Home > Types of pensions

- Collapse

- Expand

Article navigation

- Pensions for compulsory pension insurance Insurance (labor) pensions Old age

- By disability

- On the occasion of the loss of a breadwinner

- Social pensions

7 623

The first step towards innovations in pension provision was the creation of a personalized accounting system , which made it possible to record all data on citizens’ work experience on their individual personal accounts. This accounting system subsequently became the basis of pension insurance.

Reforms in the late 90s and early 2000s led to the creation of a three-tier pension system, in force since 2002. It includes compulsory insurance , state and non-state support.

Economic development has led to the creation of another element of the pension payment system - a funded pension, the purpose of which is investment , and not current expenses for pension provision.

The improvement of the pension payment system was enshrined by our government in a document such as the Strategy for the Long-Term Development of the Pension System. A new law No. 400-FZ of December 28, 2013 “On insurance pensions” was also adopted. The new rules have increased the importance of length of service when calculating future pensions. In addition, later retirement increases the size of your in the future.

Regulatory regulation

There are several regulations containing information on the rules for assigning pensions and benefits to Russians. These documents include:

- Constitution of the Russian Federation . Based on Art. 39 Every Russian citizen has the right to social security based on age. It can be prescribed in case of deterioration of health or disability, as well as the loss of a breadwinner. Appropriate benefits are provided to women who have given birth to children. All pensions and benefits from the state are regulated by law. At the same time, voluntary social insurance and the formation of additional security are encouraged.

- Federal Law No. 166. This regulatory act contains information about all types of state pensions, and also establishes categories of benefit recipients. The basic conditions for assigning payments, as well as the procedure for their execution, are given.

- Federal Law No. 165 . It includes data on compulsory pension insurance in Russia. These legal requirements must be taken into account and fulfilled by all entrepreneurs who officially employ citizens.

- Federal Law No. 4468-1 . It is intended to determine the pension of military personnel, fire inspectors, police departments or other similar departments. Persons working in these organizations have the right to special concessions and benefits when applying for state pensions.

Additional details are contained in smaller regulations. Some adjustments are made by local authorities, but they must not conflict with the requirements of federal laws.

Free legal consultation

+7 800 350-51-81

State old age pension

This type of payment is due to citizens who suffered as a result

radiation exposure or man-made disaster.

The most common category of such citizens are persons associated with the Chernobyl accident (liquidators, disabled people, persons living in the contaminated area, etc.). This payment is also available to persons living in areas with severe climatic conditions.

Depending on the specific category, a certain age is established for such citizens, after which they have the right to receive assistance. It is 5-10 years younger than the age required for labor and insurance pensions.

However, such persons are still subject to requirements regarding their minimum work experience. As for the size of the pension, it is set as a percentage of the social pension - 200 or 250%, depending on the specific category of citizens.

You will learn how to calculate your average daily earnings in this article. Are you not getting unemployment benefits this year? Find out the reason!

Read about the benefits and benefits for a labor veteran by following the link.

What is it and what types of security are there?

A state pension is a cash benefit from the state that is paid monthly. The state offers citizens different types of benefits, differing in size, rules of assignment and recipients. These include :

- old age pensions , which can be insurance or social, and are assigned upon reaching a specific age;

- according to length of service , but such payments can only be received by people working in specific professions;

- for the loss of a breadwinner , if the remaining family members cannot provide for themselves financially;

- for disability when health conditions deteriorate.

Civil servants are offered certain concessions when applying for pensions.

Reference! Some individuals may receive two payments at once. For example, disabled people who were injured during military service receive not only a disability pension, but also an old-age pension.

By old age

Elderly people cannot continue to work, so the state fully provides for such citizens. This type of social benefit is the most popular in Russia. It is prescribed for men aged 65 years and for women aged 60 years. But to process the payment, certain requirements for length of service and pension points must be met.

It is prescribed under the following conditions :

- Reaching the required age. Some individuals may be able to retire early if they work in specific fields. The list of such professions has been approved by the Russian Government.

- Experience. Its duration cannot be less than 15 years. Moreover, in 2017, it was required to officially work for only 8 years, but due to changes adopted in pension legislation, this period was increased by another 7 years.

- Odds. By retirement age you must accumulate at least 30 points. They are calculated annually based on the amount of insurance premiums paid by employers.

Attention! If even one of the conditions is not met, this becomes the reason for refusal to apply for an insurance pension. Under such conditions, an elderly person will have to work for another 5 years in order to receive a social benefit. It is equal to the subsistence level, and therefore does not provide an optimal standard of living for a pensioner.

By length of service

Such a pension is assigned only to certain categories of workers who have reached a certain level of output. This applies to employees of budgetary federal institutions, test pilots, astronauts and military personnel, as well as employees of medical and educational organizations.

First, such persons receive a long-service payment, and after reaching the age of a pensioner, they have the right to additionally apply for an insurance pension.

By profession

To receive a service pension, you must have specific length of service.:

- Astronauts. Men need to work for 25 years, and for women the length of service is reduced to 20 years. If a citizen works as a flight crew, then it is necessary to officially work for 10 years for men and 7 years for women.

- Test pilots. The length of service for men must be 25 years, and if a person is involved in flight work, then the period of work is reduced to 20 years. Women must work for 20 or 15 years, depending on their place of work.

- Military personnel. Persons who serve in the military can receive long-service benefits after 20 years of service.

- Federal government employees. The conditions for receiving a state pension change regularly for them. They need to work for at least 20 years to receive a monthly payment in 2026

- Workers of medical and educational institutions. For them, production varies from 25 to 30 years, and the exact period depends on the specifics of the work and the position held.

Important! The pension is assigned on an indefinite basis, so it is paid to the citizen for the rest of his life. Accrual is carried out from the first day after submitting the application.

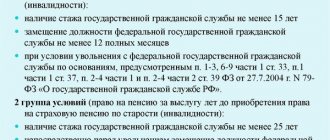

Civil servants

They have the right to receive a pension based on their production. To appoint it, you do not need to contact PF representatives, since the application is submitted to the HR department employee at the place of employment. The benefit is paid every month, and it is accrued from the moment the application is submitted.

Civil servants can receive both service and old-age pensions at the same time.

To receive benefits, an optimal length of service is required, which is 20 years. To submit an official application, you must have worked in a federal government agency continuously for one year.

The size of the payment depends on earnings for the last year of official work . Additionally, the exact number of years worked is taken into account. When calculating average monthly earnings, not only salary is taken into account, but also other cash receipts, which include bonuses, allowances or other payments from the employer.

If the minimum length of service required to apply for a pension is accumulated, then the payment is 45% of earnings, and if more years are worked, then 3% is added for each additional year.

By disability

This state payment is assigned to persons with a registered disability group, and their work experience must be at least 1 day. Upon receipt of this benefit, a person has the right to continue working.

A citizen is recognized as disabled based on the results of a medical and social examination . Documents confirming his status are transferred to PF representatives to assign payment. It is paid monthly, and additional payments are provided if there are dependents. If a disabled person lives in the north, then the regional coefficient is taken into account when calculating his benefit.

Reference! The benefit is paid until the disability is lifted or the age at which the citizen can apply for an old-age payment is reached.

For the loss of a breadwinner

It is paid to family members of a deceased serviceman, astronaut or citizen who suffered in a radiation or man-made disaster. Recipients are only disabled persons who cannot provide for themselves financially .

The benefit is paid until the recipient becomes able to work. It is appointed from the 1st day of the month during which the application is submitted.

Social pensions

They are assigned only to disabled citizens who cannot provide for themselves. These include the following persons :

- disabled people of three groups, but their payment amounts differ;

- disabled since childhood;

- disabled children;

- orphans.

Additionally, such a payment is made by persons who, upon reaching the age of a pensioner, were unable to accumulate the required number of pension points, and also do not have the necessary length of service.

Old age pension: concept and legislative framework

An old-age pension is a monetary benefit that is assigned to disabled citizens after they reach the legal age. At the moment, the procedure for their application and calculation is regulated by the following regulations:

- Federal Law “On Insurance Pensions”;

- Federal Law “On state pension provision in the Russian Federation”;

- Federal Law “On Labor Pensions in the Russian Federation”.

The latest document has not been applied since the beginning of 2015, with the exception of some rules that are related to the calculation of the amount of labor pensions.

Old age pension is divided into three types:

- insurance;

- state;

- labor

The terms of appointment and the payment procedure for each of them are worth considering in more detail.

Amendments to the Constitution

In 2021, constitutional amendments were adopted that relate to pensions. These include :

- the principle of universality and fairness regarding the assignment of pension benefits was established;

- the concept of “solidarity” was introduced, according to which pensioners should be provided for not at the expense of public funds, but with the involvement of pension savings of able-bodied citizens;

- indexation will increase with economic growth, therefore it cannot be less than the inflation rate, and it must be carried out at least once a year;

These amendments have already entered into force and are valid on the territory of the Russian Federation.

Social payments of the Pension Fund

Pension Fund bodies provide a number of social payments to certain categories of citizens:

- Social supplement. It is established for non-working pensioners if the amount of their financial support does not reach the minimum level in their region.

- Monthly cash payments. Assigned to certain categories of citizens: veterans, heroes of the USSR, the Russian Federation, holders of the Order of Glory, disabled people, former minor prisoners of concentration camps and victims of radiation.

- Set of social services. It is established without a declaration for citizens who have been assigned EDV. It includes three components: medical, sanatorium and resort and transport. You can receive NSS both in kind and in cash equivalent.

- Additional monthly financial support. Paid to citizens of the Russian Federation in the amount of 1,000 rubles (disabled persons and participants of the Second World War, former minor prisoners of fascism) or 500 rubles (those who served in the active army in 1941-1945, widows of those killed in the Second World War, former adult prisoners of fascism and those awarded the “Resident” badge besieged Leningrad).

- Supplement to pension for individual citizens. It is an independent payment, that is, it does not depend on the type and size of the established pension. Flight crew members and coal industry workers have the right to it if they have the appropriate length of service and only if they quit their jobs.

- Payments for caring for disabled citizens , disabled children and disabled people of group I since childhood. Established for one unemployed citizen for each disabled person. The payment can be compensatory (in the amount of 1,200 rubles for caring for a group I disabled person or a person over 80 years old) or monthly. The latter is assigned to a parent or guardian in the amount of 10,000 rubles (the rest in the amount of 1,200 rubles) for caring for a disabled child or a person disabled since childhood of group I.

- Social benefit for funeral. Compensates for expenses associated with the funeral of non-working pensioners, and is assigned provided that citizens apply for it within six months.

- Maternal capital. Issued once only to citizens of the Russian Federation at the birth or adoption of a second child or subsequent ones. You can use the capital after the child turns three years old to improve living conditions, educate the children, or the mother’s funded pension. The state also provided for one-time payments from these funds.

Cumulative part of pension

At the request of the employee, instead of an insurance form of security, he can choose a funded option (legislation provides this opportunity to persons born under 1967). In this case, he needs to notify the Pension Fund about this by writing a statement in free form. After this, part of this person’s pension contributions will be transferred to a management company or non-state fund. The table shows the differences in the structure of contributions for insurance and funded pensions:

| Type of pension provision | General 22% premium | ||

| Joint tariff, % | Individual tariff, % | Cumulative tariff, % | |

| Insurance | 6 | 16 | 0 |

| Cumulative | 6 | 10 | 6 |

Those who choose this security need to know that the funded part of pension contributions is not subject to state indexation, so in the end it may turn out to be unprofitable. At the same time, in Russia the moratorium on the formation of funded pensions has been extended until 2021. In practice, this means that, regardless of the chosen type of security, all contributions from citizens will be directed only to insurance needs (including payments to current pensioners). Current savings in the accounts of non-state funds are not canceled and will be compensated upon completion of the moratorium.

Mandatory pension insurance

An employee's right to a pension is determined by special contributions made from his salary. These contributions to the Pension Fund of Russia (PFR) are made by the enterprise's accounting department (but in some cases, for example, for individual entrepreneurs, private lawyers, farmers, the individual independently transfers the necessary funds).

The obligation to make contributions to the Pension Fund of the Russian Federation applies to both employed citizens of our country and to foreigners and stateless persons working here. All these employees are considered registered in the compulsory pension insurance system (MPI), therefore, in the event of an incident (injury, death, etc.), they themselves or their relatives will receive state social payments. The amount of contributions is 22% of the accrued salary. By default, these funds are distributed as follows:

- For the formation of an insurance (otherwise known as labor) pension – 16%.

- To create the savings part – 6%. This type of social security is not mandatory and can be waived by allocating all funds to the insurance portion.

The assignment of a labor pension to a specific person (or his dependents) requires the fulfillment of three conditions. These include:

- Mandatory registration of the employee in the OPS system. This is confirmed by the presence of a special certificate - the Insurance Number of an Individual Personal Account (SNILS).

- Availability of work experience. Depending on the type of pension, recipients are subject to different requirements for the duration of this period.

- The occurrence of an insured event (injury, reaching a specified age, the right to early receipt, etc.). Upon the death of the insured person, a pension is assigned to his disabled dependents (more on this below).

- What to do if the price tag of a product does not match the price at the checkout

- Mastino Neapolitano - standard and description of the breed, education and maintenance at home

- Top up MTS from a bank card via the Internet, terminal, ussd request or Autopayment service

Voluntary pension provision

This type of payment is in addition to the existing state pension, allowing citizens to increase their income in old age. To do this, it is necessary to voluntarily enter into an agreement with a non-state pension fund and make deductions of the established amount. The sources of pension benefits under this system are:

- personal payments of insured persons;

- transfers from the employer via the corporate system;

- profit when investing research and development funds in various financial projects.

Comments (8)

Showing 8 of 8

- Alexey 04/28/2016 at 12:14

I am already a recipient of an old-age pension. Can I refuse it for a certain period in order to apply for payment later, taking into account the increasing coefficient?answer

- Julia 04/29/2016 at 13:15

According to Law No. 400-FZ dated December 28, 2013. “About insurance pensions”

an increasing coefficient can be applied to the value of the individual pension coefficient and the size of the fixed payment in the event that a citizen applies for the assignment (or restoration) of payment at a later date.

Refusal to receive the established pension cannot be less than a year. To exercise this right, you need to contact the Pension Fund office at the location of your pension file and write a corresponding application. answer

I am 37 years old. Four years ago I transferred my pension savings to a non-state pension fund. Can I now change my decision and return these funds to the Pension Fund? And is there an opportunity to refuse to form a funded pension if I make such a decision?

answer

Yulia 04/30/2016 at 16:12

Every citizen born in 1967 had the right to choose a pension option until the end of 2015, namely whether to transfer funds to a funded pension or not. You have already exercised your right. But you can refuse to form pension savings even after this date. To do this, you need to contact the territorial bodies of the Pension Fund with a statement about the decision made.

Regarding the first question, you can transfer your funds from the NPF to public administration. But it should be remembered that starting from 2015, all savings will be transferred to the new insurer after five years. That is, if you apply in 2021, the funds will be transferred in early 2022, taking into account investment income. If, within five years, you decide to change your mind again and move from the Pension Fund to a Non-State Pension Fund or from one Non-State Pension Fund to another, then your savings will be transferred at the beginning of the year following your application, but with the exception of investment income (losses will also be reflected in the personal account of the insured faces).

answer

Hello. Tell me, please, maybe I didn’t understand something. I am the mother of a disabled child and receive a disability pension for the child and for caring for him. The child’s father died and was disabled since childhood and after a stroke he was assigned disability group 1, received a social pension, but before receiving this group he worked for some time, there are even entries in his work book. Question: Is my child entitled to a survivor's pension? I contacted our Pension Fund and they told me that no one is entitled to two types of social pensions. Is it so?

answer

- Oksana 01/19/2017 at 19:26

It will not be possible to apply for a survivor's pension for your child, since he is already a recipient of a social disability pension. However, if you do not work, but are caring for a disabled child, you can apply for an insurance pension for the loss of a breadwinner in accordance with Art. 10 of the Law “On Insurance Pensions”

, (since your husband was officially working before his death), but only if your child is under 14 years old.

Contact the Pension Fund of Russia with an application to assign you a survivor's pension in accordance with clause 2, part 2, art. 10 of the above law.

answer

Good day. In 2014, my father died, in 2021 he received a death certificate (previously it was not issued due to the fault of the Ministry of Internal Affairs) and assigned a pension to the Pension Fund. It turned out to be 2600 rubles. with kopecks, wrote an application for compensation for 12 months (appointment 12 months earlier). A month later they recalculated my pension and assigned me a labor pension (for the loss of a breadwinner) of 5,004 rubles and kopecks. Can I contact the Pension Fund to reassign a 12-month pension for a new payment, i.e. 5004 rub. (Clause 1, Article 11 166 of the Federal Law)?

answer

Hello! I've been retired for 6 years now. He left at the age of 50 - the liquidator of the Chernobyl nuclear power plant. Does it make sense to try to recalculate by submitting an application to the Pension Fund? I called them, they don’t welcome it, without explaining the reasons (no disability, I don’t work for health reasons). Nothing has changed dramatically since I retired. Tell me, good people, who is friendly with the law and understands. Thank you!

answer