Will there be an increase - legislative framework

Pension provision for socially vulnerable citizens is entrusted to the state. Therefore, non-working disabled people receive fixed social pensions, in the absence of work experience. The payment terms, accrual conditions, and the principle of indexation of social payments are prescribed in Federal Law No. 166 “On State Pension Security,” which is amended annually to regulate the amount of payments. The same legislative act provides social benefits to disabled children, as well as to those disabled since childhood.

For reference! The fixed base amount for calculating the disability insurance pension is also established by law, but approved by another act - Art. 15 Federal Law No. 173 “On labor pensions in the Russian Federation” dated December 17, 2001.

Unlike the indexation of insurance pensions, which will be increased from the beginning of the year by 1,000 rubles, which is due to rising prices and average wages in the country, the increase in social benefits is tied to the cost of living of pensioners over the past period.

After the publication of the draft budget of the Russian Pension Fund for 2019-2021. in September 2021, the Pension Fund officially announced that “... the average annual social pension in 2021 will be 9,215 rubles. (104.2% to PMP) ».

This means that there will be an increase in the social pension in 2021 for people with disabilities, but the exact amount will become known immediately after the adoption of the corresponding regulatory act in March 2021 before the recalculation of benefits.

Indexation of pensions for disabled people in 2019

Information was released on the projected increase in benefits in 2021, in accordance with inflation. According to some data, this coefficient will amount to an additional payment of 3.5-4%. A more accurate amount will be established after the planned recalculation on May 1, 2019. Members of the government voiced the following reasons for its implementation:

- Devaluation of the state currency.

- Inflationary growth.

Natural resources have become noticeably more expensive compared to the past period, as a result of which the state treasury has been replenished with financial resources. Based on this, the government has set a course for increasing pensions for disabled people in 2021. How much they will add will be discussed in the article.

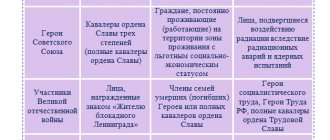

Who will have their pensions increased?

Not all citizens with limited physical or mental capabilities can receive social benefits from the state, but only:

- disabled children;

- disabled people who have been disabled since childhood;

- disabled people, regardless of group, with absolutely no work experience.

If a working disabled person of group 3 or 2 has at least one day of work experience, he is entitled to an insurance pension, which is paid by the Pension Fund of Russia.

Rice. 1. If you have social work experience. no benefits are provided

When a working disabled person reaches retirement age, he is assigned an old-age social pension without a request, which is also subject to annual indexation.

Reference! In 2021, the age threshold for receiving social security by age will increase to 60.5 years for women, 65.5 years for men.

In addition, payments to recipients of the state disability pension will increase, since its size is directly tied to the social old-age pension.

Indexation will affect benefits for disabled people:

- due to military injuries or illnesses received during service;

- WWII participants;

- due to man-made disasters, including the Chernobyl nuclear power plant;

- from among the astronauts.

If the recipient of the state disability pension has non-working family members, 33% of the fixed social benefit is added to the payment, but not more than for 3 dependents.

In total, more than 12 million Russians who have limited opportunities will receive increased benefits.

By the way, the increase in pensions after 80 years does not apply to recipients of social benefits.

Pension for parents of disabled children in 2019

If there is a disabled child in the family, both the mother and the father can receive a separate benefit. Also taken into account are people who have the status of official guardians. To become more familiar with who the guardians of disabled children can be, you can take a closer look at Article No. 35 of the civil legislation. Only authorized bodies are required to make appointments.

People who have previously had problems with a criminal record or have been deprived of parental rights cannot be guardians.

Features of the pension:

- Financial support is provided together with the social pension.

- An applicant who requests payment of benefits must submit all documents confirming the child's disability and need for care.

- Assistance is awarded only to those citizens who are unable to earn money on their own due to constant care for a disabled person.

This benefit is not subject to annual indexation; its amount is 1,200 rubles.

Parents or official guardians of a disabled child can receive not only pension or social benefits, but also certain benefits for paying taxes and housing.

People who are raising children with disabilities are allowed by law to reduce their retirement age. To do this, a number of conditions must be met. There are also additional amounts of pension points, benefits and service packages that will also add.

How much will pensions increase?

According to the Pension Fund of Russia, the average annual size of social pensions will increase to 9,215 rubles. This growth will be possible due to an increase in benefits by 2.4%.

Table 1. Amount of social disability pensions from April 1, 2019 (calculated)

| Category | Benefit amount, rub. |

| Disabled children | 12 730,82 |

| Disabled people from childhood, group I | |

| Disabled people from childhood, group II | 10 609,17 |

| Disabled people of group I | |

| Disabled people of group II | 5 304,57 |

| Disabled people of group III | 4 508,91 |

To calculate other payments, the base is based on the amount of social benefits by age, which will also increase by 2.4% and amount to RUB 5,304.57.

Table 2. Amount of state support for disabled people from April 1, 2019 (calculated)

| First group | Second group | Third group | |

| War trauma | 15 913,5 | 13 261,25 | 9 282,88 |

| Disease acquired during military service | 13 261,25 | 10 609 | 7 956,75 |

| Technogenic and radiation disasters | 13 261,25 | 10 609 | 7 956,75 |

| WWII participant | 13 261,25 | 13 261,25 | 7 956,75 |

| Resident of besieged Leningrad | 10 609 | 10 609 | 5 304,5 |

Note! The benefit for 1 dependent from April 1, 2019 will be 1,750.49 rubles.

A regional coefficient is applied to all listed benefits if the pensioner lives in the Far North or in hard-to-reach areas.

Rice. 2. For rehabilitation and treatment of disabled people, an NSO is assigned

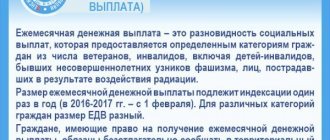

In addition, an increase in one-time cash payments for disabled people is envisaged. In 2021, the EDV will increase by an average of 3.1%.

Table 3. Change in EDV with growth of 3.1%

| Recipient category, disabled | 2018, rub. | 2019, rub. |

| WWII | 3 885,33 | 4 005,78 |

| 1 group | 3 623,98 | 3 739,42 |

| 2 groups | 2 590,24 | 2 670,54 |

| 3 groups | 2 073,51 | 2 137,79 |

| Disabled children | 2 590,24 | 2 670,54 |

| Chernobyl Nuclear Power Plant | 2 590,24 | 2 670,54 |

Reference! Upon receipt of the NSO in full or in part, the amount of the cash payment is reduced by an amount equivalent to the cost of the social service.

General calculation of disability pension

This type of support for disabled people is calculated using a special formula and depends on the disability criterion. Subjects entitled to receive it include disabled people of groups 1, 2 and 3, regardless of:

- grounds for disability;

- duration of payment of insurance premiums;

- continuation of the employment relationship or provision of services;

- from the period of onset of disability.

In the absence of evidence of payment of insurance premiums, the disabled person is paid a social disability pension. The size of the disability insurance pension is determined as the derivative of the annual pension points multiplied by the cost of one pension coefficient on the day the pension is established. A fixed payment is added to the result obtained.

Note! Conditions affecting the amount of the disability insurance pension include:

- degree of disability;

- continuation of work activity;

- the amount of accrued and actually paid insurance payments;

- the total period of work during which insurance premiums were paid;

- the presence of persons receiving financial support;

- continued stay in the Far North and similar regions.

The annual individual pension coefficient is a digital expression of the subject’s labor activity for a calendar year, taking into account the costs of paying insurance premiums. When determining the insurance pension, the sum of points before and after 01/01/2015 is taken into account.

During the period of calculating points until 01/01/2015, the pension amount is set as of 12/31/2014. The fixed base rate of the disability pension is not included in the calculation. The resulting value is divided by the price of one pension point as of January 1, 2015 - 64.10 rubles. Childcare experience is equivalent to insurance experience - a score of 1.8.

Note! The value of the points depends on the ratio of the subject’s standard insurance period to 180 months. The standard period of insurance coverage until the subject turns 19 years old is set at 1 calendar year. Every year 4 months are added to it. The maximum period of insurance coverage is 180 months.

The formation of points directly depends on the pensioner’s agreement or disagreement with the formation or refusal of a funded pension. An increase in their value is allowed until 2021. In 2021, the maximum limit was 8.7. This is due to the introduction of a moratorium on funded pensions. From January 1, 2021, the cost of 1 point is 81.49 rubles. Therefore, the fixed payment is 4,982.9 rubles. For the third disability group, this indicator is equal to 50% of the value value.

How to apply for an increased benefit

Indexation of social pension benefits for disability is carried out without application. Therefore, the benefit recipient does not need to contact the Pension Fund or other authorities to recalculate payments.

If the total income, taking into account the amount of the new benefit, as well as the Unified Social Security, National Social Security, is below the pensioner’s minimum pension, the disabled person has the right to a federal or regional social supplement.

For 2021, the PMP is set at RUB 8,846. Additional payments up to this amount are calculated automatically by the Pension Fund without submitting additional documents or applications.

Rice. 3. Most benefits can be applied for at the MFC

If the cost of living in the region where a Russian with a disability lives is above 8,846 rubles, the pensioner can apply for a regional supplement at the social security authority. To do this, just submit an application.

Reference! You can find out the size of the regional PMS at the local branch of the Pension Fund, on the official website of the Pension Fund or at the social protection authority.

You can apply for additional payment to the minimum from January 2021, when the laws regulating local primary care healthcare come into force.

Find out who can claim a Moscow pension.

Pension for a disabled child in 2019

List of due payments:

- Social pension, which belongs to one of the categories of government benefits of this type. All information directly related to it is set out in detail in Law No. 166. Based on its provisions, only those individuals who have officially confirmed their disability status receive a social pension. To really begin to receive such support from the state, you must reside permanently on the territory of the state.

- Monthly cash payments (MCP). Disabled children have every right to receive regular payments from the state, the amount of which is 2,400 rubles. It also includes a set of social services in the amount of 995 rubles. The child can choose how he wants to receive support - in cash or in the form of in-kind assistance. If you choose the second one, the total amount will be 1405 rubles.

Law No. 178 of July 17, 1999, which lays out all the points of social assistance, also states that all disabled children have the full right to a certain list of social services.

Such accrual is carried out only from the state side.

As additional services, people with disabilities and pensioners will be provided with free medications, specific products for treatment and, if necessary, rehabilitation. In addition, the child receives the right to stay in the sanatorium for free for 21 days, travel is also included. The same is allowed for the individual who accompanies the disabled person - mother, father or public guardian.

Parents of disabled children also receive some privileges. If one of them has physical limitations of any type, he has the right to retire from the age of 50. However, for this it is important to comply with certain conditions: the child at that time must be no more than 8 years old. Also, the total experience of parents for two must be 15 years. Article No. 91 provides another advantage - if a woman is caring for a disabled person, she has the right to part-time work. Only in this case the child’s age should not exceed 18 years.

Remuneration is carried out in accordance with the total hours worked.