Retirement age for municipal employees

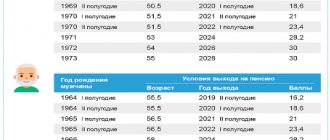

According to Federal Law No. 143 of May 23, 2016, starting from 2021, the retirement age of MS will increase annually by 6 months. Thus, in 2021, older people who held positions in the municipal structure will be able to apply for a pension upon reaching 55.5 years (women), 60.5 years (men).

These innovations will affect more than one million elderly citizens.

The changes will not affect persons who had already received a pension before the introduction of the new bill. In addition, employees who held government positions before January 1, 2021 and had at least 20 years of service, as well as employees who have accumulated 15 years of service and have received the right to a pension, are entitled to receive a pension at 55 and 60 years of age (women and men, respectively). until January 1 of the New Year.

As a result of the changes, the state will save more than 600 million rubles in 2021. Every year the amount of budget funds will increase due to the gradual increase in the retirement age of MS.

Municipal employee pension

The amount of pension payments consists of the citizen’s actual work experience, average monthly income for the previous year of service, and corresponding allowances (if any).

In addition, you need to collect a sufficient number of individual points (coefficients).

Last year, the government of the Russian Federation carried out a reform regarding the procedure for retiring municipal workers. Thus, starting in 2021, the retirement age was to be increased gradually every year by six months.

The ultimate goal of the reform is to raise the age for a municipal pension to 63 years for female employees and up to 65 years inclusive for men.

The transition period will continue until 2032. The age limit is increased in stages.

Thus, in order to retire, it is necessary to take into account the employee’s length of service and the date of the right to receive the corresponding pension payments. For example, if you were supposed to retire in 2021, you will only have this opportunity a year later.

Interesting material : teacher retirement.

How much experience is needed?

Changes to the pension reform made in July 2021 affected the MS experience, which is necessary to assign a pension. From 2017, the length of service will increase by six months until it reaches 20 years. Although in 2021, a total length of service of 15 years was required to grant a pension.

Therefore, to apply for a pension in 2021, MS must have at least 15.5 years of experience, and in 2021 - 16 years, and so on until the 20-year period.

If a former MS gets a government job after pension payments have been assigned, then the amount of the pension is not reduced or cancelled!

Municipal length of service is used as the basis for determining the pension percentage as follows:

- 15 years - 45% of the monthly salary;

- 16 — 48%;

- 17 — 51%;

It is important to know!

Pensions for combat veterans That is, for every year worked over 15 years, MS receive a pension bonus of 3%. Maximum pension rates are 75% of the average salary.

When assigning a disability pension, the MS experience does not affect the amount of the pension. If there are groups 1 or 2, the pension is equal to 75% of the salary, and if group 3 is assigned, it is 50%.

The pension size should not be lower than the subsistence level!

Taking into account length of service when calculating pensions for length of service in local self-government bodies

Speaking about how the municipal pension is calculated from 2021, it is necessary to point out that it is planned to increase service output from 15 to 20 years. Such an increase will not occur immediately, but gradually. Every year, the required amount of work experience to retire increases by six months.

In order to obtain pensioner status in 2021, a local self-government employee will need to work for 15.5 years . In 2019, this figure was 15 years.

Accounting for additional payments and one-time payments when calculating benefits

When calculating the pension benefit for a municipal employee, additional funding must be taken into account. It is aimed at payments based on length of service.

The change in value occurs:

- when an employee's salary increases;

- if you have a length of service that is more than the minimum requirement for retirement.

Expert opinion

Kuzmin Mikhail Vasilievich

Practitioner lawyer with 7 years of experience. Specializes in family law. Legal expert.

Some regions have established a one-time additional payment when an employee goes on vacation. This amount depends on the monthly salary and the duration of work in local government.

Indexation of pension payments to employees

When it comes to the amount of payments, you need to take into account indexation, which is carried out every year. However, this rule does not apply to citizens serving in local government bodies. The reason for this is that the amount of a citizen’s benefit depends on the level of wages he received.

The payment is presented as a percentage of the average monthly salary. Indexation rules may apply to amounts that are already paid, provided that there has been an increase in the employee's salary. Insurance benefits increase every year by a percentage that is close to inflation.

Long service pension

To assign a long-service pension, the MS must fulfill a number of conditions, namely:

- having a total length of service of 15 years or more (depending on the year in which the citizen applies for a pension);

- reaching retirement age.

To apply for a long-service pension, you must do the following:

- Submit an application to the HR department or the Pension Fund.

- Prepare a complete package of documents:

- passport;

- a certificate from the place of employment about the amount of salary for the last year of work;

- a certificate from the personnel service indicating the total length of service;

- a copy of the dismissal order; a document confirming the fact of assignment of a long-service pension;

- a copy of the work book.

- Review of documentation by employees of the Pension Fund (hereinafter referred to as the Pension Fund) - based on the results of reviewing the papers, the relevant authorities make a decision to assign the former MS a long-service pension.

You may also be interested in Different ways to find out your pension savings.

The pension is paid from the date of submission of the application, but not earlier than from the date of actual dismissal from public office.

The size of the pension depends on such indicators as:

- size of the casing;

- additional payments for the position;

- long service accruals;

- money paid for special working conditions;

- increases for academic degrees and titles;

- awards.

Every year the state indexes pension payments in accordance with inflation rates.

Long service pension for municipal employees

State support of this type acts as compensation for increased workload when performing work duties. According to current legislation, a municipal employee's pension for long service is due to all officials of local administrations if they have specialized experience, the duration of which is determined by law. The period of work in the municipality is also taken into account when determining the employee’s right to additional payments to his pension.

Conditions of appointment

In order to qualify for a municipal pension, it is not enough to be an employee of the local administration. You can receive this government payment only if you fully comply with the requirements set out in Law No. 25-FZ. The table shows the conditions, upon fulfillment of which the citizens are assigned state payments:

| Peculiarities | Federal legal requirements |

| Municipal service experience | In 2021 - at least 16 years (with the requirement to work for 1 year or more in one position). This entitles you to payments of 45% of the average monthly salary (unless higher values are established by local legislation). For each year worked above the standard, the amount of state benefit increases by 3%, but the maximum allowable amount is 75%. |

| Specific reasons for dismissal | To receive state benefits based on length of service, dismissal from work must be:

|

| Last place of work | For the last 12 months, the person must be employed in the municipality and from here his dismissal based on length of service must occur. If this condition is violated (for example, taking another job), the citizen loses the right to state pension payments for length of service in municipal work. |

How is it calculated

When calculating the amount of state support for length of service, you need to take into account that according to the law, the amount of labor and municipal pensions should not be higher than 75% of the employee’s average monthly salary for the last year. In this case, in order to find out the amount of payments that a citizen will receive in person, you need to calculate the full amount of the benefit and subtract from it the amount of state old-age benefits. The calculation is carried out using the formulas DSP = PVL – RSP and PVL = SMZ x PS, where:

- DSP is an addition (supplement) to the insurance pension.

- VSP – the amount of the insurance pension (fixed part and bonuses).

- PVL – long service pension. By law, this value (or the value of DSP + RSP) is limited to 75% of the SMZ and should not exceed the official salary by more than 2.3 times.

- SMZ – average monthly salary.

- PS – interest rate set depending on length of service. Its basic size is 45% (unless otherwise established by local legislation), which means that the minimum value of municipal-type state pension provision is equal to SMZ x 45%.

- Taking into account unconfirmed length of service when recalculating pensions

- When will the coronavirus epidemic end in Russia?

- Surprises of asymptomatic COVID-19

For example, you can find out the amount of payments for length of service to an employee with 20 years of specialized experience, in the last year of work he had a salary of 20,000 rubles, an average monthly salary of 60,000 rubles and received state old-age payments in the amount of 32,000 rubles. The calculations look like this:

- This employee has worked 5 years in excess of the required rate, which means that 3% is added to the minimum rate determined by the state for each year worked: PS = 45% + 3% x 5 years = 60%.

- PVL is calculated = 60,000 rubles. x 60% = 36,000 rubles. This value does not exceed the maximum values established by law (60,000 rubles x 75% = 45,000 rubles and 20,000 rubles x 2.3 = 46,000 rubles).

- The result is a supplement to the labor pension: DSP = 36,000 rubles. – 32,000 rub. = 4,000 rubles.

Amount of pension payments

The size of the MS pension with 15 years of experience is equal to 45% of the average salary. For each year worked over 15 years, the MS receives a bonus of 3% of the salary.

The maximum criteria for pension payments are equal to 75% of the cash payments of the MS. The size of the pension is directly related to the salary of a municipality employee, as well as to the size, bonuses, and benefits throughout the entire working life.

It is important to know! Procedure for assigning pensions to civil servants

In addition, the amount of the long-service pension should not be lower than the minimum wage in a particular region.

The long-service pension is paid to disabled people in the following percentage: group 1.2 - 75% of the salary; Group 3 – 50%.

The amount of pension payments for length of service is compensated for the last 3 years if the documentation was submitted after the standard deadlines.

The pension consists not only of a percentage of the salary part, but also of a fixed payment, bonuses for position, annual indexation, a funded part and other types of additional payments.

What allowances exist?

The specific procedure for calculating the length of service in municipal service is established by laws at the level of constituent entities of the Russian Federation - by regional administrations (Part 4 of Article 25 of the 25-FZ). Regional authorities determine how to count periods of public work, how to apply incentive payments and how to calculate long-service pensions.

For example, in Part 3 of Art. 2 of the Law of the Omsk Region No. 2163-OZ dated April 23, 2019 indicates who calculates the length of service in municipal service - the employee’s employer. The same rule applies in many other regions. The accountant takes all information about periods of work from the work book.

The additional payment is a certain percentage of the salary. The total length of service in the municipal service and bonuses for the length of service of a municipal employee are related: the amount of compensation depends on the number of years worked. We have collected all the bonuses for length of service in the table:

| Supplement (to salary) | Magnitude |

| For civil government employees (clause 1, part 5, article 50 79-FZ of July 27, 2004) |

|

| For the military, employees of the Ministry of Internal Affairs, the National Guard (clause 7 of Article 2 247-FZ of July 19, 2011) |

|

The amount of additional payments for teachers is established by regional authorities in local standards: for example, decree of the government of the Rostov region No. 443 of June 28, 2019. But doctors have additional compensation, taking into account the budgetary length of service and the nature of the work (Order of the Ministry of Health No. 377 of October 15, 1999):

- emergency doctors - 30% of the salary for the first 3 years of work, and for every 2 continuous years they add another 25% (maximum pay 80%);

- employees of leper colonies - pay 10% for each year of continuous activity, pay a maximum of 100% to doctors and nurses and 80% to other medical personnel.

Calculation of pensions for municipal employees

In order for the MS to be able to independently calculate the size of the future long-service pension, it is necessary to use the following formula:

Average salary* coefficient* percentage of length of service=pension.

To determine the average salary, you need to multiply the salary amount by 2.8 (the maximum salary limit for the position).

Municipal experience is used in the form of percentages, namely:

- 15 years - 45% of salary;

- 16 — 48%;

- 17 — 51%;

That is, for every year worked over 15 years, MS receive a pension bonus of 3%. The maximum indicators are 75% of the average salary.

Rules for calculating the size of pensions for municipal employees

Calculations to understand what the long-service pension for municipal employees will be, lead us to a figure equal to 45% of the average monthly salary, excluding various types of social benefits and other additional payments. The specific amount of payments is established by the relevant local law.

At the same time, the amount of pension payments of a municipal employee cannot be higher than the amount of monthly monetary compensation of a state civil servant of a constituent entity of the Russian Federation.

For each year of work more than the required norm, payments will increase by 3% up to an upper limit of increase of 75% of the average salary of a civil servant, which is calculated based on the average income for the last year of service. But these figures may vary from region to region.

The total amount of the final pension to the fixed part of the municipalities includes:

- allowances for professional duties;

- percentage of salary;

- allowances for the percentage of annual indexation;

- storage part.

When calculating payments, the official salary corresponding to a certain class rank is taken into account. For each specific subject of the Russian Federation, the calculation procedure may be different. The local board of each subject itself develops a system for calculating pension payments.

Additional options for receiving payments

Municipal employees have every right to receive two payments at once - according to length of service in municipal service and according to old age. They also have the right to refuse material compensation for length of service in order to increase the total number of IPC and increase the size of the pension.

For this category of citizens the following allowances are provided:

- for a certain number of years of service;

- under special conditions of service;

- monthly cash incentive;

- bonus for working with state secrets;

- for an honorary title or academic degree.

Important! In the case of pension provision for citizens below the subsistence level, the state is obliged to begin immediate social supplements.

Thus, due to the economic crisis in Russia, the shortage of funds will be eliminated by state and municipal employees. By raising the retirement age and increasing the length of service required for payments, the state will significantly increase state treasury funds. But the privileges, benefits and amounts of payments themselves will remain the same.

Benefits for municipal employees

In addition to pension payments, MS are entitled to the following benefits:

- Medical care for medical workers and the employee’s family after the assignment of pension payments.

- Payments of pensions for length of service or disability, as well as the assignment of a pension to the family of the MS in the event of death while performing an official assignment.

- Insurance of an employee in case of loss of ability to work during the period of work activity or after its completion, but related to the performance of job duties.

- Preferential dental prosthetics (not in all regions).

- Compensation for funeral expenses of MS (introduced at the discretion of local authorities).

Additional social benefits are provided by local authorities in different regions of the country.

Types of pensions

Rights and benefits for municipal employees are established by federal and local legislation. The state support defined by him contains:

- Long service pension. It is financed from the regional budget. In addition to officials, representatives of professions associated with risk to life - military personnel, rescuers, test pilots, etc. - have a similar benefit for length of service.

- Insurance payment for disability or old age. This subsidy has federal funding and is assigned on a general basis.

- Various surcharges. It is necessary to have the right to receive them, so they are not paid to all pensioners.

The municipal long-service pension supplements the state old-age or disability benefit up to a certain limit. In general, the total amount of the two payments should not exceed 75% of the average monthly salary for the last year worked. In this form, it is fair to consider municipal payments not as an independent state benefit, but as an additional payment to the existing one (insurance or disability).

- Eyebrow shading

- 10 products from Fix Price that you need to buy before the New Year

- Payment of pensions to Russian citizens living outside the country

Supplement to pension

MS have the right to receive the following types of additional payments:

- increase in pension in the amount of one salary;

- social additional payments when assigning a pension that is below the minimum subsistence level;

- additional payments from 50 – 80% of the salary;

- preservation of state guarantees;

- monetary compensation for unused vouchers;

- payments to relatives for the funeral of MS.

It is important to know! Pension payments and benefits for Afghans

The full list of surcharges is fixed individually by region of the country. Consequently, the list of additional payments may vary between different regions of the Russian Federation.

Additional payments are due in cases where the MS, in addition to government activities, worked in an official position in another field!

Latest news this year

Increasing the retirement age

From January 1, 2021, the age of MS pensioners will increase by 6 months annually. So, in 2021, a pension can be issued upon reaching 55.5 years and 60.5 years (men and women, respectively). The retirement age will continue to increase up to 65 and 63 years (men and women).

Increased experience

In addition to age parameters, the period of work experience will also increase to 20 years instead of 15. The increase will occur annually by 6 months.

Canceling indexing for working MS

In the next two years, municipal service employees who decide to continue working once the required parameters are achieved will not be able to see the annual recalculation until they leave the workplace. At the same time, you are allowed to work until you reach 70 years of age, no more.

Reducing the coefficient

From 2021, the coefficient for length of service will be reduced to 1% (in 2016 it was equal to 2.8% of the salary).

Getting a raise

To assign an additional payment in the amount of 75% of the salary, you must work for 10 years, not 3 years. As a result, the economic crisis had a negative impact on MS pension payments. Even the February indexation of the MS pension remains a big question.

The right to receive a municipal long-service pension

Persons holding municipal service positions on a permanent basis and with whom an employment agreement (contract) has been concluded have the right to a municipal employee pension. The source of funds for paying pensions for years served is the budget of the constituent entity of the Russian Federation and the local budget.

This right is provided for in Article 24 of the Federal Law “On Municipal Service in the Russian Federation”.

In addition to federal laws, local acts of the constituent entities of our country can clarify, make more specific or supplement the basic rules for this type of payment. The list of municipal employee positions is approved individually in each subject of the Russian Federation.

This register contains a list of job titles that are classified by:

- local authorities;

- election commissions;

- groups and functional characteristics of positions.

In addition to the basic old-age insurance payment, municipalities have the right to a long-service pension, and in certain cases, to financial assistance for disability. In the event of the death of a municipal employee, which was associated with his professional activities, members of his family are entitled to receive payments.

Important! All rights of a state civil servant fully apply to a municipal employee.

Conditions for assigning a municipal long-service pension

A municipal long-service pension is assigned only after a number of conditions dictated by federal law are met.

Among the mandatory requirements:

- municipal experience - 16 years and 6 months: +6 months every year until 2026;

- availability of the required set of individual coefficients (30 or more).

The reason for dismissal must be justified by law.

The dismissal of an employee gives the right to receive a municipal pension if:

- reduction of employees;

- reaching the age limit for performing official duties;

- liquidation of a local government body;

- inability to perform job duties due to health reasons;

- or at their own request, subject to reaching a specified age.

Please note: length of service requirements are not mandatory for a person in the event of termination of an employment contract due to staff reduction or liquidation of a municipal body.

Changes in the conditions for assigning pensions to municipalities

Federal Law No. 143 of May 23, 2016 introduced changes to a number of legislative acts that mostly affect municipal employees.

The innovations mainly concern the age of retirement and working out the required length of service to receive a long-service pension. Now men will be able to receive a second municipal pension for years of service after 65 years, and women after 63 years.

However, these changes, as well as the implementation of pension reform for all citizens, are happening in stages. Starting from 2021, the increase will proceed according to the plan of adding six months every year. The numbers required by the bill will reach the required level in 2026 for men, and by 2032 for women.

Following these calculations, in 2021 men will be able to receive pension payments upon reaching age 62, and women upon reaching age 57.

The changes also affected the length of service required to receive an old-age pension for municipal employees. Since 2021, it has increased by 5 years, reaching twenty years. The changes will come into force in the same manner as the new rules regarding age for pensioners, not immediately, but for six months every year.

Pension law

Issues regarding the assignment of MS pensions are regulated by such bills as:

- Federal Law-8 dated 01/08/1998;

- Federal Law-25 dated March 2, 2007;

- Federal Law-143 dated May 23, 2016;

- Federal Law-134 dated October 24, 1997;

- Federal Law-166 dated December 15, 2001;

- Federal Law-178 dated July 17, 1999;

- Federal Law-385 dated November 22, 2016;

On the same topic, news, we suggest looking at the new bill in the state.

Duma. At the end of this material, I would like to note that the assignment of the MS pension is undergoing a number of global changes, so every civil servant must know his own rights and responsibilities prescribed in the new legislation. This material touched on all the important aspects of the pension reform, which is related to the calculation of the MS pension in 2021.