The retirement age, established in the USSR in 1932, is still in effect in Russia to this day. However, in May 2021, a bill was passed aimed at increasing the retirement age of civil servants and came into force in January 2021. With the entry into force of the new law, certain categories of persons received the right to receive an early pension, taking into account compliance with the requirements for the amount of special experience of the person, his type of activity and other circumstances.

What are the conditions for retirement in 2021? What are the requirements for retirement age? Under what conditions is early retirement possible? Is the retirement age expected to increase? We will try to answer these questions in this article.

Old age insurance pension

An insurance pension is a regular cash payment that is formed from insurance premiums accrued by the employer during the official work of its employees and a fixed payment financed by the state. There are 3 types of insurance pension:

- old age (a person has reached the legally accepted retirement age of 60 years for men and 55 years for women);

- for disability (the citizen received/confirmed disability);

- in case of loss of a breadwinner (due to the death of one or more breadwinners in the family).

The conditions for accessing each type of pension are different. The main conditions for assigning old-age pension payments in 2021 are:

- compliance with the age giving the right to a pension (55/60 years);

- having the required number of points (11.4);

- availability of the required insurance experience (8 years).

The length of the insurance period depends on the year in which the person applies for pension payments. Every year its value increases by a year until it reaches 15 years. Thus, applicants in 2021 must have 9 years of experience, after 2024 - 15. If this is not available, the person is assigned social benefits.

Amendments to the Federal Law “On Amendments to Certain Legislative Acts of the Russian Federation Regarding Increasing the Retirement Age for Certain Categories of Citizens” dated January 1, 2015 No. 143-FZ oblige all applicants to have an IPC (individual pension coefficient), which in turn grows by 2 annually .4 units and by 2024 will reach 30 points. The value of the IPC is influenced by the presence of official employment, the amount of all contributions made by the employer to the Pension Fund, and the duration of the working period. Thus, the IPC has a direct impact on the amount of pension payments.

Important! Until January 1, 2015, the pension was called a labor pension, consisted of an insurance and funded part and was regulated by the Federal Law “On Labor Pensions” dated December 17, 2001 No. 173-FZ. In 2015, in connection with the entry into force of the Federal Law “On Insurance Pensions” dated December 28, 2013 No. 400-FZ, the labor pension was eliminated, and its parts became full-fledged types of pensions

Registration of old-age pension payments is carried out on an application basis - this means that a citizen must contact the Pension Fund of Russia office with a written application, as well as a package of necessary documents, in order to receive the monthly payments due to him. They are not assigned to insured persons automatically.

Pension payments may be increased due to a certain coefficient, which is applied if the applicant applied later than he could in accordance with the current law. Annual indexation or possible recalculation of the assigned amount can also lead to an increase in pension.

More detailed information about the old-age insurance pension can be found in the article “Old-age insurance pension”.

How to calculate your pension?

There is a formula: P = (45% NW-SP) + 3% NW * St,

where P is the amount of the future pension, SZ is the amount of monthly earnings, SP is the insurance part of the pension, St is the “extra” length of service (calculated as the total length of service minus 15).

For example. Ivanova Larisa worked for 30 years. She received the right to an old-age pension in the amount of 6,000 rubles. The monthly salary was 50,000 rubles. Thus, the size of her pension will be: 22500 - 6000 + 1500*15 = 39000 rubles.

The Government claims that money from the budget saved as a result of the upcoming reforms will be spent on increasing the pensions of absolutely all Russians. It is still difficult to predict how such changes will turn out for citizens. But, given that adjustments will be made to the legislation every year based on the results of the analysis of the results of the reforms, we can only expect positive consequences.

Early retirement

A pension assigned by the Pension Fund of Russia in connection with certain circumstances before the applicant reaches the generally accepted retirement age is called early. The requirements for insured citizens who wish to receive insurance payments ahead of schedule are described in detail in Articles 30, 31 and 32 of the Federal Law “On Insurance Pensions”.

Workers in certain professions, people belonging to certain social groups, as well as citizens who lost their jobs as a result of layoffs while approaching retirement age can apply for early payment. The more difficult the working conditions, the sooner a person is given the opportunity to retire. The categories of persons entitled to these payments include:

- workers of underground structures, persons whose work took place in hazardous conditions or in hot workshops;

- mothers of many children with 5 or more children;

- visually impaired;

- railway workers;

- persons who were involved in operating heavy equipment;

- citizens with rare genetic diseases;

- geological prospectors and search engines;

- employees of sea and river vessels;

- employees of the Ministry of Emergency Situations;

- father or mother of a disabled child;

- guardians of disabled children;

- unemployed men (from 57 years old) and women (from 53 years old) who lost their existing jobs for certain reasons;

- people who have become disabled as a result of military service;

- civil servants, teachers, doctors and others.

To apply for an early pension, the applicant must have with him original documents confirming the special experience specified in the application. In addition, you must have a passport, SNILS, and work book with you. Early pension payments are accrued from the date of application to the Pension Fund branch, subject to receipt of the right to it.

Important! Early pension payments will be suspended if the person is officially employed again.

Residents and workers of the Far North

Persons employed in the regions of the Far North, as well as places that are officially equated to these territories, can receive pension payments ahead of schedule. In addition, the pension can be indexed and increased in connection with living or working in these territories. Early retirement of workers in the Far North is possible thanks to additional calculations made by employers to the Pension Fund of the Russian Federation throughout the entire period of the employee’s work.

Men are granted pensions from the age of 55, women from 50. To retire, persons working in an area that is officially equated with the regions of the Far North must have 20 years of insurance experience. The retirement age of a person working in the Far North decreases annually by 4 months from the moment his insurance coverage reaches 7.5 years. Moreover, a year of work in areas equated to the territory of the Far North is comparable to 9 months of work in the Far North.

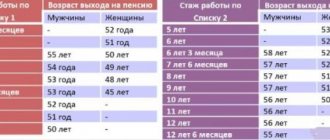

Dependence of length of service in these territories on the age at which an insurance pension is assigned

The retirement age directly depends on the number of years worked in the Far North or areas equivalent to it. The dependence of the length of service obtained in these territories on the age at which the insurance pension is assigned is reflected in the comparative table.

| Experience in the Far North (men) (in years) | Age of appointment of pension payments (year and month) | Experience in the Far North (women) (in years) | Age of appointment of pension payments (year and month) |

| 15 l. | 55 l. | 15 l. | 50 l. |

| 14 l. | 55 l. 4m. | 14 l. | 50 l. 4 m. |

| 13 l. | 55 l. 8 m. | 13 l. | 50 l. 8 m. |

| 10 l. | 56 l. 8 m. | 10 l. | 51 g. 8 m. |

| 9 l. | 57 l. | 9 l. | 52 years old |

| 8 l. | 57 l. 4 m. | 8 l. | 52 g. 4 m. |

| 7.5 l. | 57 l. 8 m. | 7.5 l. | 52 g. 8 m. |

Dependence of length of service on the area in which the citizen worked

In order not to lose years of insurance experience, years of work in places equated to the Far North and in the Far North are equalized or equalized. Thus, it is possible to derive the total amount of insurance experience of one person. To calculate your total length of service, you can use this table.

| Experience in the Far North | Experience in the Far North |

| 1 year | 9 m. |

| 2 years | 1 year 6 m. |

| 3 years | 2 years 3 months |

| 4 years | 3 years |

| 5 l. | 3 years 9 months |

| 10 l. | 7 l. 6 m. |

| 20 l. | 15 l. |

Example: Citizen K. worked for 11 years in Severodvinsk (KS) and 2 years in Petrazavodsk (which is included in the list of territories equated to the territories of the KS). 2 years must be equated to the length of service that could have been in the Far North itself. To do this, 2 is multiplied by 9 m, resulting in 1 year and 6 months. The two lengths of experience are added together and the result is 12 years and 6 months of experience. Accordingly, citizen K. is assigned a pension of 50 years and 10 months

Men who have been hunting and fishing for 25 years, and women for 20 years in the Far North, have the right to retire at the ages of 50 and 45 years. In this case, the amount of total insurance experience does not matter.

More detailed information on the appointment and registration of an early pension can be found in the article “Early pension”.

What is the pension for civil servants in Russia from January 1, 2017?

The latest news reports changes that are planned to be introduced starting next year. Within the framework of this article, we will consider in more detail all the features of the formation of a pension, at what age it is provided, etc.

During this period, the retirement age for civil servants is set at 60 years. However, at the request of management, it is allowed to work for 65-70 years. In accordance with the current legislation, insurance coverage begins at the age of 55 for women and 60 for men. If the work experience is more than 15 years, then the civil servant can count on an additional payment in the appropriate amount, both to wages and to insurance benefits.

Pensions for civil servants in 2021 will be calculated according to a new procedure. In accordance with the norms of Federal Law No. 143, an increase in the retirement age and work experience is provided. With each subsequent year, the experience will increase by 6 months. Thus, in order to receive certain privileges, such an employee will have to work for 15 years and 6 months.

The introduced bill was promulgated by the Ministry of Labor back in mid-2015, but upon approval, amendments were also made to it by the Ministry of Finance. This contributed to the fact that the changes will affect not only high-ranking officials, but also all civil servants.

Retirement age of judges

From the beginning of 2021, the retirement age of judges will increase by 0.5 years annually. Accordingly, in 2025, pensions will be assigned to male judges at 64.5 years old, and to female judges at 62.5 years old. Not only will the retirement age increase, but also the maximum possible period of work in a position, as well as the amount of insurance coverage. Now this public position can remain with judges up to 65 years of age, and the length of service must be at least 25 years for early retirement.

If pension provision was assigned to a person before 01/01/2017, these changes will not affect his payments. The amount of payments assigned to a person before this date was carried out according to the old system of formation of rights; accordingly, a judge could work in his position for only 20 years and retire at the age of 60.

Table

In order to make it easier to navigate the age indicators among civil servants, we offer the following table:

| Year of retirement | Age of men | Age of women |

| 2017 | 60,5 | 55,5 |

| 2018 | 61 | 56 |

| 2019 | 61,5 | 56,5 |

| 2020 | 62 | 57 |

| 2021 | 62,5 | 57,5 |

| 2022 | 63 | 58 |

| 2023 | 63,5 | 58,5 |

| 2024 | 64 | 59 |

| 2025 | 64,5 | 59,5 |

| 2026 | 65 | 60 |

| 2027 | 65 | 60,5 |

| 2028 | 65 | 61 |

| 2029 | 65 | 61,5 |

| 2030 | 65 | 62 |

| 2031 | 65 | 62,5 |

| 2032 onwards | 65 | 63 |

It is important to know! Pension of employees of the Ministry of Internal Affairs: conditions, calculation, news

In addition to age criteria, the length of service also increases annually, which has the following annual changes:

| Year of receiving pension payments | Experience |

| 2017 | 15,5 |

| 2018 | 16 |

| 2019 | 16,5 |

| 2020 | 17 |

| 2021 | 17,5 |

| 2022 | 18 |

| 2023 | 18,5 |

| 2024 | 19 |

| 2025 | 19,5 |

| 2026 and beyond | 20 |

Retirement age of civil servants, including deputies

From January 1, 2017, officials can hold government positions only until they are 65 years old. Previously, the age was limited to 60 years. Heads of civil services will be able, if they wish, to extend their tenure in their positions by contacting a federal government agency or the appropriate official. The period of stay can be extended to 70 years; previously, such permission was issued personally by the President of the Russian Federation.

The length of service in a position was also increased; previously it was 15 years, after which an official could apply for a long-service pension. From the beginning of 2021, the length of service will increase by 0.5 years annually. Thus, officials retiring in 2020 will have to have 20 years of insurance experience.

Pension payments to persons affected by radiation and man-made disasters

Citizens injured in radiation or man-made disasters can receive one of three types of insurance pensions. Old-age payments are assigned to victims with a reduced retirement age. The age is reduced depending on the extent to which the citizen was injured and the nature of his injuries.

| Age of reduction of insurance period | Causes |

| 10 years | Liquidators of the Chernobyl accident from 1986 to 1987, evacuated citizens, disabled people as a result of this accident |

| 5 years | Liquidators of the Chernobyl disaster from 1988 to 1990; citizens with radiation or other diseases as a result of this event; Chernobyl NPP employees |

| 5 years +0.5 years for each year lived in the Chernobyl nuclear power plant zone | IDPs from the Chernobyl Nuclear Power Plant zone |

| 3 years + 0.5 year for each year lived in the Chernobyl nuclear power plant zone; 2 years + 1 year for 3 years; 1 year + 1 year for 4 years | Residents from the Chernobyl resettlement zone before their relocation |

| 0.5 years for each year | Workers of the Chernobyl resettlement zone living in other areas |

A mandatory requirement for those wishing to retire early due to participation in or residence in an area associated with the Chernobyl tragedy is the presence of 11.4 units of IPC in 2021. Veterans or participants in military conflicts also have the right to early payments; for this they will need 20 years of military service and 10 years of insurance experience in civilian life. The person must be at least 50 years old.

Raising the retirement age

From 01/01/2017, the retirement age of government employees will be increased annually by six months to the extreme mark of 65 years. In addition, for the purpose of granting a long-service pension, the minimum insurance period for a position in government agencies will be increased annually by 6 months from 2021. By 2021 it will be 20 years.

In 2021, A. Kudrin, head of the Center for Strategic Research, put forward an initiative to increase the retirement age for all citizens to 63 years. However, Deputy Prime Minister Olga Golodets said that the decision on reform will be made in 2021 after the formation of a new government.

Federal Law No. 143 - the main bill

The amendments to the Federal Law on raising the retirement age for civil servants dated November 15, 1997 N 143-FZ, signed by the president, which sets out the new procedure for pension provision for civil servants, have several main provisions:

- The generally established retirement age is increasing for persons holding government positions in the Russian Federation, constituent entities of the Russian Federation, as well as those in municipal service. The increase will occur by 5 years for men and 8 years for women;

- the retirement age will be raised gradually, increasing by 6 months every year;

- the required work experience for civil servants is also increasing from 15 to 20 years, in connection with which amendments have been made to the law “State pension provision in the Russian Federation”;

- constituent entities of the Russian Federation can independently make changes that increase wages at the expense of local budget funds, as well as adjusting the age limits for civil service employees;

- persons who acquired the right to receive an old-age insurance pension before the approval of the amendments do not fall under the law;

- deputies of the State Duma or members of the Federation Council will begin to receive monthly supplements to their old-age or disability pensions after five years of civil service.

The main bill is Federal Law No. 143 of November 15, 1997