Calculation nuances

After the procedure for calculating the pension was changed, the factors influencing its size were supplemented with the individual pension coefficient. It is calculated by entering your salary, from which income tax has not been deducted, into the form on the website. IPC is also called pension points, and therefore they affect old-age benefits, since each of the points has a certain value, and the main part of the pension is calculated based on their number.

The old-age benefit paid to a person is provided according to the following criteria:

- age - 55 years for women and 60 for men (recent reforms in Russia increase the age to 63 years);

- the period for paying insurance premiums (current length of service) must be no less than the established norm - from 2024, after a gradual increase, the figure will reach 15 years;

- The minimum score is 30 points.

A citizen can earn a limited number of points per year, for example, for 2021 it is 8.7, and for 2021 you can get 10 points for citizens who do not have pension savings. Otherwise, in 2021 you can get a maximum of 6.25 points both in Moscow and any other region.

Government authorities carry out annual indexations of insurance pension payments, increasing them by the amount of inflation. A funded pension held by non-state pension funds or management companies is not subject to indexation, so you should only count on the income that investments will bring. If the profitable projects in which the company decides to invest money turn out to be unprofitable, then he risks losing funds, although only part of them will be reimbursed by the state.

Not everyone will be credited

Let's consider the general principles of calculation for the pension system in force since 2015.

Our pension is formed from the contributions that the employer pays for the employee in the amount of 22 percent of the salary. At the same time, all 22 percent can be used to assign an insurance pension*, but for some - those who chose to form a funded pension*, until 2014, 22% was distributed between an insurance (16%) and a funded pension (6%). Since 2014, the funded pension has been “frozen”, and all 22% are transferred to the insurance.

The retirement age itself, as we remember, has been increased, and now there is a transition period in effect.

Therefore, in the first half of 2021, women who have reached the age of 55 years and 6 months, and men who have reached the age of 60 years and 6 months can retire.

After the end of the transition period - from January 1, 2028 - the period will move to 60 years for women and 65 years for men.

It should be noted right away that the current system excludes the automatic assignment of pensions. In addition to reaching a certain age, two more conditions must be met:

– work experience, which gradually increases: in 2021, 11 years are enough, from 2024 and later – at least 15 years;

– the minimum amount of individual pension coefficients* (depending on the level of wages) must be no less than 18.6 in 2020, and in 2025 and after – no less than 30.

When all conditions are met, the amount of the monthly payment is calculated based on the data on length of service and wages available to Pension Fund employees.

If for some reason there is not enough length of service or coefficients, a pension is not awarded. You will need to continue working to increase your experience and accumulate the missing number of coefficients.

However, for various reasons this is not always possible. In this case, you can purchase the pension coefficients necessary to assign a pension.

Example:

Olga Sergeevna should retire in 2021, but since most of the time she had a very low salary, three pension coefficients are not enough.

She can buy them in addition - that is, as if paying for herself the insurance premiums that the employer usually makes. How to calculate the price of such an acquisition?

The minimum amount of insurance contributions is equal to the product of the minimum wage and the rate of insurance contributions to the Pension Fund, increased by 12 times.

So, the amount of insurance premiums for the billing period 2021 = 1 minimum wage (as of 01/01/2020 - 12,130.00 rubles) x 22% x 12 = 32,023.20 rubles.

This minimum contribution is equal to 1 year of insurance experience and approximately 1.55 pension points. Therefore, to purchase 3 individual odds, Olga Sergeevna needs approximately 61,980 rubles.

But what if there is no money for it? In this case, you must wait another five years from retirement age, and then the state will assign a social pension (for men from 70 years old, for women from 65 years old). Its size is small, but with the help of a social supplement it will be brought to the subsistence level. The regional law establishes that for 2021 the minimum subsistence level for a pensioner to determine the amount of social supplement to pension is 10,039 rubles.

Other scoring cases

Individual points can be accumulated by a person not only due to work experience, but also in some situations equated to work activity in whole or in part.

For example, 1.8 points are awarded annually if the entire period was devoted to caring for:

- disabled person of group 1;

- a child who is officially disabled;

- old people over 80 years of age;

- children under 1.5 years old.

The same number of points is awarded to a citizen who served a year in the army upon conscription, while parents can receive a different number of IPC. For a year of caring for a second child, the parent will be awarded 3.6 points, further ones will be valued at 5.4 points annually.

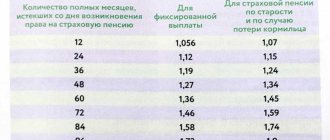

The pension fund encourages people to retire as late as possible, given that every year a person does not quit his job, his future pension increases significantly. For example, 5 years after the right to a pension and its non-realization, the fixed and insurance parts will increase by 36% and 45%, respectively.

Formula to help

You can approximately calculate your old-age insurance pension using a special formula: the sum of your pension coefficients multiplied by the value of the pension coefficient (established on the date the pension was assigned) plus a fixed payment.

The size of the payment and points is indexed annually. As of January 1, 2021, the cost of the coefficient is 93 rubles, and the size of the fixed payment is 5,686.25 rubles. It is also indexed annually by the state.

Thus, the calculation of the insurance pension in 2021 is carried out according to the formula:

insurance pension = sum of pension coefficients x 93.00 + 5,686.25.

The amount of your coefficients can be easily found out from the statement of the status of your individual personal account, which will be sent to your account on the State Services service within a few minutes after the request is sent.

For example, you have accumulated 60 coefficients.

It turns out that the amount of the insurance part of the pension is 60 x 93.00 + 5,686.25.

The total amount is 11,266.25 rubles.

But younger people who were born in 1967 and later can also have a funded pension. Before retirement, it could be invested with the help of a state management company - Vnesheconombank - or you could entrust your funds to a non-state pension fund or management company, always paying attention to profitability indicators. They vary depending on the economic situation, but if investing year after year gives minimal or even negative income, this is a clear reason to think about it. There is a very important point that you need to pay attention to when changing a non-state pension fund or management company: if you do this more often than once every five years, you can lose investment income, and in the case of a negative investment result, you can reduce your pension savings by the amount of the investment loss.

But let’s say the investment was successful and a certain amount has been accumulated in the account. How will it be added to the insurance part of the pension?

To calculate the monthly payment amount, you need to divide the total amount of pension savings by 258 months (this is the expected payment period).

For example, there are 300 thousand rubles in the account. Accordingly, after division you will get 1,162 rubles, which will be paid additionally monthly to the main part of the pension.

Yes, it's not very much. And probably everyone would like to know how to increase their pension.

The most obvious option is long-term work with a high official salary. This makes it possible to purchase a larger number of pension coefficients. So, if a person receives 50 thousand rubles “in an envelope”, but according to documents only 10 thousand, then 20 years of experience will give 100 pension points less than would be possible with an official salary. And this will reduce the pension by at least 8,000 rubles.

The second option is to apply for a pension later than the due date. For example, if you do this 5 years after the right to it arises, the payment amount will be approximately 40% greater.

And finally, you can take part in various voluntary pension insurance programs. This may be a good option for those who have a “gray” salary, but a high level of income. We are talking about concluding an agreement and regular contributions to non-state pension funds.

REFERENCE

*Insurance pension is a monthly cash payment to compensate citizens for wages or other income that they received during their working career. Its size depends on length of service and earnings. The insurance pension is accompanied by a fixed payment in a fixed amount, which depends on the type of insurance pension.

*Savings part – monthly payment of pension savings formed from insurance contributions of employers and income from their investment.

*Individual pension coefficient is a specific unit of measurement of length of service and salary used to calculate the insurance part of the pension.

Additional questions on pension calculation can be asked to the specialists of the hotline of the Pension Fund Office for the Krasnoyarsk Territory (391) 229-00-66.

№ 35 / 1213

Related links:

14 Jul '2021

Residents of the Krasnoyarsk Territory have opened more than 250 thousand brokerage accounts

15 Jun '2021 Krasnoyarsk residents were warned about illegal immigrants working in the financial market

21 Apr '2021 Another resident of the Krasnoyarsk Territory won a million rubles in the lottery

15 Apr '2021 Deputies decided to protect the minimum income of debtors

Comments:

Andrey

16 Jul '2021 19:48 They made suckers out of all pensioners in Russia, they openly consider them gifts, I write... Pi... Pi.. Pi...

F.M.E.

25 Mar '2021 11:40 Pension depends on length of service and salary - complete nonsense, I retired: more than 25 years of experience, but only 20 years were counted - how is that? People who have much less experience than mine receive more pensions than I do - how is that?

Mirlanbek

13 Feb '2021 20:29 How pensions will be paid for the last 3 years yes

Military support

Security for military personnel who have retired is also calculated using a formula, but different from that used for civilians. It is half of the salary for the position and the bonus for length of service, to which is added a reducing pension coefficient multiplied by 3%. Also, 2% is added to the amount if the salary was not indexed.

There are several types of military pension:

- by length of service;

- on disability;

- for the loss of a breadwinner (recipients of funds are relatives of a person who died while performing a military task).

To retire for retirement, you will need to serve at least 20 years, that is, you can potentially retire at 40 years old if you start serving at 20 years old. If 20 years are not reached by the exit age, then mixed experience is taken into account, allowing employment in companies and formations other than the armed forces.

Fixed payment

The constant part of the pension provision is the same for all recipients of such funds, and in 2021 it amounts to 4,982 rubles. But this is also influenced by the category to which the person belongs, for example, persons with more than 15 years of experience in the Far North can apply for a pension with a fixed share of 7,474 rubles, but they must have at least 25 years of experience For men, women must work 20 years.

Disabled people of group 1 can count on 9965 rubles, which will be paid in a fixed part. Representatives of disability group 2 are entitled to receive 4,982 rubles, and people from group 3 receive the least - 2,491 rubles. This pension volume is indexed annually, and this increase occurs on February 1 of each year. The increase is influenced mainly by the size of inflation, but the level of income of the Pension Fund also matters; if a sufficient amount of taxes is received, then the increase will be higher.

Features of pension calculation

When determining the amount of funds for those retiring in 2021, four periods of earned money are applied. These are three time periods, which are divided into the period before 2002, from 2002 to 2014, as well as the time after 2015. In addition to work, there is also a period of other non-insured periods, for example, military service, child care and other legally stipulated periods of time.

The value of the individual pension coefficient in 2021 is 81.49 rubles, its increase occurs in August of each year, for which inflation rates are used, leading to indexation. To calculate the fixed part, there is a simple formula: the number of points is multiplied by the cost of each, and a fixed payment is added to the result.

This way, a pension can be calculated in 2021, which will potentially be paid to a person, but in essence, only the number of accumulated labor points depends on the citizen, since their value and fixed amount change only as a result of indexation and are established by the state, for which a law is adopted.

Minimum points

Since 2015, citizens’ pension rights have been formed in individual pension coefficients (points). All previously generated pension rights have been converted into pension coefficients and are taken into account when assigning an insurance pension.

The number of pension points depends on accrued and paid insurance contributions to the compulsory health insurance system.

There is a minimum number of points that must be achieved in order to qualify for a pension. Since 2015, this minimum has gradually increased.

For example, in 2021, to apply for a pension you need to have 18.6 points.

Table 1. Minimum number of points giving the right to an insurance pension:

| Year | Minimum points |

| 2015 | 6,6 |

| 2016 | 9 |

| 2017 | 11,4 |

| 2018 | 13,8 |

| 2019 | 16,2 |

| 2020 | 18,6 |

| 2021 | 21 |

| 2022 | 23,4 |

| 2023 | 25,8 |

| 2024 | 28,2 |

| 2025 and beyond | 30 |

Funded pension

In 2015, thanks to changes in legislation, the funded pension no longer applies to the labor pension, and is a separate type of benefits paid in old age. The size of the savings portion depends on how long the funds have been deducted and in what amount they were contributed to the savings organization.

This pension contribution can be paid by the employer throughout the entire period of a person’s work, then 22% of the salary is paid - 16% goes to the insurance part of the pension, and 6% to the funded one. In addition, there is an opportunity to additionally invest maternity capital, doing this partially or in full, and if you wish, there is the option of participating in the co-financing program.

A funded pension can be received if the amount of savings is at least 5% of the total amount, but if the reserves made are less than this limit, the citizen can receive the money one-time.

Checking savings

Previously, only the Pension Fund could provide information about existing savings, but at the moment a citizen has the opportunity to check the amount of funds:

- on the websites of State Services or the Pension Fund, for this you only need a SNILS number;

- at the Pension Fund branch;

- from employees at banks or directly at ATMs.

To create a personal account on the State Services website, you will need to enter the series and number of your passport into the form, adding to them the number of your pension insurance certificate. To go to pension services, you need to go to the official pfrf website and then log in to your account on State Services. If you wish, you can clarify working issues on the PFR hotline, but information about the status of your pension account cannot be obtained remotely.

Points for working pensioners

In 2021, working pensioners can count on an increase only thanks to the accumulation of new pension points, which are recalculated in August of each year. But even such an increase is insignificant, because if the standard indexation is 3.7% of the amount of payments, then no more than three points can be awarded for length of service, and in conversion this is about 244 rubles.

Description of the pension calculation formula

When determining the size of an insurance or labor pension, the following parameters must be taken into account, which will ultimately allow you to obtain the most accurate figures:

- IPC – individual pension coefficient. To put it simply, this is a pension point on which the size of the subsequent pension salary depends. What is also interesting is that the pension point is formed depending on the amount of wages before retirement.

- Pension coefficient . For most potential retirees, this indicator acts as a motivational measure, since it encourages people to work officially until they reach retirement age. The longer a person works, the larger the pension will ultimately be.

- Minimum guaranteed amount of retirement salary. The legislation of the country determines the minimum amount of a pension that can be considered guaranteed, so a person can definitely count on receiving a similar salary. For certain categories of the population, this indicator is extremely important, since it determines the only possible level of social benefits.

If desired, residents of Russia can independently calculate the amount of their own pension received due to reaching a certain age, using the following formula:

IPC x SIPC x K + FV x K = SP

It is also worth noting that when calculating the pension salary, namely for the formation of the individual pension coefficient, 3 time periods are taken into account, thanks to which it is possible to accurately determine the amount that will be provided in the end:

- Until 2002. All data on accumulated experience and level of earnings is obtained independently, since funds do not have the ability to personalize information.

- 2002-2014. Pension forms have all the data and can independently generate the amount of contributions, but here experience plays an important role only in order to determine the minimum experience indicators.

- Since January 2015 . Here laws in the form of Federal Law-400 are already taken into account, which is considered the basis for carrying out calculations and their subsequent use.

As shown above, the pension calculation formula is very complex and has a lot of consistency. But, fortunately, you don’t have to figure out all the details on your own, since there is a great opportunity to use a ready-made service, in which all the necessary items are included by default, all that remains is to substitute the numbers. But calculating numbers also requires careful attention, since this is the only way to obtain the correct information.

Calculation on a calculator

How to calculate your pension online? It’s very simple, you just need to use the tool on the website of the Pension Fund of the Russian Federation. It is suitable only for people who worked in civilian areas, since the Ministry of Defense is responsible for providing support for the military and security forces and the amount for them is calculated according to slightly different procedures.

The exact figure can only be obtained after a person sends his application to the Pension Fund for vacation, and all benefits and income of the citizen will be taken into account. Some components are permanent and not individual, but it should be taken into account that the person will retire this year.

People who worked in the Far North, or cared for other citizens, can receive an increased pension coefficient, according to which benefits are calculated. If a citizen is self-employed, he must transfer 1% of the amount of income amounting to no less than 300,000 rubles for pension insurance.

The pension calculator consists of a questionnaire in which the citizen independently enters:

- person's gender;

- year of birth;

- how long did you serve in conscription?

- number of existing or planned children;

- caring time for others;

- the period of delay in obtaining a pension after reaching age;

- official salary level;

- type of employment - hiring or self-employment;

- period of work experience.

After clicking the calculation button, a preliminary calculation of the pension amount will appear on the screen if the data specified in the form is correct at the time of retirement. The calculator also allows you to calculate the pension points that a citizen can earn in a year with a certain salary level.

Necessary data for calculating the northern pension on a calculator

In order for the calculation of the northern pension made on the calculator in 2017 to be correct, you must enter only reliable information.

To carry out calculations you will need to enter the following data:

- the age when a citizen plans to retire (please note that when working in the northern regions of the country and in areas equivalent to them, you can retire earlier than throughout Russia);

- monthly salary;

- in a letter from the Russian Pension Fund you will need to find the amount of existing savings for a future pension.