For every working citizen, length of service, that is, the period of work activity, is important. The law distinguishes several types of length of service. First of all, this is insurance experience. It should be understood as the periods during which contributions to extra-budgetary funds were made for a citizen.

This is what is needed to assign a pension. In addition, the length of service is highlighted, that is, the total period of work of a citizen, which is currently practically not used. There is also a special length of service, which refers to the period of performance of work of a special nature.

In the context of this article, we will talk about continuous length of service, which previously was of great importance for workers in terms of receiving certain social guarantees.

Retirement Options

In Russia there are 3 options for pension insurance for citizens:

- According to the age.

- Due to disability.

- In case of loss of a breadwinner.

An insurance pension is monetary compensation for citizens who received wages and made contributions, as well as compensation upon the death of a breadwinner for disabled dependent family members. The following are entitled to receive this type of benefit:

- citizens of the Russian Federation insured under Federal Law No. 167 of December 15, 2001;

- disabled persons due to the loss of a breadwinner;

- foreign citizens or stateless persons permanently residing in Russia and insured under Federal Law No. 167 of December 15, 2001.

An employee’s general labor pension consists of an insurance and funded part.

Since July 24, 2009, Federal Law No. 213, when calculating pensions, introduced the concept of valorization, in other words, an increase in the amount of pension capital accumulated before 01/01/1991. For work experience acquired during the Soviet period, citizens receive 10% of the calculated pension capital and plus 1% for each full year worked.

What after 2007

Today, this concept is completely absent from the current legislation. However, long periods of work in one place or in one field of activity may still be important in certain circumstances.

Let's take a closer look.

- For medical workers . Salaries and pensions for medical workers largely depend on length of service. At the same time, the very principle of calculating continuous service has been preserved for them. However, it does not affect the amount of temporary disability benefits, but the salary of medical workers. So, for example, those doctors who carry out medical activities related to working with especially dangerous infectious diseases receive bonuses for each year.

- For workers working in areas with difficult climatic conditions. Citizens living and working in northern areas have a large number of benefits and preferences. Among them are various cash bonuses. For example, persons who work on islands located in the Arctic Ocean have the right to an increase in wages after a certain period of work. Of course, it cannot be called continuous experience in the form that existed before 2007, but the principles of calculation remain quite similar.

- Special cases. Many organizations, both public and private, are interested in ensuring that their personnel remains constant for as long as possible. In this regard, in their local acts they can independently determine additional allowances and bonuses for long service in this position.

It should be noted that this issue is not regulated in any way by law.

Reference! Despite the lack of legal regulation of the issue related to bonuses for long work experience, this point can be spelled out both in local acts of organizations (collective agreement, regulations on bonuses) and in employment contracts concluded between employees and employers.

In addition, long-term work in one specialty and at one place of work can be taken into account by personnel services when assessing the professional suitability of an applicant, as well as when deciding on his hiring.

It is also useful to read: How much northern experience is needed for a preferential pension

Insurance old-age pension

Since January 2015, to receive an old-age pension, 3 conditions must be met:

- Reaching the legally established age.

- Having a minimum required length of experience.

- The number of pension points achieved.

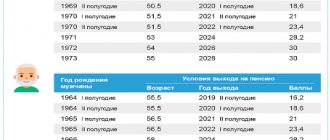

After the approval of the new version of the law on insurance pensions, Federal Law No. 400 of December 28, 2003, women from 60 years of age and men from 65 receive the right to retire. Until this age, a citizen is required to work for 10 years in 2021. With each subsequent year, the rules change, and the minimum total length of service increases. In 2021, his term should be at least 11 years, and by 2024 and later - 15.

Points for receiving a pension are a relatively new concept for Russians; they were legalized in 2015. They are calculated depending on the citizen’s salary level. The average monthly official income of the employee will be taken into account when calculating the pension. For those retiring in 2021, it is enough to score 16.2 points, in 2023 – 25.8. And by 2025, in order to accrue an insurance pension, you must accumulate at least 30 points. This attitude encourages citizens themselves to strive to receive official wages with proportional taxation, and not to rush into retirement immediately after reaching retirement age.

| Year | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 and beyond |

| Minimum experience | 10 | 11 | 12 | 13 | 14 | 15 | 15 |

| Point | 16,2 | 18,6 | 21 | 23,4 | 25,8 | 28,2 | 30 |

The pension assigned by the state directly depends on how long the employee worked and how much he contributed monthly to the Pension Fund. Conscientious employers with legal accounting make deductions from employee salaries on a monthly basis, thus increasing the number of points. From the moment of retirement, points are recalculated at the then current rate. In 2021, the point is equivalent to 87 rubles 24 kopecks.

Citizens who have worked in the Far North for 15 years, and in equivalent areas for 20 years, have the right to early retirement. Men can retire at the age of 60, women - 55. Such citizens upon retirement receive an additional privilege - an allowance for northern experience in difficult conditions. The increasing coefficient depends on the area: for example, among the Karelians the multiplier is 1.15%, and among the Chukchi and those who worked in the Arctic Ocean regions it is 2.0%.

Citizens of Russia with standard experience of 42 years for men and 37 years for women have the right to early retirement, 24 months before reaching retirement age. But in this case, the man must be at least 60 years old, and the woman – 55.

Calculation of pension payments based on northern work experience

To calculate the northern experience, it is worth using the following formula:

FC* PK1+IPK*S*PK2

PF – fixed part; C – the cost of one point – in 2021 is equal to 78.28 rubles; IPC – pension coefficient; PC1 – coefficient for increasing the fixed part as work continues; PC2 is the coefficient for increasing the IPC under similar circumstances (according to the previous paragraph).

The average size of pension (northern) payments in 2021 is 13,000 rubles.

In 2021, the official retirement age among the female population is 55 years. It is during this period that a woman has the right to stop working and receive pension payments. But there are professions that primarily depend on work experience. Therefore, this material deals with the total length of service among the female part of the population to receive pension payments.

What indicators will affect the recalculation

The size of the pension benefit is not a fixed amount, it varies depending on:

- presence or new appearance of dependents;

- exceeding the threshold of 80 years, when the state introduces additional payments;

- the pensioner did not retire, but continued to work and thereby increased the number of accumulated points;

- there have been changes in the cost of living that were legally approved;

- within the region of residence of the pensioner, regional allowances and payments are provided;

- legislators approved the indexation of pension payments to the level of inflation.

If any of these indicators or several change at the same time, the payment amount is recalculated.

Allowances for working over 35 years

Starting in 2021, the Russian Federation will increase the size of pension payments for those men and women who have more than 35 years of experience.

According to calculations by the Pension Fund (PFR), pensioners receive an increase in their monthly pension for the specified length of service. Thus, for 30 to 35 years of service, a pensioner is awarded one pension coefficient for each year of work. And those women who have worked for more than 35 years receive an increase of 5 pension points.

It is important to know! Peculiarities of pension formation in case of loss of a breadwinner

But it is worth paying attention to the fact that the amount of the increase does not imply large sizes. So, the average amount of additional payment is about 1000 rubles.

The authorities plan to pay an additional 500 rubles to the basic payments for each year over 35 years of labor activity. But this bill has not yet entered into legal force.

Additional periods of service

The pension insurance period includes the following periods of activity:

- military service or any other equivalent period;

- the period for receiving compulsory social insurance benefits during periods of temporary incapacity for work;

- child care time from 0 to 18 months, but not more than 72 months in total for all children;

- the period while the person receives unemployment benefits;

- the period allotted to the employee by the employment center under the program of resettlement to another area with subsequent employment;

- unjustified stay in places of deprivation of liberty or detention during the investigation;

- time to care for a disabled person of group 1, an 80-year-old person or a disabled child;

- the period during which the employee was suspended from work on unproven charges;

- the period of stay with a spouse working abroad in diplomatic missions, but for a total period of up to 60 months.

All described periods are added to the length of service if before their onset the employee performed labor duties and deductions were made from his salary to the Pension Fund. Study is not included in the list of periods for increasing work experience. Planned vacations, sick leave and other similar periods are included in the length of service, because mandatory contributions to the pension fund are made from the employee’s vacation and sick pay.

Minimum length of service for calculating pensions from 2018 for military pensioners

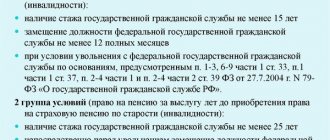

The law defines two main options for military personnel to receive a long-service pension (Article 13 of Law No. 4468-1):

- If your service has reached 20 years.

- If the total work experience exceeded 25 years, of which at least 12.5 years were military or equivalent service.

In the first case, no additional conditions are required to receive a pension. In the second, the serviceman’s age must exceed 45 years, and the reason for dismissal must be reaching the age limit, medical conditions or staff reduction.

As we see, military personnel can retire at a fully working age. If they then work “in civilian life”, they can get the right to a second one, i.e. insurance pension.

The minimum length of service for an old-age pension in this case will be determined by Law 400-FZ in the same way as for “ordinary” pensioners. Other requirements will be similar – i.e. reaching “civilian” retirement age and achieving a minimum score. Those periods of service and work that were taken into account when calculating a military pension, naturally, will no longer be included in the minimum length of service for calculating a serviceman’s labor pension “on a general basis.”

Long-term bonuses

Long service of 30, 35, 40 years does not give the right to receive separate additional payments and pension supplements. The entire period worked by a citizen is taken into account in the initial calculation of payments. The approved law provides for clauses on awarding increasing coefficients for deferring retirement from 1 to 10 years.

Veterans of Labor receive additional payments to their pension, but it is important to take into account the limitation. If the title is awarded in a specific regional subject of the federation, then the bonuses will apply only there; if at the federal level, then throughout the district. To be granted status, a citizen must have:

- more than 20 years of experience for women, 25 for men;

- thanks or certificates from the President of the Russian Federation;

- state orders, medals or titles;

- intradepartmental award, which is included in the list of awards for awarding status.

Where to submit documents

To receive an old-age insurance pension, you should contact the Pension Fund at your place of residence or submit a package of documents to the multifunctional center. If the pensioner continues to work, then there is no need to collect any papers to index payments. The Pension Fund carries out recalculation annually on August 1. When an employee applies for the title of Veteran of Labor, he should contact the social security department.

When calculating an old-age pension, a citizen submits:

- passport;

- work book and other documents confirming periods of work experience;

- salary statement for 5 years of work until 2002;

- certificate of presence of dependents;

- documents confirming the change of last name, first name or patronymic;

- additional documents upon request of the Pension Fund.

If you don't have enough points

Those Russian citizens who have reached retirement age under the new legislation, but have not accumulated the established minimum points, or those who have no work experience at all, will not receive an insurance pension monthly payment. The state accrues a social pension to such persons. To establish and pay it, men must reach the age of 70, and women 65. But the transition is as smooth as the general increase in the retirement age for working citizens.

In the case where a Russian has not reached the new legally prescribed age, but cannot continue professional activities for health reasons, he has the right to collect documents for the award of a disability pension. Those persons who have been identified with serious impairments in their life activities apply for a social disability pension, regardless of how old they are. Workers who have been injured at work or due to other life circumstances also apply for a disability group and a social pension from the state. More information about pensions on Brobank in the Pensions section.

about the author

Klavdiya Treskova - higher education with qualification “Economist”, with specializations “Economics and Management” and “Computer Technologies” at PSU. She worked in a bank in positions from operator to acting. Head of the Department for servicing private and corporate clients. Every year she successfully passed certifications, education and training in banking services. Total work experience in the bank is more than 15 years. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

Comments: 4

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article: Klavdiya Treskova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

- Sergey

06/14/2021 at 18:28 Why do you need a salary statement for 5 years of work before 2002, and not a statement for the last 5 years of work? The amount of payments before 2002 is several times less than in 2021.

Reply ↓ Anna Popovich

06/14/2021 at 20:28Dear Sergey, the list of documents is established by the Pension Fund and is necessary for the correct calculation of the pension.

Reply ↓

04/06/2021 at 10:33

I have been working since 1990. I worked as a hazard in production for 4 years. When should I retire and what is the amount of my pension in rubles?

Reply ↓

- Anna Popovich

04/06/2021 at 18:11

Dear Airat, in order to correctly calculate the period of retirement and the amount of payments, contact the Pension Fund of the Russian Federation contact center in your region (follow this link you can find the telephone numbers of the territorial divisions of the Pension Fund of the Russian Federation).

Reply ↓