Due to the fact that in the Russian Federation, during its existence, pension reform has already been carried out three times, it is difficult to understand how payments are calculated, what the pension consists of, what kind of innovation is pension points, and how to ultimately calculate the amount of payments for retirement. speaking, it's a bit complicated.

This article is intended to clarify the questions of what pension points are, how they are calculated for different time periods, from Soviet times to today, what is the maximum number for calculation, and how many of them are needed for retirement.

Formulas for calculating pensions are given and the pension calculator and the rules for its use are described. The article will be relevant to all persons planning to retire in the foreseeable future and who want to know what payments they can count on.

What is a pension point and why is it needed?

The IPC is a numerical expression of how a person’s given working year is valued. Depending on the type of work performed, this value may vary. In addition to work activities, points are also awarded for types of activities specified by law that provide public benefit.

This includes parental leave, and for each subsequent child the number of pension points increases. So, for the first child 1.8 points are awarded, for the second 3.6, for the third and for subsequent children, no matter how many there are, 5.4 points per year, respectively. Military service is assessed at 1.8 points per year, as is caring for a disabled person of the first group.

When carrying out calculations for the joint venture, the value of fixed payments is summed up with a coefficient that takes into account how late the person retired relative to the minimum possible age, as well as the sum of pension points multiplied by their current ruble equivalent.

That is, if an employee accumulates a lot of pension points for his work activity, then he can count on large insurance payments when retiring.

General information about pension payments

The main problem in understanding the calculation of payments lies in its heterogeneous structure. Formally, these are two elements: an old-age insurance pension and a fixed payment. The insurance part is formed by savings earned by:

- until 2002;

- 2002-2014;

- since 2015;

- during non-insurance periods.

The fixed payment in 2021 amounted to 4,982.90 rubles.

Important! The amount of payment for different categories of recipients is regulated by Articles 16.17 of the Law “On Insurance Pensions” No. 400-FZ.

Who is eligible for a long-service and old-age military pension in 2018?

General reasons for exit clearance:

- age;

- required duration of insurance period;

- the corresponding number of pension points.

How pension points are calculated

Points can be awarded only if the employee works officially and makes payments to the Pension Fund, as well as in some cases provided for by law, when a person is involuntarily unemployed, namely:

- while in custody;

- during military service;

- being on maternity leave;

- care for disabled children, disabled people of the first group and people over 80 years of age;

- being in the status of officially unemployed;

- periods of incapacity;

- some other cases provided for by law.

The number of points received for work is directly proportional to the so-called “white” salary; how to calculate them will be given below in the text.

What are pension points and how they are calculated

Points are awarded by Pension Fund employees and depend on a number of factors.

First of all, the number of accumulated IPC points is influenced by what type of savings is chosen by the citizen. If he chooses an exclusively insurance type of pension, then the maximum number of points that can be awarded to him in 2025 will be 10. In 2021, while the process of increasing the minimum number of IPC is not completed, a working person can be awarded no more than 8.6 points per year.

https://www.youtube.com/watch?v=ytpolicyandsafetyru

When a future pensioner chooses a combined option that combines both an insurance and funded pension, the maximum number of points is reduced to 6.25. This is due to the fact that more than a quarter of contributions paid to the Pension Fund of Russia went to the funded part.

Attention! Currently, this issue is not relevant due to the freezing of this type of pensions.

Savings contributions were frozen in 2014, and since then this moratorium has been extended annually. Last year 2021 The President signed a decree on a new extension of the moratorium until 2021.

True, a potential retiree has the opportunity to significantly increase the number of points earned by voluntarily delaying retirement. The longer a citizen continues to work and does not apply for a social pension, the more bonus points he is awarded. For example, a person applies for an insurance pension only 5 years after he reaches the required age, then the number of IPC points accrued to him automatically increases by 45%.

Has an individual pension point and monetary calculation. For 2021, one point “costs” 87.2 rubles, and its value is growing every year. The price of IPC is increased to compensate for the depreciation of the national currency as a result of inflation.

Expert opinion

Elena Koshereva

Pension lawyer, ready to answer your questions.

Ask me a question

For example, in 2015, a pension point cost 64.1 rubles. The amount of the insurance supplement to the basic pension is the product of the total number of earned IPC points and the cost of one point.

The IPC was introduced by Federal Law No. 400, which came into force in 2015. It is a kind of abstract indicator for financial and statistical calculations, which has a specific monetary expression - value. They were introduced to simplify calculations when calculating insurance pension payments.

The procedure for calculating PB depends on a number of indicators:

- The amount of insurance experience. The longer it takes for money contributions to be transferred to the PFR insurance fund, the more points will accumulate in the account of a given citizen.

- Salary amount. The employer transfers to the Pension Fund an amount equivalent to 22% of the employee’s salary. Consequently, the higher a citizen’s wages, the faster the IPC will accumulate in his personal insurance account.

- Additional factors for which points can be awarded are caring for children, the disabled, the elderly, and conscript service in the Armed Forces of the Russian Federation.

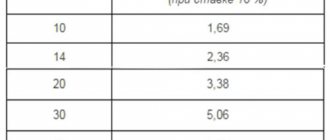

The monetary expression of the IPC is not a constant value: their monetary expression changes annually. Starting from the moment of introduction, their price increases in proportion to inflation rates. Initially, in 2015. the price was 64 rubles. Cost of 1 pension point in 2021 is already 87.2 rubles, and its price is expected to be indexed in the future. Below is the change in the price of the IPC from the moment of its introduction to the present.

| Years | Cost (in rubles) |

| 2015 | 64,1 |

| 2016 | 74,2 |

| 2017 | 78,6 |

| 2018 | 81,5 |

| 2019 | 87,2 |

| 2020 | 93 |

| 2021 | 98,8 |

| 2022 | 104,7 |

| 2023 | 110,5 |

| 2024 | 116,6 |

Pension legislation sets an upper limit on the number of pension points that a citizen can accumulate in one year of work. In 2021 the maximum number of PB that a Russian can accumulate in 12 months is 9.13 points. Since the introduction of IPC, there has been a constant increase in this maximum amount. The increase should end in 2021, when this figure reaches 10 PB per year. The dynamics of this growth are as follows:

- 2016 — 7.8

- 2017 — 8.6

- 2018 — 8.7

- 2019 — 9.13

- 2020 — 9.57

- 2021 — 10.

Restrictions on the amount of point accumulations have been introduced in accordance with the maximum salary from which contributions to the Pension Fund of the Russian Federation insurance fund are made. In 2021 the ceiling for deductions is 74 thousand rubles. and will increase slightly until 2021. Pension contributions in excess of the specified amount are not paid.

In relation to private entrepreneurs and self-employed citizens, the point system for calculating pensions has its own nuances. If the employer makes contributions to the Pension Fund for hired employees, then individual entrepreneurs transfer the funds for themselves. That is, the entrepreneur acts simultaneously as both the insured person and the policyholder. The amount of deductions is fixed and is established in accordance with Art. No. 430 NKRF.

The minimum base for calculating deductions is the minimum wage established in the country. That is, in 2021, the individual entrepreneur is obliged to transfer monthly interest on the amount of 9.48 thousand rubles to the OPS system. At the same time, the entrepreneur, at his own request, has the right to make large payments.

Here the same rules apply to him as to other citizens (data for 2021):

- The maximum possible number of accumulated PBs per year is 9.13.

- The legal age limit has been reached.

- There is a minimum work experience in years and insurance - in the IPC.

Expert opinion

Elena Koshereva

Pension lawyer, ready to answer your questions.

Ask me a question

If the above conditions are met, the entrepreneur has the right to count on accrual of insurance from the state.

pensions according to size

from the accumulated IPC.

Formula for calculating pension points

You can calculate the points assigned to a person in proportion to their salary for the year as follows:

IPC = SV / SVmax*10

In this formula, SV means insurance premiums accrued to the Pension Fund of the Russian Federation, amounting to 22% of total earnings, excluding tax, or 16% (optionally 10% in the presence of a funded pension, to choose from) in the case of an individual account.

CBmax is an indicator of maximum contributions at 16% of the taxable base. The size of this base is indexed annually, for example, in 2021 it was 796 thousand, in 2021 – 876 thousand, and in 2021 1.021 million rubles.

This formula explains why it is profitable to receive a so-called “white” salary. The IPC in this case is formed exclusively from insurance premiums paid in the presence of exclusively official employment.

How to calculate pension points for Soviet service

The difficulty in calculating points for work during the Soviet era lies in the fact that in order to calculate points, it is necessary to provide documentary evidence of the fact that the work took place, indicating its type, its duration, the salary paid at that time, as well as a number of other factors.

At that time, all information was recorded exclusively on paper, with the resulting disadvantages - the possibility of damage and loss. Soviet service includes military service, maternity leave, and some other types of activities provided for by law that have social significance or forced absence from work.

Payments for Soviet service are made as follows: 1% of the amount of the accrued pension for each year of confirmed service. That is, having 3 years of Soviet service (before 1991), a pensioner receives a 3% bonus, 15 years - a 15% bonus, respectively.

The detailed methodology for calculating Soviet (before 1991) and post-Soviet (1991-2001) length of service is reflected in the provisions of Federal Law 173 “On Labor Pensions in the Russian Federation”. This document contains not only the standards themselves, but also formulas with examples of calculations.

How to calculate pension points before 2002

According to the decree of the President of the Russian Federation, regardless of length of service and documents provided, for the period from 1991 to 2001 inclusive, pensioners receive a 10% increase to the existing pension.

This means that in this case it is not necessary to confirm the presence, duration of employment and the amount of wages for the specified period. The period from the times of the USSR to the end of 2001 is conventionally called the Soviet-post-Soviet period.

From 2002 to 2014, calculations are carried out based on the amount of salary deductions actually paid by an officially employed employee in a given period of time. This figure is multiplied by the indexation coefficient, resulting in the size of the pension capital.

After which, this amount is divided by 228 and by the pension point coefficient, which was 64.10 rubles at the time of 2015. The arithmetic is somewhat confusing, but if you figure it out, there shouldn’t be any difficulties with the calculation.

Pension calculation in 2021.

Calculation of pensions in 2021.

You can calculate the size of the pension accrued in 2021 using our pension calculator from 45-90. What distinguishes it from all others, including the PFRF calculator, is that it takes into account all periods of a citizen’s working activity and calculates the real, not hypothetical, amount of pensions. To carry out related calculations - determining the average monthly salary for any period before 2002 and finding the average monthly salary coefficient (AMS), as well as the amount of pension capital earned for the periods from 2002 to 2015, you can use our other calculators.

In order to understand how a pension is calculated and what its size depends on, it is important to know the basic principles of the formation of pension rights, as well as the key details and features of the calculations, which are described below.

General parameters that will be used to calculate pension amounts in 2021.

- The minimum required insurance period to qualify for an insurance pension in 2021 is 9 years. (In 2021 – 8 years).

- The minimum required IPC to obtain the right to an insurance pension in 2021 is 13.8. (In 2021 - 11.4).

- The cost of one pension coefficient ( SPK ) in 2021 is 81 rubles 49 kopecks (In 2021 - 78 rubles 58 kopecks).

- The size of the fixed payment ( FB ) to the old-age insurance pension in 2021 will be 4,982 rubles 90 kopecks . (In 2021 - 4805 rubles 11 kopecks).

What parts does the pension consist of and how is it calculated.

The basic pension that a citizen will receive upon retirement in 2021 will consist of an “Old Age Insurance Pension” and a “Fixed Payment”.

Fixed payment to the insurance pension (IF).

A fixed benefit ( FB ) is added to the old-age insurance pension for all pensioners without exception. Its size in 2021 is 4,982 rubles 90 kopecks.

The law (FZ-400) defines the PV as follows: “A fixed payment to an insurance pension is provision for persons entitled to an insurance pension in accordance with this Federal Law, established in the form of a payment in a fixed amount to an insurance pension.”

For northerners, disabled people and a number of other beneficiaries, an increased fixed payment is provided. Details are described in Article 17 of Federal Law-400 .

Parts of the old-age insurance pension ( SPst )

The old-age insurance pension ( SPst ) is formed from four parts - three correspond to different periods of a citizen’s working activity, and the fourth is accrued for other periods equated to the insurance period.

The insurance pension consists of:

- part of the insurance pension earned for periods before 2002.

- part of the insurance pension earned for the periods from 2002 to 2014.

- part of the insurance pension earned for periods after 2015.

- part of the insurance pension accrued for other (non-insurance) periods.

Individual pension coefficient (IPC)

Since January 1, 2015, the pension rights of citizens are measured and taken into account by the value of the individual pension coefficient (IPC) in points . To calculate the size of the pension in rubles, you need to know (calculate, calculate) the value of the individual pension coefficient. When the IPC is known, it is multiplied by the cost of one pension coefficient (point) in the year the pension was assigned and the amount of the “Old Age Insurance Pension” is determined in rubles.

In accordance with the structure of the old-age insurance pension, the IPC is also calculated on the basis of three main terms with the addition of a fourth, which takes into account pension rights for “other” (non-insurance) periods - military service, periods of child care, etc.

IPC = IPC before 2002 + IPC for 2002-2014 + IPC after 01/01/2015 + IPC for other periods.

For each of the specified periods, the IPC is determined and calculated in a different way.

Pension rights formed before 2002

(IPC until 2002)

They depend and are completely determined by three parameters:

- Duration of insurance (work) experience up to 2002.

- The average monthly earnings of a citizen either for 2000-2001, or for any 60 months (5 years) in a row in the period up to 01/01/2002 (whichever is more profitable is chosen).

- The duration of the insurance period was until 1991.

Incorrect accounting or underestimation of any of the listed parameters may lead to an underestimation of the pension amount.

Pension rights earned during this period are first calculated in rubles and then transferred to IPK . A detailed algorithm for calculating the IPC until 2002 is described in the article.

The main problem of calculating the IPC before 2002 for those retiring in 2021 is that the Pension Fund (PFRF) does not have complete information about citizens and their work activities for periods before 2002. Therefore, the value of the IPC before 2002 is , which at your request will display, for example, the Personal Account of the PFRF website, as a rule, does not correspond to reality. If a calculation using a calculator or based on a “manual” algorithm shows a result different from that indicated in the Personal Account, then you will have to prove your case to the Pension Fund of the Russian Federation with official documents confirming your experience and earnings (work book, certificates of earnings, archival documents, etc.). You need to worry about the availability of such documents and their compliance with the requirements of the Pension Fund of the Russian Federation (the necessary stamps and signatures) in advance.

Pension rights formed in 2002-2014.

(IPK for 2002-2014).

They depend and are completely determined only by the size of the pension capital ( PC ), formed from insurance contributions to the Pension Fund of the Russian Federation over these years.

Neither the insurance period - the duration of the periods in 2002-2014, during which insurance contributions were transferred to the Pension Fund of the Russian Federation for you, nor other parameters, have any impact on the size of the insurance part of the pension earned in 2002-2014. (provided that the total insurance period is sufficient to acquire the right to receive an old-age insurance pension). The calculation and assessment of pension rights formed for 2002-2014 are carried out in rubles on the basis of Federal Law No. 173-FZ, which are then converted into IPK .

About how pension rights and IPC for 2002-2014. described in detail in the article.

Information about this period of labor activity and the amounts of transferred insurance premiums is known and recorded on the citizen’s ILS in the Pension Fund of the Russian Federation, since since 2002, personalized accounting has been fully operational in the Pension Fund of the Russian Federation. The value of the IPC for 2002-2014 can be found in your Personal Account on the PFRF website or on the State Services website, but you will not be able to influence or change its size. To control the correctness of the data specified in your Personal Account, the IPC for this period can be calculated either using our special calculator or “manually” based on an algorithm.

Pension rights formed after 01/01/2015

(IPC after 01/01/2015).

They depend and are completely determined only by the amount of insurance premiums received by the citizen’s personal insurance policy in the Pension Fund of the Russian Federation.

From January 1, 2015, after Federal Law-400 came into force, the method of calculating the IPC has changed. For each calendar year, its value began to be calculated using the formula

IPC year - individual pension coefficient determined for each calendar year starting from January 1, 2015; SV year - the amount of insurance premiums accrued and paid for the corresponding calendar year for the insured person; NSV year - the standard amount of insurance contributions for the old-age insurance pension, calculated as follows

NSV year = 0.16 x Prev. Vel. Bases.

Prev. Vel. The base is the so-called “limit value of the base for calculating insurance premiums” - the “ceiling” of the annual salary (cumulative from January 1 of the corresponding year), from which insurance premiums are calculated in the amount of 22%, of which 16% goes to the formation of the insurance pension (if a funded pension was not formed). From amounts exceeding this threshold, insurance premiums are also transferred to the Pension Fund, but at a different rate - in the amount of 10% and they go not to the individual personal account of the citizen, but to the “common pot” of the Pension Fund. The maximum value of the base is established annually by government regulations.

Reference. Values Previous Vel. Bases :

in 2015 - 711,000 rubles; in 2021 - 796,000 rubles; in 2021 - 876,000 rubles, in 2021 - 1,021,000 rubles .

To calculate and evaluate your annual IPC earned after 01/01/2015, you can use simplified formulas

- IPK 2015 = (average monthly salary in 2015 / 59,250) x 10. Cannot exceed 7.39. If it turns out to be greater, it is equal to 7.39.

- IPK 2016 = (average monthly salary in 2021 / 66,333) x 10. Cannot exceed 7.83. If it turns out to be greater, it is equal to 7.83.

- IPK 2017 = (average monthly salary in 2021 / 73,000) x 10. Cannot exceed 8.26. If it turns out to be greater, it is equal to 8.26.

- IPC 2018 = ((earnings for 2021 until retirement) x 0.16 / 163,360) x 10. Cannot exceed 8.7. If it turns out to be greater, it is equal to 8.7.

IPC for other periods.

For socially significant periods - military service, child care and some others, points are also awarded, as a result of which the IPC is formed for other periods . It is charged if the citizen did not work during these periods. The number of points awarded for non-insurance periods, in accordance with clause 12, article 15 of the Federal Law “On Insurance Pensions”, is as follows.

- The coefficient ( IPC ) for the period of military service under conscription, as well as periods of service and (or) activity (work) provided for by Federal Law of June 4, 2011 N 126-FZ “On pension guarantees for certain categories of citizens” is 1 ,8.

- The coefficient ( IPC ) for a full calendar year of another period provided for in paragraph 3 of part 1 of article 12 of the Federal Law-400 is:

1) 1.8 - in relation to the period of care of one of the parents for the first child until he reaches the age of one and a half years;

2) 3.6 - in relation to the period of care of one of the parents for the second child until he reaches the age of one and a half years;

3) 5.4 - in relation to the period of care of one of the parents for the third or fourth child until each reaches the age of one and a half years.”

Final calculation of the pension amount

After the IPC for individual periods, they are added up and the final IPC :

IPC = IPC before 2002 + IPC for 2002-2014 + IPC after 01/01/2015 + IPC for other periods.

With a known IPC, the size of the pension assigned in 2018 is easy to calculate. To do this, the IPC is multiplied by the cost of one pension coefficient and a fixed payment is added to the resulting amount.

Pension = IPC x 81 rubles 49 kopecks + 4,982 rubles 90 kopecks

Notes.

1. The described algorithm for calculating pensions remains unchanged and is applied from January 1, 2015 to the present day.

2. The most important period, from the point of view of the possibility of influencing the amount of the accrued pension, is the period of working activity until 2002. The amount of the pension can be influenced by choosing the most favorable wages for this period (for 60 months in a row) and the length of the insurance period (confirming it necessary documents). To do this, you will have to carefully study the algorithm for calculating pensions for periods before 2002.

3. It is difficult to influence the size of the pension accrued for other periods (after 2002) - all information on the amount of insurance contributions is recorded on the ILS in the Pension Fund of the Russian Federation and is “not subject to appeal.”

4. We have described the old-age insurance pension algorithm. In some cases - with early retirement, northern length of service and other features, additional subtleties may arise in the calculations. Many of them are discussed and sorted out on our forum in the “Communication” section. This is a collective store of knowledge, where you can get hints on how to act correctly in many non-standard situations.

5. Those who took part in the formation of pension savings in a non-state pension fund or management company will additionally receive an addition to the “basic” pension in the form of a “Savings Pension”. However, since the vast majority of citizens retiring in 2021 either did not form a funded pension or formed it in very small amounts, we do not consider it within the framework of this article and will talk about it in other publications.

How to calculate pension points for 2021

To calculate this figure, it is necessary to determine the amount of contributions by the employer to the Pension Fund, calculated based on the money earned during the year, multiplied by a coefficient of 0.16. Although deductions amount to 22%, 6% of them goes to the solidarity portion and is not taken into account.

For example, in the case of a salary of 25,000 rubles. per month, deductions will be:

25000*12*0.16=48000 rubles

Next, you need to divide the received amount by the maximum possible contribution amount for 2021, amounting to 140,160 rubles:

48000/140160=0.34

After which this coefficient is multiplied by 10, the result is 3.4 points for 2021.

How to calculate pension points in 2021

The principle of calculation is similar to that described above, with the difference that the maximum possible contribution amount for 2021 is calculated as follows:

1021000*0.16=163360 rubles

Suppose the average salary of a citizen is 32,000 rubles.

Thus, the deductions will be:

32000*12*0.16=61440 rubles

The coefficient is 61440/163360=0.37, the number of points for the year will be 3.7, respectively.

General definitions and formulas

As can be seen from the table, the IPC completely determines the size of the pension. But to calculate the IPC itself, it is now necessary to calculate the value of each of its components. For insurance periods before 01/01/2015, this is done according to the formula:

Estimated amount of insurance pension/cost of one point + sum of coefficients for each year/coefficients

For insurance periods starting from 2015, the new formula is:

(Number of points per year + sum of non-insurance period coefficients)/coefficients

At the same time, the maximum value of the coefficients by year has been established: For insurance periods from 2015, a new formula:

- for 2015 – 7.39;

- for 2021 – 7.83;

- for 2021 - 8.26;

- for 2021 – 8.7.

Important! Both formulas are working. Each of them applies exclusively to its own period of time: before January 1, 2015 and, accordingly, after.

Procedure for calculating average monthly wages for employees

What is the maximum number of pension points for calculating a pension?

The value of points earned changes in proportion to earnings. However, there is a certain limit above which, regardless of earnings, points are not awarded.

Today, the maximum countable amount of earnings is 1.021 million rubles, and accordingly, the number of points is 8.7, even if a person earned two or three million during the current year.

The maximum amount subject to calculation, and therefore the maximum points, is indexed annually. So, in 2021 the maximum score was 8.26, in 2021 it will be 9.13.

Formula for calculating the insurance part of a pension

For calculations, you can use a fairly simple formula:

RSP=BP*PK+IPK*SPK*PK

Where:

- RSP - the amount of the insurance pension.

- BP is the basic, state-guaranteed part of payments assigned when a person reaches retirement age.

- PC - increasing incentive coefficients accrued for each year that a person works after reaching retirement age, determined for a period of 1 to 10 years, and the constituent figures are from 1.056 to 2.11, respectively.

- IPC is an individual pension coefficient calculated on the basis of insurance contributions.

- SPK is the amount that makes up the conditional value of the point at the present time.

How to calculate pension by points

The individual coefficient for 2021 can be personally calculated using the formula: IPC = StVz: MaxStVz * 10 .

That is, the pension point is equal to the quotient between the amount of insurance premiums for the year and the maximum amount of insurance premiums for the year, which is multiplied by ten.

How to calculate a pension based on points - as an example:

If the salary is 35,000 rubles, the annual salary will be 420,000 rubles. At the same time, the citizen paid 92,400 rubles in insurance premiums (since only insurance premiums in the amount of 22% were deducted, and the funded part was temporarily frozen). The amount of insurance premiums is divided by the amount of insurance premiums from the maximum salary subject to contribution: 1,021,000*22%=224,620.

How to earn a good pension - specific recommendations

As a result, the number of points for 2021 will be 92.400: 224.620 * 10 = 4.1

When retiring, all points accumulated during working life and points accumulated during non-insurance periods are added. Now the amount must be multiplied by the price of one point approved this year and the amount of the fixed fee added. This is how the insurance pension is calculated.

How to calculate the amount of your pension

To make all the necessary calculations, you need to know the following parameters:

- the size of your IPC, that is, the points awarded;

- the size of the incentive multiplier applied individually to a citizen depending on how many years he has worked after becoming entitled to an old-age pension;

- insurance parts introduced in the Soviet, post-Soviet periods, as well as before 2014;

- the presence of grace periods, including military service, work in rural areas (subject to 30 or more years of work experience, followed by residence in rural areas), care for the disabled, including children and the elderly;

- the presence or absence of pension capital at the time of termination of employment.

In order not to bother yourself with voluminous formulas, these parameters are entered into a special pension calculator, and the calculation occurs in a matter of seconds. If you want to calculate it yourself, the easiest way is to use the formula given above in the text.

Pension reform news

Calculation of pension points in 2021

In 2015, the provisions of the Pension Reform came into force, according to which a new indicator was introduced into the methodology for calculating pensions - the IPC (individual pension coefficient), or pension point.

Starting from 01/01/2015, the insurance pension of citizens is calculated according to the formula:

StrPence = PenceB * StPenceB + FixPayout,

where PensB is the number of pension points accumulated by a citizen during his working life; StPensB – the value of 1 pension point, established at the time of payment; FixPayment – a fixed payment to the insurance pension.

In 2021, the size of the fixed payment and the value of the pension point are indexed and amount to:

- FixPayout – RUB 982.90;

- PensB – 81.49 rubles.

The above indicators are used in calculating pensions for citizens who reached retirement age in 2021 or acquired the right to an insurance pension on other grounds (for example, if they have professional experience for teachers, medical workers).

What is a pension calculator

This program allows you to approximately estimate your pension by age, according to the above parameters, without doing complicated calculations yourself.

It is immediately worth noting that the results of the calculations do not necessarily correspond one hundred percent to those that will be obtained during calculations in the Pension Fund of the Russian Federation and will become final upon payments. Therefore, all figures obtained are approximate.

The most useful are the calculators of the Ministry of Labor and the Pension Fund.

For example, the PFR calculator allows you to take into account the following parameters and obtain results taking them into account:

- coefficient for additional experience of 30 years and above;

- child care coefficients, depending on the type of child;

- the size of the official salary;

- type of work activity – entrepreneur, self-employed, hired worker.

What are pension payments

The time has passed when calculating your pension was an easy and simple matter - taking into account length of service and earnings gave people the opportunity to independently “estimate” the amount of future benefits. Pension reform and additional laws laid the foundation for multi-level pension provision for different categories of citizens applying for government payments. A pension is a benefit paid every month to maintain a citizen's standard of living.

Related articles Who can receive the funded part of the pension at a time Who receives a social pension in Russia The right to an old-age insurance pension

A priori, it is believed that a person has no other sources of income, so traditionally pensioners belong to a socially unprotected category of citizens who are hit hard by any negative changes - the economic crisis, the growing level of inflation, rising prices for food and essential goods. An “extra penny” in the form of social payments and average increases to the monthly benefit will help the pensioner’s family budget, so knowledge of the procedure for recalculating pensions is important for every person applying for subsidies.

What changes have occurred in the pension calculator in 2021

Insurance payments to pensioners who are officially not working were indexed, amounting to 3.7%. The cost of the IPC was 81.49 rubles, despite the fact that it was previously planned to value it at 81.96 rubles. Fixed payments for 2021 are 4982.9 rubles. The basis for them is the so-called solidary part of insurance premiums collected from citizens (6% of the 22% collected).

How to use a pension calculator to calculate pension points and calculate your pension

To use the calculator, you just need to enter the appropriate query in a search engine like Yandex or some other; the search results will offer a lot of options, including the one that is on the official website of the Pension Fund of Russia.

As a rule, these programs operate online and do not require any downloads to operate. When making calculations, for processing you will need the data specified in the previous paragraphs of the article, which is entered into the appropriate fields to be filled out.

The most convenient and accurate in calculations is, as already mentioned, the PFR calculator. To use it, follow the following link: https://www.pfrf.ru/eservices/calc/