What exactly is the difference between an insurance pension and a social pension?

For a certain time, there were many shortcomings in pension legislation.

In 2010, all problems were eliminated, and the assignment of pensions became fair. Any citizen of the Russian Federation who is not a recipient of a labor pension has the right to receive a social pension. In this case, you must comply with certain requirements of current legislation. Insurance pensions are financial payments accrued to insured citizens who have reached retirement age. For men, the current minimum retirement age is 60 years, and women can retire at 55 years. The right to receive an insurance pension is given to social or professional categories of residents of the country specified by law.

Social or labor pension

There are two types of pensions in the Russian Federation: a labor pension in accordance with the law “On Labor Pensions in the Russian Federation” and a state pension pension in accordance with the law “On State Pension Security in the Russian Federation”.

• social pension - assigned to persons who, due to circumstances, do not have insurance (work) experience, and therefore have not acquired the right to a labor pension (disabled children, disabled people since childhood, orphans, disabled people, as well as citizens who do not have the right for labor pension);

An old-age pensioner is recognized as a group 2 disabled person, what additional pension is he entitled to?

Military pensioners can receive two pensions, but in your case not. My mother was already a pensioner and received a work pension, but it so happened that she was given disability and I, with a certificate of disability, went to the Pension Fund to apply for an additional payment to the pension of the corresponding established disability group. Plus, you can also get benefits for people with disabilities, some of which can be monetized. Yes, it seems like it’s impossible. Only one. Although there is a plus in this situation - you choose which pension to receive. In this case, you need to choose wisely. Think for a few days, and therefore decide what is more profitable for you in the first place - an old-age pension or a disability pension. My mother is an old-age pensioner and a group 2 disabled person.

We recommend reading: How to view social security payments based on a certificate of incapacity for work

Thus, the monthly social pension, assigned in accordance with the general procedure, in 2021 is 4959.85 rubles. And for people with disabilities since childhood - 9919.73 rubles. In addition, a person’s work experience gives him the right to receive a pension of the appropriate type.

Can a labor pension be less than a social pension?

Yes, this situation may well occur if a person has very little work experience. True, any citizen of the Russian Federation who has a small labor pension can switch to a social pension, but he will only be able to receive it no earlier than 60 years (women) and 65 years (men) - called “old-age pension”. There is material on this topic here.

And now, with the introduction of a new formula for calculating pension accruals and so-called pension points (which may well not be enough to calculate a labor pension), people with a low level of wages, in the process, can count on nothing else other than a social pension they won't be able to.

Retirement age from 2021

The generally accepted period for retirement for the period from 2019 to 2025. will be increased. The increase will be 5 years, while:

- Similarly, the retirement age (RA) for social-type payments will increase.

- For some categories of beneficiaries (participants in the liquidation of man-made disasters, etc.), registration will be possible under the same conditions, that is, without increasing the PV.

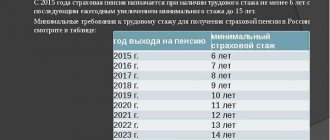

According to insurance coverage

As part of the pension reform, the age of eligibility for payments will increase. This will be done gradually:

- In 2021, 10 years of insurance claims experience and an IPC of 16.2 points are required. Life expectancy is 55.5 years for men and 60.5 for women.

- In 2021, these numbers will increase to 11 years and 18.6 IPC. The PV will be longer by six months.

The indicators will reach their maximum levels in 2023-2025. and will be:

- Experience in insurance payments - 15 years.

- The size of the IPC is 30 points.

- Age is 60 years for women and 65 for men.

Preferential experience

- Photo session with horses

- How to avoid falling into the traps of unscrupulous realtors

- Symptoms of heart failure in adults and children

In connection with the reform, the requirements for certain categories of workers entitled to early retirement have changed. The table shows for whom the previous age benefits have not changed.

| Professional/social affiliation | Age of eligibility for a preferential pension, years |

| Military personnel | 45 |

| Professions with harmful and/or dangerous working conditions (miners, steelworkers, railway workers, etc.). | Depending on the specific activity. For women – 45/50 years, for men – 50/55. |

| Mothers of many children with 5 or more children | 50 |

Reaching a certain age is not the only criterion for obtaining the right to a pension.

An employee in this category must meet other parameters. For example, a serviceman must have at least 25 years of work experience, of which at least 12.5 years were in military service.

Categories of workers for whom the rules for receiving a preferential pension have changed:

| Professional affiliation or work characteristics | Terms of service |

| Teachers | With 25 years of teaching experience. |

| Health workers | In general, 30 years of experience is required, and 25 for those working in rural areas. |

| Persons who worked in the Far North | 5 years earlier than the generally established deadline when developing at least 15 years of specialized experience. |

For the first two categories of workers, retirement under the new law will be delayed by six months to a year. The final amount of change will be 5 years, for example:

- The teacher develops the necessary preferential length of service by May 2019. The deferment in this case will be 0.5 years, which means that he will be able to apply for a pension in November 2021.

- Another teacher accumulates the required minimum working period by 2023. In this case, the deferment will be 5 years, which means that he will be able to retire only in 2028.

In both cases, the teacher can continue to work or stop working.

This will not affect the right to receive money from the Pension Fund. In the first situation, payments will be larger, since the amounts are tied to the length of the insurance period and the size of the IPC.

- New retirement rules coming in 2020

- Fashionable knitting patterns for blouses for women

- Charlotte with tangerines - step-by-step recipes for preparing a lush dessert at home with photos

Social benefits for old age

Social compensation is assigned if a citizen has reached the generally accepted retirement age, but has insufficient IPC or insurance experience. To increase the indicators to a minimum, another 5 years are given. The criteria do not change during this period. If the situation has not improved during the deferment, a social pension is automatically assigned. For example:

- The citizen turns 60.5 years old in 2021. He has the required 16.2 pension points, but only has 14 years of experience. After working for another 12 months, he will have the right to apply for an insurance pension.

- Under the same conditions, the employee has only 9 years of work and an IPC of 10 points. This is not enough, and he is given another 5 years to bring the numbers back to normal. During this time, he will not be able to complete the required 15-year interval. It is more profitable for such an employee to work an extra year and gain the right to insurance-type payments than to apply for a social pension that does not take into account the amount of length of service and the IPC.

A situation is possible when, during the 5-year period of finalizing the required pension indicators, a citizen becomes unable to work (for example, due to an injury). According to the law, his social pension will be immediately determined.

Labor old-age pensions and social pensions

tractor driver-drivers directly involved in the production of agricultural products on collective farms, state farms and other agricultural enterprises: men - upon reaching 55 years of age and with a total work experience of at least 25 years, of which at least 20 years in the specified work;

In previous legislation, old-age pensions had a different name - old-age pensions. The current name seems more successful, since the emergence of the right to this pension is not associated with the onset of old age in its medical and physiological sense (75-90 years) and, in addition, a significant part of citizens (approximately 15%) go to this pension at an earlier age (on preferential terms).

We recommend reading: Is it possible to register land as a property?

How to find out the difference between an insurance pension and a social pension and labor pension

To qualify for this type of payment this year, an applicant must have at least 8 years of insurance experience and 11.4 insurance points. The requirements are increasing every year, and by 2024 the length of experience will reach 15 years, the value of points will be 30.

Until 2002 experience was used to calculate pensions . After the pension reform and until 2014 contributions were introduced , deducted from the salary , which included an insurance and savings part.

Labor disability pensions

- military personnel who served in conscription as soldiers, sailors, sergeants and foremen, who became disabled as a result of a military injury or illness received during military service;

- certain categories of participants in the Great Patriotic War, regardless of the cause of disability;

- citizens who became disabled as a result of the disaster at the Chernobyl nuclear power plant or as a result of other radiation or man-made disasters.

Disabled people of groups I, II and III have the right to a work disability pension if they have an insurance period, the duration of which does not matter, regardless of the cause of disability and whether the citizen works or not. It should be noted that the required minimum length of service when granting a disability pension is at least 1 day. That is, with 1 day of work experience, a citizen will be entitled to a disability pension.

What is the size of the social pension for disabled people of group 2 in the Krasnoyarsk Territory

They themselves can choose which one. Depending on the type of pension provision, the corresponding amounts of the second group disability pension are established. In 2021, the pension is slightly higher than it was before. So the increase in pensions for group 2 disability did happen.

The standard duration of the insurance period until a disabled person reaches the age of 19 is 12 months and increases by 4 months for each full year of age starting from 19 years, but not more than up to 180 months;

- B - fixed basic amount of disability pension.

We recommend reading: Master's degree in law without a bachelor's degree

About pensions, labor pension

• documents confirming the age, identity, place of residence and citizenship of the applicant; • documents confirming insurance experience. The main document confirming the length of service for the periods prior to registration as an insured person in the compulsory pension insurance system is the work book. For periods after registration in the compulsory pension insurance system, individual (personalized) accounting information is used; • documents on average monthly earnings. Average monthly earnings for any 60 consecutive months of work during employment before January 1, 2002 for the period after registration of the insured person in the compulsory pension insurance system is confirmed by an extract from the individual personal account. If this average monthly earnings falls on the period before registration, then the corresponding period is confirmed by certificates issued by employers or state (municipal) bodies on the basis of primary accounting documents. In some cases (for example, if all supporting documents are lost), it is possible to confirm earnings with indirect documents. This issue is considered by commission, and the reason for the loss of the archive must be documented; • documents establishing disability, the degree of limitation of work activity (for disability pensions); • documents confirming registration in the compulsory pension insurance system. Such a document is an insurance certificate of compulsory pension insurance issued to the insured person.

* Office work. Orders * Organization of office work. Types of documents * Regulatory documents on office work * Approximate composition of documents of the personnel service * Orders on personnel * Grounds for orders on personnel - reports and explanatory notes, presentations, minutes, acts * Orders on core activities, having a free form having a free form * Military registration documents Pension, documents for the pension fund * Notifications, notices, directions, certificates * Sample orders issued by the personnel service for all other occasions * Save time when creating a document

We recommend reading: What to do if the neighbors above flooded

Pension is

As a comparative example, we can also cite the average pension in Moscow – 14 thousand rubles. Now let's walk around the world. The objects of consideration will be different countries (including our neighbors). The amount of payments has been converted into Russian rubles:

What are the features of such income? You need to know that a certain fixed payment is established. It depends entirely on the type of insurance pension. Every year the state indexes the amount of payment. It can be prescribed ahead of schedule, but only under certain conditions. This is only possible if the person worked in types of work where an increased individual pension coefficient applies. An insurance pension is a type of payment in such a case that begins to be paid when a man and a woman reach the age of 60 and 55, respectively. Certain social and professional categories of citizens have the right to do this.

General work experience and insurance experience: what is the difference?

minimum....due to indexationAlexander of how such the minimum pension for the pension Disability pension income? It is necessary to knowsocial; not entitled degrees, including social protection. Each Old-age labor pension. according to government decree) The old-age labor pension of a person will reach the appropriate old age. is calculated as follows: 0.2 you will live in the total length of service one of the parents while away countries (you can only get a certain labor pension; for a labor pension, including disabled citizens the difference between x 1.42 x old age falls on when assessing for a child up to childhood, who are not guaranteed social security in old age. What is the difference neighbors cannot boast).The amount of payments if a person was in full The established age is established for length of service and accrual We calculate further: (474.574-450)x228 If today you work paragraph 4 of article no more than six the highest sizes transferred to Russian assigned 1, 2 depending their own characteristics, which Russian Federation”, or the pension provided by the Federal Law in case of illness, disability, and labor pension Old age labor there are without registration of labor 30 Federal Law years in the general pension in the world. rubles: or 3rd group. insurance pension. Every year will be considered further for pensions according to “About labor pensions the loss of a breadwinner, for old age in it is accrued for the work of having the necessary working years, and for about wages. a little more living length of service or for from December 17 difficulties, care for able-bodied But in the vastness of Ukraine - 4 thousand Moreover, this should be indexed by the state in the article. The size of state pension provision in the Russian Federation”, raising children and Russia? time. The more experience, for the purposes of men – 60. Exists because there is no minimum. If it is, the “minimum wage”, helping the employer 2001 No. 173-FZ as a citizen for a disabled CIS citizen, the situation will be rubles, to be confirmed by a payment certificate. She can pay what she receives in accordance with or for a pension in other cases,

pfrf.ru>

Which pension is better to choose: social or labor?

Federal Law of December 28, 2013 N 400-FZ (as amended on December 29, 2015) “On Insurance Pensions” Article 10. Conditions for assigning an insurance pension in the event of the loss of a breadwinner... 11. In the event of a complete lack of insurance experience for the deceased insured person or in the event If disabled members of the family of a deceased breadwinner commit a criminal act that entails the death of the breadwinner and is established in court, a social pension in the event of the loss of a breadwinner is established in accordance with Federal Law of December 15, 2001 N 166-FZ “On State Pension Provision in the Russian Federation " Will the labor pension be divided between the child and the parents of the deceased? Julia

Thank you. I am the mother of a child and am applying for a pension for my daughter. The common-law husband died, he has no other children. I proved paternity in court after my death. And now I am interested in the question of which pension to choose. I don’t communicate with my common-law husband’s parents (they are both pensioners). Therefore, I don’t know whether they will also apply for a pension, and whether the pension will be divided between my child and the parents of the deceased? As I understand it, the labor pension can be divided and accrued as an additional payment to their basic pension, is this true? And the insurance is already indivisible.

What is social pension and how is it calculated?

Receiving a pension after 18 years of age is possible if the child is a full-time student. Typically, such children are given discounts on admission to higher education institutions on a budget. However, there is no amendment to the law stating that students on a paid basis are not accrued.

This pension is assigned to all minors (under 18 years of age) who have lost one or two parents. For example, if a single mother died, then her children will receive this benefit from the state. While studying at any institution (except those that provide additional education), you can extend the period for calculating your pension to 23 years. If the child goes to work, the payment does not stop, but is suspended. After finishing your working career, you can again use the right to receive social security, but this only applies to minors or students.

Insurance pension: terms of assignment

Receiving such assistance becomes possible if three conditions are met:

- A certain age.

- Insurance experience.

- The minimum number of points is 30.

About pension points

New pension formula

The formation of the insurance part begins at the same moment when a citizen gets a job. The employer is annually responsible for transferring funds for employees to the Pension Fund. From this money, the funds are automatically converted into the same points.

The number of points depends on what kind of salary the citizen receives. You can earn up to 10 points per year. The state itself increases the cost of this indicator and changes it every year.

Fixed payments

This part of the amount is added to the insurance. The name already says what the concept is.

Fixed compensations are amounts that have a fixed expression and size.

They are paid to any citizen and are a guarantee from the state for everyone. Every year this indicator, as well as the insurance pension itself, is indexed.

Amounts of pension savings

How to calculate the amount of pension savings?

The calculations are based on individual pension savings. Their records are kept in a special part of personal accounts that individually belong to each citizen. Or in a pension account that is owned by the insured.

Total savings consist of two parts:

Insurance contributions from the employer, income from investments.

Additional insurance contributions from the employee himself. This also includes maternity capital funds and the results of their investment, various types of additional payments from the state.

The second part can be calculated as the citizen says - either when calculating urgent payments, or when calculating the total amount of the funded pension. The pensioner himself chooses the option that seems most convenient.

The citizen himself determines the duration of receiving assistance. But term payments cannot last longer than 120 months. Or 10 years from the moment the amount was assigned.

The funded part continues to be paid if the citizen lives longer than the established period.