From April 1, pensioners do not need to report to the Pension Fund about the fact of dismissal from work

According to the law, two months are allotted for processing information and making a decision on payment. So, if a pensioner left work in April, then he will receive a pension, taking into account indexation, starting in July. If the dismissal occurred in May, the pension in the new amount will be paid starting in August.

Pensioners who stopped working on April 1, 2020 and later do not need to report the fact of dismissal to the Pension Fund. Employers will submit information about resigned employees to the Pension Fund on a monthly basis. After processing this information, the pensioner will be set the size of the insurance pension, taking into account the missed indexations.

MILITARY PENSIONERS FOR RUSSIA AND ITS ARMED FORCES

From the beginning of 2021, changes will occur in the system for recalculating pensions for working pensioners who quit their jobs and decided to retire. As reported by the Pension Fund, the indexation of pension payments and the accrual of all bonuses will take place from the first day of the month after dismissal. Such changes are provided for by Federal Law No. 134, which will come into force on January 1, 2021.

Many working pensioners are interested in the question of whether they need to visit the Pension Fund after leaving work to notify them that they are no longer working. It is up to the employer to inform the Pension Fund about the dismissal of a pensioner from work, reports www.piterburger.ru. It is he who must inform the date from which the pensioner no longer works.

Where should pensioners go after dismissal to recalculate their pension?

Moreover, in 2021, there was a special procedure for recalculating pensions after the dismissal of a working pensioner.

Important For example, if a citizen quit on December 29, 2017, then he will begin to receive an indexed pension only after three months, that is, from March 29, 2018.

Such instructions are contained in paragraph.

6 and 7 art. 3 of Law No. 358-FZ of December 29, 2015 (as amended on November 22, 2016). In 2021, a working pensioner quit his job, when will the pension be recalculated? In this case, a different algorithm applies.

Thus, according to the law dated July 1, 2017 No. 134-FZ, the bonus will be accrued from the day following the date of dismissal.

Attention Regardless of the date of retirement, a citizen does not need to contact the territorial fund with an application.

From April 2021, personal application is no longer required.

The employer independently reports to the Pension Fund about the insured persons.

What does the size of indexation depend on? Let’s define a list of indicators on which the size of the increase in insurance charges depends:

- number of accrued (earned) pension points;

- the amount of calculated and transferred insurance premiums on the citizen’s individual personal account;

- personal (individual) pension coefficient;

- the total indexation coefficient established by current legislation.

- the sum of all periods of labor activity for which contributions were made;

As noted above, there is no need to write an application for indexation to the department of the territorial fund. And the size of a person’s pension itself depends on the amount of insurance premiums paid by the organizations where he worked.

And, although in 2021, instead of indexation, pensioners were paid an amount of 5,000 rubles, now the recalculation will be carried out according to all the rules.

Increasing pensions after termination of an employment contract Employees who have retired but are still working have a number of questions regarding the indexation of pension payments.

The reason for most of them is the lack of recalculation for this category of workers.

If a working pensioner quits, do you need to inform the pension fund?

Considering the absurdity of this legislative norm, Federal Law No. 134-FZ of July 1, 2021 was adopted, according to which the pensioner will begin to receive the full pension three months after dismissal, but these three months will be compensated to him. The new law comes into force on January 1, 2020.

I retired three years ago, but I still continue to work. I want to retire from October, but my son is trying to dissuade me from waiting until next year, as if the law will change and indexation will go faster. Is it true? What month is the best month to quit?

Is it necessary to inform the pension fund about the dismissal of a pensioner?

New rules for indexing pensions Since 2020, the rules for recalculation have undergone some changes. At the moment, only those who have stopped working and subsist only on social benefits from the state can receive an annual supplement to their assigned insurance-type pension.

Indexation of pensions after dismissal Do I need to report dismissal to the Pension Fund of the Russian Federation? A couple of years ago, pensioners were required to personally contact the Pension Fund after leaving their workplace to confirm their “unemployed” status. Since April 2021, the obligation to notify Pension Fund employees has been removed from retired pensioners.

What documents need to be submitted to the Pension Fund?

On a monthly basis, the employer is required to submit to the Pension Fund the SZV-M form, approved by PFR Resolution No. 83p, February 1, 2021. It contains information about all employees, including those dismissed during the reporting period.

SZV-M contains information of insured subordinates, their full name, INN, SNILS. According to the information provided in the reports, the Pension Fund sees with which employees the director of the company has terminated employment relations, and which pensioners continue to work for the benefit of the country.

When dismissing a subordinate, the employer is obliged to provide the Pension Fund with a package of documents, which includes the following papers:

- a copy of the pensioner’s passport;

- an extract from the employee’s dismissal record book or a copy of the order to terminate the employment relationship;

- individual personal account insurance number (SNILS);

- notification from the employee about termination of employment (executed in the form of an application).

You can send them electronically or order delivery by Russian Post or courier. It is acceptable to submit a package of documents through the Multifunctional Center.

Expert opinion

Irina Vasilyeva

Civil law expert

The employer must submit the documents to the Pension Fund in the month following the dismissal of the pensioner.

Dear readers! To solve your problem right now, get a free consultation

— contact the on-duty lawyer in the online chat on the right or call:

+7

— Moscow and region.

+7

— St. Petersburg and region.

8

- Other regions of the Russian Federation

You will not need to waste your time and nerves

- an experienced lawyer will take care of solving all your problems!

Do I need to inform a pensioner about his dismissal at the Pension Fund?

In practice, unpleasant situations occur when a pensioner became unemployed more than four months ago, but still receives the same pension as before. Most likely, this is the fault of an unscrupulous employer who did not notify the Pension Fund about an employee of retirement age.

This is interesting: Young Family Program 2021 Conditions Documents Belgorod Region

At the same time, you can now go to court with a claim to recover wages for the entire period of work, starting from the day you were hired to the present. If you are not fired, then the employer is obliged to pay you wages. Information from the PF will be evidence of the conclusion of an employment contract.

Does a working pensioner need to inform the Pension Fund that he has quit?

In 2021, precisely in order to track working pensioners, monthly reporting to the Pension Fund of the Russian Federation was introduced for employers - the SZV-M form, which reflects a list of all employees and their INN and SNILS. Previously, employers submitted reports to the Pension Fund only once a quarter; it also included information about employees, but, apparently, the Pension Fund needs more timely information, so pensioners were required to notify the Pension Fund themselves that they had taken a job or quit.

It is imperative to report and provide a certificate or work book with a notice of dismissal. According to the new laws, working pensioners are not entitled to pension indexation. The Pension Fund of the Russian Federation does not automatically carry out indexation after dismissal, but will do it for you from the moment you apply and provide documents stating that you are no longer working (they refused to retroactively recalculate my mother, only from the date of application). So the sooner you report, the more you will receive, not by much, of course, but it is very difficult to live on our pensions, and here is at least some kind of increase.

How should I report to the Pension Fund?

Notification of the Pension Fund of the Russian Federation about the dismissal of employees, including pensioners, is carried out by employers.

Organizations submit information about their employees to the Pension Fund of the Russian Federation, on the basis of which the fact of employment of each person is established.

Employers are required to inform the Pension Fund about a change in the pensioner’s labor status, even if he has expressed a desire to independently notify the institution of his dismissal.

If the organization fails to provide reports, it faces administrative liability.

What reports must the employer provide?

Every month, before the 15th day, the organization sends SZV-M reports to the Pension Fund of the Russian Federation, which includes information about each insured employee. The form was approved by resolution of the Pension Fund No. 83p dated 02/01/16 and contains personal information about employees (full name, INN, SNILS).

The length of service or the amount of contributions paid is not displayed in the report. The data shows which employees have finished working at the enterprise and who continues to work.

In addition to the SZV-M form, employers send to the Pension Fund an annual report SZV-STAZH based on the results of the previous reporting period. The document must be submitted by March 1 of the current year.

When dismissing a pensioner early, it is not necessary to send SZV-STAZH reports to the Pension Fund.

For example, if an employee quit in September 2021, the employer has the right to provide information about him until March 1, 2020, together with information about other employees. Separate reporting for a citizen is submitted to the Pension Fund only if the employee retires.

The report contains personal information about persons employed in the organization (full name, SNILS), working period, reasons for early retirement. The purpose of the document is to notify the PF about the length of service of employees with a particular employer.

From 01/01/2020, in connection with the introduction of electronic recording of work experience, employers are also required to submit SZV-TD reports. The document includes information about the employee’s position, his work, dismissal, grounds for leaving, etc. The reporting deadline in 2021 is monthly until the 15th.

If a pensioner quits his job, is it necessary to notify the Pension Fund and what documents are needed?

The new law has a caveat: after retirement and dismissal from work, all provided indexations for the pensioners’ working time will be compensated. Two months after dismissal, the pensioner will begin to receive payments in a larger amount. This is how much time the Pension Fund allocates for processing the information received.

Citizens of retirement age who retired between October 1 and March 31, 2021 were required to report this fact to the local Pension Fund office. This had to be done before the end of May. Otherwise, the pensioner would continue to receive a pension without indexation.

A working pensioner quit his job: will his pension increase, is it necessary to make a recalculation to the Pension Fund of the Russian Federation

All others cannot qualify for indexing. It happens, but in accordance with other regulations. In this case, the size is determined by the relevant laws. There are also several regional payments for citizens who are not included in the specified list. Their size is determined by the financial capabilities of the budget of a particular region.

- Not including all employees in the list. Because of this, those who were forgotten to include do not receive pension points for the specified period. Since all information is often copied by accounting employees from the previous report, there is a high level of risk that when filling out the next one, this person will not be entered into the database again.

- Not including retirees who continue to work in the report. As a result, Pension Fund employees will index the pension. If the employee later appears on the list again, corrective entries will be made and the indexation will be cancelled. Moreover, the employer or pensioner will be forced to return the money that was paid in excess of the norm, as this is considered illegal enrichment.

This is interesting: Donor Books

Should a Pensioner Notify the Pension Fund of His Dismissal?

Based on this information, the employee will be able to find out how accurate the information about him is. But in some situations, it happens that in due time a citizen who left his workplace does not receive the additional payments due to him. Not everyone understands what exactly needs to be done here.

I quit in August 2021. In a month I’ll get a job again. How will my pension be indexed? I am a working pensioner. I quit my job on March 1, 2021, and started working again on March 2, 2021.

This is interesting: Article 228 of the Criminal Code Part 5

From April 1, pensioners do not need to report to the Pension Fund about the fact of dismissal from work

According to the law, two months are allotted for processing information and making a decision on payment. So, if a pensioner left work in April, then he will receive a pension, taking into account indexation, starting in July. If the dismissal occurred in May, the pension in the new amount will be paid starting in August.

Pensioners who stopped working on April 1, 2020 and later do not need to report the fact of dismissal to the Pension Fund. Employers will submit information about resigned employees to the Pension Fund on a monthly basis. After processing this information, the pensioner will be set the size of the insurance pension, taking into account the missed indexations.

Do I need to report to the Pension Fund if a pensioner quits his job?

Since 2020, the recalculation rules have undergone some changes. At the moment, only those who have stopped working and subsist only on social benefits from the state can receive an annual supplement to their assigned insurance-type pension.

If the year before last the indexation amount was 11 percent, then this year it is only 4. However, the authorities are reassuring pensioners, pointing out that another indexation will probably be carried out in mid-autumn.

Informing the Pension Fund about the termination of work by a pensioner

Pensioners who quit their jobs after March 2021 may not independently report their termination of employment. The employer is obliged to inform the PF about this and submits a reporting form every month.

Accruals, taking into account planned indexation, are due to the citizen from the next month after official notification. If the pensioner decides to start working again, the level of the insurance pension will not be reduced, but the indexation freeze will resume.

How to correctly fill out an application for termination of work?

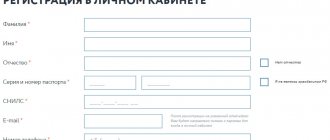

The Pension Fund of Russia is notified of dismissal through an application in the prescribed form, which can be downloaded from the link. Let's figure out how to fill it out correctly:

- in the top line you must enter the name of the territorial body of the Pension Fund of the Russian Federation - the branch of the Pension Fund at the place of registration;

- in part 1, you must enter the citizen’s personal information: full name, insurance account number, identification card details, telephone numbers, etc. The name of the territorial branch of the Pension Fund of the Russian Federation, which accrues the pension to the applicant, is also indicated;

- in the 2nd part you should write the date of dismissal;

- In Part 3, you must list the documents attached to the application. To do this, fill out the attached table. The first column is the document number for the item; the second column is the title. The territorial body is required to provide: a work book,

- identification,

- SNILS;

If a pensioner quits, how to inform the pension office?

Portal of the Government of the Omsk Region Working pensioners do not need to go to the Pension Fund after dismissal In the event that a working pensioner quit his job during the period starting from April 1, 2020 and later, the increase in the size of his insurance pension and the fixed payment to it will occur as follows way.

For working pensioners, their pensions were increased twice a year. The first time - in February as part of the general indexation to the level of inflation and the second time - in August, based on the insurance premiums paid by the employer for him in the previous year. With the adoption of new laws and regular discussions in the press regarding pension legislation, many are confused about how pensions are recalculated for working pensioners.

Working pensioners do not need to go to the Pension Fund after dismissal

The Pension Fund reminds all working pensioners that, in accordance with changes in pension legislation, starting from 2020, the insurance pension and the fixed payment to it are paid without taking into account the February indexations of the pension coefficient by 4% in 2021 and 5.4% in 2021.

In accordance with the new Article 26.1 of the Federal Law of December 28, 2013 No. 400-FZ “On Insurance Pensions,” clarification of information about the implementation or termination of work by a pensioner is carried out on the basis of information from individual personalized records. The decision on the payment of insurance pension amounts, a fixed payment, taking into account indexation, is made in the month following the month in which the body providing pensions received the information provided by the policyholder. Pension amounts, taking into account indexation, are paid from the month following the month in which this decision was made.

This is interesting: How to Evict a Debtor Family With Children from a Rented Apartment

Indexation of pension after dismissal of a working pensioner in 2020

If a person stops working, but subsequently wants to re-employ himself until the security is indexed, he will be recognized as working again. The recalculation will be cancelled.

- The citizen makes a decision on dismissal and writes a corresponding statement. Let's say that employment was terminated on November 30, 2021.

- The employer prepares a report for November for the Pension Fund. It must be submitted by December 10. In the above example, the fact of leaving will not yet be reflected in the reporting. Employee data is provided for the past month.

- The dismissal will be noted in the reporting documentation for the next period. The process is carried out until January 10, 2021.

- In February 2021, fund employees will take into account the data from the January report and recalculate. All missed promotions are taken into account. An increase for 2021 will also be provided.

- In March, the person will be paid the funds, taking into account the recalculation. Unpaid funds for December, January, February and March, taking into account indexation, will be added to the due amount.

Is it necessary to inform the Pension Fund about dismissed employees and dismissed pensioners?

The initial package of documents for granting a pension can be submitted not only by the employee himself, but also by his current employer, with the written consent of the employee. Documents can be submitted directly to the territorial office of the Pension Fund of Russia, sent by mail or transferred through a multifunctional center. In addition, documents can be sent electronically via the Internet. This is provided for in paragraphs 5 and 52 of the list approved by Order of the Ministry of Labor of Russia dated November 28, 2014 No. 958n, Decree of the Government of the Russian Federation dated July 7, 2011 No. 553, paragraphs 4 and 14 of the Rules approved by Order of the Ministry of Labor of Russia dated November 17, 2014. No. 884n.

If the package of documents for assigning a pension is sent by the employer or the employee himself electronically using the Personal Account on the website of the multifunctional center or on the official website of the Pension Fund, identification documents, age, and citizenship of the citizen do not need to be sent. In addition, after a package of documents is sent electronically, the originals of such documents on paper do not need to be submitted to the territorial body of the Pension Fund of the Russian Federation. This is stated in paragraph 2 of paragraph 75 and paragraph 10 of paragraph 80 of the regulations, approved by order of the Ministry of Labor of Russia dated January 19, 2020 No. 14n.

Recalculation of pension after dismissal of a working pensioner

The employer is obliged to provide monthly information about the insured persons in the SZV-M form. If the employer provides incorrect information about the retired elderly employee in the report, the indexation will not be paid. Pension Fund representatives will recalculate only after providing correct information. The state will not pay compensation for the employer’s mistake. The lost amount can only be claimed from the employer through the court.

IMPORTANT! In August last year, representatives of the Pension Fund of the Russian Federation carried out an undeclared adjustment of payments to retired elderly people. The reform standard is determined by clause 3, part 2, part 4 of art. 18 of Law No. 400-FZ; clause 56 of the Rules, approved. By Order of the Ministry of Labor of Russia dated November 17, 2014 No. 884n. This means that a similar recalculation of pensions will be carried out in August 2021. Moreover, there is no need to submit any applications for increased payments to the Pension Fund.

Is it necessary to confirm the fact of dismissal at the Pension Fund of Russia branch in order for the additional payment to be withdrawn?

Since April 2021, pensioners have been relieved of the responsibility for submitting notices of dismissal to the Pension Fund. This responsibility has been transferred to employers, who must submit monthly information about all persons working for them. Thus, the Pension Fund will automatically determine the fact of employment of each citizen.

Insureds provide to the Pension Fund reporting on insurance premiums for compulsory pension and compulsory medical insurance, as well as individual personalized accounting information for each insured employee using a single reporting form approved by the Resolution of the Board of the Pension Fund of the Russian Federation, registered with the Ministry of Justice of the Russian Federation on February 18, 2014 and published in the Rossiyskaya Gazeta No. 41 dated February 21, 2014.

Do I need to contact the Pension Fund to notify?

If a working pensioner quits his job, do I need to go to the Pension Fund and what should I report? The pension fund must be notified of the change in the status of a working pensioner to an unemployed person within the period specified by law.

From 2021, the obligation to inform is assigned to employers who provide monthly and annual information about persons employed by them.

The pensioner does not need to notify the Pension Fund of his dismissal and acquisition of the status of a non-working citizen.

Personal information is required only when receiving federal social security benefits for retirement. Persons whose financial support does not reach the subsistence level of their region of residence are entitled to apply for the supplement. Due to this additional payment, pensioners can count on receiving benefits not lower than the minimum wage for a pensioner in a constituent entity of the Russian Federation.

It is necessary to contact the Pension Fund if, 4 months after dismissal, the pension amount does not change. During this period, data from the employer is received by the Pension Fund, and the institution recalculates the benefit.

If this does not happen, the pensioner will need to contact the Pension Fund independently with an application for his dismissal and recalculation of payments. Additionally present:

- passport;

- a copy of the work book with a record of termination of the contract;

- SNILS.

The delay or lack of increase in the benefit amount may be due to incorrect provision of data by the employer, loss of documentation and PF errors.

Some citizens apply to the Pension Fund immediately after dismissal in order to speed up indexation. Employees will accept a statement from the citizen informing about the change in his status, but this will not affect the timing of recalculation. Revision of the benefit amount is made only on the basis of reports submitted by the employer.

Should a pensioner, after dismissal, inform the Pension Fund so that the indexation of his pension will be returned to him?

Moreover, in some cases, for example, if the policyholder fails to provide information about work within the prescribed period, the pensioner has the right to submit an application to the pension authority of the Pension Fund of the Russian Federation about his employment or termination of work.

Currently, in order to index his pension due to termination of work, a pensioner does not need to inform the territorial body of the Pension Fund of the Russian Federation about his dismissal. The fact of termination of work by pensioners is clarified monthly on the basis of individual (personalized) accounting information received from policyholders.

12 Jun 2021 uristlaw 187

Share this post

- Related Posts

- Department of Social Welfare Khmao Ugra Social Payments to Labor Veterans

- Where can you top up a pensioner’s preferential transport card in the lower

- Is there a benefit in Kursk for an Armed Forces Veteran to undergo an MRI?

- 100000 For 2 Children

Indexation after dismissal: Pension fund reveals secrets

— The main legal act regulating pension issues, including the procedure for paying pensions during working life, is Federal Law No. 400-FZ “On Insurance Pensions” dated December 28, 2013.

For example, if a pensioner quit in December, in January the employer presents information about him for December as still working, even if he only had one working day in December. Only in February, when reporting for January, will the policyholder submit information about this citizen as unemployed. In March, a decision will be made on the payment of pensions, increased by the indexation percentage, from April 1.

12 Jun 2021 uristlaw 195

Share this post

- Related Posts

- Rest houses and camp sites of the Russian Federation for military pensioners

- Where to Get a Certificate About the Number of Persons Registered in the House

- I Owe The Bank From My Salary The Debt Is Deducted What Happens If I Buy An Apartment

- GIS housing and communal services can find out the debt without a personal account