Foreign investment

In general, there are quite a lot of concepts of foreign investment, probably several dozen. I will try to give the most general and understandable of them. Foreign investment is understood as the amount of investments (property, financial and intellectual) that foreign investors, as well as foreign branches of Russian companies, invest in domestic companies to generate income in the future.

The number of such investments determines the country’s investment climate, that is, how attractive the country is for such investments by foreign entities. Private individuals can also act as foreign investors, however, most often their role is played by funds, companies, transnational corporations or even other states themselves.

All foreign investments are divided into direct and portfolio, short-term, medium-term and long-term. Direct investments from abroad are aimed at purchasing controlling stakes in domestic enterprises in order to participate in their management. As a rule, such investments are the most desirable for the state, since, most often, the invested companies undergo modernization, people working for them improve their skills, new jobs are created, etc.

Portfolio investments are directed to the purchase of shares of Russian companies in order to make a profit from the subsequent resale of their shares. Economic science classifies investments for a period of up to 2 years as short-term investments, 2-5 years as medium-term investments, and long-term investments as investments with an investment period of more than 5 years.

Foreign investment is a necessary factor in the development of any national economy. Thanks to them, it becomes possible to accelerate economic growth, create new jobs and gain access to advanced global technologies.

About the rights of foreign investors

A foreign investor has considerable freedom of action on the territory of the Russian Federation. For example, he

has the right to acquire shares of commercial organizations and government securities, take part in the privatization of property, rent land, use real estate and natural resources of the country. Moreover, Russian legislation contains basic guarantees of the rights of foreign investors on the territory of the state.

In accordance with the laws of the Russian Federation, a foreign investor has the right to remove from the country property and information originally imported into Russia as a foreign investment.

In this case, the principles of quotas, licensing and the application of other measures of non-tariff regulation of foreign trade activities do not apply to it.

Let's take a closer look at the basic rights of foreign investors.

Subrogation

The main problem of international investment law is ensuring the protection of deposits. Not a single investor investing in the unstable Russian economy is immune from the application of restrictions or forced seizure measures: nationalization, requisition, etc.

To some extent, the rights of a foreign investor can be protected by the principle of subrogation, which operates in investment legislation, the law of individual countries and international law.

Risks may be political/non-commercial (military action, civil unrest, nationalization and other forms of forced seizure of property). Typically, investment insurance in this case is carried out by state or international insurance organizations acting on behalf of the capital exporting country.

An investment guarantee scheme at the national and international levels involves the conclusion of an insurance contract between the investor and the guaranteeing body.

Compensation for requisition or nationalization

In general, depositors' property cannot be seized, requisitioned or nationalized. Investors have the right to demand compensation for losses incurred due to illegal actions or inaction of government bodies and officials.

When requisitioning or nationalizing property, the foreign investor is paid the full value of the requisitioned property and other losses. If the circumstances in connection with which the requisition is made no longer apply, the foreign investor may apply to the court to demand the return of the remaining property. At the same time, he is obliged to return the amount of compensation received, taking into account losses from the decrease in the value of the property.

Compensation for withdrawal of investments provided by foreign investors must be paid as quickly as possible, without unreasonable delay.

Application of the stabilization clause

The taxation of investors is characterized by the effect of a “stabilization clause” - an important investment guarantee aimed against a tightening of the tax burden. This feature of taxation is taken into account and applied by courts considering disputes related to the protection of foreign investors.

The application of a stabilization clause to a foreign investor protects the interests of the investor from the tightening of the laws of the recipient country regulating the investment regime. If national legislation changes in a direction unfavorable to the investor, he can count on a delay in the application of these changes.

The stabilization clause was first discussed in Art. 14 of the RSFSR Law of June 26, 1991 “On investment activities in the RSFSR.” Its application in the new Foreign Investment Law depends on a number of conditions. This principle:

- applies to commercial organizations with foreign investments of at least 25% of the authorized capital and to investors/organizations that have invested in priority projects.

- applied when the total tax burden or the regime of prohibitions and restrictions in relation to foreign deposits is tightened in comparison with the total tax burden and regime in force on the date of commencement of project financing;

- guaranteed during the payback period of the investment project (no more than 7 years from the date of commencement of capital investment in the project).

Use of investment income

A foreign investor can freely use his income and profits on the territory of the Russian Federation for any purposes that do not contradict Russian legislation. Transfer of income, profits and other funds received in foreign currency outside the Russian Federation, as well as reinvestment of profits received by non-resident investors are among the basic rights of investors.

Investment income is considered:

- profit, dividends, interest;

- sums of money received in fulfillment of obligations under contracts and other transactions;

- funds received by the investor after the liquidation of the company or alienation of invested property, property rights and intellectual rights;

- compensation provided for in Art. 8 of the Law on Foreign Investments.

About foreign investments in the Russian Federation

Foreign investments in Russia are regulated by the federal law of the same name, which was adopted almost 20 years ago, in 1999. It contains legal guarantees for the preservation and unhindered withdrawal of financial resources by foreign investors. In addition, the law provides for separate conditions for investing in certain sectors of the economy, for example, the oil and gas industry, banking sector, etc. Moreover, it should be noted that this practice also exists in other countries, where the state also limits foreign investment in key sectors of the national economy.

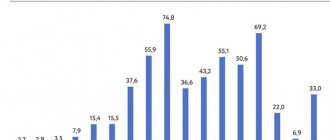

Another feature of our country is that even loans received by domestic companies from foreign financial organizations are also considered foreign investments. Moreover, the share of such investments today is more than 90%. The worst thing is that most of these loans are short-term and their repayment period is less than a year. About 9% of all loans received from abroad are foreign direct investment, and less than one percent is portfolio investment. The main economic areas where foreign investors seek to invest their money in the Russian economy are information technology and the financial sector. Moreover, these industries are among the leaders in attracting foreign capital in other countries.

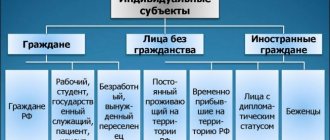

Legal status of a foreign investor in the Russian Federation

As follows from the provisions of the federal legislation of the Russian Federation, foreign investors have the same legal status as Russian ones. In addition, the state promises that the legal regime for the activities of foreign investors in Russia will be favorable for investors from abroad. They can:

- independently determine the volume and direction of deposits;

- enter into agreements with other investors;

- own and manage objects and investment results;

- transfer under an agreement/contract the rights to make and results of capital investments;

- control the intended use of funds;

- freely withdraw funds in foreign currency outside the Russian Federation;

- pool your own funds with the capital of other investors, etc.

State policy in the field of foreign investment is implemented by the Government of the Russian Federation. This particular authority:

- determines measures to control the activities of subjects;

- is in charge of introducing prohibitions/restrictions on investments and issues bills;

- decides which projects have priority;

- regulates the interaction of investors with individual constituent entities of the Russian Federation;

- creates and coordinates programs to attract new investments.

Along with the Law “On Foreign Investments,” the legal status of foreign investors in the Russian Federation is regulated by numerous provisions and by-laws.

The most significant include clause 4 of Article 1 of Part 1 of the Civil Code of the Russian Federation dated November 30, 1994, Art. 210 Arbitration Procedure Code of the Russian Federation dated May 5, 1995 and Part 2 of Art. 433 Code of Civil Procedure of the RSFSR dated June 11, 1964.

In addition, there are also international (often bilateral) agreements that stipulate aspects of the mutual recognition of the rights and obligations of legal entities, determine their status, and modes of operation.

It is customary to distinguish two main types of regimes: absolute and relative, but the second classification is more often used. The most common schemes can be considered national treatment and the most favored nation principle.

What does national treatment provide?

According to the Convention for the Protection of Investor Rights, signed on March 28, 1997, foreign investors are subject to national treatment. The principle of this legally binding provision is established by international treaties and agreements, as well as federal legislation.

The national treatment provided for foreign investors in the Russian Federation assumes that nationals of another country, stateless persons and legal entities have the same rights and obligations as Russian citizens and companies.

This principle is enshrined in the Civil Code and the Constitution of the Russian Federation.

When determining the legal status of foreign investors, national treatment is the main principle. Most often it is used in relation to:

- copyright and related rights;

- economic activities of foreign investors;

- foreign-made goods;

- free access to judicial bodies;

- legal assistance;

- social security.

The government sets the limits for the application of this principle, taking into account the interests of the country, as well as in order to prevent foreign investors from abusing their rights. There are the following types of exemptions for foreign investors: stimulating and restrictive exemptions. The specified measures and benefits are established by Russian legislation.

What is the most favored nation principle?

In contrast to the national regime, which blurs the line between the rights of foreign and domestic investors, the most favored nation principle equalizes the position of foreign organizations and foreign citizens. At the same time, a privileged legal regime, in particular, provides foreign investors in one country with the same rights that investors in another country received. All of them have the right to count on benefits when importing equipment and raw materials, exemption from customs taxes and duties, etc.

The benefits of this regime can be taken by investors who invest in underdeveloped sectors of the economy, enterprises located in hard-to-reach regions with poorly developed infrastructure and requiring large capital investments.

Stimulating investment

Since investments improve the national economy, any state seeks to attract foreign investors, creating favorable conditions for them to invest their money. This can happen in several ways. Moreover, countries compete with each other in attracting investments, because the investor will also choose the most profitable offer for himself. The most common ways in which investment is stimulated are:

- The introduction of new technologies and production methods that make it possible to receive sufficiently large profits when investing investor money, which may be of interest to potential foreign investors.

- Development of the information technology and banking sectors, which are most popular among investors today, including foreign ones. Today, venture investments are often made in the field of IT technologies, that is, investments that almost completely finance projects that are sometimes still at the “idea” level. And although this method of investment allows the investor to acquire a significant share of the startup, this is a real chance to bring a business idea to life.

- Creating favorable conditions for the functioning of multinational corporations and joint ventures.

- Providing legal guarantees to investors - clarity and transparency of legislation, guarantee of safety of funds introduced into the state, stability of the legislative framework, its immutability for the worse for investors.

- Economic stability - a stable national economy that has been growing for several years.

- Political stability is a strong political system without shocks and with developed democratic institutions.

One of the main and most common ways to stimulate investment in the national economy is the creation of special free economic zones. As a rule, the effect of such a zone extends to the administrative area of the state (district, region, region). This establishes preferential treatment for enterprises with foreign capital, as well as for foreign investors.

Such benefits include a variety of tax reductions and simplifications in completing state-mandated procedures for doing business. A special case of free economic zones are the so-called offshore zones, where foreign investors are generally freed from the need to pay local taxes and fees. As a rule, to operate in such a territory, they must pay a registration fee once, as well as pay a fixed fee once a year, the amount of which does not depend on the type of activity of the company or on the size of its profit. Since the amount of such fees is much lower than taxes in their home countries, foreign investors en masse choose offshore companies for their investments.

Benefits for depositors

Tax breaks are another way to stimulate foreign owners of capital. Providing foreign investors with preferential loans or loan guarantees is an excellent financial motivation for them.

The size and conditions for providing benefits depend on the investor’s share in the authorized capital of the organization. According to Art. 5. Law “On Foreign Investments in the Russian Federation”, if an investor owns 10% or more of a share in the authorized capital of an organization, then when reinvesting he can enjoy all the benefits listed in this law. Similar conditions apply to Russian companies that receive the status of an organization with foreign deposits.

In addition, benefits for foreign investors may be of a non-tariff nature. For example, if a company's capital consists of 30% of foreign investments, it has the right to export manufactured products without a license.

Regional benefits

The federal authorities allow self-government bodies of constituent entities of the Russian Federation, within the limits of their powers at the regional level:

- provided foreign investors with benefits and guarantees;

- financed and otherwise supported investment projects of foreign investors.

To do this, they can use local budget funds, budgets of constituent entities of the Russian Federation and extra-budgetary material resources.

Tax concessions for residents of special economic zones

As reported on, special benefits are provided for residents of special economic zones. Thus, they are subject to reduced tax rates on profits, are exempt from paying property tax for 5-10 years (depending on the zone), if it was created or purchased to conduct business in the territory of the zone, is located and used within this zone;

Some constituent entities of the Russian Federation exempt residents from paying transport tax.

At the federal level, investors may be exempt from paying land tax for a period of 5 to 10 years if the plot is located in a special zone.

In addition, some investors may receive additional benefits in the form of accelerated depreciation and lower premium rates.

Benefits for entrepreneurs engaged in certain types of activities

Art. 16. of the Investment Law contains a list of benefits for the payment of customs duties and other concessions. To receive them, investors must implement priority investment projects (large investments in production and social infrastructure, high-tech sectors of the manufacturing industry) in accordance with the customs legislation of the Russian Federation and legislation on taxes and fees.

Thus, the import of equipment and spare parts for it into the Russian Federation is not subject to taxes if this property is a contribution to the authorized capital of the organization.

Privileges for Skolkovo residents

Is it profitable for investors to participate in the Skolkovo project? In recent years, this complex has become the center of the Russian infrastructure for the development of scientific and technical innovations. Attractive tax concessions await project participants.

In addition, according to amendments to the law of September 28, 2010 No. 244-FZ “On Innovation”, the maximum share of participation of foreign legal entities in the authorized capital of small and medium-sized enterprises increased from 25 to 49%.

Legal guarantees for foreign investment

Naturally, no investor will invest money in a state that cannot guarantee him legal support for such activities. An investor who makes portfolio investments, lends to a company in another country, or buys a controlling stake in its shares, has the sole goal of making a profit. This can only be done if he is confident that he can easily withdraw his funds from another country at any time. That is, the state must guarantee him this and legislate this possibility. No one will invest their money in the economy of a country with an unstable political regime in which laws are not respected.

That is why, to attract foreign investment, different countries are developing laws that guarantee the safety of foreign investors’ funds. In our country, this is stated in the already mentioned Federal Law, as well as other legislative acts, including decrees of the President of the Russian Federation. In particular, our country guarantees the unhindered withdrawal of foreign investments after investors pay all established taxes and fees in the currency in which these investments were made.

The presence of government guarantees for the unhindered withdrawal of investments and profits from the country into which they were introduced is one of the main factors in attracting foreign financial flows.

Summing up our conversation about foreign investments, we can note that today their use is an objective necessity for any state. They make it possible to solve a number of problems caused by globalization and internationalization of the world economy. Foreign investments create conditions in the country where they come, from which not only the investor himself benefits, but also all participants in this process. Thanks to the development of production and increasing the competitiveness of national goods, the state itself receives a profit. That is why countries are interested in attracting foreign investment, for which they create conditions that are attractive to investors from abroad.

Author Ganesa K.

A professional investor with 5 years of experience working with various financial instruments, runs his own blog and advises investors. Own effective methods and information support for investments.

Restrictions for foreign investors

In order to prevent the occurrence of destructive consequences for the state’s economy, in the Russian Federation there is a set of measures that control the process and areas of capital investment. So, in Russia it is practiced:

- ban on the admission of foreign investors to strategic sectors of the economy;

- accreditation, notification and licensing procedure;

- a ban on conducting activities in certain areas of the economy;

- mandatory equity participation of the state in enterprises financed by a foreign investor;

- establishment of a special fiscal regime;

- application of concession agreements;

- control of all types of activities of a foreign investor related to the development of subsoil and natural resources.

In addition, government agencies monitor compliance with the requirements for the depositor.

Banking activities

The Russian authorities do not object to the investment of funds by foreign companies in the authorized capital of domestic banks. However, if previously the maximum share of capital reached 50%, then from January 2021, according to the procedure specified in Art. 18 of Law No. 372-FZ “On Banks and Banking Activities” the maximum volume of such deposits was 13.44%. This figure is due to the obligations assumed by the Russian Federation when joining the WTO.

Some foreign investments are not taken into account when determining the quota. According to the Central Bank of Russia, the share of foreign capital will be calculated annually.

In media business investing

Since 2021, amendments to the law on mass media have come into force. According to this document, the share of foreign capital in Russian media cannot exceed 20%, although before that time it was 50%.

These amendments affected about 1,000 media outlets with foreign shareholders. The restriction has forced large companies to reconsider their shareholder structure or change owners. The changes affected the STS Media holding and the printed press (Russian edition of Forbes, Vedomosti, The Moscow Times). NBC Universal and AMC Network left the market.

Participation in the insurance business

Insurance is a special branch of the economy, the purpose of which is not only to protect the property interests of Russian citizens and legal entities, but also to create a strong economic environment, without which economic growth is impossible. The insurance business helps strengthen the financial system of the Russian Federation through constant investments in the economy, including foreign ones.

The state strictly regulates the activities of foreign entities in the insurance industry, insurance supervisory authorities control the volume of the market for these services (quotas on the permissible share of foreign investment).

The quota is calculated as the ratio of the size of the contribution of the investor and their subsidiaries in the authorized capital of insurance companies (IC) to the total authorized capital of the insurance company. As stated in paragraph 3 of Article 6 of the Law “On the Organization of Insurance Business in the Russian Federation”, if the specified quota is more than 50%, the insurance supervisory authorities do not license the activities of insurance companies that are subsidiaries of the main investor organizations or those that have The share of investors in the authorized capital exceeds 49%.

The same document states that payment by foreign investors for shares of insurance companies they own can only be made in Russian rubles.

In diamond mining

The territories where diamond deposits are located are included in the list of subsoil areas of federal significance, so only licensed companies will be able to obtain the right to develop them.

As follows from the amendments to the federal law “On Subsoil”, access to deposits is granted to companies in which investors from abroad control no more than 25% of the capital.

Previously, this threshold was 10%, but in order to attract strategic foreign investors to the extractive industries, concessions had to be made. Although the increase in the share of foreign investors in the management of the company will not allow them to make key decisions, these changes will stimulate the process of studying the subsoil and production of the mineral resource base of the Russian Federation.

Investing in strategic companies

Russian legislation does not prohibit investors from making investments in the form of purchasing shares (shares) in the authorized capital of business companies (ECOs) of strategic importance, and making other transactions that give them control over such companies. In November 2014, the President of the Russian Federation signed draft amendments to the law dated April 29, 2008 No. 57-FZ, which simplifies the investment procedure, but at the same time prescribes:

- coordinate the deal with the Government Commission (Article 7);

- notify the authorized executive body about the transaction being carried out (Article 14).

The notification procedure is contained in the Decree of the Government of the Russian Federation dated October 27. 2008 No. 795 and provides for the transfer of data about the company that owns shares (stakes) in the enterprise and about the persons controlling it.

In the field of land use

The principle of national treatment also applies to issues of property rights. In general, investors can buy and alienate property, pledge it, own and use it under the same conditions as Russian citizens and legal entities, but with some restrictions.

Typically, these restrictions affect land ownership. Chapter 1 of Law No. 101 “On the turnover of agricultural land” states that such persons cannot acquire ownership of land plots included in the list of agricultural lands.