Investments in Russia 2021

Despite the fact that Russia does not have the most favorable investment climate, the amount of investment in our country is growing year by year. This is facilitated by two main factors - the number of financially literate people is growing and the increasing advertising of various types of investments. And if the first factor is a positive thing, then the second cannot be said so unequivocally. Advertisements for investments, from bank deposits to buying franchises and opening a new business, await the modern person almost everywhere - on TV, in the press, on the Internet and on social networking pages.

A certain number of gullible Russians fall for such annoying advertising with a fairly predictable result - they lose their savings. To prevent this from happening, you need to know what kinds of investments there are, and how to choose your own instrument that would fully meet the interests of the investor. Money does not tolerate being taken lightly; this is worth remembering.

“Any investment must make sense both today and tomorrow.” Robert Kiyosaki

Which funds are better to invest in – on Russian or foreign exchanges?

This question sooner or later arises before any investor who is considering the possibility of investing on foreign exchanges. Is it worth entering foreign markets? Or is it possible to purchase only those instruments that are circulated in Russia?

Let's try to look at this with a specific example. Let me make a reservation right away that the figures presented below do not pretend to be any serious research. Ideally, one would use longer time periods and data across different asset classes, and make more detailed calculations.

However, let's take one asset class that is well represented in both the Russian and foreign markets - shares of US companies. Data from the MSCI USA index will be used for calculations.

This is a fairly broad index that includes a large number of US stocks. In addition, it was this index that was used as a basis for a long time by the ETF from the FinEx company - FinEx USA UCITS ETF (FXUS). Now this fund uses a similar index, but from a different index provider.

Let's take data on the MSCI USA index for the period from 2006 to 2019. Why for this period? If you download the newsletter (a brief description of the index) from the MSCI website using the link https://www.msci.com/documents/10199/67a768a1-71d0-4bd0-8d7e-f7b53e8d0d9f, then the data for this will be presented there time interval.

Accordingly, this data is easiest to obtain without researching or collecting anything manually. Therefore, I will start from this period of 14 years.

The newsletter presents the change in MSCI USA index returns by year. This uses US dollar data on the total return of the index - i.e. profitability taking into account reinvestment of dividends.

Let's assume that we have a certain fund traded on the Russian stock exchange, the commission of which is 0.9% per year. As a matter of fact, this is exactly the commission that FinEx USA UCITS ETF (FXUS) has. He had the same commission before when he used the MSCI USA index as the base index.

Let's also assume that we have a foreign fund based on the same index, but with a commission of 0.03%. In reality, I have not found an ETF based on the MSCI USA index with such a commission on foreign exchanges. However, large funds of shares of US companies are traded on American exchanges based on other indices, but with a commission of 0.03%. For example, Vanguard Total Stock Market ETF (VTI) or Vanguard S&P 500 ETF (VOO). That is why I suggest taking this commission amount for calculations.

Accordingly, the annual return of a notional Russian fund will be equal to the return of the MSCI USA index minus a commission of 0.9%, and the return of a notional foreign fund will be equal to the return of the MSCI USA index minus a commission of 0.03%. All returns are presented in US dollars.

Let's further assume that the investment was made from December 31, 2005 to December 31, 2021 (14 years). The investment amount at the end of December 2005 was $10,000, no further amounts were contributed. What will be the final result?

If we convert dollars into rubles at the exchange rate of the Central Bank of the Russian Federation as of December 31, 2005, it turns out that the investment amount was 287,825 rubles. Further, at the end of 2021, it turns out that at the exchange rate as of December 31, 2021, investments in a Russian fund with a commission of 0.9% increased to RUB 1,915,337.79. In turn, a foreign fund with a commission of 0.03% brought in approximately 230,000 rubles. more: RUB 2,146,577.10

However, it is worth remembering taxes (I note that I do not take into account the accompanying brokerage commissions in these calculations). When investing within the Russian market, you can completely avoid paying personal income tax on the profit received due to a discount on the holding period (after three years of owning a security, you will not have to pay personal income tax on the profit) or through an individual investment account (IIA) with type B. In your own However, when investing in funds that are traded on foreign exchanges, these tax benefits do not apply. As a result, you will have to pay personal income tax on all profits received.

Let's compare how the final results will change, taking into account that when investing in a Russian fund, personal income tax will not arise, and the results of investments in a foreign fund will decrease by the amount of personal income tax in the amount of 13% of the profit.

It turns out that over a period of 14 years from 2006 to 2021, the result of the notional Russian fund was slightly better than that of the foreign one. Accordingly, in this particular example, when only the difference in the commissions of the two funds is considered and some other factors are not taken into account, which may also affect how closely the fund repeats the performance of the underlying index, the Russian fund slightly outperforms the foreign one. In other words, in this situation, the tax benefits outweighed the difference in fees that may exist between funds on the Russian and foreign exchanges based on the same asset class.

Now let's change the difference in fund commissions a little. Let's assume that for some reason this difference is 1% per year. This could be the case, for example, because US equity funds that are registered outside the US have to pay a dividend tax on US shares of at least 15% of the dividend amount. American funds are exempt from this tax. Accordingly, the same FinEx U.S. stock ETF listed in Ireland essentially receives 15% less in dividends than a comparable U.S. fund. Because of this, the degree of lag from the underlying index may increase. However, it is also worth noting that such problems arise only with American stocks. For other asset classes, there generally will not be such a difference in dividend taxes between U.S. and non-U.S. funds.

Let's get back to the calculations. Let's consider the option if a fund traded on a Russian stock exchange performs 1% per year worse than a fund traded abroad:

In this case, it turns out that even taking into account taxes, the result of a foreign fund over 14 years would have exceeded the result of a Russian fund. In this option, the difference in commissions had a more significant impact than tax benefits.

At one time, I made similar calculations - what would happen if the profitability of a Russian fund lags behind the profitability of a foreign fund by 1% per year. The table below shows the yield in rubles. However, it does not change every year.

As a result, it turns out that with a difference in profitability of 1%, sooner or later a year comes when the result of a foreign fund begins to outstrip the result of a Russian one, taking into account the fact that the Russian fund will not have to pay taxes.

At the same time, if the returns of the funds are not very high, then the foreign fund begins to outperform the Russian fund quite quickly - around the first or third year. In this case, the profit that is released in Russia due to tax incentives is minimal, so the difference in commissions plays a more significant role.

If the ruble return of funds is at the level of 10%-15% per year, then the foreign fund begins to outperform the Russian fund also after an average of 10-15 years.

With a return of more than 15%, a foreign fund begins to outperform the Russian one after 17-20 years. Thus, there still comes a period of time when the difference in commissions begins to have a more significant effect than exemption from personal income tax

Let me remind you that all this is relevant provided that the Russian fund consistently lags behind the foreign fund by 1% per year.

If the difference in commissions and, accordingly, the difference in the accuracy of tracking the underlying asset between a Russian and a foreign fund is not very large, then Russian funds will be in a more advantageous position due to tax benefits.

The figure below shows the calculation results if the difference in commissions between Russian and foreign funds is 0.4% per year.

Bottom line

Despite the difference in commissions in the region of 0.8%-1% per year compared to foreign funds, funds available on Russian exchanges can show quite decent results if they closely follow the change in the value of their underlying assets. The existing difference in commissions is covered by the opportunity not to pay personal income tax when selling funds purchased on Russian exchanges. As a result, over a certain period of time, “Russian” funds, as a rule, can outperform similar foreign funds in terms of profitability.

However, with such a difference in commissions, sooner or later a year may come when the result of investments in foreign funds will be higher than the result of investments in Russian funds. Depending on the level of profitability of the funds, this can happen in about 3 years (if the profitability is not very high), or in 10-15-20 years (if the profitability is higher).

If the difference in commissions between funds available on Russian and foreign exchanges is at the level of 0.4%-0.5% per year or lower, then Russian funds will have more significant advantages over investments in foreign funds, because . tax benefits will cover the difference in commissions.

And in certain asset classes (for example, gold or Russian shares), for which there are funds on Russian exchanges with commissions not much higher than the commissions of similar foreign funds, it is already more effective to invest in Russia than abroad.

At the same time, when answering the question of which funds are better to invest in - Russian or foreign - an investor, first of all, should focus on subjective factors. In other words, my personal opinion on a number of points:

- where is it more reliable to invest over the long term - in Russia or abroad;

— does the investor want a larger selection of assets for his portfolio;

— does he have a desire to directly withdraw his funds abroad;

— whether he is ready for more independent actions when investing on foreign exchanges.

If you look only at the profitability that funds available on Russian and foreign exchanges can show, then “Russian” funds look quite normal in this regard, even outperforming the profitability of similar foreign funds at certain moments. But this is all relevant, again, provided that Russian funds repeat well the change in the value of their underlying assets, and no other factors other than commission will have a significant impact on the accuracy of this repetition.

At the same time, the investor may well not make any clear choice between Russian and foreign funds, but invest simultaneously in both the Russian and foreign markets. This will allow for additional diversification within the portfolio, and keep part of the capital in Russia and part abroad.

* * *

Subscribe to my Telegram channel “About ETFs and Passive Investments” - you can find articles there that are not on the site

Investment classification

Typically, investments are classified according to several criteria at once, that is, characteristics. It is needed mainly for clarity and ease of systematization of a significant amount of information with such a large number of existing types of financial investments. I would like to highlight the classification of investments as simply as possible, citing both the types and characteristics of certain investments. A novice investor can use this information not only as basic knowledge, but also as a main component to calculate the return on investment and its feasibility.

By type of ownership

This is a characteristic that demonstrates the source of financial investments. There are:

- Private - these funds are invested by individuals as well as legal entities;

- State - a financial investment made by central or local authorities using budget funds;

- Mixed - as the name implies, such investments are made jointly by individuals, as well as non-governmental and government bodies;

- Foreign investments are investments made by foreign states and their residents, which can be either legal entities or individuals;

- Joint - financing that comes from both domestic and foreign entities.

By objects

This type of classification indicates which object will be financed. There are 4 types of such investments:

- Real investments are investments in fixed and working capital, tangible and intangible assets.

- Financial investments are investments primarily in financial instruments, such as shares, foreign currency, and precious metals.

- Speculative - investing in investment assets for the purpose of their subsequent resale.

- Venture capital is a financial investment in newly created companies that have great potential for future development and, accordingly, profit.

According to intended purpose

An investment can also be characterized by its goals:

- Direct - investments in materials for business development in order to further take an active part in the company’s business activities.

- Portfolio investments - financial. investing in the securities of an enterprise, which allows you to receive income from the company’s activities and influence its future policy.

- Real investment is investing money in material production.

- Non-financial - contributions in the form of patents, discoveries, trademarks, which helps to increase operational efficiency.

- Intellectual - investing in intellectual forms of activity - developing know-how and new technologies.

By investment period

According to the terms of investment, it is customary to divide them into:

- Short-term - such an investment is invested for up to 1 year;

- Medium-term - investment ranges from 1 year to 5 years;

- Long-term - investments are made for a period of more than 5 years.

According to the degree of risk

Depending on the degree of investment risk, it is customary to distinguish 4 types of investments:

- Risk-free investments - this option is different in that there is no real risk of losing funds, that is, there is a one hundred percent guarantee of profit, which is extremely rare.

- Low-risk investments - in these investments the risk of losing funds is significantly less than the market average.

- Medium-risk investments - the level of risk is close to the market average.

- A high-risk investment—the level of risk is many times greater than the market average. A feature of such high risk is the equally high return on investment.

Data on foreign direct investment—a vital statistic for assessing bilateral relationships between countries and the scale of their activities—present a huge challenge today: the use of intermediary countries with business-friendly tax and legal regimes makes it difficult to understand where much of the investment is coming from. However, an economist from UNCTAD (United Nations Conference on Trade and Development) explained how this obstacle can be overcome: with this approach, the financial data of a number of large economies, such as Russia and China, look completely different.

According to UNCTAD, between 30% and 50% of foreign direct investment passes through “conduit” countries, making it difficult to determine the true source. Meanwhile, countries acting as investors appear in the reports of only a dozen governments, and the largest emerging economies are not among them. That makes it difficult to know how much U.S. and European sanctions have reduced the flow of Western investment into Russia or what U.S. investors are risking in China as a result of President Donald Trump's trade war against the country.

In recent years, economists have been trying to develop ways to adjust the data so that it can identify the final investors. In 2021, two International Monetary Fund economists proposed using official FDI figures as a benchmark, based on data provided by the few countries that care to identify the end investor. The estimates obtained are quite rough because we are talking about developed Western economies and the way they use intermediaries differs from the methods of emerging markets.

Earlier this year, UNCTAD economist Bruno Casella proposed a more sophisticated way to bypass the middlemen. It is based on assessing the probabilities of one country acting as a “conduit” for another country and then converting those probabilities into a model using a mathematical system known as Markov chains. Casella tested his method on countries with the most transparent statistics on foreign direct investment, such as Germany, France, Switzerland and the United States. Based on data on the direct source of investment, his model produced results that were quite close to actual reported data on the final investing countries.

Handelsblatt 09/13/2019 El Confidencial 08/21/2019 Financial Times 08/05/2019 The Economist 07/02/2019

In an appendix to this year's World Investment Report, UNCTAD used the Casella method to value foreign direct investment shares by ultimate investor. The results are radically different from the data reported by most countries. I was especially struck by the comparison of UNCTAD estimates with official data from the Central Bank of Russia for 2021 (the last year for which such a comparison can be made).

No, this is not Cyprus

According to UNCTAD, Russia receives a much smaller share of foreign direct investment from small island states than it reports.

Of course, no one, including the Central Bank of Russia, ever believed the fairy tales that Cyprus, the Netherlands and Bermuda are the largest foreign investors in Russia. Most of the investments they report are believed to come from Russian businessmen concerned about the lack of property protection in their homeland. Indeed, UNCTAD found that 6.5% of Russian FDI—about $28.7 billion in 2021 data—was of Russian origin.

Moreover, UNCTAD's assessment shows a significant increase in European and American investment. Based on Casella's model, the largest investor in the Russian economy is the United States, with about $39.2 billion at stake. This may explain why the Americans never escalated sanctions to such an extent that the Kremlin was tempted to expropriate American investors' assets. The same goes for the EU.

Meanwhile, for Russia, the repatriation of capital registered as foreign, but not actually so, remains an important political task. In its World Investment Report 2019, UNCTAD linked the decline in investment inflows into Russia in 2018 to government attempts to force Russian business owners to redirect their assets back home.

The US is also the largest foreign investor in China, accounting for 9.7% of total FDI stock, according to UNCTAD. At the same time, China itself consistently reports greater investment inflows from its Asian neighbors, and the official US share of Chinese FDI is only 3%.

Arab News 10/14/2019 The Wall Street Journal 09/07/2019 Foreign Media 07/04/2019 Le Figaro 05/22/2019

Meanwhile, according to UNCTAD, Chinese investment accounts for only 1.3% of US inward FDI. As with Russia, the United States must tread carefully to avoid striking too hard at Chinese interests. For example, destroying Huawei Technologies Co.'s smartphone business would likely lead to retaliation against U.S. companies operating in China, and the damage could be disproportionately high.

Of course, Casella's sophisticated and relatively accurate method offers us only estimates, not actual data. It's still nothing more than a crutch of sorts.

If more countries reported end investors instead of just middlemen, it would be invaluable, as evidenced by the greater understanding of actual economic relationships between countries that these estimates provide. This kind of reporting would easily make it possible to determine which states are most often used by investors from specific countries as intermediaries. This information could be useful in managing bilateral tax and legal regimes, not only to reduce tax evasion, but also to determine which features of the regulatory climate are particularly important to investors. This is something G-20 leaders should think about as they discuss the larger challenge of bringing greater transparency to globalization.

InoSMI materials contain assessments exclusively of foreign media and do not reflect the position of the InoSMI editorial staff.

Foreign investment in Russia

Foreign investment for a state like Russia is an important component of the national economy. That is why Russia at the legislative level adopted the Law “On Foreign Investments”, which protects the rights of foreign investors. At the same time, financial investment from abroad has a large number of advantages:

- Russia attracts capital and new technologies;

- Modernization of production increases the profitability of the enterprise and GDP;

- Improve the competitiveness of domestic enterprises on the world market and increase the export of Russian goods;

- Improve the organization of Russian production and increase the productivity of enterprises.

The main industries that are most attractive to foreign investors are IT, banking sector, gas and oil industry.

Western experts confidently say that Russia has a promising market and investing in it is very profitable. These words are confirmed by world-famous companies, including Ikea, Pfizer, Leroy Merlin, Mars Inc and others, for which Russia is a country in which they are not afraid to build new plants and factories. According to analysts, the Russian economic recession has ended and in 2017 the domestic economy began to grow again. This indicates a positive atmosphere for foreign investors.

Foreign investments in the domestic economy make it possible to attract capital and high technologies, and therefore improve the competitiveness of Russian goods on the world market.

Risks for foreign investors and Russian partners

There are risks in any investment activity. But for foreign investors and business owners in Russia they are different.

Types of investment risks for investing companies.

| Pure risks | ||

| Risk name | Definition of the term | Examples of risks |

| Risk of physical harm | Force majeure circumstances and actions of various persons that affect the value and liquidity of assets. | Floods, fires, natural disasters, racketeering, hacking, theft and so on |

| Regulatory risk | Changes in government policy, its laws and legal impact on the economy | Changes in laws are not in favor of companies, reduction of benefits, increase in refinancing rates |

| Economic risk | Negative impact on the company's activities in financial matters | Inflation, competition from suppliers of similar goods, changes in demand |

| Speculative (investment) risks | ||

| Risk name | Definition of the term | Examples of risks |

| Credit risks | Risks associated with obtaining loans and borrowings | Changes in interest rates during loan repayments, inability to repay payments on time, legal costs |

| Risks of the first stage of the investment cycle | Operational and installation risks; risks associated with infrastructure implementation | Failure during commissioning, freezing of the construction process, technical problems and shortcomings |

| Entrepreneurial risks | Interest, currency, financial, commercial risks | A very wide range of risks, which include problems with supplies and sales, lack of investment, risk of loss of investments, too high interest rates for the use of leasing and rented facilities, and so on. |

| Country risks | Political changes in the country where the investment is made | The most dangerous risk group. If political conditions change dramatically in the recipient country, the investor may lose his entire investment. This includes inter-country conflicts, wars, sanctions, etc. |

For a Russian investor, the risks are approximately the same, with the difference that he has more ways to influence the distribution and use of capital. You can invest only 10% of shares in a Russian enterprise and already have the opportunity to manage the company’s activities. But Russian investors are protected by laws, largely because the excess of foreign investors and their direct influence on the economy is dangerous for the country. Therefore, there are always certain restrictions for foreign investors. Russian investors have more powers in their country, which means fewer risks. In addition, the state provides Russian investors with additional guarantees and benefits, which makes attracting foreign investment capital profitable.

Popular types of investment in Russia

Many Russians dream about passive income, because how tempting it is to receive an impressive amount every month without making any effort. This is where investments help, which today are available even to a person with an average income. But if so, why are there so few investors in a country like Russia? The answer is obvious - investments always carry the risk of losing their funds and the higher the possible earnings, the higher the risk of losing part or even the entire investment.

And our mentality is such that a person is not always ready to risk his money; he prefers earning money without investments. The term “financial pyramid” is well known to our compatriots and at the moment they are not too ready for financial risk. Nevertheless, the question of where Russians can invest their money profitably today remains relevant. It's time to cover in more detail the most popular areas of investment in Russia.

Investments in cryptocurrency

If you have a desire to invest in cryptocurrencies, but do not know where to buy Bitcoin for rubles, then we recommend that you pay attention to the Matbi online exchanger. This is a convenient platform not only for buying and selling, but also for reliable and secure storage of digital assets. After registering on the site, the user has access to 4 crypto wallets for storing Bitcoin, Litecoin, Dash and Zcash. Now all that remains is to top up your personal account balance with rubles and start exchanging rubles for one of the cryptocurrencies. All processes are discussed in detail in this video.

Bank deposits

The simplest and most popular way of investing Russians’ money over recent years is a bank deposit. Its advantages are a low entry threshold, because the first deposit can be made with only 1,000 rubles in hand, as well as high guarantees of maintaining the deposit. In addition, the simple system of bank-client relationships captivates many. Once you deposit money in a banking structure for a certain period of time, you can forget about managing the deposit, all that remains is to receive interest on time, the amount of which is known in advance. On the other hand, a bank deposit is more likely to preserve savings from inflation than a full-fledged investment, since it will not bring much money - the income from the deposit is only slightly higher than the inflation rate.

Real estate

The second most popular type of investment for Russians. Its popularity is due to the low risk of capital loss, because the property cannot depreciate in value. If its price falls during a crisis, then the rest of the time it grows steadily. In addition, owning your own real estate allows you to earn money not only from the increase in its value, but also from renting it out. However, this investment also has disadvantages. Firstly, not everyone can afford to buy an apartment or a house in order to earn money from it. First you will have to earn a million, or even more than one, in order to invest in real estate. In addition, it is too low-liquidity asset. If you urgently need money, you won’t be able to sell the property quickly, and you need to be prepared that it can be sold at a price much lower than the market price.

Stock market

The stock market is one of the most profitable ways of investing, which involves buying stocks, bonds and other securities. At the same time, the investor invests his money in a really existing business, because a share is nothing more than a piece of an enterprise. And if the business works, then the shares bring profit to its owner, both in the form of dividends and by adding value.

You don’t need a lot of money to buy shares; in addition, this type of investment allows you to diversify your stock portfolio, which makes it possible to reduce risks. However, you have to pay for high returns with unnecessarily high risks, since the share price can have very wide fluctuations. And to trade them profitably and, accordingly, to make money, you need to acquire special knowledge, which not everyone likes.

Forex market

Investments in the foreign exchange market are quite popular all over the world. Russia also has its own supporters of this type of investment. For some of them, Forex trading is a permanent remote job that brings good profits, much higher than other types of investments. For professional traders, profits can be 100-500% per month and this is not the limit. However, only a few achieve such results even with very good preparation. Without the appropriate knowledge, you can not only fail to make a profit, but also lose your money. If you don’t have the time or special knowledge to trade Forex, but you have a desire to invest in the foreign exchange market, then you should take a closer look at investing in PAMM accounts. These are special accounts managed by professional traders. For such services they take a portion of the profits. Thus, you can slightly reduce the risks, although you will have to sacrifice profitability.

Mutual funds

Mutual funds in the West are a very popular investment instrument. But in our country there are much fewer investors in mutual funds. The shareholder’s income largely depends on the professionalism of the fund manager; in addition, there are risks of loss of income due to the wrong choice of mutual fund. On the other hand, investors are attracted by higher profitability than a bank deposit with sufficiently high security of the investment and there is no need to independently understand the intricacies of working in the stock market.

Collectibles

Many Russians still believe that investing money in collectibles, such as paintings, antiques, etc. can bring good profits. This statement is only partially true for long-term investing. In addition, non-professionals have a very high chance of falling into a fake. All this makes financial investment in collectibles a very dubious proposition.

Not only the potential profit, but also the risk depends on the choice of investment type, and therefore this issue must be approached more than responsibly.

What foreign investors gave to the Russian stock market

After a two-year break, the share of international investors in publicly traded shares of Russian companies began to grow again and is approaching half. Such a strong dependence potentially carries risks of a market decline in the event of a mass departure of non-residents. But at the same time, foreign investors contribute to the growth of diversification and quality of issuers. As a result, the importance of the Russian market is increasing - issuers that were previously placed abroad are returning to it, and new IPOs are being conducted with dual listings. Total capitalization is also growing, although so far it remains at a level of only about 1% of the global one.

The triumph of high-tech

By the end of 2021, the share of international investors in free float shares of Russian issuers was almost equal to the share of domestic ones. MidLincoln Research estimates it reached 48% in November, up 3 percentage points (pp) from the end of 2021. Compared to the end of 2021, the growth was 8 percentage points. Prior to this, over the course of four years, the share of international investors had been steadily declining. Back in 2013, they accounted for more than 70%, but since 2014, against the backdrop of ever-expanding sanctions, non-resident investments began to decline rapidly: to 57% of free float by mid-2021 and to only 40% by the end of 2018.

Current growth is unevenly distributed across different sectors. According to MidLincoln, non-residents increased their presence in the consumer goods sector of secondary goods (to more than 57%), electric utilities (to 46%), and most strongly in the sector of high-tech companies - by 26 percentage points, to more than 96%. This sector was the most popular among investors this year; the capitalization of its Russian segment increased 2.5 times, to $31.4 billion.

As explained by the founder of MidLincoln Research and chief economist of IQG Hovhannes Oganisyan, the increase in market capitalization of the sector as a whole and the increase in the share of non-residents in free float were led by the inclusion of Yandex securities in the MSCI Russia index, the increase in the popularity of Mail.ru, the listing in Russia of HeadHunter and the IPO of Ozon.

Yandex placed depositary receipts on NASDAQ back in May 2011, and in 2021 the Moscow Exchange included them in the calculation of the broad market index and the international index provider MSCI was able to add them to its index focused on Russian securities. In August, Yandex received an 8.1% stake in it. According to BCS Global Markets analysts, this could provide an influx of passive funds into the company's shares in the amount of up to $1 billion. “Large institutional Russian investors, for example, pension funds, are limited in their ability to invest in shares of companies registered abroad. Therefore, such shares are mainly bought either by individuals or by Russian funds that are small by global standards, but mostly by foreigners,” explains Hovhannes Hovhannisyan.

The inclusion of Yandex shares in MSCI Russia led to a reduction in the shares of companies in the oil and gas and financial sectors. The shares of Sberbank, Gazprom, LUKOIL suffered the most, which decreased by 1.4 p.p., 1.3 p.p. and 1.2 p.p., respectively (to 16.1%, 14.5 % and 13.8%). As a result, passive funds were forced to reduce their investments in shares of these companies. This year, the attractiveness of investments in the oil and gas sector was reduced by the fall in oil prices, and for banks - by the depreciation of the ruble. According to MidLincoln Research estimates, since the beginning of the year, the share of foreigners in the free float of the oil and gas sector has decreased by 4 percentage points, to 50.1%, and in the financial sector - by 1.1 percentage points, to 29.3%.

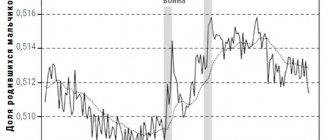

Vulnerable to crises

But such a large share of foreign investors, twice the share of their average presence in developed markets, also creates additional risks. In particular, sharp market declines in 2008, 2014 and March 2021, when the RTS currency index collapsed several times, were largely due to the departure of foreign investors.

The situation is complicated by the low capitalization of the Russian market by the standards of global funds; its share in the world is slightly more than 1%. According to Bloomberg, the capitalization of the RTS index is $608 billion, which is two and a half times lower than the levels of mid-May 2008 (about $1.5 trillion).

“The smaller volume of total capitalization of Russian companies compared to Western markets makes our market more vulnerable to crises, in which case foreign players focused on a shorter horizon may begin to sharply withdraw invested funds, thereby causing volatility,” - about Mikhail Bespalov.

The Russian market cannot boast of wide industry diversification, which also affects its resistance to external shocks. In particular, with the risk of a bubble in the IT sector increasing this year, the collapse of the dot-com market in 2000 comes to mind. In addition, if more than 3 thousand shares of American and international companies are traded on the NYSE, then on the Moscow Exchange there are only two hundred, taking into account a couple of dozen depositary receipts of foreign companies.

At the same time, the structure of the Russian economy in terms of gross output is still concentrated in several industries (oil and gas, mining, energy, financial), which is also reflected in the structure of the stock market. “The technological (industrial) and medical sectors, nuclear energy retain the status of state or private enterprises. Sectors of the new economy - IT, robotics, biotech - are by and large at the startup stage and are supported by private capital,” notes Deputy General Director of Management Company TFG Ravil Yusipov.

"Hot money" is becoming a thing of the past

However, now Russian market participants estimate the degree of negative influence of non-residents to be noticeably lower than five to ten years ago. The most toxic for any market is the so-called hot money, which provokes an increase in volatility. “There has been less such “hot money” on the market over the past decade. Those non-residents who invest because they count on long-term growth in cash flows from their investments add no more risk to the market than domestic investors,” says Vitaly Isakov, Investment Director of Otkritie Management Company.

In addition, the current expansion of the presence of foreign investors has occurred in the context of a rather negative background in relation to Russian assets. These are increased sanctions rhetoric, the tense situation with COVID-19, lower oil prices, and problems with economic recovery. As a result, in the event of corrections, as was the case in the American market in September, international investors will probably not leave Russia entirely, but will simply shift to value stocks that are gaining popularity - companies with established businesses and dividends. In the Russian index, the weight of these sectors exceeds 70%.

Sales of non-residents can also be purchased by private Russian investors entering the market en masse. According to the Moscow Exchange, in November the total number of unique brokerage accounts of “physicists” exceeded 8 million, and more than 4.2 million new accounts have been opened since the beginning of the year. In general, since the beginning of the year, the volume of assets in brokerage accounts of individuals has increased by 1 trillion rubles, to 4.7 trillion rubles.

“The Russian stock market has already shown in many ways its maturity and strength. And the flight of non-residents from the market in the spring of this year was bought by residents,” notes Konstantin Bushuev, chief investment strategist at Otkritie Broker.

Meanwhile, non-residents are increasing the diversification of the Russian market. Many large initial public offerings in recent years have taken place primarily on foreign exchanges. They mainly concerned sectors that are poorly represented on the Russian market. “The Russian market is evolving and changing, the share of commodity and cyclical sectors is decreasing. Just three or four years ago, it was difficult to imagine that the weight of Yandex in the Moscow Exchange index would be close to the weights of LUKOIL and Norilsk Nickel,” notes Mr. Isakov.

The importance of the Russian market itself for issuers is also increasing. The growing capital intensity of the Russian market attracts companies whose business is concentrated in Russia, but which have placed their securities abroad, mainly in London and New York.

In the second half of 2021, at the request of issuers, depositary receipts of MD Medical Group, Globaltrans, HeadHunter, Mail.ru Group began trading on the Moscow Exchange. O'Key Group GDRs will begin trading on December 14. And at the end of November, Ozon held an IPO on two platforms at once - NASDAQ and the Moscow Exchange. At the same time, demand from local investors alone, according to Kommersant, exceeded the supply volume five times. A little earlier, in October, Sovcomflot and the developer Samolet held an IPO on the Moscow Exchange. In general, the placement of these shares alone added $12 billion to the capitalization of the Russian market.

All investors are important

Next year, market participants expect an increase in the number of new placements, which will contribute to the growth of capitalization of the Russian market and its diversification, and therefore attractiveness not only to local but also foreign investors. Olga Plevako, partner in KPMG's Investment and Capital Markets Department in Russia and the CIS, notes a sharp increase in demand for IPO preparation services in the last month, which was stimulated by general optimism in the capital markets following the announcement of the successful completion of vaccine trials. “Additionally, the interest of Russian companies in IPOs was fueled by the success of Ozon’s placement,” notes Ms. Plevako.

According to estimates by Dmitry Brodsky, managing director of Renaissance Capital, in 2021, five to six Russian companies will consider the possibility of holding an IPO, mainly from the technology and consumer sectors. VTB Capital expects at least five transactions to be completed on the equity capital market in the first quarter. “We are seeing strong interest in potential placements from issuers and their major shareholders in the mining sector, particularly in gold mining, as well as in the technology, financial and retail sectors. Many issuers and shareholders are also actively monitoring the situation on the equity capital market in the context of potential secondary placements,” notes Dmitry Bolyasnikov, co-head of equity capital markets at VTB Capital.

According to Reuters, online cinema ivi and European Medical announced plans to hold an IPO. After the successful placement of Ozon, Sistema JSFC plans to conduct an IPO of the timber industry holding Segezha Group. Owners of metallurgical companies will continue to sell small shares, says Andrey Chepur, Managing Director for Equity Capital Markets at BCS Global Markets. According to his estimates, the total volume of initial placements planned for 2021 will be several times higher than the volume of 2021.

Independent financial analyst Alexander Golovtsov on foreign investors in the Russian market

The choice of sites for a company to expand its investor base largely depends on the industry and its size, investment bankers say. “To attract investors investing in the technology sector, it is logical for Russian companies to enter international platforms, primarily NASDAQ,” notes Dmitry Brodsky. According to Olga Plevako, investors on international platforms favor Russian companies in the financial, IT and technology sectors, as well as large, well-structured and profitable companies in traditional industries such as mining.

“Listing only on a local site can be attractive for medium-sized companies, since preparation and listing itself in Russia costs companies less than on international sites. Also, local listing may be preferable for companies that have only ruble revenue or are focused on a narrow segment of consumers,” adds Ms. Plevako.

At the same time, the majority of IPOs currently being prepared involve listing on the Moscow Exchange, and only a few are planning a listing in London or on American exchanges. The growing popularity of the Moscow Exchange can be facilitated not only by an increase in its capital intensity at the expense of private investors, but also by work on infrastructure development. According to Dmitry Bolyasnikov, a large number of investors, both Russian and foreign, have the opportunity to trade on the exchange; transaction settlements and other processes comply with the best international practices: “We are seeing more and more Russian issuers preferring listing in Moscow.”

Placement or even listing on the Moscow Exchange may also be of interest to large issuers who want to get into indexes such as MSCI Russia, which are targeted by a large layer of passive investment funds. “The main criterion for inclusion in such an index, in addition to the company’s capitalization, is precisely the presence of a listing in the country of doing business (or the main part of it) and the level of liquidity of shares on the local exchange,” says Mr. Bolyasnikov.

Regardless of the listing, any IPO/SPO from Russia is usually offered to foreign institutional investors, and they tend to make up the bulk of the order book, notes Andrey Chepur. Therefore, for further popularization of the Russian market, all investors, not just Russian ones, are important for placements. Mikhail Bespalov believes that the presence of foreign capital in the Russian market should be viewed not as a risk, but as an opportunity to increase liquidity and provide Russian companies with the means to attract the financing necessary for development, without incurring significant additional costs compared to their foreign ones. colleagues.

Vitaly Gaidaev

Investment management

In order for investments to bring profit, it is not enough to invest money. They need to be managed correctly. Thanks to a properly constructed strategy, you can significantly increase profits while reducing the investment amount. Management itself can be reduced to three main stages: investment assessment, implementation of the developed strategy, monitoring or supervision of invested funds. Let's look at these stages in more detail.

Investment evaluation

At the first stage, the investor collects all available data about the investment instrument, as well as the accompanying market. At this stage, it is already possible to determine the duration and profitability of the investment. Market analysis is one of the most important and critical stages in financial investments.

Implementation of the strategy

After the investor has decided on the direction of the investment, it is time to carry out his plans. At this stage, it is important to act according to the planned plan and chosen strategy. If it is developed correctly, profits will follow.

Monitoring

Even the best strategy can fail. This is why it is important to constantly monitor your investments and change your strategy if necessary. This is especially true when investing in the foreign exchange and stock markets. Thus, you can sell assets at a profit and get the maximum profit, or get rid of the investment in time to avoid losses.

Foreign investments

Many people believe that foreign investment is only available to very rich people. In fact, you can open an investment account in a foreign company even with a small amount. At the same time, we are not talking about shady foreign offices, but about large companies that are controlled by state regulators.

Another myth is that foreign investment is prohibited for Russians. Indeed, a number of laws have recently appeared requiring foreign account holders to report to the tax authorities, but there is no talk of a ban. There are investment methods that allow you to legally reduce the level of communication with the tax authorities and control over your accounts.

It is also not necessary to speak a foreign language well. Some foreign companies have already mastered the Russian language and provide the opportunity to communicate in their native language.

Advantages of foreign investment:

- large selection of financial instruments;

- more opportunities for portfolio diversification across countries, currencies and asset classes;

- diversification of funds by country (storing money in the accounts of foreign companies, and not just in Russia);

- more favorable conditions for financial instruments and investment conditions;

- direct access to exchanges in other countries without unnecessary intermediaries;

- more reliable and higher capital protection (much more than 1.4 million rubles);

- the opportunity to receive passive income (foreign funds pay dividends, unlike mutual funds).

There are currently three ways to invest abroad:

- through a foreign bank

- through a foreign broker

- through a foreign insurance company

Foreign bank

If we talk about investing through foreign banks, then first of all this concerns clients of Private Banking - a service for wealthy clients within which the bank offers banking, investment and consulting services. Investor capital requirements are usually from 100 thousand to 1 million dollars/euro or more. And the larger, more famous and more reliable the bank, the larger the amount required. On the one hand, the bank offers such clients some unique services, advantageous offers, provides a personal manager or financial advisor, and so on. But the investor has to pay a lot for this comfort.

Typically, banks already have ready-made investment proposals - portfolios, their own funds, structured products. Therefore, they primarily offer clients their own products, which may not be the most profitable and optimal in terms of commissions, costs and composition. In addition, large banks are financial holding companies, which, in addition to the bank itself, also include a management company, a broker, and an insurance company, so the bank will strive to sell the client other financial products, such as life insurance.

By the way, last year large Swiss banks introduced commissions for Russians who have less than $5 million in their accounts in the amount of 1,000 Swiss francs per month. Thus, they try to refuse to work with “small” clients.

Opening an account in a foreign bank carries with it the obligation to notify the tax authorities about the opening of such an account and annually report on the flow of funds in the account. In addition, the banks themselves may ask you to document the legal origin of your funds, as they do not want to be involved in money laundering mechanisms. You will also have to file your own return and pay income tax.

As for insurance of bank accounts, the amount of insurance depends on the country: in the European Union 100 thousand euros, in the UK 75,000 pounds, in Switzerland 100 thousand francs, in the USA 250 thousand dollars.

Foreign broker

Foreign brokers can be divided into two categories:

- foreign subsidiaries of Russian brokers

- directly foreign brokers

Daughters of Russian brokers

Most foreign subsidiaries of Russian brokers are registered in Cyprus. This carries additional risks, since Cyprus is not the most reliable jurisdiction from an economic point of view, has low credit ratings, and in 2013 there was a serious financial crisis in Cyprus.

Another disadvantage of Cypriot brokers is that they work through a sub-broker, that is, they do not have direct access to foreign exchanges, so they buy securities through other brokers (American or European). The insurance amount for a brokerage account is up to 20,000 euros.

The advantages include the fact that communication with the broker will take place in Russian, as well as lower commissions compared to other foreign brokers. To open an account you will need an amount from $200 to $10,000.

Advice for a novice investor

Getting started is never easy, and being a novice investor without experience and a clear plan is even more so. Where to invest your money, what investment projects to choose to increase your funds? These are just a few of the questions that a new investor asks himself. The path to the stars, and in our case, to profit, in any case, will be through thorns.

But you can’t do without it, because whoever doesn’t take risks doesn’t win. To help beginners, I want to share my own experience and give some tips that can help avoid the most common mistakes.

Make a plan and follow it

A competent investor must have a clear plan of action - how much he is willing to spend on an investment, how much he would like to receive and in what time frame. It is this plan that is the basis of future profits, be it investments in startups or a bank deposit. Although life is life, and the plan may change, it will be the “framework” of your actions.

Explore your chosen niche

Knowledge is power, and investing is no exception. Without knowledge, you should not invest in stocks or currencies, since in this case losses will follow immediately. Investments do not tolerate hasty decisions! To invest in an investment instrument, you need to carefully study it, assess the risks and opportunities, and then decide on the advisability of such an investment. If you are too lazy to do this, then it is better to look for another source of additional income, for example, sites for making money on the Internet.

Manage risks

Risk management is an important component in investment management. If an investment instrument becomes less profitable, you need to find out why this happened. This is what will help avoid losses in the future. Another important component of risk reduction is investment diversification. This will allow you to compensate for decreased profits on some instruments by increasing profits on others.

Turn off your emotions

Emotions and profit are incompatible. A cool head when drawing up a plan, analyzing an investment instrument and managing risk is an important part of success. With experience, financial intuition will appear, but for this this very experience needs to be gained, and this will take time.

The main task of investing is to save money and only then make a profit. That is why it is better for beginners to choose investments with low income, but also with low risk.

Additional income from investments is not a myth at all, and many people around the world have become convinced of this, and Russia is no exception. Money must work and bring in money, otherwise it simply depreciates under the influence of inflation. On the other hand, investment and risk are, in many ways, synonymous words, and you need to be prepared for this. Everyone chooses for themselves, but, as history shows, those Russians who choose this investment path are more likely to be lucky in the form of gaining financial independence.

Author Ganesa K.

A professional investor with 5 years of experience working with various financial instruments, runs his own blog and advises investors. Own effective methods and information support for investments.

Russians are looking for reliability and simplicity

In October, the World Gold Council (WGC) published the results of a study on the attitudes of private investors in different countries towards investing. WGC surveyed 12 thousand respondents in China, India, North America, Germany, and Russia. In Russia, more than 2 thousand investors who live in different cities throughout the country were interviewed during online interviews.

Source: WGC report

On average, a private investor in Russia prefers to allocate 15% of his income to savings and investments. At the same time, Russian portfolios, as a rule, do not differ in diversity, the authors of the study conclude. The average number of products in a Russian investor's portfolio is 2.7 (compared to the global average of 3.4). 57% of Russians own two or more investment products in their portfolio and only 6% of portfolios contain six or more different products.

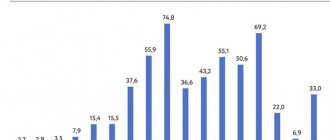

Here is what the top 6 most popular products among Russian investors look like:

- savings account

- Foreign currency

- Real estate

- Life insurance

- Cryptocurrencies

- Gold

The majority of Russians still prefer traditional deposits and savings accounts to any other investment instruments.

— The popularity of savings accounts is quite understandable. Investors are looking for opportunities that do not involve risk. They want simple products with accessible entry points that are easy to buy and sell in small quantities. In fact, a deposit is still the most accessible instrument for investors, regardless of age, gender, income and geography. In addition, they are considered the safest way to invest money while protecting your wealth, conclude the authors of the WGC report.

Source: WGC report

Another reason for the undying popularity of deposits is the demand for them from older investors.

“Older people are looking for opportunities to protect their capital,” explain the authors of the study. — This group invests for two main reasons: stable income and wealth protection. They are generally risk averse and an important goal for them is to pass on some of their wealth to the next generation. Therefore, they first choose the most conservative instruments.

Foreign exchange is the second most popular investment option. Russians use foreign currency as a means to preserve savings in the face of ruble weakness. At the same time, of those who invest in foreign currency, 78% of respondents prefer to keep their money in US dollars, and 56% prefer to keep their money in euros.

Investments in real estate and life insurance products are consistently popular among Russians. But the top five most popular instruments in Russia, surprisingly, are cryptocurrencies.

Despite the fact that Russian investors also suffered from losses in the cryptocurrency market, these assets remain in the top among Russians primarily due to their availability.

True, cryptocurrencies are most often used as a short-term investment, just like foreign currencies, and are usually bought and sold throughout the year, the WGC study emphasizes.

It is curious that neither stocks nor bonds were included in the top 5 most purchased instruments among Russians. Thus, according to a WGC survey, only 11% of respondents admitted that they bought shares in the last 12 months. Only 10% of respondents made investments in OFZs.

Source: WGC report