More recently, many pensioners of the Russian Federation were able to get acquainted with what awaits them in the future. This applies to new taxes, which will now be mandatory for all citizens of the country. Of course, the majority are against this innovation. But, if you understand this issue well, it will become clear that there are weighty arguments that led the government to such measures. Therefore, now it is worth paying attention to several issues:

Pension tax in Russia 2021: what does it mean?

Tax is part of the money that is paid to the state “voluntarily-compulsorily.” But it is worth noting that thanks to this money, improvements are taking place in the country, and the opportunity to increase wages or pension accruals is provided. Until recently, some part of the population was not subject to such tax collections. But pensioners are most often the most vulnerable members of the state: many are no longer able to provide for themselves, so they need support from other people. Very often, many of them complain about problems that may arise when receiving a pension:

- If the postman brings it, there may be delays, and his life is at particular risk.

- Having a trustee to receive your pension is also a risky option.

- Banks open and close.

- There are no optimal conditions for storing money for all citizens.

- A new card every year means new difficulties in using it.

- If you receive your pension yourself, there is no guarantee that you will get home safe and sound, because scammers are waiting for those who can easily be scammed out of money.

This list can go on for a long time. But it shows that if the state had a common system for receiving pensions, the population would be more protected. Therefore, a decision was made to transfer all citizens to a unified payment system. There will be no additional tax. It only includes card servicing. And such services are paid for by all ordinary citizens of the country who use any cards from different banks. So there's nothing wrong with that. These are guarantees of quality and reliability.

Payment of transport tax

The conditions for assigning transport tax (hereinafter referred to as TN) are enshrined in the Tax Code of Russia (hereinafter referred to as TC).

However, the Tax Code does not have standards for TN for older citizens. In most cases, these benefits are established by municipal authorities.

The Tax Code allocates a portion of vehicles that are not subject to taxes . These types of transport include:

- rowing (or motor) boats with power up to 5 hp. (horsepower);

- wheelchair;

- transport up to 100 hp, which is provided to social protection authorities.

As for benefits for older people, most regions distinguish the following categories of citizens who have the right to receive a discount when paying for TN:

- Heroes of the USSR and the Russian Federation with medals and awards (for example, the Order of Glory of any degree).

- Citizens affected by radiation.

- Disabled people of all types (except group 3).

- Parents of disabled children.

- Residents of the Far North.

- Veterans and participants of the Second World War (Great Patriotic War);

- Citizens with more than one vehicle.

To find out about possible benefits, a pensioner must contact the tax department. Let us give examples of benefits in St. Petersburg and Moscow.

Find out how transport tax is calculated for pensioners here.

In St. Petersburg, older people do not pay tax contributions for one vehicle if the following conditions are met:

- year of manufacture of the car - before 1991, power no more than 150 hp;

- motor boat, cutter or other watercraft up to 30 hp.

It is important to know! Tire Pressure Sensors TPMS

As for Moscow bonuses, pensioners are not provided with transport benefits in accordance with Law No. 33 of 07/09/2008.

TN benefits are of a declarative nature , therefore, an elderly person is required to submit an application to the tax authority. The form should include the following information:

- name of the tax department;

- Full name of the official and the applicant;

- TIN;

- passport information;

- address of registration and actual residence;

- category of pension payments;

- contact information (phone, email);

- the essence of the request;

- reference to the regional law on the provision of transport benefits;

- complete information on transport;

- a list of documents that are attached to the application;

- date and signature.

In addition to the application, the elderly person must prepare the necessary list of documentation, namely:

- Passport details.

- Pensioner ID or certificate.

- Documents for the vehicle.

- Certificates confirming the pensioner’s right to appropriate benefits.

The Government is currently discussing the issue of abolishing the labor tax for pensioners, but this bill has not yet entered into force.

When calculating TN, the following indicators are taken into account:

- Vehicle ownership period.

- Engine power.

- Gross tonnage.

- Transport category.

- Lifetime.

Who will pay this tax and when?

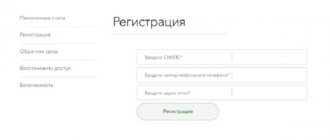

All employees of public sector activities, those who have social benefits from the state, accept government payments, and pensioners have been transferred to the new Russian payment system MIR since 2018. The joint stock company “National Payment Card System” officially appeared in July 2014. But development began back in 2011. Before the payment system appeared on the market, providing money transfer and storage services, it had fully established its operation, taking into account the latest technical developments. First of all, this system meets international quality standards for making secure payments. What are the features of a plastic card?

- The name and logo are the result of an all-Russian vote.

- A hologram is a special square sign that allows you to distinguish a fake from a real card.

- Hidden signs. For example, when scanning a card with ultraviolet light, a currency symbol appears: ruble.

- A distinctive sign of the WORLD card is the application of a pattern.

The pension tax in Russia in 2021 began its work from the beginning of the year. All state employees received new cards in the first half (before July 1), and new clients - from July 1. But after the decree is issued, all pensioners do not need to immediately run to the bank to change their card. Each of them has a certain validity period. As soon as it ends, the card holder needs to come to the branch of the servicing bank. There he will receive a new card from the MIR payment system.

Housing issues

What benefits do old-age pensioners enjoy? The next category of government bonuses is housing. Usually, in order to receive appropriate support, you need to submit a written notification of the exercise of your rights to the Criminal Code.

What can you claim in Russia after receiving pensioner status? Today it is:

- discount on payment for housing and communal services and rent (from 50% to 100%);

- reimbursement of expenses for using a home telephone;

- free emergency home phone installation;

- assistance with gasification at home (free connection outside the general queue);

- exemption (from 80 years old) or 50% discount (from 70 years old) on the cost of major home repair services.

All this is guaranteed, as a rule, in all regions of the Russian Federation. But that's not all. Housing benefits do not end with the listed features.

How much will the funds be deducted?

Pension tax in Russia 2021 is charged for card servicing and will be deducted in the amount of 750 rubles per year. Although at first glance this figure may seem large, only 62 rubles will be withdrawn every month. Although the state made such a decision and introduced a unified payment system, it takes care to index pensions. What it is? Indexation – increasing income. Recently, the Russian government has implemented such a pension increase by 5.4%. And this is not the limit, since in the near future the increase will occur by another 0.38%.

Medicine

The next very important area of human life is medicine. It offers special bonuses to seniors.

The majority of them do not require any registration. It is enough to have an identity card and a pension card with you.

What benefits do old-age pensioners have in the field of medicine? Among them are:

- free provision of medicines (prescription);

- treatment in sanatoriums and resorts (by referral) without payment;

- free service in medical institutions out of turn;

- service in nursing homes and boarding houses without charging a fee;

- supply of dentures free of charge.

As already mentioned, no registration of benefits is necessary. When applying for medical help, you simply need to confirm your pensioner status.

What else do you need to know about the payment system that will provide services?

On the official website of the MIR payment system there is a special section “Participants”. Here everyone can get acquainted with the list and find out which banks are already issuing these cards. In this section, the visitor will be able to clearly see in which places it is accepted and read about what regular partners say about the payment system. The card itself has mandatory elements that allow it to be distinguished from a fake. The 4 main factors were mentioned above. But you should also pay attention to the fact that in addition to the company logo, it should contain the name of the bank that issued the card. It can be of several types. Each pensioner chooses for himself what he wants to open. This will be indicated by a special inscription on the front side. Each card has its own special number, which begins with the 6 digits of the bank identification number. Mandatory rule: owner's name and expiration date. On the back there will be a pattern, a magnetic stripe, a place for a signature, an additional verification code and contact information for the person who issued the card.

Housing

The point is that, under certain circumstances, pensioners can receive housing from the state. Free housing is not provided to everyone. Today the following can apply for it:

- people who do not own any living space;

- needy pensioners (official recognition as such is required);

- persons who have special services to the state (veterans, heroes, etc.).

Accordingly, elderly people of average income cannot hope for free housing. Registration of this benefit is carried out at the city administration or at the regional housing chamber.

Working citizens

Retirement age in Russia comes quite early. The population, even after receiving pensioner status, tries to continue its activities. This not only helps you feel younger, but also contributes to an increase in your pension.

Working pensioners have the right to government support. They may require:

- tax deductions for certain transactions;

- leave without pay at a time convenient for you (the duration depends on the status of the pensioner);

- pension recalculation once a year;

- free advanced training or retraining at the expense of the employer;

- accrual of pension points for the period of employment.

Non-working pensioners also have the right to a tax deduction, but only if more than 3 years have passed since the date of dismissal. Otherwise, this opportunity is lost for persons who do not pay personal income tax (13%).

We arrange tax benefits

Now it is clear what benefits an old-age pensioner has. All listed government bonuses are offered to the entire elderly population. How to apply for tax benefits?

To do this, you will need to contact the Federal Tax Service at your place of registration. The pensioner must bring with him:

- application requesting tax exemption;

- pensioner's ID;

- passport;

- TIN (if any);

- documents on ownership of transport/real estate.

After studying the papers, the Federal Tax Service will exempt the pensioner from taxes. For the changes to take effect from the year the citizen applied, a written request must be submitted before November 1. Otherwise, you will be exempt from taxes from the next tax period.

Financial sector

All citizens of the Russian Federation are granted a pension at a certain age. Benefits for an old-age pensioner will be issued after the person is officially recognized as elderly. Today, having a job does not affect the receipt of most government bonuses.

Old people in Russia also receive financial benefits. Among them are:

- exemption from personal income tax for material support;

- receiving a pension;

- increasing the insurance portion of pension payments at a certain age.

As already mentioned, under certain circumstances and needs, citizens will be helped to ensure a living wage in the region.

Transport

The benefits provided to old-age pensioners often depend on where exactly the family lives. Special attention needs to be paid to the transport sector.

The thing is that today in Russia they are talking about the abolition of transport benefits for pensioners. This measure was adopted in most regions. But in some cities, older people were not deprived of government bonuses in this area.

Elderly people have the right to:

- free use of public transport;

- purchasing tickets for suburban transport out of turn;

- travel on commuter vehicles without charging a fee (usually after 80 years of age).

It is important to note that benefits (if any) do not apply to route and regular taxis.

Deductions

You should also pay attention to the preparation of tax deductions. They are provided to all working citizens who pay 13% of personal income tax to the state treasury. Pensioners receive this support according to general rules.

They must bring with them:

- application requesting a deduction;

- identification;

- registration certificates;

- work book;

- income certificates (usually in form 2-NDFL);

- tax return;

- documents providing grounds for receiving the deduction (mortgage agreement, purchase and sale agreement, etc.);

- details of the account to which funds should be transferred.

After a detailed consideration of the request, pensioners can wait for a response from the Federal Tax Service regarding the provision of a deduction. If everything is done correctly, the money will arrive in your account in approximately 1.5-2 months. It is clear what benefits an old-age pensioner has.