Is it possible to fire a pre-retirement employee?

This year, issues of protecting the labor rights of pre-retirees have become especially relevant. Due to the pandemic, enterprises and organizations began to lay off staff, and people of pre-retirement age were often hit. What legal guarantees do they have? In 2021, Art. 144.1 “Unjustified refusal to hire or unjustified dismissal of a person who has reached pre-retirement age.” According to it, “an unreasonable refusal to hire a person on the grounds that he has reached pre-retirement age, as well as an unjustified dismissal of such a person from work for the same reasons, is punishable by a fine of up to 200 thousand rubles. or in the amount of salary or other income of the convicted person for a period of up to 18 months, or by compulsory work for a period of up to 360 hours.”

If a pre-retirement employee believes that he was fired illegally and unreasonably, he should contact the labor inspectorate, the prosecutor's office and the court. The employer has the right to dismiss an employee on his own initiative only on the grounds provided for in Art. 81 of the Labor Code of the Russian Federation: liquidation of an organization, reduction in the number or staff of an organization’s employees, etc.

The concept of “pre-retirement” and at what age it is awarded

The need to introduce additional social protection for the population arose with the initiation of pension reform. Now the age at which a person can apply for an old-age pension increases periodically, every 2 years . Many citizens are alarmed by the changes, because the period of their working life is extended.

The legislation had the concept of “pre-retirement” earlier. It concerned those who had 2 years left before their well-deserved pension. The only benefit then was the opportunity to apply for a pension for the unemployed. Who lost their job due to downsizing or liquidation of the enterprise. Now this status applies to people who have 5 or less years left before their well-deserved rest.

The set of changes relating to the pension system is contained in one law - Federal Law-350 , where PP (pre-retirement pensioners) was discussed in the text of Article 2 (clause 6).

“Persons of pre-retirement age (two years before the age giving the right to an old-age insurance pension, including those assigned early)” should be replaced with the words: “citizens of pre-retirement age (within five years before the age giving the right to an old-age insurance pension , including those appointed ahead of schedule).”

It turns out that the 2 year difference was increased to 5 years . Consequently, PP are citizens who have a maximum of 5 years left before they receive an insurance pension.

At what age is a person considered pre-retirement?

| 2019 | 2020 | 2021 | 2022 | 2023 | |

| Men | 56 years old | 57 years old | 58 years old | 59 years old | 60 years |

| Women | 51 years old | 52 years old | 53 years old | 54 years old | 55 years |

Most benefit programs take your general age into account. PP for them is considered to be women - 55 years old (minimum), and men - 60 years old (minimum).

Increased unemployment benefits at age 50 – no limits

Currently, due to the pandemic, the maximum amount of unemployment benefits has been increased to 12,130 rubles. But if for all other citizens this measure is valid until the end of this year, then for pre-retirees the increased benefit amount will remain after January 1, 2021. The period for paying benefits to pre-retirees is also longer. For those pre-retirement people who have been in an employment relationship for at least 26 weeks, unemployment benefits are calculated as follows: in the first 3 months - 75% of average monthly earnings, the next 4 months - 60% of earnings, thereafter - 45%. At the same time, the amount of the benefit cannot be higher than the maximum amount (in 2021 - 12,130 rubles) and lower than the minimum (1,500 rubles). To register it, you need to contact the employment center at your place of residence, where you will be registered as unemployed and the payment will be calculated.

When and at what age do they change their passport in Russia based on age?

The legislator obliged Russian citizens to exchange their old national passport upon the occurrence of certain events. In essence, it is the main document of a person that allows him to be identified.

Every person should have a passport, regardless of their class, gender, or age.

What you need to know

The national passport of a Russian citizen has a uniform format for the entire population of the state. For its design, Russian, established as the state language, is used.

In the republics of the Federation, the passport and birth certificate are supplemented with an insert in which entries are made in their official language.

Important Concepts

| Term | Definition |

| Passport | A properly executed act by which the identity of the bearer is certified. In foreign countries, it is certified by a foreign passport, which is issued by voluntary expression of will. |

| Birth certificate | A public document documenting the birth of a person. Until he turns 14, it serves as his identity document. In accordance with the requirements of the Constitution of the Russian Federation, at this age he is entitled to receive a passport |

Reasons for replacement

Russian citizens are required to change their current passport at the age established by the legislator, taking into account age-related changes occurring in the human body. The older he gets, the more the external features of his face and body change.

| Its first replacement occurs at age 20. | When a person reaches full puberty. During this period, the process of growth and formation of the body ends. In this case, its parameters reach their final value. Characteristic signs of individual traits begin to appear on the face |

| Secondary passport renewal is carried out at the age of 45 years | When the human body is characterized by the physical blossoming of maturity. His external features become somewhat rough, natural wrinkles form on the face, the scalp becomes thinner, the face becomes massive due to changes in the shape of the soft parts of the face |

Go How to transfer the original document from an organization against receipt

| Modification of personal data | As a rule, it is carried out at the request of the person |

| Correcting the date of birth | This kind of procedure is performed in exceptional cases. For example, if incorrect information was entered into the passport by mistake, a spelling error was made, or the entry was not made in accordance with the rules |

| Gender change | It can be produced by a person due to personal choice, which is influenced by psychological factors |

| Damage to a document due to the fault of its owner | Due to the influence of external factors beyond his control |

| Lost document | Regardless of the circumstances under which it was lost by the owner |

| Discrepancy between surnames on birth certificate and passport | What often happens when the civil registry office or the Federal Migration Service is inattentive, the said bodies make mistakes, or inaccurate numbers |

| Other cases | Provided for by existing legal acts. For example, entering into an official marriage with the subsequent change of surname by one spouse to the surname of the second spouse |

Legal grounds

In accordance with the requirements of regulatory legal acts, a national passport must be issued at the age of 14, when a citizen is endowed with limited rights and responsibilities. The norm is provided for by the act - “Regulations on the passport of a citizen of the Russian Federation”.

It provides definitions of basic concepts, explains the rules for drawing up a document and issuing it. It was approved by Russian Government Decree No. 828, which was published on July 8, 1997.

The right to change a surname is established by the provisions of the articles:

- 32 of the Family Code of the Russian Federation;

- 19 Civil Code of the Russian Federation;

- 58 of the Federal Law “On Acts of Civil Status” No. 143-FZ, issued on November 15, 1997.

State duty is one of the types of mandatory payment levied on individuals and legal entities. The fee is paid for the performance by government bodies of legally significant actions in their favor. The issue of its payment is regulated by the standards of Chapter 25.3

Tax Code of the Russian Federation. Its size is determined by the type of service provided to the citizen. For example, 300 rubles are withdrawn for replacing a passport.

The replacement of a passport is carried out on the basis of the provisions specified in the order “On approval of the Administrative Regulations of the Federal Migration Service for the provision of public services for the issuance and replacement of a passport of a citizen of the Russian Federation, identifying the identity of a citizen of the Russian Federation on the territory of the Russian Federation.” The act was issued on November 30, 2010, number 391. It explains the procedure for drawing up a new document.

Go to Examples of good reasons for absenteeism What grounds can justify an employee’s absence

Important aspects

The citizen’s national passport contains information regarding:

- the authority that issued the document;

- the date and place of birth of the citizen, his gender, official marriage status and presence of children;

- registration at the place of residence or removal from it;

- special physiological characteristics of the human body, such as blood group according to the ABO system, Rh factor - Rh factor.

If a citizen submits a timely application for a passport replacement to the FMS office, then it is issued without any complaints from the specified body. But the application must be submitted within one month. The period is counted from the date of the event that became the reason for replacing the document.

If a citizen misses the deadline established by the legislator, a measure of influence in the form of an administrative penalty is applied to him. Citizens are subject to a fine of 2,000-3,000 rubles.

According to the norms, a fee must be paid for the provision of services to citizens by a government body that has legal significance for the citizen. Its amount for issuing a new document is 300 rubles. If it was lost or damaged due to the fault of its owner, then 1,500 rubles are paid for issuing a new passport.

The legislator has not introduced a rule regarding the replacement of a national passport based on gender, so the period for its replacement is the same for everyone without exception.

It is the main document that allows you to certify a person’s identity, his citizenship, and residence permit.

The procedure for exchanging a national passport is carried out in an application form. Citizens must submit an application to the Federal Migration Service to be issued a new document for one reason or another.

The authority is obliged to issue it within 10 days, counting from the date of registration of the application and receipt of the required documents.

form 1P (first page)

form 1P (second page)

If they are submitted through the MFC operator or the official website of the government services portal, then the issuance of a new passport will take up to 2 months. This is justified by the transfer of documents to the FMS, whose functional responsibilities include the preparation and issuance of a new document.

The following documents must be submitted along with the application:

- passport to be exchanged;

- birth certificate;

- certificate of marriage or divorce;

- children's metrics;

- decision on the adoption of children, if such an act was committed;

- payment receipt confirming payment of state duty.

Go to Where you can change your passport as a citizen of the Russian Federation: detailed procedure

Males must additionally present a military ID if they are members of the Russian Armed Forces. The package of documents is accompanied by 2 photographs, a sample of which is approved by the legislator.

With the development of new computer technologies, Russian citizens have wide opportunities to receive services via the Internet. They must submit an application on the official website of the “electronic government”, which provides services to the population of the country.

replacing a passport through the State Services portal (step 1)

replacing a passport through the State Services portal (step 2)

Citizens must:

- register on the website of the State Services portal;

- gain access to your personal account;

- fill out an application form;

- send a request to the service system.

Every Internet user will be able to easily fill out an application for an identity card and send it to the system. The State Services portal maintenance service contains instructions that the user must follow.

With its help, you can correctly compose an application, but you need to be extremely careful when filling out its form.

The procedure for issuing a passport and the requirements for its content are provided for by the legislator. The Office of the Federal Migration Service has developed provisions regarding the period for issuing a passport in its local regulations.

A certain time stipulated by the regulations is allotted for replacing a passport. In accordance with them, it is impossible to replace an old document with a new one before the established deadline.

In conclusion, it should be noted that during the period of the passport exchange procedure, the citizen is issued a temporary certificate that has legal force.

: passport replacement at 45 years old

Family law

Career reboot

If the employment center cannot find a job in your specialty, you may be able to find a job after training. The state has developed a program for retraining and advanced training especially for pre-retirees. It is designed for both the unemployed and those who have a job but want to become more competitive in the labor market. You can get into the program yourself by contacting the employment center, or through your employer. The average training period is 3 months, during which unemployed pre-retirees are paid a stipend in the amount of the minimum wage, and working people are paid a salary. Moreover, the training itself is free for pre-retirees.

How and where to get a pre-retirement certificate

A useful document that can confirm citizenship status. It is an official document and has the seals of the relevant institutions.

It’s easy to get help ; all you need is a computer with a working Internet connection:

1. First, a citizen must register by opening the State Services portal. Through it, most services for providing statements, certificates and necessary information are carried out remotely.

2. Then open PFRF.RU - the official website of the Pension Fund . Log in there by logging in through your State Services account.

3. You need the “Pensions” , there – “Order a certificate “extract”. Next is the tab: “on classifying a citizen as a citizen of pre-retirement age.”

4. You must indicate the key parameters of your request:

· designate the institution where the certificate is needed. For example, the Federal Tax Service, the employer company or the employment service;

· the user wishes to receive the finished file by letter to his personal email.

5. Having completed the procedure, click: “Request” . A window will appear where you need to click on: “Call History”. All that remains is to save the document: “help in PDF format”.

Citizens are not required to provide employers with such certificates. Those can request the paper themselves by contacting the Pension Fund.

Other options. The classic ways to get an extract are to visit the Pension Fund with a passport or the MFC. Managers can clarify the purpose of the request. The procedure is simple and happens quickly.

Regional benefits: transport, housing and communal services, medical services

In addition to federal benefits and guarantees, there are regional social support measures for pre-retirement people. Usually these are preferential travel on public transport, discounts on transport taxes, benefits when paying for housing and communal services and medical services. For example, in Moscow, a pre-retirement person can count on free travel on public transport (except taxis), the metro, the Moscow Central Circle and commuter trains, as well as free production and repair of dentures (except for the cost of precious metals and metal-ceramics), free travel and reimbursement travel expenses (if it doesn’t work and treatment is necessary for medical reasons). Pre-retirement veterans are given a 50% discount when paying for housing and communal services.

Pre-retirements in the Krasnodar Territory also partially have benefits for travel on public transport, and local “Veterans of Labor” are entitled to regional payments and compensation for housing and utility costs. In the Nizhny Novgorod region, the package of benefits is much smaller, but there is a discount on transport tax. For pre-retirees of the Yamal-Nenets Autonomous Okrug, all the benefits that were previously given upon reaching retirement age have been preserved. One of the main ones is a monthly allowance of 2 thousand rubles, but for this you need to work for at least 15 years in Yamal. Non-working veterans of the district can also count on 50% compensation for housing and utility costs and other benefits.

Regional benefits are established by the laws of the constituent entities of the Russian Federation, so they may differ depending on the place of residence of the pre-retirement person. To find out what social support measures are provided specifically in your region, contact the social protection authorities at your place of residence or the MFC.

When to change your passport based on age in the Russian Federation, IiNews

Documents and personal photographs to obtain or replace a passport must be submitted by a citizen no later than 30 days after the occurrence of the circumstances specified in paragraphs 1, 7 or 12 of these Regulations (clause 15 of the Government of the Russian Federation of 07/08/1997 N 828).

“Residing at the place of stay or at the place of residence in the residential premises of a citizen of the Russian Federation who is required to have an identification document of a citizen (passport), without an identification document of a citizen (passport), or with an invalid identification document of a citizen (passport) - shall entail the imposition of an administrative fine in the amount of two thousand to three thousand rubles.”

Who is considered pre-retirement?

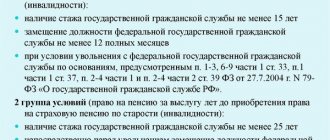

The right to most pre-retirement benefits arises 5 years before the new retirement age, taking into account the transition period. From 2021 onwards, it is used by women born in 1968. and older and men born in 1963 and older. The only exceptions that are not subject to the 5-year rule are tax benefits. They are provided upon reaching the previous retirement age. For most, this is 55 or 60 years, depending on gender, and in the case of early retirees, earlier.

The pre-retirement age of teachers, doctors and other workers, whose right to a pension arises when they complete their special service, occurs simultaneously with its acquisition. For example, a teacher who completes his teaching internship in September 2021 will be considered pre-retirement from that moment.

For those whose retirement age has not changed, they also have the right to benefits 5 years before retirement. For example, for mothers with many children and five children, it occurs from the age of 45, that is, 5 years before their usual retirement age (50 years).

Benefits for pre-retirement age citizens

The fourth stage of social support for pre-retirement and retirement age is receiving benefits. There are preferential conditions for federal purposes, that is, adopted by the law of the Russian Federation, and regional ones, adopted by local authorities.

Below are the main benefits for pre-retirement age citizens of the Russian Federation:

- Preferential taxation on real estate and land tax. In accordance with Art. 407 of the Tax Code of the Russian Federation on the provision of tax benefits to individuals, the taxpayer is exempt from paying property tax in relation to one piece of real estate. Benefits for paying land and property taxes will not be accrued upon retirement, as is the case now, but at a certain age: for a woman at 55 years old, and for a man at 60 years old.

- Partial exemption from personal income tax. In Art. 217 of the Tax Code of the Russian Federation lists all types of payments for which personal income tax is not calculated; this income mainly includes all payments and compensation from the Pension Fund, as well as material assistance.