to those persons who work in accordance with contracts and licenses that represent non-standard activities.

- If the time of work in several places at the same time coincides, the person independently chooses where to get the data for calculation.

If there are no documents confirming a person’s employment, the testimony of several witnesses is taken as the basis. In this case, witnesses cannot prove the period of work, only the fact of activity.

This procedure is carried out in the event of force majeure situations in which documents were destroyed, but not through the fault of the applicant.

When applying, it is worth distinguishing between two different concepts: work experience and insurance experience. You can contact your pension fund for help.

For sick leave

When calculating length of service for sick leave, many nuances are taken into account

To determine the length of service for sick leave, there are revised rules that consist of many paragraphs, chapters and subparagraphs. This is a state instruction for calculation, which indicates all the nuances.

General provisions regarding counting:

- The invoice is made in accordance with time intervals, which are set in a calendar manner: 30 days - a month of insurance time for payments, 12 months - a year.

- If an employee has a coincidence regarding employment at several enterprises at the same time, then the person chooses which place of work to include in the calculation. The applicant is required to submit a corresponding statement.

- In the process of counting by day, it is worth considering that the start of accrual starts from the day that precedes the date indicated on the sick leave.

The special definition for payment does not include the period of time spent caring for a child, starting from the fourth child.

If the work book indicates several places of work with different length of service and intervals, then the calculation will be carried out in relation to each individual case, and only then summed up into the total length of insurance.

In accordance with the type of activity and length of service, the insurance period is also determined in the process of calculating sick leave. The amount can range from 60% to 100%. All the nuances regarding the calculation of sick leave payments can be found in the pension department.

Rules for calculating work experience

In order to correctly calculate the length of service, you need to know what is included in it.

As we have already determined, both insurance and length of service are calculated differently, which means you need to have knowledge of two calculation methods at once.

There are many nuances in the length of service calculation procedure that are worth paying attention to.

What periods are considered when calculating?

Work experience represents all the labor, mental and physical activity of a citizen. A citizen begins to receive his first work experience from the moment he enters a higher educational institution or decides to receive secondary or secondary specialized education.

As a general rule, when calculating work experience, any activity that a citizen has had and is related to the acquisition of knowledge, that is, study, service in the armed forces, has weight.

And also, there are a number of other grounds and cases that can be considered work experience. Let's consider each of them separately.

Work experience includes:

- woman's maternity leave;

- Holiday to care for the child;

- sick leave;

- training in an educational institution of higher, secondary and secondary specialized education;

- compulsory service in the armed forces;

- advanced training, obtaining a second higher education.

All these time frames, which are not periods of labor activity, also refer to general work experience.

Methods (manual, electronic) of counting

There are several ways to calculate length of service using a work record book. This can be either an electronic or manual counting option. Each of them has its pros and cons.

So, for example, the electronic method is quite fast, but the manual method involves some mental process that will take some time.

Each calculation method deserves special attention, so let’s take a closer look at them.

Manually

In order to calculate the length of service from a work book manually, you need to prepare some details. You will, of course, need your work record. Also place a piece of paper, pen, and calculator in front of you. Get ready to do the math.

The formula for calculating length of service using a work book is very simple, but requires attention.

Open the work book to the title page, which contains information about your education.

Write down the number of years you studied at a higher education or secondary specialized educational institution.

Next, write down the period of military service, if any. Add maternity leave time if available.

Now count your years of work officially. To do this, you need to add up all the entries in the work book about hiring and dismissal. The resulting figure is added to the calculated periods of service, maternity leave and study.

Now, by adding up all the data, you can see what your total work experience is.

How to calculate length of service according to a work book? Example. Alexander studied at the institute for five years, then served in the army for another year. Then he worked in one organization for about three years.

At the job where he works and to this day he has worked for five years. Now, by adding up all the data, you can see what your total work experience is.

Thus, Alexander’s work experience consists of 5+1+3+5=14. It is these fourteen years that are considered the official period of the employee’s total work experience.

Electronic (using what?)

We calculate the length of service according to the work book using the Internet. There are many sites on the World Wide Web that offer you the ability to calculate your retirement experience without any problems.

To do this, all you need to do is find a suitable website and fill out a form based on your work record.

After entering all the data, the system will give you the result of your experience.

Using the 1C program

The 1C program can also help with calculations. To do this you need to have the skills to work with it .

In order to calculate your length of service, you need to draw a table on the screen and fill it in with information about your employment in accordance with your work book.

Only after all the columns of the table have been filled in, you can set the calculation formula and get the finished result.

The system will calculate your work experience and also offer to print the result.

Periods counted in the insurance period

Article 16 of Law No. 27-FZ lists all periods of time that are included in insurance. These include, in particular, the following intervals:

- Work under an employment agreement.

- Carrying out activities under a civil contract:

- civil service;

- service in civil and municipal bodies;

- service in the army and equivalent government institutions;

- Temporary disability due to illness.

- Care period:

- for a newborn up to one and a half years old (in total no more than 6);

- for a disabled child>;

- for a disabled person of group 1>;

- for an elderly citizen who has crossed the 80-year-old threshold.

- Status registered with employment authorities.

- Participation in paid community work.

- For rehabilitated persons - time spent under arrest and serving a sentence.

- The period of voluntary transfer of contributions to the Pension Fund by a person who is not included in the compulsory insurance system.

- The period during which the individual who entered the compulsory insurance system voluntarily paid contributions for the applicant.

- Living with a military spouse in an area where employment in the specialty is impossible, including abroad.

Attention: the specified preferential periods of time will be taken into account in the StS if the person worked officially before they began or after completion (Article 11 of Law No. 400-FZ).

All other periods will not be included in the length of service. For the self-employed population (individual entrepreneurs, notaries, etc.), the insurance period will include the time period during which contributions to the Pension Fund were transferred.”

Example

Sergei Petrovich worked in three private companies, as indicated in his Labor Code:

- LLC "Scarlet Sails": from 10/16/1996 to 02/18/2001;

- JSC "Volt": from 02/19/2001 to 09/22/2008;

- Parus LLC: from 09/23/2008 to 06/01/2017.

To determine the total length of service, it is necessary to calculate the lengths of continuous service at each enterprise:

- 02/18/2001 - 10/16/1996 = 02 days. 02 months 4 years.

- 09/22/2008 - 02/19/2001 = 03 days. 07 months 7 years.

- 06/01/2017 - 09/23/2008 = 08 days. 07 months 8 years.

Let's sum up the periods: 02 days. 02 months 4 years + 03 days 07 months 7 l. + 08 days 07 months 8 l. = 13 days 04 months 20 years.

Attention: time interval conversion rules were used for calculations.

What to do if the archive is missing

If the necessary documents are missing, the time of work can be confirmed by witnesses. In this case, you must provide a certificate stating that the archive has not been saved. This is possible for the following reasons:

- carrying out military operations;

- natural disasters (tsunami, flood, earthquake(;

- emergency situations (accidents, disasters, etc.).

To confirm the length of service, testimony of two or more witnesses who worked with the applicant during that period of time is required.

When determining the period of work, the age of the applicant is taken into account:

- the time spent working is taken into account from the moment the applicant turns 16;

- if hired labor was used during the holidays, then the period of work starting from 15 years (in rare cases - from 14 years) is taken into account.

If there are discrepancies in the testimony of witnesses regarding the time period, the period of time confirmed by both witnesses is taken as a basis.

Self-calculation of pension

Due to constant changes in legislation and the release of new amendments, it can be difficult to understand accruals without the help of Pension Fund employees.

However, everyone can calculate the size of their future pension. It is enough to know what it consists of.

Insurance payments

Not every citizen of the Russian Federation knows how to calculate the preferential part of a pension.

It is difficult to determine exact numbers, because... they include 3 indicators:

- The amount of pension coefficients. Their citizen is obtained every time the employer pays 22% of his salary to the Pension Fund. To find out the final score, you need to divide a person's annual income by the salary limit. In 2021, it is estimated at RUB 1,021,000. The resulting number must be multiplied by 10. The answer will be the number of points the employee receives per year.

- Cost of 1 coefficient. This figure is constantly changing, so when calculating your pension you need to rely on the latest data published by the Pension Fund of the Russian Federation. In 2021, due to indexation by 6.6%, the price for 1 point increased to 93 rubles. Previously it was equal to 87.24 rubles.

- Fixed payment. It is mandatory and is always included in the total amount of the insurance pension, not counting contributions for government employees.

Pension calculation formula.

For military pensioners

Military personnel can receive double payment. It consists of the state pension for the military and the insurance part. The first one begins to be paid when the service life exceeds 20 years or the total length of service is 25 years. Also, the basis for receiving such income is the loss of a breadwinner or disability.

The second part of payments to military personnel consists of the insured amount. Only persons who meet all the requirements can count on it:

- Men must be over 65 years old, women over 60 years old.

- The minimum experience in the civilian sector is 11 years.

- The sum of individual coefficients is 18.6 points or more.

If all the requirements are met, but the person does not receive a military pension, disability income will consist only of insurance payments. Individuals assigned to double accrual may continue to work. In this case, recalculation will occur automatically every year on August 1.

Formula for calculating a military man's pension.

For employees of the Ministry of Internal Affairs

A separate formula for calculating disability payments is provided for civil servants of the Ministry of Internal Affairs. The exact amount of monthly accruals is announced by the Pension Fund. However, to determine the approximate size of the pension, you can use the formula RPO = 1/2 x (OD + OSZ + NVL) x 72.33%, in which:

- RPO - the total amount of pension payments that an employee of the Ministry of Internal Affairs will receive.

- NVL - Lifetime Achievement Award. If a person has been a civil servant for more than 20 years, he will receive 50% of the average salary for his position. For every 12 months beyond the specified period, 3% of this amount is added to the pension. The total premium cannot exceed 85%.

- OA is the salary received by the employee. You need to enter these numbers yourself. If a person received a promotion during his overall length of service, the calculations must be divided into periods before and after, because The numbers at this point will vary. The total numbers are summed up.

- OSZ - salary determined by a special rank.

For employees of the Ministry of Internal Affairs after dismissal upon reaching working age, coefficients are provided that affect the final amount of the pension. For example, payments may be increased for the class of flight personnel or area of work. On average, aircraft personnel additionally receive about 20,000 rubles. The maximum increase in 2021 is RUB 29,020.71.

Other types

There are many types of pensions that can be received upon reaching the age of incapacity, loss of a survivor or disability.

According to Russian legislation, in addition to the main ones, there are 3 more types of charges:

- Voluntary. Every citizen has the right to choose a third-party organization that will generate his future income. To do this, it is necessary to conclude an agreement with a non-state pension fund (NPF). The pension will consist of contributions that a person makes independently. It is permissible to involve the employer in this process. He will make monthly contributions, as is the case with the funded type of payments from the Pension Fund.

- State. Military personnel, astronauts, and air crew members who have lost earnings due to retirement due to long service can count on such disability income. The reason for the payments may be a person being injured due to disasters (including due to the release of radiation) or during military service. Often such compensation is awarded to persons who became disabled due to the Chernobyl accident or during the liquidation of its consequences.

- For service. In addition to military personnel and police officers, employees of the Federal Penitentiary Service can receive such a pension. To do this, you need to work in the authorities for at least 20 years. A health worker's pension is also calculated with an increase. The required experience is 25 years in rural areas or 30 in cities.

Does work without a work book count as length of service?

In our country, working without a work book is not uncommon, so many people wonder whether working under an employment contract without a work book is included in the length of service?

Unfortunately, if you once worked for an organization or individual without registering an employment record, then this time does not relate to your overall work experience . Therefore, when applying, be sure to insist on official employment.

But if your employer contributed payments to the tax office for you, but simply forgot to make an entry in your employment record, then you are still considered to be working, which means that the period of work is included in your length of service.

How to calculate?

In order to calculate such length of service not included in the work book, you will need to contact the pension fund at your place of residence , where you will be given the appropriate document about the fact of work and the time.

How to calculate payout amounts online

It is difficult to independently determine the amount of income for a disabled citizen due to the many components of the formula. Therefore, the Pension Fund of the Russian Federation has developed an online version of a pension calculator that allows you to calculate the amount of future payments. There is no need to obtain data for it from the employer or government agencies. The odds are determined automatically based on the entered information.

You can calculate your future pension using the calculator on the official website of the Pension Fund.

You must enter in the fields:

- total work experience

- expected retirement date;

- amount of children;

- year of birth;

- floor;

- the number of dependents and the period of their provision.

What is taken into account when calculating

In accordance with the Resolution, the calculation period is the calendar year (12 months) that preceded the month in which the calculation is made . For example, if the calculation is performed in November 2021, then the calculation period is considered to be from November 1, 2017 to October 31, 2018.

Paragraph 5 of the Resolution states that when determining the average daily salary, only the days actually worked by the employee are taken into account. Therefore, it is necessary to subtract from the total the days for which the employee’s average salary was calculated. The legislation provides for the following situations in which an employee’s salary is calculated based on his average daily salary in the previous period:

- Was on vacation or a business trip;

- Visited government institutions (court, prosecutor's office, military registration and enlistment office);

- Was idle or absent for reasons beyond his control;

- Was on sick leave;

- Was on unpaid leave.

When calculating the total amount of income received by an employee during the billing period, you must be guided by paragraph 2 of the Resolution, which lists the types of payments that are included in the employee’s total income:

- Wage;

- Additional payments and various bonuses for class, professional skills, experience, etc.;

- Compensatory payments related to difficult working conditions, overtime work and work on non-working days (holidays and weekends);

- Premiums, bonuses, remuneration and other payments provided for in the collective agreement or internal regulations regarding remuneration approved by the enterprise.

According to paragraph 3 of the Resolution, the following types of payments are not included in the calculation of total income:

- Various types of social benefits (travel, vouchers, financial assistance, etc.);

- Dividends;

- Remuneration for members of supervisory boards and boards of directors.

Northern work experience

The rules for calculating the length of service of citizens who worked in the regions of the Far North and equivalent areas are basically the same as when calculating the usual one.

Working in the North only provides some additional benefits upon retirement and salary increases.

Some features exist: periods are not taken into account:

- status registered at the labor exchange after layoff>;

- maternity leave (one and a half and three years);

- part-time work. If a citizen worked at several enterprises on a part-time basis, this must be confirmed.

When a citizen wants to confirm his work experience in the Far North, it is necessary that in the work book in the “Organization” column there is an entry that the enterprise is located in the Far North region; if it is not there, you should take a certificate of the location of the enterprise in advance .

For example:

Sorokin P.P. provided a work book to confirm his work experience and calculate his pension. He intends to confirm his northern experience and take advantage of the benefits. According to records, he worked in an organization located in the Murmansk region (belongs to RKS) from November 12, 1990 to October 15, 2002. He was fired from it due to staff reduction. From October 19, 2002, he was registered with the labor exchange and received unemployment benefits until November 18, 2003. From November 20, 2003 to April 4, 2013, he worked at an enterprise in Murmansk. Using an online calculator, we calculate the length of service.

1. Enter the values in the columns:

- 12.11.1990–15.10.2002

- 20.11.2003–4.04.2013

We do not include the period when Sorokin was registered at the labor exchange, since they are not taken into account when calculating the northern length of service. Click on the calculation button.

2. We get the result of data processing. Years worked: 21 | months: 3 | days: 19.

Periods of work according to the Labor Code

When calculating length of service under the Labor Code, not only the periods during which contributions to the Pension Fund of the Russian Federation were made are taken into account

In accordance with the Labor Code, various schemes are defined regarding the calculation of work periods:

- If a person was officially working in two places at the same time, then the person himself has the right to choose which place of work to take into account when calculating.

- Any type of activity in accordance with the Labor Code, if contributions were made to the pension fund.

- Seasonal work, as well as work that concerns the army and navy, are counted as a full calendar year.

In accordance with the type of activity regarding the Labor Code, points are also determined that are awarded in connection with other circumstances: maternity leave, caring for a disabled person, or a young child. There can be a lot of such periods. The main period provided for by the Labor Code is temporary incapacity for work, that is, sick leave.

Other activities

Any activity of a person during which contributions were made to the pension fund is included in the insurance period unconditionally. It is important to have the relevant documents that will become the evidence base in the process of applying for an insurance pension.

For example, residents of the southern regions of the country are engaged in subsistence farming, but at the same time make appropriate contributions to the pension fund. This means that the calculation will be carried out in accordance with these data.

This list may include other types of activities, in particular work abroad under an international or private agreement. The main thing is to correctly draw up the document in accordance with the legislative framework of the Russian Federation.

How to calculate your pension in 2021

The size of the pension in 2021 is calculated using the traditional formula (SP = IPC × SPK + FV), into which the IPC value for each individual citizen is substituted. It is important to remember the following:

- For non-working citizens, the values of SPK and , established for 2021, are substituted into the formula. For working citizens, those that were established by law on the date of registration of their pension payments are substituted.

- The calculated amount of payment for non-working citizens cannot be less than the minimum subsistence level of a pensioner (PMP) in the region of residence. Therefore, the amount will be further increased to the regional PMP if necessary.

If a citizen is not yet a pensioner, but only wants to calculate his future pension, he can use the pension calculator posted on the Pension Fund website. To calculate your pension online, you will need to enter the necessary data into the fields of the calculator (date of birth, gender, information about length of service and earnings). The calculation results will display information about the size of the IPC, the duration of the insurance period and the amount of the future pension (example picture below).

Pension Fund calculator for calculating the size of the insurance pension

Taking into account features and nuances

At the moment, the minimum threshold of insurance experience for calculating an insurance pension is 5 years

The insurance period is necessary for calculating the insurance pension. At the same time, there is a minimum threshold at which social assistance is accrued in connection with retirement. Since 2015, the pension is calculated if the insurance period is at least 5 years. Every year the age of this criterion is growing, and by 2025 they plan to introduce a period of 15 years.

If, upon reaching retirement age in a certain year, the required number of years is not accumulated, then not an insurance pension will be assigned, but a social one. This means that payments will be limited to the minimum rate. With an insurance pension, the amount of payments is determined by the salary from the last place of work. Here it is worth considering the number of years worked.

The insurance pension is also accrued if certain pension points are available. Today the coefficient should not be lower than 6.6, but every year it will grow. In 2025 it will be 30 points.

You can learn about the principle of accrual of pension points from the regional pension fund or at the enterprise. It all depends on who will calculate the insurance period in the future.

Even if a person worked abroad or for a private individual, was himself a private entrepreneur, but at the same time contributed the amount specified by law to the pension fund, then the accrual of insurance experience will be made in accordance with the amount of insurance payments.

The principle of calculating the insurance period depends on the length of service. The principle of calculations is determined by special acts that spell out all possible options regarding employment and work.

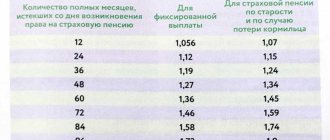

Increasing your pension using bonus factors

The pension calculation has introduced the ability to increase the pension using bonus coefficients if a person decides to retire later than the established period of his own free will.

Upon reaching retirement age, a person can continue to work, and a coefficient of increase in both the fixed part of the insurance pension (PC1) and an increase coefficient of the IPC (PC2) is introduced into his pension.

These bonus coefficients for the number of full months of delay in receiving a pension are presented in the table

| Number of months to defer receiving a pension | IPC increase coefficient (PC2) | PV increase coefficient (PC1) |

| Less than 12 months. | 1 | — |

| 24 months (2 years) | 1,07 | 1,056 |

| 36 months (3 years) | 1,15 | 1,12 |

| 48 months (4 years) | 1,24 | 1,19 |

| 60 months (5 years) | 1,34 | 1,27 |

| 72 months (6 years) | 1,45 | 1,36 |

| 84 months (7 years) | 1,74 | 1,58 |

| 96 months (8 years) | 1,9 | 1,73 |

| 108 months (9 years) | 2,09 | 1,9 |

| 120 or more (10 years or more) | 2,32 | 2,11 |

These coefficients greatly influence the final pension. Thus, with a voluntary delay of receiving a pension for 10 years, the fixed part of the pension increases by 2.11 times, and the Individual Pension Coefficient increases by 2.32 times. The resulting insurance pension will increase by two and a half times compared to the initial one.

What periods are counted in the insurance period?

In accordance with the requirements of legislative acts, periods of labor activity that are carried out under an employment and civil law contract are included in the insurance period. It also includes periods of service in state, civil and municipal bodies.

This norm is approved by Article 16 of the Federal Law “On Compulsory Social Insurance in Case of Temporary Disability and in Connection with Maternity.”

Periods included in the insurance period:

- service in the armed forces and equivalent government institutions;

- temporary loss of ability to carry out work activities due to illness;

- leave to care for a young child until he is one and a half years old, until he reaches 6 years old, an elderly family member who has a disability, including a child who has been disabled since childhood;

- staying without official employment, subject to registration at the employment center;

- performing paid public works;

- labor activities carried out outside the Federation, when the second spouse is deprived of the opportunity to find a job;

- service in military units located in areas where the second spouse cannot get a job due to its absence. As a rule, no more than 5 years are credited to the second spouse of a military personnel.

In some cases, the time spent in prison is counted towards the insurance period if the citizen was acquitted by a judicial authority.

It should also include the time allotted for moving to another area where the citizen was sent by the employment center for his further employment.

According to generally accepted rules, the periods of time noted above are counted into the insurance period when some work activity was carried out before or after it, regardless of its duration. This provision is enshrined in Article 11 of the Federal Law “On Insurance Pensions”.

Examples of how pensions are calculated

As we have already said, the pension is calculated using the new formula SPS = FV × PC1 + IPC × SPK × PK2 In addition, we have just learned how to calculate the components of this formula: IPC, FV and bonus coefficients. Here are examples of calculating future pensions.

Example: Old-age pension, that is, upon reaching the age limit.

Citizen Sidorov knows that he can retire by age in 2017. In 2015, Sidorov’s pension rights were converted into points and are now equal to 70 pension points. Three years before retirement, Sidorov will earn 5 more points. Sidorov repaid his debt to his homeland for 2 years by serving in the army, for each year of service another 1.8 points are awarded. Thus, adding up all the points, we get Sidorov’s IPC at the time of retirement of 78.6 points. Taking as an assumption that the SPK in 2021 will be equal to 100 rubles, and the minimum size of the PV will be equal to 5000 rubles, taking into account the non-application of bonus coefficients, we have a formula for calculating the pension of citizen Sidorov: SPS = PV + IPK × SPK 5000 + 78 .6 × 100 = 12860 rub.

Example: Retirement after retirement age

Citizen Feoktistova began working at the age of 17 in 2015. Twice she was on annual leave to care for a child, during these years she received 1.8 pension points for her first child, and 3.6 for her second. Only 5.4 points. Citizen Feoktistova’s work continued without interruption until her retirement and another 5 years beyond her seniority. That is, the retirement age was reached at 55 years in 2053, and she exercised her right to a pension only 5 years later in 2058. Over 41 years of work experience, Feoktistova earned 341 pence. point, and together with children’s 346.4 points. We will proceed from the assumption that the PV in 2058, taking into account indexation, will be 18,000 rubles. The premium coefficients for retiring 5 years later will be: for IPC - 1.34, for FV - 1.27. We will take the cost of a pension point in 2058 to be 580 rubles. Then citizen Feoktistova’s pension can be calculated using the formula: 18000 × 1.27 + 346.4 × 580 rubles. × 1.34 = 292,082.08 rub.

It looks good, at least at today's prices. Of course, this is a very rough calculation with many assumptions.

How to find out the exact calculation of your pension? This can be done on the website of the Russian Pension Fund. The personal account of the pension fund already contains all the data about your work experience, accumulated pension points and pension rights formed today. And most importantly, on the PFR website there is a pension calculator with which you can calculate your pension by entering data about your current place of work, salary and other additional information.

Knowing how to calculate your pension, you can take measures in advance to increase it by the time you go on vacation.

What are the types

When establishing pensions, starting from January 2007, the insurance period began to be used in accordance with the amendments introduced to legislative acts. Until this time, continuous work experience was used in calculations.

According to the definition of regulatory legal acts, the insurance period represents the duration of production activity, during which insurance contributions were paid to the Pension Fund.

In accordance with the standards of labor legislation, the insurance period is divided into types:

- general, presented in the form of generalized time spent on working, studying in educational institutions of various profiles, leave to care for young children, performing military service upon conscription;

- special, reflects labor activity at enterprises that are located in unfavorable climatic conditions, with dangerous and harmful production conditions. The insurance period takes into account the period of employment at the above-mentioned enterprises until January 1, 2002.

Each type of work performed must be documented by presenting a work book, employment contract, or employment order.

And in conclusion, it should be noted that any Russian citizen is endowed by the Constitution of the Russian Federation with the right to work.

In accordance with the requirements of labor legislation, during official employment, a record of employment and dismissal is made in the work book. As a rule, it is the basis for calculating the total labor and insurance experience of citizens.

Individual pension coefficient (IPC)

This is the number of points given for years worked. The IPK is calculated as follows: the IPKs and IPKn are summed up (the old one, accumulated before 2015, and the new one), then the resulting value is multiplied by K - an increasing factor. The later a person finishes working activity, the greater it is. For those who stopped working immediately upon reaching the required age, it is equal to 1.

How to calculate the amount of pension? Using the formula: IPKn = (CB/HCB)*10, where:

- CB is the amount of contributions from the employer;

- HCB is a standard that also needs to be known in advance.

For 2021, HCB = 207,720 rubles, which was determined by multiplying the marginal base (determined annually by the state) by 16%, that is, by 0.16.

Example

There are additional divisions for socially significant periods of life.

| Points | Life situations |

| 1,8 |

|

| 3,6 | Caring for a 2nd child up to 1.5 years old. |

| 5,4 | Leave at the birth of the third and subsequent children during the first year and a half. |

The monetary equivalent of these points is also determined by the state and increases annually. So from 2020 to 2024 it will increase from 93 to 116.63 rubles.

Special insurance experience

What else do those who are planning to retire soon need to know? There is an insurance guard. It is also called professional. How to calculate the insurance period in this case?

There is no fundamental difference from the overall length of service. The only difference is that during the transfer of mandatory contributions to the Pension Fund of the Russian Federation, the person worked under special conditions that cannot be called normal. We are talking about work activity:

- in difficult or harmful conditions;

- in the Far North or similar remote areas;

- in certain weather conditions.

Factors on which future pension depends

Independent calculation of pensions based on points should be carried out taking into account the citizen’s salary. Higher income will increase your future monthly benefit amount. The duration of official work is important. The number of pension points depends on the length of service. The current legislation sets only lower limits for retirement. So, today women can go on a well-deserved retirement in old age at 55, and men at 60. Starting in 2021, a gradual increase in the retirement age will begin. It will end in 2023. After this period, women will be able to retire at 60 years old, men at 65 years old. However, if the pensioner continues to work instead of filing a monthly benefit, this will affect the final payment amount.

Confirmation of insurance experience

The only official document that can confirm the official insurance experience is a correctly executed employee’s work book with all the relevant inserts. What if a citizen cannot provide a work book? Then the employment contracts with the employer that were concluded at the previous place of work come into force. In some cases, you can confirm your work history with the help of two or more witnesses. But this method can only be used in court.

Fortunately, now the question of how to calculate an employee’s insurance length does not cause difficulties. All data has long been stored on electronic media. And all information about money transfers is available in the Pension Fund of the Russian Federation.

Requirements for the procedure for calculating insurance experience

The legislation of the Russian Federation establishes certain requirements for the procedure for calculating the insurance premium. If they are not followed, the length of service may be calculated incorrectly or completely lost. How can this be avoided? Every HR employee should know how to calculate an employee’s insurance length and what requirements must be met.

Some of them are listed below:

- It is necessary to exclude from the work experience the time when a citizen of the Russian Federation worked abroad.

- The periods when a person worked for an individual entrepreneur and was a member of peasant farms and tribal communities should be taken into account. However, this can only be done if contributions were made for the person to the Pension Fund of the Russian Federation.

- All periods during which the citizen received a pension (labor or disability) must be excluded from the insurance period.

- Overlapping periods are not counted. As a rule, such a need arises if a person officially works in one place, but is registered, for example, as a hired worker with an individual entrepreneur. Only one part is excluded.

- Seasonal work must be included in the calculation of the insurance period.

- Those periods that relate to the recording of length of service are also counted.

How to calculate length of service using a work book?

Calculation of length of service at enterprises is carried out by HR specialists and is used by accounting departments. In small companies, personnel and accounting functions can be combined in one department and even one person. According to Article 2 of Federal Law No. 166, adopted in 2001, length of service is used to assign pension benefits. It represents the sum of all periods of a person’s working activity. The experience can be general and continuous.

The procedure for determining work experience is defined in the Labor Code of the Russian Federation. To calculate it, the following is accepted:

- 1 year - in 12 months;

- 1 month - in 30 days.

When calculating a pension, two types of length of service are taken into account: labor and insurance. The length of service includes only the periods of time of direct performance of work noted in the work book.

The length of service does not include the following periods:

- a person’s service in the army or in public service;

- time for caring for disabled people of groups 1-2, people over 80 years old and maternity leave>;

- serving a sentence and registering at the labor exchange.

The period of work is calculated based on the entries entered in the work book. They are entered into the document in chronological order. When hiring and leaving a job, the date of the event is indicated in the work book. The easiest way to calculate is to write out all the periods from the work book and add them up.

The difficulty in calculations arises from the fact that the periods consist not only of full years, but also of months, weeks and days. All of them must be taken into account when calculating.

In accordance with current legislation, the work book must be completed without errors. There is a special procedure for making corrections to it. There are special programs for calculating work experience, but most HR officers and accountants prefer to do it manually.

The algorithm for calculating experience is as follows:

- The periods of work activity are determined. People who have changed their last name must attach the relevant documents to their work books.

- If there is no exact date in the work book entries, the following is accepted: July 1 when indicating the year and the 15th if there is an entry about the month.

- The work experience is calculated.

How to count

From time to time there is a need to calculate how much time you work in total or in a particular place. To do this, you will need a work book and an online calculator for calculating work experience for 2020. It's easy to use.

In the first window, indicate the date of employment in accordance with the entry in the documents that confirm employment. In the work book, the dates of employment are usually located next to each other.

In the second window, indicate the date you left your job.

If you need to add several work periods, click “Add period”.

Add sequentially as many periods as required (simply repeating steps 1-3).

After entering all the dates, click “Calculate”.

The result in years, months and days that the online insurance period calculator gives is the desired value. The program automatically converts 30 days into a month, and 12 months into a year.

Let us note that the service is intended primarily for determining benefits for temporary disability and maternity, although our online calculator of work experience based on a work record book will help calculate the period of employment, for example, for assigning pensions. But the result will be approximate, for reference.

Read more: Work experience for retirement: frequently asked questions

Procedure and formulas for calculating work experience

To calculate length of service, you can use a simple formula that can be used to make calculations for specific periods. After they are calculated, they are summed up into years and months.

Example. The following entries were made in the work book of citizen N:

- 25.05.1996 — 13.03.2004. Ancillary worker at construction site No. 1, UM No. 2, Kirov.

- 15.03.2004 — 28.10.2010. Janitor of housing and communal services No. 12.

- 25.11.2010 — 28.12. 2015. Turner 2nd category at JSC ServiceMash.

Calculation of experience:

- Sum of periods when the employee was hired: 25.05.96+15.03.04+25.11.2010=65.19.2110.

- Sum of periods when the employee was dismissed from work: 13.03.04+28.10.2010+28.12. 2015=69.25.4029.

- Work experience: 69.25.4029-65.19.2110=06/04/1919 (19 years, 6 months and 4 days).

Until recently, to calculate pensions, length of service was calculated. Currently, the insurance period is taken into account. It includes the years in which the employee paid contributions to the Pension Fund.

Sources

- https://assistentus.ru/kalkulyator-stazha/

- https://vkadry.com/raschet-strahovogo-stazha.html

- https://naim.guru/trudovaya-knijka/staj.html

- https://nalog-nalog.ru/stazh/obwij_trudovoj_stazh_chto_vhodit_i_kak_podschitat/

- https://JuristPomog.com/labor-law/kak-poschitat-strahovoj-stazh.html

- https://lgoty-vsem.ru/pensiya/oformlenie/pravila-podscheta-i-podtverzhdeniya-strahovogo-stazha.html

- https://ZnayDelo.ru/buhgalteriya/kak-rasschitat-srednij-zarabotok.html

- https://zakonguru.com/trudovoe/kodeks/stazh/raschet.html

- https://BusinessMan.ru/kak-rasschitat-strahovoy-staj-pravila-i-primeryi.html

- https://zakonguru.com/trudovoe/trudovaya/stazh-formula.html

How to find out the amount of future pension savings in 2020

Let's consider the method of calculating the most popular payment - upon reaching a certain age. It consists of two parts – insurance and savings. And since you can calculate the amount of your old-age pension yourself, you need to prepare in advance certain information about yourself or your elderly relative.

- The length of work experience in years and months. This value includes not only the actual stay at the place of work, but also sick leave, leaves, including to care for a child or an elderly relative, as well as the period of stay at the labor exchange while employees are looking for employment that matches their experience.

- The amount of salary and all allowances, and income tax is not minus.

- The year when a person retires. This is even more important for those who continue to work after reaching retirement age.

- Individual pension coefficient and its cost.

- The amount of the fixed payment may vary due to annual indexation.

Previously, the savings system worked, but then a moratorium was introduced on the accrual of this money until 2022. But they are not canceled, but are issued to pensioners as a supplement to the insurance portion. This is a way to smoothly transition to a new accrual mechanism.

Knowing all the listed values, every citizen will understand how the amount of an old-age pension is calculated. To do this, you need to use a formula to find the total annual pension savings, and then divide them by the expected number of months - the expected survival period. For 2020 it is 258, that is, 21 and a half years. Once this period is passed, payments will not change and will remain fixed.