Instructions for using the calculator

- Indicate salaries according to position and rank. Salaries are set in accordance with the regulations of the Government of the Russian Federation, links are given below.

- Select the EFA increase percentage for the class qualification.

- Select the long service bonus and regional coefficient.

- In the “Work experience” item, select the percentage of payments (depending on length of service).

- Select a reduction factor.

- The “Pension in rubles to be issued” item will display the due amount of pension payments.

Calculation of pensions for employees of the Ministry of Emergency Situations in 2021 calculator

If an employee has served for more than 20 years, then for each year of service he is credited with an additional 3%, and not 1%, as before reaching this point. The more a worker earned before retirement, the greater their pension contributions will be.

Important: if the length of service “clean” in the Ministry of Emergency Situations is less than 20 years, the calculator will not calculate your pension. Important: The regional coefficient, for example, is 1.2 as a percentage, the value is 20% More details in the Decree of the Government of the Russian Federation 1237 of December 30, 2021 On the sizes of coefficients and percentage allowances and the procedure for their application to calculate the salary of military personnel serving under a contract and employees of some federal executive authorities Pension calculator Salary by position: Increasing salary coefficient by position for class qualifications (for flight personnel): Salary by special rank: Full years of service: Regional coefficient: Disability II gr. Disability I gr. 000 rub.

Conditions for the retirement of an Emergencies Ministry employee

The conditions for receiving old-age benefits for a military personnel differ from the general civilian ones and include the following conditions:

- Must be over 45 years of age.

- The total experience is more than 25 years, which also includes education, military service, etc.

- Work for at least 20.5 years in the Ministry of Emergency Situations.

Important! Law No. 941 of September 22, 1993 regulates the amount depending on the duration of service. It does not apply to employees employed by the Ministry of Emergency Situations; they receive it under general civil conditions.

Certain categories have the right to early retirement because their activities involve a high degree of danger. Who is included here:

- fire truck drivers;

- dispatchers;

- mechanics and engineers;

- fire ship employees;

- spotlighters;

- bosses.

Procedure for leaving a law enforcement officer:

- A report is submitted.

- The length of service count is reproduced.

- A referral to ITU is given.

- A pension case is being opened.

- Funds are transferred through a bank.

How to calculate the pension of the Ministry of Emergency Situations

- It is mandatory for the recipient of a pension from the Ministry of Emergency Situations to have a proper length of service when he retires from professional activity;

- an employee of the organization is obliged to submit an application for calculation of the proper amount of the pension accrued to him;

- when an employee retires and registers for receiving it, he must prepare a full package of documents that are required to receive pension accruals;

- the employee’s length of service at his workplace must be sufficient for the required pension to be accrued to him in the proper amount;

- a specific type of pension is established for an employee of the Ministry of Internal Affairs to receive after retirement;

- it is necessary for the employee to have continuous work experience in order for the pension in the specified amount to be paid to him;

- The calculation of pension accruals for an employee is carried out in full compliance with all stated requirements:

- when calculating pensions for employees of the Ministry of Emergency Situations, it is necessary to accurately determine the type of experience the recipient has;

- recipients of the song are required to provide for calculation documents confirming their right to receive a pension of a specific type in connection with their length of service;

- calculation and accrual of pensions for employees is possible only if the citizen has documents confirming the fact of his Russian citizenship;

- preferential categories of pension recipients include persons who worked in the far north or have a long history of service in the Ministry of Emergency Situations, as well as those who received injuries received during service;

- the presence of special ranks received during service in the Ministry of Emergency Situations is the basis for receiving a pension in excess of the established amount.

- An application to perform this calculation is accepted.

- All documents certifying the status of a firefighter are provided to calculate his pension.

- The service life of an EMERCOM employee as a firefighter must be at least 15 years.

- The calculation is carried out using the calculation coefficient for calculating the pension of this particular category of recipients.

- Firefighters receive the right to an increased pension if they have state awards received during the period of service.

- It is possible to calculate the pension of a firefighter of the Ministry of Emergency Situations at a preferential rate if he has documents confirming that he has a disability of any of the groups.

Pension reform of the Ministry of Emergency Situations in 2021

Experts estimate the extra five years of salary payments at several hundred billion rubles, so the project turned out to be unjustified from an economic point of view.

So in the near future, the reform of the Ministry of Emergency Situations is unlikely to affect the timing of retirement - however, no one guarantees that it will not be remembered when the economic situation worsens again. A similar fate befell the FMS in the same year, whose powers were also transferred to the Ministry of Internal Affairs. And this year it became known that starting from 2021, the existing structures of the Ministry of Emergency Situations will be transferred under the direct control of the ministry. Naturally, this will lead to massive layoffs: up to 10–15% of all employees will be forced out.

Experience for receiving a pension

When applying for an early pension, employees of the Ministry of Emergency Situations must have either 20 years of service or 12 and a half years of service with 25 years of total experience. Prior to special experience, studies in a specialty within 5 years, as well as the period of military service, are counted.

Expert opinion Elena Smirnova Pension lawyer, ready to answer your questions. Ask me a question Service in areas of the Far North or equivalent to the Far North is calculated in multiples (double or one and a half).

According to the Law of the Russian Federation No. 4468-I, employees of the Ministry of Emergency Situations are equal to military personnel and are entitled to appropriate benefits.

The required age limit for taking undeserved rest is 50. The required work experience is 25 years and above.

The legislative framework

Calculation of pensions for employees of the Ministry of Emergency Situations is carried out on the basis of the following documents:

- Government Decree No. 1020 of 12/08/11 on establishing salaries for executive branch employees;

- Order of the Ministry of Emergency Situations No. 762 of December 19, 2011 on establishing salaries for fire service employees;

- Government Decree No. 1237 of December 30, 2011** on the approval of bonus coefficients for employees who served in the Far North and in areas equivalent to it.

** The coefficient size can vary from 1.1 to 2.0. It depends on the place of service.

Management commentary on increasing length of service to 25 years

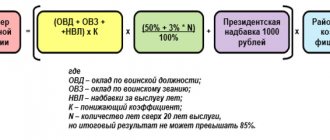

Description of the Ministry of Emergency Situations pension calculator

The calculation and calculation of pensions for employees of the Ministry of Emergency Situations differs from the standard method, since this category of citizens belongs to the rank of military personnel and law enforcement agencies in general. The main feature of working in the ranks of the Ministry of Emergency Situations is the increased risk of the profession, since rescuers and firefighters work in conditions associated with a threat to health and life. Therefore, the state provided a special procedure for calculating the accrued pension. The government has also developed relevant legislation.

The calculation of benefits issued to an employee of the Ministry of Emergency Situations upon retirement is based on the following regulatory documents:

- Order of the Government of the Russian Federation No. 1020 dated 08.12. 2011. With its help, you can determine the salaries of employees working in executive authorities. These salaries are used when calculating the amounts of social charges.

- Order of the Ministry of Emergency Situations of the Russian Federation No. 762 19.12. 2011. This document allows you to take into account the salaries of non-standard regular professions of employees of the state fire service.

- Decree of the Government of Russia No. 1237 of December 30. 2011. The resolution contains the values of the multipliers and percentages. The document also indicates the procedure for using them to calculate funds allocated for the maintenance of contract military personnel. As well as employees in areas with adverse weather or environmental factors.

- State Law No. 93-FZ of April 20, 2015. The law is necessary to control changes in the state budget for the period 2016-2017.

- Resolution No. 941 of September 22, 1993. Controls the procedure for calculating length of service for military personnel.

According to the above documents, an employee of the Ministry of Emergency Situations has the right to receive the following types of pensions:

- Long service pension. This type of payment is assigned subject to the required length of service (more than 20 years). In this case, the pensioner can receive an increase of 50% of the amount of the salary, with an increase of 3% annually (no more than 85% of the total amount).

- Insurance old-age pension. The minimum retirement age to receive this type of payment should be 60.5 years for men and 55.5 years for women. Also obligatory conditions are the presence of contributions to the pension fund and an insurance period of at least 15 years. Persons who hold non-military positions in the Ministry of Emergency Situations can apply for an old-age insurance pension.

- Disability pension. Assigned to employees of the Ministry of Emergency Situations who received serious injuries during their service. To obtain it, a conclusion from a medical commission is required, which determines the disability group, according to which the amount of the benefit paid will be determined. Until reaching a certain age (55.5 years for women and 60.5 years for men), a person must undergo annual examinations to re-confirm the disability group. After the specified age has passed, the group is assigned for life.

- Mixed service pension. An employee of the Ministry of Emergency Situations may qualify for this type of payment if he is dismissed after working for at least 12.5 years due to reduction in service, poor health, or exceeding the maximum service life. Also, to receive a pension, a total work experience of more than 25 years is required and the worker’s age must be more than 45 years. If all conditions are met, the pensioner can receive an additional 50% of the salary and an annual increase of 1%.

Reference! When receiving any type of pension payment, an addition to the amount is due if there are the following awards at the federal level: Hero of Russia; Order "For Merit to the Fatherland"; Order of St. Andrew the First-Called; Olympic champion title.

As we can see, the process of calculating the pension of an employee of the Ministry of Emergency Situations contains quite a lot of features and numerical expressions, which makes the calculation complex and time-consuming. That is why a special calculator program for the amount of pension payments for Emergency Situations Ministry workers was developed. When entering the necessary data, it is capable of automatically calculating the amount of the benefit, taking into account the necessary regulatory documentation.

The program base is equipped with a number of characteristics necessary for calculation:

- positions, special titles and corresponding salaries in accordance with regulatory documentation;

- bonuses for years worked;

- coefficients (regional - ranging from 1.15 to 2.0, decreasing - 54 -72.23%).

Attention! The calculation without a reduction factor will be carried out after 2035.

Using the program does not pose any difficulties, but for a better understanding, let’s consider the procedure for using the calculator.

Indexation of pension benefits for employees of the Ministry of Emergency Situations

The increase in pension depends on two factors:

- inflation rate;

- Pension Fund budget.

In 2021, the state signed a bill that temporarily halted the increase in cash payments due to economic problems. The EMERCOM pension calculator in 2021 took these features into account. From 2021, cash payments are again indexed to take into account inflation.

The head of the Ministry of Finance made a statement saying that the increase in cash benefits for all categories of pensioners would be stopped. And the president promised mandatory indexing.

Federal Law No. 400-FZ dated December 28, 2013 regulates insurance pensions, establishing one mandatory indexation at the beginning of the year and one taking into account the budget capabilities of the Russian Pension Fund.

Length of service in the Ministry of Internal Affairs since 2021: 25 years, latest news

Regional publications talk about the mood of the local police due to such rumors. As it turns out, police officers, especially at the lower level (precinct officers, traffic police lieutenants, etc.), amid talk of an imminent increase in seniority, are leaving the staff of the Ministry of Internal Affairs.

Conveying this decision to military personnel and police officers is a politically difficult task. It is clear that none of those affected by such a reform will like this. And the right moment is needed to announce the reform itself.

MILITARY PENSIONERS FOR RUSSIA AND ITS ARMED FORCES

The currently valid norms of the Law of the Russian Federation of February 12, 1993 No. 4468-1 “On pension provision for persons who served in military service, service in internal affairs bodies, the State Fire Service, bodies for control of the circulation of narcotic drugs and psychotropic substances, institutions and bodies of the penal system, and their families" (hereinafter referred to as Law No. 4468-1) provide for the possibility of dismissal from military service with the right to a pension for length of service (clause "a" of part 1 of Article 13 of Law No. 4468-1) of military personnel and employees who, on the day of dismissal from service, have served in military service and other types of federal public service for 20 years or more (including in preferential terms).

Upon dismissal from military service and other types of federal public service before January 1, 2021, for persons who are subject to the Law of the Russian Federation of February 12, 1993 No. 4468-1 “On pension provision for persons who served in military service, service in internal affairs bodies” , State Fire Service, authorities for control over the circulation of narcotic drugs and psychotropic substances, institutions and bodies of the penal system, and their families,” the right to retire for long service and to be assigned a pension for long service under the conditions in force before joining this Federal Law comes into force.

Pension for employees of the Ministry of Emergency Situations in 2021

When calculating the EMERCOM pension in 2021, the salary for the position specified in the employment contract, rank and increments for additional time worked are taken into account. The total number is multiplied by the inflation factor, and then, if necessary, the salary for length of service is added.

- Access to the state pension is made from the age of 50.

- The total length of service for first and second class rescuers required to retire is 15 years.

- For firefighters of other categories, the total length of service required to switch to state support is 25 years. However, it does not include the process of undergoing practical training, training, or work in a civilian structure.

We recommend reading: Write a Nurse Resume