Payments that a working pensioner can receive

The Pension Fund exercises strict control over the receipt of insurance premiums. If the employer transferred insurance premiums for a pensioner as for an employee, the pension will be recalculated.

To the point! Legal ways to increase your pension.

Regardless of the form of the contract , the obligation to provide information about employed pensioners lies with the employer. Every current month, before the 15th day, the employer is obliged to inform the Pension Fund of the Russian Federation about its employees using the SZV-M form. Based on these data, the Pension Fund collects and analyzes information on the need for indexation.

According to the law, a pensioner has the right, but not the obligation, to provide information about his employment.

Pensioner and work

FIXED-TERM EMPLOYMENT CONTRACT Fixed-term contract - only by agreement. If a pensioner wants to get a job, the employer can enter into a fixed-term employment contract with him. In this case, a fixed-term contract can be concluded only by agreement between the employee and the employer (Part 2 of Article 59 of the Labor Code of the Russian Federation). Please note: if an employee working in an organization has become a pensioner, he does not need to be fired and a fixed-term employment contract is signed. Otherwise, in accordance with Part 1 of Art. 5.27 of the Code of Administrative Violations, an organization can be fined for violating labor and labor protection laws. Fixed-term employment contracts include those concluded to perform seasonal work. When drawing up such an agreement, the employer should warn the employee that paid leave is provided to him or compensation for unused leave is paid at the rate of two working days per month of work (Article 295 of the Labor Code of the Russian Federation). If the employee does not use the vacation or is not granted vacation with subsequent dismissal, he will receive appropriate monetary compensation (Part 1 of Article 126 of the Labor Code of the Russian Federation). If the employer insists on a fixed-term employment contract. A forced limitation on the term of an employment contract with a retired employee is unacceptable. That is, the employer does not have the right to insist on concluding a fixed-term contract if the nature of the work to be done and the conditions for its implementation allow concluding an indefinite employment contract. If the court subsequently finds that the employee was forced to enter into a fixed-term contract, such a contract will be recognized as open-ended (concluded for an indefinite period). This is stated in paragraph 13 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated March 17, 2004 N 2. In addition, the court recognizes a fixed-term contract as indefinite if, at the end of its validity period, the organization enters into a similar fixed-term contract with the pensioner with the same labor function as earlier. For violating the rules for drawing up a fixed-term employment contract, the company may be fined. The fine for a legal entity ranges from 30,000 to 50,000 rubles. In addition, suspension of the organization’s activities for up to 90 days is used as a penalty (Part 1 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation). Entry in the work book. In the work book of a retired employee, an entry about hiring should be made in the general manner (that is, without indicating that a fixed-term contract has been concluded) in accordance with clause 3.1 of the Instructions approved by Resolution of the Ministry of Labor of Russia dated October 10, 2003 N 69.

This is interesting: Veteran of Labor At what age do benefits begin in Moscow

WHO IS CONSIDERED AN AGE PENSIONER According to clause 3 of the Determination of the Constitutional Court of the Russian Federation of May 15, 2007 N 378-O-P, old-age pensioners include persons who have reached retirement age and who, in accordance with pension legislation, are assigned an old-age pension. If a pension is assigned due to other circumstances, such a citizen is not considered an old-age pensioner. Men who have reached the age of 60 years and women who have reached the age of 55 years have the right to an old-age labor pension (Clause 1, Article 7 of the Federal Law of December 17, 2001 N 173-FZ “On Labor Pensions in the Russian Federation”). However, in some cases, an old-age labor pension is assigned before reaching the specified age: - persons working in special conditions. Lists of relevant jobs, industries, professions, positions, specialties and institutions are listed in Decree of the Government of the Russian Federation of July 18, 2002 N 537; - some categories of workers listed in Art. Art. 27 and 28 of Law N 173-FZ (for example, men upon reaching the age of 55 years and women upon reaching the age of 50 years, if they have worked for at least 15 calendar years in the Far North or at least 20 calendar years in equivalent areas and have insurance experience of at least 25 and 20 years, respectively); - unemployed citizens who were dismissed due to the liquidation of an organization, a reduction in personnel or staff and who, regardless of interruptions in their work activity, have a length of service that gives the right to an old-age pension, but not earlier than two years before the retirement date established by the legislation of the Russian Federation ( Clause 2 of Article 32 of the Law of the Russian Federation of April 19, 1991 N 1032-1 “On employment in the Russian Federation”). Please note: a citizen who has reached retirement age, but who has not been assigned a pension for various reasons, is not considered a pensioner (clause 3 of the Determination of the Constitutional Court of the Russian Federation of May 15, 2007 N 378-O-P).

Pension recalculation in 2021

Recalculation is carried out automatically for all categories that apply for additional payments in the form of indexation. In 2021, it will occur from January 1 and will be 6.6% according to the following parameters:

- increasing the price of a pension point to 93;

- increase in fixed payment by 352.06 rubles. up to RUB 5,686.25

Only non-working pensioners will receive an increase. According to Law No. 350 Federal Law of October 3, 2018, the pension should increase by an average of 1,000 rubles. in a year.

To the point! Income tax on pensions in 2021: from which payments personal income tax is withheld.

If a pensioner gets a job temporarily

- 35% of Russian companies refuse the services of older workers (employers recruit youth teams from creative, sociable and active young people);

- 39% employ pensioners in some cases (less often in high positions that require extensive experience, concentration and maximum output, more often in low-paid positions as cleaners, security guards, drivers);

- 26% of companies are happy to hire retirees.

However, despite some difficulties in combining work and retirement, the answer to the question of whether it is profitable for a pensioner to work in 2021 is almost obvious. The material component will certainly be a plus.

Pros and cons of employment

For a pensioner, going back to work will bring a number of benefits:

- Additional leave at your own expense up to 14 days. Disabled pensioners have the right to leave up to 35 days, and WWII veterans – up to 60 days.

- Preferential medical care: free examination without a queue, free dental prosthetics, 50% discount on medicines for working veterans.

- Dismissal without the need to work 14 days.

Going to work deprives the pensioner of indexation of the insurance part of the pension, in some cases - social benefits, as well as:

- payments for transportation costs to the place of the sanatorium-resort holiday;

- subsidies for low-income dependent care.

If a Non-Working Pensioner Gets a Temporary Job

To do this, you need to submit an application to the Pension Fund of Russia department before May 31 of the current year and provide documents confirming the termination of employment, namely a work book. In some cases, other documents may be needed.

After reviewing your application, your pension will begin to be paid starting next month, taking into account indexation. That is, if a pensioner stopped working after indexation, then from the next month after submitting the application he will receive the size of the insurance pension and a fixed payment to it, which has already increased due to indexation.

How to determine the size of your pension

There is no fixed value that determines the amount of payments for all categories. To determine the amount of monthly payments, you need to know the year of retirement and the length of official work experience. You can make the calculation at the Pension Fund at your place of residence. You can calculate the approximate value using the calculator on the Pension Fund website.

The calculator cannot be used to calculate pensions for law enforcement officers and military personnel due to the fact that they do not have work experience in civilian structures as employees.

Return of the funded part of the pension to a pensioner

Only those who regularly deposited funds into an individual personal account can return accumulated deductions. Payments can be made at the personal request of a person who has reached the appropriate age. The pensioner only needs to write a statement asking for the money to be paid.

We recommend reading: How to get to Australia from Kazakhstan

Many citizens do not fully understand what the concept of pension savings includes. Persons who have already reached retirement age may not even know that it is possible to return the funded part of the pension to a working pensioner.

Recalculation of pension after dismissal

When employed, the pensioner receives a salary, but loses the indexation of part of the pension payments. According to Law No. 400 Federal Law of December 28, 2013, indexation is carried out annually from February 1. Upon dismissal, the pension will be recalculated from the 1st day of the month following the dismissal.

For example, a citizen was officially employed from April to September and quit of his own free will. The employer submits information to the Pension Fund of the Russian Federation in the SZV-M form by October 15, and the employee is counted as employed for September. For October, the reporting will no longer contain data on the citizen, and the Pension Fund will transfer him to the status of non-working pensioners. Pension recalculation will take place on October 1.

Do I need to notify a pensioner of his dismissal to the Pension Fund of Russia?

If a pensioner stops working, then the size of his pension will become larger, since for non-working citizens it is mandatory to carry out annual indexation of cash payments. For example, in 2021, due to indexation, pensions will increase by 4.1% from April 1. Typically, pension indexation is carried out in the fourth month after official dismissal.

16% for housing and communal services. Where have you seen this? one heating 2-3 thousand! And a lot of other payments - electricity, gas, major repairs, mechanical cleaning, utilities, water. Do those who compile such tables generally pay public services? Most pensioners are barely surviving!

We recommend reading: How to enter the registration number of a birth certificate in public services

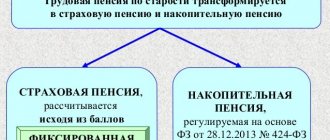

Legislative framework for calculating pensions

The amount of payments is determined individually. The calculation procedure is regulated by legislative acts:

- 385 Federal Law of December 29, 2015 on the accrual procedure;

- 167 Federal Law of December 15, 2001 on compulsory pension insurance;

- 350 Federal Law dated October 3, 2018, fixing changes in pension payments;

- 134 Federal Law dated July 1, 2017, fixing certain pension changes;

- No. 400 Federal Law dated December 28, 2017 on the accrual procedure.

If a pensioner goes to work, the insurance part of his pension will not be indexed until the moment of dismissal, and then indexation will be restored in full.

Author: Viktor Sukhov, editor-in-chief. November 27, 2021.

What does a pensioner lose when he gets a job?

1) Social old age pension

. These pensions are assigned to men upon reaching 65 years of age, and to women at 60 years of age, unless their right to an insurance pension is confirmed (there is no required length of service or “pension points”).

4) Social supplement to pension

(federal or regional). These payments are assigned in cases where the total amount of social security received by the pensioner does not reach the minimum subsistence level approved for the corresponding region of residence of the pensioner.

If a pensioner gets a job, what does he lose?

For example, citizen Sidorova S. quit the plant where she worked for 20 years as an occupational safety inspector due to reaching retirement age. After 3 years, I got a job at Zvezda LLC. After six months of work, she fell ill and submitted a sick leave to the accounting department, which she was paid at the minimum wage.

Despite the fact that working pensioners are provided with a number of different benefits, we should not forget that they lose a lot by continuing to work. For example, working pensioners are not paid some financial benefits due to non-working pensioners.