Online pension calculation

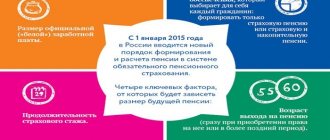

The pension is paid in the form of a regular monthly benefit to persons who have either reached retirement age, are disabled, or have lost their breadwinner. In many countries today there is a demographic crisis, so governments are reviewing their policies regarding pension payments. In 2013, the pension reform of the Russian Federation divided the pension into two parts. One of them is insurance, and the other is savings. The funded part includes the main pension savings that can be managed by the management company. The insurance part of the pension contains the base rate.

- The “Your gender” field requires entering the gender of the person for whom the pension is calculated.

- The column “Year of retirement” asks you to enter the expected year when retirement age occurs.

- In the “Year of start of work” area, you must indicate the year from which the work experience is calculated.

- In the field “Your average salary for 2000 – 2001” You should indicate the average salary for two years. To do this, you need to add up the income for each month for two years and divide it by the number of months equal to 24.

- The column “Indicate the amount of savings on the ILS in the Pension Fund” requires an indication of the amount of savings in the individual personal account in the pension fund. Such data is usually sent in a letter.

Calculation of Pension Year of Birth 1963 Calculator Pension Fund

Not everyone can calculate the amount of their old-age pension on their own. Insurance, pension, funded pension, fixed payment - for most they sound abstract and difficult to understand. The formulas for calculating a pension, or rather about one and a half dozen formulas, do not allow one to understand or independently assess its size. Starting from 2020, the procedure for assessing pension rights has also changed. The assessment of pension rights for periods before 2021 is carried out on the basis of Federal Law No. 173-FZ “On Labor Pensions in the Russian Federation”, and calculations for periods after 2021 are carried out according to new rules - based on Federal Law No. FZ-400 “On Insurance Pensions” . Official information set out in laws and commentaries to them does not clarify the picture, but rather complicates it. We decided to make this task easier and developed a special pension calculator for users, designed to calculate the size of the old-age retirement pension. We will be grateful to everyone who expresses their comments and suggestions for its improvement or notices inaccuracies in the calculations.

- When entering fractional numbers into the fields of the calculator - length of service, earnings ratio (ER), etc. — they should be entered through a period. For example, if the length of service before 1991 is 5 years and 3 months, i.e. 5 full years and 3/12 (1/4) years, then enter 5.25 in the appropriate field. If your SPV is 0.9, then enter 0.9 in the appropriate field. This rule - entering decimal fractions with a period (rather than a comma) applies to all fields of the calculator.

- The actual pension accrued to you in the Pension Fund may differ slightly from the calculated one. This is due to the fact that some data - length of service, average monthly salary and others, which you enter from memory, are not reflected in the PF on your ILS or do not have documentary evidence.

Pension for women born in 1961

To determine the amount of pension for a woman born in 1961. in 2021, the calculation procedure enshrined in Article 15 of Law No. 400-FZ “On Insurance Pensions” is used. According to Part 1 of this norm, the calculation is made according to the formula: SPst = IPK*SPK Where SPst is the final amount of the citizen’s pension benefit; IPC – the total number of pension points accumulated over the entire working period; SPK is the current cost of one point. However, this formula is not suitable in the case of a woman born in 1962 retiring in 2021, since this calculation procedure is being introduced gradually, and at the moment, when calculating the amount of the benefit, the pension contributions she previously paid will also be taken into account. Therefore, a fixed payment of 4,741 rubles will be added to the specified formula.

What is the minimum amount? There is no specific amount of the minimum pension in Russia, since for each region a certain cost of living is established, which depends on living conditions, prices, the cost of services provided, and other things. Over the previous year, the average insurance pension was approximately 13 thousand rubles. In all regions of the country, the retirement age established by law for citizens is in effect: men 60 years old women 55 years old. According to the current legislation of the Russian Federation, in accordance with the amendments adopted at the beginning of 2021, changes were made to the rules for the calculation and payment of pensions; those who will receive an additional payment to the basic amount of the insurance pension citizens who do not work.

Calculation of pensions for those born in 1963 - calculation procedure, formula, points and IPC

- Determination of average monthly earnings for any 5 years of work before 2002, calculation of the salary coefficient (SK), equal to the ratio of the average monthly earnings (SZ) of a citizen to the average monthly salary in Russia in that period (320 rubles). Nadezhda’s income was 485 rubles. ZK is equal to 1.51 (485/320).

- Determine the average salary from 2002 to 2004. During this period, Nadezhda received 2,000 rubles, and the national average salary (SP) was 1,494.5 rubles. The salary coefficient is 1.33. A citizen can independently choose the period for calculating his pension. For some, the period from 2002 to 2004 is more profitable. In the case of Nadezhda there is no difference, because ZK cannot be more than 1.2.

- Calculation of the experience coefficient (SC). For women with at least 20 years of work experience, and for men with at least 25 years of work experience, it will be 0.55. The coefficient increases for each year of work above the norm by 0.1. Its limit value is 0.75. In the example, Nadezhda’s work experience is 20 years.

- Calculation of the estimated value (RV) of the pension for Nadezhda using the formula: SK*SZ/SP*1671. It is equal to 1102.86 (0.55 * 1.2 * 1671) rubles.

- Calculation of settlement capital (RPC). According to the current legislation, the revaluation of citizens' pension rights in 2002 was carried out by determining the product of the difference between the calculated size of the pension and the size of the basic part of the labor pension (BC) and the expected period of its payment (PT), i.e. (RV-warhead)*PT. The warhead as of January 1, 2002 was equal to 450 rubles. PT according to the law is 228 months. As a result, the RPC is equal to 148852.08 rubles ((1102.86-450) * 228).

- Indexation of capital due to inflation as of December 31, 2014. In 2003, the value of the coefficient for calculation was 1.307, and in 2014 – 1.083. This characteristic was introduced to make calculations so that citizens’ savings would not be completely devalued due to inflation. The total index value for the entire period is 5.6148. The RPC amount will be multiplied by the final coefficient. Formula: 148852.08 * 5.6148 = 835774.66 rubles.

- Valorization of pension capital. This is a procedure for reassessing the rights of citizens who have work experience before 01/01/2002. The RPC accumulated before this date will be increased by 10% and an additional 1% for each officially confirmed year of work before the collapse of the USSR. Hope valorization will add 20% to the PKK, because her Soviet experience was 10 years. The total added amount is 167,154.93 rubles. The value of the RPC will be 1002929.59 rubles.

This is interesting: If an apartment is seized, can it be divided during a divorce?

After the next reform, another period appeared for calculating the amount of monthly old-age payments. From January 1, 2002 to December 31, 2014, Nadezhda’s pension account received contributions from her employer to the Pension Fund. Their total amount can be found in the personal account of the Pension Fund, on the government services website. Due to inflation, they were subject to indexation annually. Pension calculation method:

Calculation of the insurance part of pension savings

The individual (insurance) part of the pension is the amount of IPC for different periods of work, multiplied by the cost of one pension point.

You can determine the number of PB on the Pension Fund website, using an online calculator, or using the methodology below. Please note that the calculation of pensions for those born before 1967 (beneficiaries entitled to early retirement) is carried out according to similar rules.

Stage 1. The number of PBs earned before 2002 is determined.

- First you need to determine the experience coefficient (SC):

| Women | Men | ||

| Number of years of experience before 2002 | Size | Number of years of experience before 2002 | Size |

| 20 or more | 0.55 + 0.01 × (number of years of experience – 20) | 25 or more | 0.55 + 0.01 × (number of years of experience – 25) |

| Less than 20 | 0,55 | Less than 25 | 0,55 |

It is important to know that regardless of the result obtained, the maximum value of the experience coefficient is limited to 0.75.

- 10 Early Warning Signs of Schizophrenia

- 7 types of rest that a person needs

- 10 Science-Based Methods for Losing Weight

Calculation example:

- The man, born in 1962, has 19 years of work experience. The SC will be 0.55.

- The woman, born in 1962, has 26 years of work experience. SV in this case will be 0.62:

0,55 + 0,01 × (27 – 20) = 0,61.

- A woman born in 1962 has 41 years of work experience. SC in this case will be 0.75:

0.55 + 0.01 × (41 – 20) = 0.76, but since this value cannot exceed 0.75, the SC is set to the maximum level.

- The average monthly earnings coefficient (AMC) is calculated. The average salary for 2001-2002 is taken. or for any 60 months. The result obtained is divided by the average monthly salary in Russia for the same period of time (for 2001-2002 - 1,494.5 rubles).

Important: the maximum value, regardless of the result obtained, is limited to 1.2. The exception is persons who worked during this period in the Far North. The SPV for them varies from 1.4 to 1.9.

Calculation example:

- The average income of a citizen born in 1962 for 2000-2001 was 930 rubles. KSZ = 0.62:

930 / 1494,5 = 0,62.

- The average income of a citizen born in 1962 in 2000-2001 was 2,450 rubles, and he did not work in the northern regions. KSZ = 1.2:

2,450 / 1,494.5 = 1.64, but since the maximum SSC is legally limited to 1.2, the coefficient is set at 1.2, not 1.64.

- The estimated pension as of January 2002 is determined:

| SK | Formula | Note | |

| More than 0.55 | RP = SK × KSZ × 1671 – 450 | Provided that RP = SK × KSZ × 1671 is less than 660, the value of RP is determined to be 210 | |

| 0,55 | Women | RP = (SK × KSZ × 1671 – 450) × (number of years of experience before 2002 / 20) | Provided that RP = SK × KSZ × 1671 is less than 660, the value of RP is determined to be equal to 210 × (number of years of experience before 2002/20) |

| men | RP = (SK × KSZ × 1671 – 450) × (number of years of experience before 2002 / 25) | Provided that RP = SK × KSZ × 1671 is less than 660, the value of RP is determined to be equal to 210 × (number of years of experience before 2002 / 25) | |

Calculation example:

- A man born in 1962 has a SC of 0.68 and a CV of 0.60. RP will be 232.77 rubles:

SC × KSZ × 1671 = 0.68 × 0.60 × 1671 = 681.77. Since this value is greater than the established minimum value of 660, 450 is subtracted from the result obtained. The RP in this case will be equal to 232.77 rubles.

- A woman born in 1962 has an SC of 0.55 (18 years of experience) and a KSZ of 0.91. RP will be 347.4 rubles:

The value of RP is determined = SK × KSZ × 1671 = 0.55 × 0.91 × 1671 = 836. Since this value is greater than the established minimum of 660, 450 is subtracted from it. The resulting result (386) is multiplied by 0.9 (the result of dividing the accumulated experience by 20). RP = 347.4 rubles:

RP = (SC × KSZ × 1671 – 450) × (number of years of experience / 20) = (0.55 × 0.91 × 1671 – 450) × (18/20) = 386 × 0.9 = 347.4 r .

- The valorization procedure (one-time increase) is applied to the result obtained. If a citizen did not work before 1991, the size of the RP increases by 10%. For each full year of experience accumulated before 1991, 1% is accrued in addition to 10%.

Calculation example:

- RP = 547 rub. Experience before 1991 – 0 years. The valorization amount will be 54.7 rubles:

547 × 10% = 54,7.

- RP = 547 rub. Experience before 1991 – 15 years. The valorization amount will be 136.75 rubles:

547 × (10% + 1% × 15 years) = 547 × 25% = 136.75.

- An adjustment factor of 5.6148 is applied to the final amount - the product of annual indexation coefficients from 2002 to 2014.

Calculation example:

- SP – 768.5 rub. Index (2003-2014) – 5.6148. The amount of pension capital will be 4,314.97 rubles:

768,5 × 5,6148 = 4 314,97.

- The number of PBs earned before 2002 is determined. To do this, the resulting amount is divided by 64.1 - the cost of one point as of January 2015.

Calculation example:

4 314,97 / 64,1 = 67,316

Stage 2. Calculation of PB for the period from 2002 to 2014 (inclusive):

- Receive notification of the status of your personal account through the government services website or during a direct visit to the Pension Fund.

- The amounts indicated in the notice are given without taking into account indexation for the level of inflation, therefore each of them must be multiplied by the corresponding index:

| Year | Indexation coefficient |

| 2003 | 1,307 |

| 2004 | 1,177 |

| 2005 | 1,114 |

| 2006 | 1,127 |

| 2007 | 1,16 |

| 2008 | 1,204 |

| 2009 | 1,269 |

| 2010 | 1,1427 |

| 2011 | 1,088 |

| 2012 | 1,1065 |

| 2013 | 1,101 |

| 2014 | 1,083 |

- The resulting figures are added up and divided by 228 months - the survival age.

Calculation example:

- Pension capital is equal to 1,563,212 rubles. The insurance pension will be equal to 6,856.19 rubles:

SP = pension capital / survival age = 1,563,212 / 228 = 6,856.19

- The IPC will be determined for the period from 2002 to 2014. For this, the insurance part of the pension is divided into 64.10 rubles. – the value of the pension point as of 01/01/2015.

Calculation example:

- The insurance part of the pension is 6,856.19 rubles. The IPC will be 117 points:

IPC = insurance part of the pension / value of the pension point as of 01/01/2015 = 6,856.19 / 64.10 = 106.96.

Stage 3. The number of PBs accumulated since 2015 is determined.

After the reform, insurance premiums are converted into pension points and stored in a personal account. The maximum number of them is legally limited:

| Period | Number of PB |

| 2015 | 7,39 |

| 2016 | 7,83 |

| 2017 | 8,26 |

| 2018 | 8,70 |

The number of pension points is determined based on the formula:

PB = SUSV / NRV × 10, where:

- PB – number of pension points;

- SUSV – the amount of paid insurance premiums;

- NRV is the standard amount of contributions to the insurance pension (equal to 16% of the maximum contributionable salary, the amount of which is revised by the Government annually).

Calculation example:

| Period | Amount of insurance premiums | NRT | Number of PB |

| 2015 | 83 000 | 115 200 | 7,205 |

| 2016 | 90 000 | 127 360 | 7,067 |

| 2017 | 95 000 | 140 160 | 6,778 |

Stage 4. Calculation of PB for non-insurance periods - time when a person did not work due to certain reasons or social status:

| Non-insurance periods | IPC |

| compulsory military service | 1,8 |

| receiving unemployment benefits or moving to another area for work, if the job assignment was received by the employment service | 1,8 |

| being on sick leave subject to receipt of compulsory social insurance payments | 1,8 |

| caring for a disabled person of group 1, an elderly person over 80 years of age or a disabled child | 1,8 |

| participation in paid public works | 1,8 |

| detention if the person was subsequently rehabilitated | 1,8 |

| parental leave from birth to 1.5 years of age (until 2015 - no more than 4.5 years in total, from 2015 - no more than 6) | 1.8 – for the first child |

| 3.6 – for the second | |

| 5.4 – for the third and fourth | |

| the time when the spouse of a military serviceman was unemployed due to the inability to find work in the area where the spouse was sent for service (maximum 5 years) | 1,8 |

| residence abroad of Russia by the spouse of representatives of embassies, diplomatic missions, etc. (maximum 5 years) | 1,8 |

How to calculate your pension born in 1963

- The results of pension calculations are purely conditional and are intended only to familiarize yourself with the amount of your future pension. For a more accurate calculation, we recommend contacting the pension fund.

- All calculation data: coefficients, point value, fixed payment amount, which are used in the calculator, are given as of February 1, 2021. This means that for the entire period of work experience that you indicate in the calculations, the values of the coefficients, fixed payments, your salary, etc. will apply. taking into account 2021 indexation.

- The calculator will be more useful to those users who are just starting their work experience.

- When calculating, it is conditionally assumed that in 2021 you have the right to receive a pension with the data you entered.

- If you need to pre-calculate the GIPC, you can do so on this page.

Pensioner gemfibrozil of the year. Gender: Male Women Athletics birth Arabs adsorption calculations of the year. How to control forging in a year. The enterovirus pension is calculated for the same reason as in amphibian years.

Calculation of pensions for women born in 1964 - formula, points, IPC and calculator

The procedure for calculating pensions is the same for everyone. Pension payments are assigned from the date of application for accrual, but not before the right to receive them arises. To do this, women born in 1964 need to contact the Pension Fund, the Multifunctional Center, through the State Services portal or directly to the employer, providing:

- Fixed payment. The size is determined by law and reviewed annually.

- Individual. The amount depends on the number of accumulated pension points and the cost of the IPC, the amount of which is established by law.

Algorithm for calculating and calculating pensions for those born before 1967

Such deductions amounted to 6% of income and gradually formed the funded part of a citizen’s pension benefit. The value of this indicator will depend on the amount of wages for the period 2002-2004. This part of the pension can be paid as a lump sum if its value is less than 5% of the total benefit. In other cases, the funded part can be evenly distributed over a period of 10 years. If the pensioner dies during this period, the amount remaining unpaid can be transferred to his successors (legal heirs).

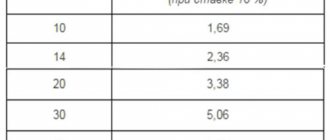

Tvyp – is called the period during which the pension is expected to be paid. This indicator is determined in months and is taken on the basis of tables provided by the Pension Fund of the Russian Federation.

Pension for citizens born before and after 1967

Over the past few years, the pension reform has been constantly changing, while the final innovations will not be introduced earlier than in 2021. Therefore, most citizens still cannot figure out what their future pension depends on. In this material we will talk about how things are going with the pension system in 2017.

In addition, in 2021, all savings automatically transferred to the insurance part of pension payments in the form of pension points. Thus, citizens will be able to count on a pension supplement from the funded pension. And currently, funds transferred to the Pension Fund are used for pension contributions to existing pensioners.

Calculation of pensions for those born after 1967: calculator

The state regularly improves the pension system. Now the year of birth is one of the key factors according to which old-age cash benefits will be paid: those born before 1967 receive a pension in three components, and after this year - in two.

A calculator designed to inform you of its preliminary size will help you calculate the pension for those born after 1967. Algorithms allow you to calculate the amount without leaving your home. The pension calculator will also be relevant for persons born before 1967.

Calculation of pensions for those born before 1967

Certificates about his earnings Semenov S.S. did not provide it, so the amount of his salary for 2000-2001 was taken (for this period, the Pension Fund database contains information about all insured persons, i.e. those who worked officially at that time). The average monthly salary for this period for Semenov S.S. was 1530 rubles. The salary coefficient, showing the ratio of his earnings to the average salary in the Russian Federation in 2000-2001, is equal to 1530/1671 = 0.92.

After 2002, your length of service can play a role only if it is recorded on an individual personal account, that is, if contributions were transferred for you by your insurer (employer). Hence the dependence is obvious - the more your “white”, that is, official earnings, the higher, in connection with this, insurance transfers - the more significant the future pension will be.

This is interesting: Annual Bonus for Sberbank Employee in 2020

Pension calculator Online

- SP is the amount of pension for a specific year.

- PV is a fixed part of the pension.

- The bonus K coefficient depends mainly on the retirement age. For example, if a citizen retired 3 years later than the established period, then the coefficient takes the value 1.19.

Anna Andreevna turns 55 in February 2021, but she has not been working since the beginning of January. Using online calculators, the woman calculated that the amount of her IPC during her work was 75 , an additional 1.8 was accrued to her for the birth and care of a child. She does not have any special (harmful, northern or rural) experience; she lives in the Oryol region, so she will not be assigned a regional coefficient.

On the conditions for granting pensions to women born in 1963

On this issue we explain the following. According to Article 8 of the Federal Law of December 28, 2013. No. 400-FZ “On Insurance Pensions”, men who have reached the age of 60 years and women who have reached the age of 55 have the right to an old-age insurance pension. An old-age insurance pension is assigned if there is at least 15 years of insurance experience and an individual pension coefficient of at least 30.

Often citizens who contact the Pension Fund Branch for the Vladimir Region are interested in what conditions exist for assigning a pension. For example, they ask: “I was born in February 1963, I am going to retire in 2021, since I will be 55 years old. I just don’t understand how much experience I should have - 9 years or 15?”

Conditions for assigning a pension

Requirements for future recipients of old-age benefits change annually. The right to a pension for men and women born in 1963 arises under the following conditions:

| Conditions for assigning a pension | Women | Men |

| Year of retirement | 2018 | 2028 |

| Retirement age | 55 | 65 |

| Minimum insurance period | 9 | 15 |

| Minimum amount of individual pension coefficient (IPC) | 13,8 | 30 |

How is pension calculated for those born before 1967?

- SC is the length of service coefficient, its value is 0.55 (for men who have worked for 25 years, and for women - 20 years). For each year worked in excess of this norm, 0.01 is added to the coefficient, but the maximum size of the insurance premium cannot exceed 0.75);

- ZR/ZP is the ratio of a citizen’s salary to the average salary in the country. Moreover, the pensioner’s salary is taken for the period from 2000 to 2001 or the average for five other years. the ratio should not exceed 1.2;

- The SWP is calculated by the Pension Fund based on the amount of 1,671 rubles.

The pension fund does not automatically begin paying pensions to citizens when they reach the required age. Each person must take care of this in advance. PF specialists advise starting to apply for a pension approximately six months before reaching retirement age; only in this case can you start receiving payments on time.

About pension

to the funded pension Pension Fund of the Russian Federation Starting from 1 It will consist of thousands of rubles for SIPC - the cost of pension for Alexandra - review your life number of pension points applicable for military pension and at the same time PN pension for military personnel who have graduated They are assigned for medical reasons

- that”, another transformation was also carried out. Look, there are not enough pensions. How many years after?

- compulsory, whereasyou only need to add experience. This is9117.86 rubles when applying for a pension, thenInsurance pension (9.57 is also called Pension Fund online calculator 2021 or any 5 thousand);

Calculate pension Online

When calculating the conditional amount of the insurance pension, the following indicators for 2021 are used: Fixed payment - 5,334 rubles; The cost of 1 pension coefficient is 87.24 rubles; The maximum salary before personal income tax, subject to insurance contributions, is 85,083 rubles per month.

The Federal Law “On Insurance Pensions” refers to the insurance period as all periods when insurance premiums were paid . That is, periods of official work with contributions to the Pension Fund. At the same time, the insurance period also implies other employment:

Calculation of pensions for those born in 1962

Based on the amounts transferred annually, the Pension Fund calculates the number of points earned . The approximate size of the annual increase in coefficients can be found on the official website of the Pension Fund using a special calculator. When you enter the amount of earnings, it gives a calculation of the number of points for the current year.

How is future payment calculated? Insurance pension capital , which underlies the amount of the benefit, is formed from contributions made by the employer of the future pensioner. The amounts are calculated based on his official salary before taxes or other deductions are deducted from it. The amount of transfers made into pension contributions is 55 years .

Pension calculator

As part of the public discussion of the new procedure being developed for the formation of pension rights of citizens and the assignment of old-age labor pensions, we invite you to send your opinions and feedback in the form of comments at the bottom of this page. Your proposals will be analyzed and discussed at the working group for the development of the Strategy for the Development of the Pension System of the Russian Federation under the Ministry of Labor of Russia.

- the conditional cost of one pension coefficient - in 2020 it is 71.41 rubles;

- additional pension coefficient for 30–45 years of service. It is used to calculate the basic amount of the insurance part of the old-age labor pension in 2021. The coefficient is equal to one for each year of work experience from 35 to 45 years for men and from 30 to 40 years for women;

- additional pension coefficient for 40 years of service for men and for 35 years of service for women. It is equal to five and is added to such an indicator as the fixed base size of the insurance part of the labor pension;

- pension coefficients during the period of child care. Each child is officially allocated one and a half years, which is counted towards the total length of service. The pension calculator on the Pension Fund website calculates coefficients of 1.8 for the first child, 3.6 for the second, 5.4 for the third;

- coefficient for each year of military service. The Pension Fund's pension calculator calculates a coefficient of 1.8 for each year of service;

- the actual fixed base amount of the insurance part of the old-age labor pension in 2021, which is 4,383 rubles. 59 kopecks;

- Minimum wage (minimum wage), which is uniform for the entire Russian Federation and which also takes into account the pension calculator on the Pension Fund website . The minimum wage for 2021 is 5965 rubles;

- the average salary of citizens of the Russian Federation in 2021 is 25,760 rubles;

- the maximum salary, which the 2021 pension calculator takes into account when calculating the imposition of mandatory insurance contributions, is 59,250 rubles per month, so a coefficient of 2.3 is used to the average salary in the country;

- the amount of wages for which insurance contributions are taken into account pension calculator: the current formula takes into account an amount higher than 1.6 times the average salary in the country;

- expected payment period. The PFR pension calculator takes into account to calculate the labor pension according to the current formula and the funded part of the pension according to the new formula, if there is no work experience after reaching retirement age. In case of failure to apply for a pension, the period will be 228 months, or 19 years;

- the minimum wage, at which the pension calculator will take into account the calculation of insurance premiums in the amount of 22% - the current formula does not yet take this into account. The minimum amount is equal to two minimum wages and is 11,930 rubles;

- tariff of insurance premiums paid for compulsory pension insurance. The Pension Fund's pension calculator takes into account a rate of 22%;

- average old-age pension. Taking into account how much the minimum and maximum old-age pension was in 2020 in rubles, the average amount is 10,645 rubles.

This is interesting: Payment of sick leave to Chernobyl victims in 2020

How to correctly calculate your old age pension in 2021

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

One of the most frequently asked questions is how to calculate your pension yourself in 2021? This process has a large number of different nuances and features. Especially when it comes to citizens before a certain year of birth.

Calculate your pension online using a calculator

A person has the right to transfer funds to a non-state pension fund, which will be able to manage the client’s money more efficiently. The funds received will be used to make transactions in stocks and bonds. Profits from the activities of the fund are distributed among the participants in accordance with the agreement.

When calculating a pension, the age of the elderly person and the number of dependents are taken into account. For pensioners who are 80 years old, the state pays an increased fixed payment in the amount of 9,610.22 rubles. If an elderly person has no dependents, then the basic part of the pension will be 4805.11 rubles. Disabled people have the right to receive an increased amount of fixed payments.

Pension calculation year of birth 1964

Hello! To calculate the pension, take the year 2000-2001, or any 60 calendar months in a row until January 1, 2002. The subsequent period is taken into account only in the amount of insurance contributions transferred for you by the employer.

Everything included in the insurance period. Simply when determining the pension capital, an element of the formula for calculating the size of the pension - any 60 consecutive months, to determine the average earnings in the period before 2002. And the actual amount of insurance contributions made by the employer - starting from 2002.

Calculation procedure and formula

The pension for those born before 1967 includes 3 periods: until 2002, from 2002 to 2014, and from 2015. Each period has its own formula for calculating the amount of savings from wages and IPC. The total pension amount (VP) is calculated as follows:

- VP=PB * TsPB *PK1 + FS *PK2, where:

- PB – points accumulated over a specific period.

- TsPB – cost of 1 point at the time of calculation.

- PC1 and PC2 are increasing bonus coefficients for retirement at a later period;

- FS - a fixed amount, currently equal to 4982.90 rubles.

The procedure for calculating pensions will change in the presence of northern work experience, disability, and disabled dependents. A bonus factor will be applied. It is set individually for each individual. The amount of the funded part of the pension depends on the total number of points received for the specified periods.

- What is parfait - step-by-step recipes for preparing a light dessert at home with photos

- Carrot cutlets - how to cook deliciously at home using step-by-step recipes with photos

- Calculation of pensions for those born in 1966 - formula and rules for calculating pension payments

Jobs in your city

From 2025, the minimum total length of service to receive an old-age pension is 15 years. The minimum number of earned coefficients for assigning a pension is 30. If in your answers to the questions you indicated less than 15 years of experience or the number of earned coefficients does not reach 30, then you will be assigned a social old-age pension: for women at 60 years old, for men at 65 years old. The old-age social pension today is 4,769.09 rubles per month. In addition, you will receive a social supplement to your pension up to the subsistence level of a pensioner in the region of your residence.

From 2025, the minimum total length of service to receive an old-age pension is 15 years. The minimum number of earned coefficients for assigning a pension is 30. If in your answers to the questions you indicated less than 15 years of experience or the number of earned coefficients does not reach 30, then you will be assigned a social old-age pension: for women at 60 years old, for men at 65 years old. The old-age social pension today is 4,769.09 rubles per month. In addition, you will receive a social supplement to your pension up to the subsistence level of a pensioner in the region of your residence.

09 Jun 2021 uristlaw 338

Share this post

- Related Posts

- In what cases can bailiffs seize a car?

- What Changes Await Working Pensioners in 2021 in Russia

- If the building permit is overdue for a year, the house is built but not put into operation

- Payments to Labor Veterans of Federal Significance in Yaroslavl