The government announced an increase in the retirement age to 63 for women and 65 for men. RBC looked into what positive and negative effects this measure would have

Photo: Dmitry Rogulin / TASS

The government on Thursday announced one of the most anticipated reforms of the past few years - plans to raise the retirement age to 65 for men (now 60) and 63 for women (now 55). Prime Minister Dmitry Medvedev spoke about this at a meeting of the Cabinet of Ministers. The document will soon be submitted to the State Duma, where it is planned to be considered in the first reading in the spring session (ends on July 29). According to the Pension Fund, there are now about 43.2 million pensioners in Russia (about 29.4% of the total population).

Why do we need to raise the retirement age?

The government was forced to take such a step by the situation with labor resources - the share of working people “is becoming less and less, there are, accordingly, more and more pensioners,” Medvedev said, and this could lead to “an imbalance in the pension system, to the point that the state will not be able to fulfill its social obligations." Only by raising the retirement age can we “ensure a normal standard of living for pensioners,” he emphasized.

In 1970, there were an average of 3.7 able-bodied citizens per pensioner; in 2021, this figure will be reduced to two people, according to materials prepared for State Duma deputies and members of the Federation Council. By 2044, there will be only 1.5 working citizens per pensioner, calculated the Center for Strategic Research (CSR) of Alexei Kudrin, whose experts prepared proposals to increase the retirement age to 63 and 65 years for men and women.

“Until recently, Russia was the last country in Eastern Europe that did not increase its retirement age in line with rising life expectancy. Current demographic forecasts suggest that the working-age population in Russia will decline by 0.8% in 2019–2020, by 0.5–0.6% in 2021–2022, and so on until the mid-2020s,” Oleg Kuzmin, chief economist at Renaissance Capital for Russia and the CIS, wrote in his review. If we accept the changes proposed by the government, the number of employed people in Russia could grow from 73 million to 74.5 million people by 2023 (under current legislation it will decrease to 70.6 million people), he added.

In the current demographic, economic and institutional conditions, it is impossible to provide pensioners with a decent pension, Liliya Ovcharova, director of social research at the National Research University Higher School of Economics, told RBC. According to her, raising the retirement age in other countries was accompanied by changes in the healthcare system, as well as the implementation of programs to support the employment of older people. “If these measures are not taken, then, of course, there are significant risks associated with the fact that, firstly, unemployment among older people will increase. Secondly, the proportion of people who apply for a pension not for old age, but for disability, may increase quite avalanche-like,” Ovcharova warned.

“63/65” is not the only option that was discussed when deciding on the new retirement age. As sources told RBC, the government was also considering other parameters, in particular increasing the retirement age to 65 years for men and 60 for women, as well as to 62 and 60 years, respectively. The “65/63” parameters chosen by the government are an “extreme” scenario and a “proposal for bargaining,” says Alexander Safonov, vice-rector of the Academy of Labor and Social Relations. First Deputy Prime Minister and Finance Minister Anton Siluanov, at a briefing following the government meeting, refused to consider the adopted option “the most stringent.” The fact is that the government is raising the retirement age in stages, he explained.

Where and how to apply for an old-age pension?

The legislation of the Russian Federation states that financial payments are processed by the pension authority, which is located at the place of registration (residence) of the citizen. Accordingly, if a person has moved to another district or city, he will have to contact the department again. In this case, you must provide the entire package of documentation.

What will you need to apply for a pension? The list should include the following:

- statement;

- residence permit or passport of a citizen of the Russian Federation;

- SNILS document;

- a certificate indicating the average salary for 5 consecutive years up to 2002. In this case, the department that will deal with the registration will pay special attention to data for 2000 and 2001. Since this information was provided by employers and also recorded by the Pension Fund;

a package of documentation confirming the length of work experience. Please note that the papers must contain your full name, date of birth, period and place of work, basis for issuance, position, as well as the date when the document was issued. It is also worth adding here the documents that are issued after dismissal.

In some cases the list may be expanded. The employee of the pension department will indicate which additional documents need to be provided.

If you have any problems or questions, you can count on advice from a PF employee. He must tell you in detail what documents you will need and how to fill them out. After clarification of all questions, the citizen is given 3 months to collect all the necessary papers.

For old times' sake

The government did not equalize the retirement age for men and women, although women in Russia, according to statistics, live longer than men (life expectancy is 77 years versus 66.5 years, according to Rosstat (.pdf) for 2021).

There are no demographic or economic reasons for maintaining the difference in retirement age for men and women, Ovcharova believes. “But it is an ingrained social norm that women have some kind of social bonus for caring for children and the elderly,” the economist said. “Given that women live longer, the retirement age of both men and women should be the same from an economic point of view,” says Ovcharova. Who can retire and when?

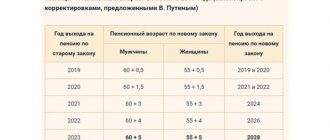

When raising the retirement age, a 10- and 16-year transition period is provided. The increase itself will occur at a pace of “plus one year every year,” follows from the statement of Deputy Prime Minister Tatyana Golikova. The increase will affect men born in 1959 and younger and women born in 1964 and younger. For example, men born in 1959 and women born in 1964 will be eligible to retire in 2021 at ages 61 and 56 (under current rules, they would retire in 2021). Men born in 1960 and women born in 1965 will be able to retire in 2022, at ages 62 and 57, respectively.

Overall, the transition period will last until 2028 for men and until 2034 for women (see infographic). From now on, all men and women who do not belong to preferential categories will retire at the age of 65 and 63, regardless of the year of birth.

The retirement age will also increase for some categories that have the right to retire early. For example, citizens working in the Far North and equivalent areas will be able to retire at 60 and 58 years of age (for men and women, respectively). Now their retirement age is 55 and 50 years. 2.9 million people receive pensions on this basis, it was noted in materials for deputies and senators. The transition period for them will be the same as for retirement on a general basis.

Cheat sheet for the government: how the pension system was reformed in the world Photo gallery

The age for early retirement (for the same five and eight years) will also increase for teaching, medical and creative workers. The social old-age pension, which citizens who do not have the required work experience receive, will also be delayed - from 65/60 years for men and women to 70/68 years. And people with extensive work experience—40 years for women and 45 years for men—will be able to retire two years earlier (this opportunity still exists).

The current amendments do not provide for changes to the length of service required by the military upon retirement (currently 20 years), but the Ministry of Finance, according to Siluanov, believes that it “should also be adjusted.” “We have similar studies with the Ministry of Defense, this will be one of the elements of our proposals,” said the First Deputy Prime Minister.

New requirements for experience

To obtain the right to a pension, a person is required to work for the amount of time established by law. The value of the indicator is reflected in paragraph 2 of Article 81 number 400. In accordance with the regulatory legal act, payments are accrued if a person has 15 years of insurance experience. However, the final value of the indicator will be established gradually. The transition period began in 2015. The indicator will increase by one year over 6 years. The final value will be reached in 2024. The new law will not affect the change in the period of incapacity for work. Corrections were made earlier. The process will follow in the same order.

Note! The law provides for an additional benefit depending on the duration of official work.

If the insurance period for women is 37 years, and for men 42 years, you can go on a well-deserved retirement in old age 2 years earlier.

| Year | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

| Experience requirements | 10 | 11 | 12 | 13 | 14 | 15 |

When calculating the indicator, the period of activity during which contributions to the pension fund were taken into account is taken into account. This happens during official employment. Paragraph 1 of Article 12 of Federal Law No. 400 reflects other deadlines that are also taken into account. This is military service, caring for a disabled person of the 1st group or a child under one and a half years old. If he has limited health capabilities, the law allows the entire period of care to be included in the length of service.

Who will not be affected by raising the retirement age?

The government has identified categories of citizens who will be able to retire on the same conditions as now, Medvedev said.

Among them are those working in harmful and dangerous industries; women who have five or more children; visually impaired people of the first group and military trauma; one of the parents or guardians of people with disabilities since childhood; citizens injured in the Chernobyl accident. How does this relate to life expectancy?

Since the approval of the current boundaries of the retirement age (some of them were adopted in the 1930s, and the basic rules were approved in the 1950s–1960s), “life expectancy has increased by more than 30 years, in addition, both living conditions and working conditions,” Medvedev said. Now this figure is almost 73 years, and by 2030, according to the May decree of President Vladimir Putin, it should reach 80 years.

But at the current retirement age for men (60 years), the probability of 20-year-old men surviving to retirement age is 68%, wrote RANEPA economists Yuri Gorlin, Viktor Lyashok and Tatyana Maleva. With the retirement age increasing to 63 years, the likelihood of living to this age and living a long retirement for Russian men becomes one of the lowest among developed countries (below the level of Ukraine, Bulgaria, Lithuania and Belarus), they emphasized.

Dmitry Medvedev and Anton Siluanov (Photo: Mikhail Japaridze / TASS)

The authorities “dramatically changed the situation in terms of life expectancy since 2000, the situation has changed even more dynamically since 2007, when various national projects in the field of healthcare and demography were adopted,” Labor Minister Maxim Topilin said on Thursday.

Amount of fixed payment to the insurance pension

As of the end of 2021, the fixed pension payment is equal to 4805.11 rubles, which are accrued every month. This amount can be increased if the pensioner is included in the preferential list - then, depending on the category, the amount of the additional payment will be 6246.64-21622.99 rubles. The table shows the categories of citizens who have the right to a monthly fixed payment:

| Category of citizens | Monthly payment amount, rubles | |

| Having no dependents - citizens over 80 years of age or disabled people of the first group | 9610,22 | |

| Citizens of the same category with 1-2-3 dependents | 11211,92-12813,62-14415,32 | |

| Citizens under 80 years of age who do not have a disability of the first group and have 1-2-3 dependents | 6406,81-8008,51-9610,21 | |

| Residents of the Far North (and areas that are equivalent to it) | When using the increasing coefficient, the pension will increase by the specified amount | |

| Citizens, having worked for 15 or more years in the regions of the Far North, and having a work experience for men of 25 years or more, for women 5 years less. | Persons without dependents under 80 years of age and in the absence of disability of the first group | 6246,64 |

| Persons over 80 years of age who have no dependents or have a disability of the first group | 12493,28 | |

| Persons with 1-2-3 dependents under 80 years of age and in the absence of disability of the first group | 8328,85-10411,06-12493,27 | |

| Persons with 1-2-3 dependents over 80 years of age or if there is a disability of the first group | 14575,49-16657,70-18739,91 | |

| Citizens, having worked for 20 or more years in the regions of the Far North, and having a work experience for men of 25 years or more, for women 5 years less. | Persons without dependents under 80 years of age and in the absence of disability of the first group | 7207,67 |

| Persons over 80 years of age who have no dependents or have a disability of the first group | 14415,34 | |

| Persons with 1-2-3 dependents under 80 years of age and in the absence of disability of the first group | 9610,22-12012,77-14415,32 | |

| Persons with 1-2-3 dependents over 80 years of age or if there is a disability of the first group | 16817,89-19220,44-21622,99 | |

- Vitamin E for face for home use

- Chicken in sweet and sour sauce: recipes

- How to reduce a child's temperature

Not the last stage

The pension age bill has yet to pass through parliament and the presidential administration.

The document will be submitted to the State Duma “in the very near future” so that deputies can consider it in the first reading before the end of the spring session, Medvedev said (thus, the main discussion of the reform will take place in the fall). Vladimir Putin, who must put the final signature on the bill, has not previously spoken out clearly about raising the retirement age. “As for the retirement age, you know my position; I have always treated and treat this today with the utmost caution and accuracy. What would you like to pay attention to? One of the key tasks that I have formulated for the government is to increase the incomes of pensioners, and significantly increase their incomes,” he said during the annual direct line in June.

What will citizens and the state get?

After increasing the retirement age, pensions for current pensioners will increase by 1 thousand rubles. per year, Medvedev said. Now insurance pensions are indexed to last year’s inflation level - so, in 2021, the average pension will increase by 481 rubles; in the past two years it also grew by 400–500 rubles. The growth of pensions above inflation is prescribed in Putin’s May decree. Thanks to the change in the retirement age, pensions will be indexed not only on February 1 according to inflation, as before, but then on April 1 (due to additional income), Tatyana Golikova said. But the government does not yet plan to return the indexation of pensions for working pensioners, which was suspended in 2021. Golikova told reporters on Thursday that there is no such measure in the current package of amendments.

“The decision to raise the retirement age is one of the steps to increase the resources of the Pension Fund, which will certainly be used to increase pensions for pensioners,” Siluanov said, without specifying specific figures on the economic effect.

The financial effect of increasing the retirement age will increase from year to year and will exceed 1% of GDP by the early 2030s, Vladimir Nazarov, director of the Research Financial Institute of the Ministry of Finance, told RBC. “In the first year [of raising the retirement age], it will be about 150 billion rubles, then the figure will increase and reach over 1% by the beginning of the 2030s,” Nazarov said. According to him, part of the funds will most likely be used to increase pensions. “At current prices, this will be approximately an increase of 1 thousand rubles. By the beginning of 2030, we will be able to increase the pension to 20 thousand rubles at current prices (that is, adjusted for inflation - RBC), ”the economist noted. If the retirement age increases, GDP may grow by an additional 0.5 percentage points. per year from 2021 to 2028, Kuzmin calculated.

Raising the retirement age could reduce the Pension Fund deficit by “several hundred billion rubles, but will create social and macroeconomic problems,” believes Sergei Suverov, director of the analytical department of BKS Savings Management Company. “In particular, there may be pressure on wages, and consumer demand is also likely to decline,” he said.

Are there any positive aspects to the reform?

It is difficult to answer this question unambiguously, because changes in the law will lead to a lot of negative consequences for the economy and the financial situation of older people and young people.

Some experts believe that the reform will help balance the fund’s budget and “patch” the existing “holes” in it.

Another positive aspect is the planned increase in the amount of payments. However, in this case, the monthly amount received by the pensioner will be supplemented by only one thousand rubles. It is also unclear when the pension increase is expected.

Will there be unemployment?

The economic effect of raising the retirement age in the proposed scenario does not justify the social risks, Safonov believes.

The authorities will be faced with the need for additional expenses to bring the income of unemployed citizens to the subsistence level, he emphasized. “At the same time, a decision is being made to increase VAT (it was increased from 18 to 20%. - RBC), which will affect the income of the population. The real incomes of citizens will fall, and accordingly this will worsen the employment situation,” the expert said. According to him, the likelihood of unemployment rising is “very high.” “Considering that we are now in unique demographic conditions, when a very small generation of the 1990s is entering the labor market, and a huge generation of post-war baby boomers are leaving the labor market, then purely statistically there can be no increase in unemployment,” argues Nazarov . Moreover, it will decline, “because raising the retirement age, even at the stated pace, only closes the [labor] deficit by half,” Nazarov said.

Siluanov assured on Thursday that the government is not abandoning “building an insurance pension system” and is also creating “voluntary pension insurance systems.” He recalled the concept of individual pension capital - a system developed by the Ministry of Finance and the Central Bank and providing for the automatic subscription of citizens to pension contributions, which will increase from 1 to 6% of salary over five years.