In the coming year, the size of the minimum pension will begin to be calculated using a new methodology. This is dictated by changes in the calculation of the minimum wage (the corresponding federal law has already been adopted in the State Duma). The basis is the experience of countries with successful social policies. To calculate the minimum wage, instead of the cost of the consumer basket, the median per capita income of a citizen will be used.

Living wage for a pensioner in the table by region for 2021

The cost of living for pensioners in all constituent entities of the Russian Federation, which affects the size of pension payments, is presented in the table:

| The subject of the Russian Federation | Living wage for a pensioner, in rubles | |

| from January 1, 2021 | For 2021 | |

| Central Federal District | ||

| Belgorod region | 8659 | 8016 |

| Bryansk region | 9860 | 9120 |

| Vladimir region | 9800 | 9077 |

| Voronezh region | 9020 | 8750 |

| Ivanovo region | 9521 | 8978 |

| Kaluga region | 10002 | 9303 |

| Kostroma region | 9734 | 8967 |

| Kursk region | 9144 | 8600 |

| Lipetsk region | 8811 | 8620 |

| Moscow | 13496 | 12578 |

| Moscow region | 10648 | 9908 |

| Oryol Region | 8917 | 8744 |

| Ryazan Oblast | 9321 | 8694 |

| Smolensk region | 9782 | 9460 |

| Tambov Region | 9396 | 8241 |

| Tver region | 9875 | 9302 |

| Tula region | 9997 | 9310 |

| Yaroslavl region | 9231 | 8646 |

| Northwestern Federal District | ||

| Republic of Karelia | 12783 | 11840 |

| Komi Republic | 12645 | 11534 |

| Arhangelsk region | 12014 | 10955 |

| Vologda Region | 10221 | 9572 |

| Kaliningrad region | 10378 | 9658 |

| Leningrad region | 10359 | 9247 |

| Murmansk region | 15066 | 14354 |

| Nenets Autonomous Okrug | 19353 | 17956 |

| Novgorod region | 10096 | 9423 |

| Pskov region | 10113 | 9529 |

| Saint Petersburg | 9757,10 | 9514 |

| North Caucasus Federal District | ||

| The Republic of Dagestan | 9020 | 8680 |

| The Republic of Ingushetia | 9020 | 8846 |

| Kabardino-Balkarian Republic | 10198 | 9598 |

| Karachay-Cherkess Republic | 8920 | 8846 |

| Republic of North Ossetia-Alania | 9100 | 8455 |

| Chechen Republic | 10020 | 9035 |

| Stavropol region | 8646 | 8297 |

| Southern Federal District | ||

| Republic of Adygea | 8540 | 8138 |

| Republic of Kalmykia | 8973 | 8242 |

| Republic of Crimea | 9060 | 8912 |

| Astrakhan region | 9621 | 8969 |

| Volgograd region | 8719 | 8569 |

| Krasnodar region | 9922 | 9258 |

| Rostov region | 9445 | 8736 |

| Sevastopol | 9862 | 9597 |

| Volga Federal District | ||

| Republic of Bashkortostan | 8645 | 8645 |

| Mari El Republic | 8719 | 8380 |

| The Republic of Mordovia | 9020 | 8522 |

| Republic of Tatarstan | 8423 | 8232 |

| Udmurt republic | 8917 | 8502 |

| Chuvash Republic | 8466 | 7953 |

| Kirov region | 9348 | 8511 |

| Nizhny Novgorod Region | 9360 | 8689 |

| Orenburg region | 9020 | 8252 |

| Penza region | 9020 | 8404 |

| Perm region | 9613 | 8777 |

| Samara Region | 9320 | 8690 |

| Saratov region | 8566 | 8278 |

| Ulyanovsk region | 9247 | 8574 |

| Ural federal district | ||

| Kurgan region | 9248 | 8750 |

| Sverdlovsk region | 9521 | 9311 |

| Tyumen region | 9958 | 9250 |

| Chelyabinsk region | 9794 | 8691 |

| Khanty-Mansiysk Autonomous Okrug - Ugra | 14044 | 12730 |

| Yamalo-Nenets Autonomous Okrug | 14033 | 13510 |

| Siberian Federal District | ||

| Altai Republic | 9539 | 8753 |

| Tyva Republic | 9485 | 8846 |

| The Republic of Khakassia | 9986 | 8975 |

| Altai region | 9573 | 8894 |

| Irkutsk region | 10540 | 9497 |

| Kemerovo region | 9147 | 8387 |

| Krasnoyarsk region | 10963 | 10039 |

| Novosibirsk region | 10378 | 9487 |

| Omsk region | 8932 | 8480 |

| Tomsk region | 10436 | 9546 |

| Far Eastern Federal District | ||

| The Republic of Buryatia | 10372 | 9207 |

| The Republic of Sakha (Yakutia) | 15077 | 14076 |

| Amur region | 11272 | 10021 |

| Jewish Autonomous Region | 13526 | 11709 |

| Transbaikal region | 11256 | 9829 |

| Kamchatka Krai | 18148 | 16756 |

| Magadan Region | 17560 | 15943 |

| Primorsky Krai | 12119 | 10775 |

| Sakhalin region | 13604 | 12333 |

| Khabarovsk region | 13205 | 10895 |

| Chukotka Autonomous Okrug | 19000 | 19000 |

The information is provided on the basis of regulations adopted by local authorities.

Additional payment up to the subsistence level for pensioners in 2021

If, during the calculation or annual indexation of a pension, it turns out that it is less than the PMP, then the citizen should contact the territorial branch of the Pension Fund of the Russian Federation (at the place of registration) or the nearest MFC to apply for an increase. This will bring total income to the value of the PMP. The bonus is provided exclusively to pensioners who have stopped working (officially unemployed).

You must have the following package of documents with you:

- passport;

- an application of the established form (can be downloaded on the Internet with a sample filling, manual filling in legible handwriting or on a computer is acceptable);

- employment history;

- a certificate of the current pension amount (not required when applying through the Pension Fund of the Russian Federation);

- other documents confirming the financial situation and status of the person submitting the application.

When calculating the amount of additional payment from the federal or regional budget, all benefits received by the pensioner in monetary terms must be taken into account:

- for special services to the Fatherland (given to WWII veterans, cosmonauts, liquidators of the Chernobyl accident, etc.);

- if there are dependents;

- upon reaching 80 years of age;

- for experience in the regions of the Far North and equivalent areas;

- for experience in agriculture and living in rural areas;

- compensation for housing and communal services;

- monetary equivalent of a set of social services for people with disabilities;

- EDV (one-time cash payment).

If you find an error Please select a piece of text and press Ctrl + Enter

photo by Andrey Andreev

The authorities have established a living wage for residents of Chuvashia. In addition, social pension recipients will be indexed by several percent from April this year.

From April 1, Russia will index social pensions by 3.4%. The average size of such payment will be about 10,183 rubles. For citizens whose social pension is less than the subsistence level, there is an additional payment that will be increased.

Living wage in Chuvashia:

- Per capita - 9,804 rubles.

- For the working population - 10,414 rubles.

- For pensioners - 8,466 rubles.

- For children - 9,883 rubles.

On March 11, a “Pro City” correspondent conducted a survey of Novocheboksary residents on the topic of pensions. The townspeople shared how much they received, whether they had enough money, and where most of it went. They also asked pensioners whether 8,466 rubles a month would be enough for them.

“No, it’s not enough, for our bosses this is for one day, but a pensioner needs to live on this for 30 days. I have been a leader and teacher all my life, but I earn 12,500 rubles. We have to save money. Thank God, my children live with me, and they support me, we have a common budget with them. I don’t count how much is spent on groceries, my daughter and son-in-law are paying off bills, and my pension is spent on my treatment. The grandchildren are growing up, there’s not even anything to congratulate. Many pensioners live the same way, barely getting by,” says Alevtina Petrova.

“Those who don’t have enough have high utility bills. Many old people stayed in large apartments, and in the end they paid about 7,000-8,000 rubles. Just imagine, you’ll pay for this out of 8,466 rubles, well, that’s all. And my pension is 15,000 rubles and another 1,200 rubles are veterans’. I have enough, I have enough for everything. I live like in a fairy tale. I have, how to say, balance, my daughter helps me, and I help my son,” said Tatyana Sviridova.

“Let them try to live like this themselves. We also want to eat, we want to dress, half of our pension will be spent on medicine, the rent is crazy. I don’t know how anyone can live on 8,000 rubles, so let them try to live. Let them give up their 500,000 rubles a month. My labor pension is 13,400 rubles, and my disability pension is 1,900 rubles. 6,000 rubles are spent on utilities. Everything goes towards extinction, so that the extra people die out. Slow extinction, so that there are no pensioners,” says Svetlana Ivanova.

“We have a common budget with our daughter, it’s enough for us. I have a labor pension, I am a Labor Veteran, my pension is 25,000 rubles. For those who receive 12,000 rubles, what can I say, apparently they don’t eat meat so often, and they need to drink less. The minimum should be 16,000 rubles for pensioners to receive. Regarding the social pension of 10,183 rubles, is this for those who did not work and are sitting here on the boulevard? You don’t even need to give them a ruble; they’d rather beg on the boulevard for beer than work. Most of us receive labor pensions, so they should increase it,” says Lyudmila Ivanova.

“We have to work and earn our pension. You don’t need to rely on anyone, everyone should rely on themselves, and not on someone else. The state is not a cash cow, they also need to protect us, that’s all,” said Galina Petrova.

“Naturally, that kind of money is not enough. When the rent for an apartment is about 5,000 rubles, and only 3,000 rubles are left for soap and a toothbrush. I am over 80 years old and have a working pension. My daughter pays for housing and communal services; my daughter and son-in-law also buy food for me. I can’t say that I have a small pension, but if I paid for housing and communal services and food myself, I wouldn’t have enough money. About social pensions, I can’t say why they have so little, but I don’t know how they should live,” says Antonina Ivanova.

Video:

Social policy in the Russian Federation is implemented through the division of powers between the center and the regions. Pensions are assigned according to federal legislation.

Let's consider how to apply for a pension in Chuvashia in 2021, and where to apply. Is it possible to increase the minimum accruals? What should an applicant for a social supplement to a pension do for this?

Self-study documents

Law of the Chuvash Republic No. 21 “On the subsistence level in the Chuvash Republic” (02/11/2021)

Federal Law N 178-FZ “On State Social Assistance” (06/11/2021)

Federal Law No. 44-FZ “On the procedure for recording income and calculating the average per capita income of a family and the income of a citizen living alone for recognizing them as low-income and providing them with state social assistance” (04/24/2020)

Decree of the Government of the Russian Federation N 512 “On the list of types of income taken into account when calculating the average per capita family income and the income of a citizen living alone to provide them with state social assistance” (05.21.2020)

Federal Law N 134-FZ “On the subsistence minimum in the Russian Federation” (December 29, 2020)

Did you find this information useful?

0 0

General provisions of the pension system

Residents of the Chuvash Republic are subject to federal legislation regarding the assignment of pension benefits. This means that in the region, as well as throughout the country, there are the following types of pensions:

- By old age:

- insurance is assigned when the criteria for length of service and points are met: after 60 years of age for women;

- after 65 years for men;

- at a different age in the presence of preferential grounds;

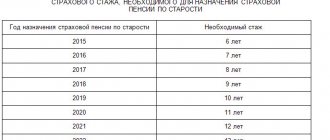

- work experience of at least 15 years (this indicator will be relevant by 2024, in 2021 the minimum experience is 11 years, within 4 years it will increase by 1 year annually);

- 30 individual pension coefficients (in 2021, the minimum amount of pension points is 18.6, the required number will increase annually and will reach 30 by 2024)

- social:

- women who have celebrated their 65th birthday;

- men over 70 years of age;

- foreign citizens and stateless persons permanently residing in the territory of the Russian Federation for at least 15 years and who have reached the specified age;

- state: assigned to citizens affected by radiation or man-made disasters;

- The state pension for long service is assigned to federal civil servants, military personnel, astronauts and flight test personnel.

- For disability:

- insurance in the presence of disability and at least one day of insurance experience;

- social in the presence of disability and lack of insurance coverage;

- state is assigned to military personnel, citizens who suffered as a result of radiation or man-made disasters, participants in the Great Patriotic War, citizens awarded the “Resident of Siege Leningrad” badge, and cosmonauts;

- In the event of the loss of a breadwinner, the following pension is entitled:

- insurance is assigned upon the death of the breadwinner, who was dependent on the applicant for pension provision. The main condition is that the deceased breadwinner has an insurance period (at least one day);

- social is assigned to children under the age of 18, as well as over this age, studying full-time in educational organizations, until they complete such training, but no longer than until they reach the age of 23, who have lost one or both parents, and children of a deceased single person mothers;

- state pension is assigned to disabled family members of deceased (deceased) military personnel; citizens injured as a result of radiation or man-made disasters, astronauts.

Regional authorities may establish additional social support measures for pensioners living in a federal subject. Thus, pensions in Chuvashia in 2021 will be brought to the subsistence level.

Attention: pension benefits can be assigned from the date of birth of the recipient. This occurs if the baby's parent has died. The baby is entitled to a survivor's pension.

Statistical data for Chuvashia

Future and current pensioners are interested in data on expected payments in old age. The government constantly monitors accruals. In addition, its tasks include organizing social assistance for low-income pensioners.

In 2021, the following data was relevant for residents of Cheboksary and the entire republic:

| Index | Size (RUB) | Why is it used? |

| Average payment to pensioners in Chuvashia | 13 800,0 | To assess the general financial situation of this population group |

| Minimum | 7 101,0 | To determine the share of poor |

| Minimum wage indicator (MROT) | 11 280,0 | For comparison with the level of financial situation of pensioners |

| Living wage for pensioners | 7 785,0 | To increase the content of pensioners |

| Number of recipients | 336 thousand people | To form a budget |

What determines the amount of payments for pensioners?

Benefits on the pension payout vary. The specific accrual to a person depends on two important factors:

- periods of official employment, when the employer paid contributions to the Pension Fund (PFR);

- the amount of earnings in each specific period (affects the number of accumulated points).

In addition, the following factors influence the amount of future old-age support:

- the birth of a child by a woman (a certain number of points are added for each);

- time spent caring for the child (only one and a half years are taken into account);

- period of service in the armed forces.

Conclusion: residents of Chuvashia find themselves in the most advantageous position at retirement age:

- those who worked officially;

- receiving large official salaries.

Supplement to insurance pension

Having changed the method of calculating pensions, the Government of the Russian Federation was faced with a very unpleasant fact:

- the majority of elderly citizens in Chuvashia receive very small amounts of money, not reaching the subsistence level.

This situation has developed throughout the country. It had to be resolved by introducing a new legislative norm. It consists of the following:

In addition, a non-working pensioner can choose only one additional payment from those indicated. As a rule, people focus on the one that is larger in absolute terms (size).

Cumulative payments

The program for creating savings for old age started in 2008. Unfortunately, it is frozen in 2021.

However, some residents of Chuvashia managed to take advantage of its benefits. Now they are reaping the fruits of their foresight. According to the latest data, 99% of those who chose savings ordered a lump sum payment. RUB 175 million was spent for these purposes in 2021.

For information: 155 residents of the Republic decided to receive savings under the urgent program (within 10 years). Their increase in insurance content is on average 900.0 rubles. per month.

Methodology for assigning pension benefits

Applicants for benefits from the Pension Fund budget must complete the following steps:

Hint: social benefits are assigned without a work book. To obtain it in some cases you will need:

- certificate of disability;

- death certificate of the breadwinner and documents on family ties.

Where to contact

The state system of working with pensioners is organized on a territorial basis. Therefore, you need to select the nearest PFR branch:

| Address | Telephone | Schedule of work with the population |

| st. K. Ivanova, 87 | + | from 8.00 to 17.00 |

| st. Kalinina, 109/1 | + | from 8.00 to 18.00 |

Hint: you should contact PFR specialists at the specified time from Monday to Friday.

How many pensioners are there now in Chuvashia?

Based on the results of the first half of 2021, the number of pensioners in Chuvashia receiving pensions from the Pension Fund is about 366 thousand. More than 3 thousand of them are those who, having retired from the law enforcement agencies, earned themselves civilian experience; 27 thousand receive social pensions.

In 2021, more than 34 billion rubles were spent on pensions and social payments from the Pension Fund budget.

The republic has seen a growing trend in the number of pensioners; an increase of approximately 2 thousand is expected by the end of the year. In the capital of Chuvashia, Cheboksary, there are also more and more pensioners, and today their number exceeds 126 thousand.

Last changes

Our experts monitor all changes in legislation to provide you with reliable information.

Bookmark the site and subscribe to our updates!

“Clerk” Column Pensions

The living wage for a pensioner, which is set by the authorities of each region at the end of the year, essentially represents the minimum pension for non-working pensioners (with some reservations).

Pension in Chuvashia in 2021

This type of people includes disabled people, orphans, as well as those who live in difficult living conditions. For this reason, since the beginning of this year, several fundamental changes have been introduced in this area, which will directly affect the topic of pensions in Chuvashia. We will tell you what these changes are and what citizens can expect in this article.

Now let’s first look at what an insurance pension is and what its size is. The insurance pension is payments that are paid in old age.

Minimum pension and subsistence level in the Chuvash Republic and Cheboksary In addition to the average pension, in Chuvashia and Cheboksary there is also a type of pension called the minimum amount.

This is a type of pension that is provided to absolutely every citizen, regardless of whether he was working or not. Also, for this type of pension, the length of service and the amount of accumulated pension points do not matter. Previously, the minimum pension was 8,762 rubles.

Pension supplements in the Chuvash Republic and Cheboksary

But it should be noted that one of the main conditions for receiving this bonus is that you do not have the right to perform labor activities. Otherwise, you will not be awarded any bonus.

Also, in order to apply for a pension, you need to provide the necessary list of documents, without which your application will not even be considered.

In the end, I would like to say that the state never ceases to take care of its citizens, regardless of their position and condition. More and more reforms are constantly being introduced that help make the pension system even better and its operation even more efficient. And this is far from the limit, since many more different programs are planned, the main goal of which is to improve the standard of living of pensioners.

FSD or RSD

The federal social supplement is paid by the territorial bodies of the Pension Fund of the Russian Federation and is established if the total amount of cash payments to a non-working pensioner does not reach the pensioner’s subsistence level established in the region of residence, which, in turn, does not reach the pensioner’s subsistence level in the whole of the Russian Federation.

That is, FSD is paid when the regional PMP is lower than the federal one (living in the region is cheaper than the average in Russia).

A regional social supplement is paid by regional social protection authorities if the cost of living of a pensioner in a constituent entity of the Russian Federation is higher than the same figure in the Russian Federation, and the total amount of cash payments to a non-working pensioner is lower than the regional subsistence minimum.

That is, RSD is paid when the regional PMP is higher than the federal one (living in the region is more expensive than the average in Russia).

What changes in 2021 according to Putin's benefits

Putin's child benefits in 2021 are paid for the first and second child. However, in order to receive them, a number of conditions must be met (in particular, the amount of family income). How to get benefits? What exactly has changed since 2021? At what salary can you get Putin's benefits for the low-income? We answer questions.

You may be interested in:: Benefits for travel to St. Petersburg for a combat veteran if the registration is not in St. Petersburg

Change No. 1: payment period increased

From 2020, monthly benefits until the child is three years old will be received by families that are recognized by social security as low-income. For this purpose, the average per capita family income is determined. In 2021, it should not exceed 1.5 times the regional subsistence level for the second quarter of the previous year. From 2021, its value will be calculated based on 2 times the size. For example, if in the region the cost of living for the working population in the second quarter of 2021 was 12,130 rubles, then families with a monthly income per person of no more than 24,260 rubles will receive benefits for up to three years in 2021.

Starting from 2021, the cost of living (LM) for the country and regions is calculated according to new rules. The corresponding law was signed by Russian President Vladimir Putin at the end of December. Previously, the cost of living was calculated based on the consumer basket, but from 2021 it is determined as part of the average per capita income of citizens.

How is income calculated?

When calculating the total amount of material support for a non-working pensioner, the amounts of the following cash payments are taken into account:

- pensions, including in the event of a pensioner’s refusal to receive said pensions;

- urgent pension payment;

- additional material (social) support;

- monthly cash payment (including the cost of a set of social services);

- other social support measures established by the legislation of the constituent entities of the Russian Federation in monetary terms (with the exception of social support measures provided at a time).

In addition, when calculating the total amount of material support for a pensioner, the cash equivalents of the social support measures provided to him for paying for the use of a telephone, residential premises and utilities, travel on all types of passenger transport, as well as monetary compensation for the costs of paying for these services are taken into account.

How is it formed

The formation of a pension depends on its type.

Thus, the insurance is formed from the main part, which is different for each citizen, and depends on the individual pension coefficient, a fixed bonus (including an increased one), and the federal (regional) social supplement to the subsistence level.

Social, as a rule, is established in hard monetary terms or as a percentage of it. For the basic size of social. pensions are usually taken from the pension established for disabled people of the 2nd category - that is, 5034.25 rubles.

Indexing

From January 1, 2021, old-age insurance pensions have been indexed by 6.6%.

Previously, the process of assigning a social supplement went like this: the pension was indexed. and if she did not reach the PMP, they gave an additional payment.

The rules have changed since 2021. Now they first calculate the additional payment (before indexation), and then index the pension and add the calculated additional payment to it. That is, now the minimum pension will always exceed the PMP. How much depends on the size of the pension.

In this article we will not dwell in detail on the issue of the new surcharge system. We will talk about this in detail in the next article.

Table of cost of living values by quarter

PM is calculated for three categories of citizens: pensioners, workers and children. The Rules for Calculating PM clearly establish that mandatory payments are a tax on personal income. Those. payments are included in the minimum of only the working population.

About the cost of living in the region

Note to the table: quarterly values are shown for 2014, 2015, 2021, 2021, 2021, 2021, 2021, 2021. These living wage values are used in the cities of Cheboksary, Novocheboksarsk, Kanash, Alatyr, Shumerlya, Tsivilsk and other settlements of the Chuvash Republic.

In 2021, parents received such benefits until the child turned one and a half years old (Part 1, Article 2 of Federal Law No. 418-FZ of December 28, 2017). From January 1, 2021, benefits will be paid for children under three years of age (Federal Law dated August 2, 2019 No. 305-FZ).

Who received how much?

As can be seen from the table, in many regions low-income pensioners will not receive any increase. According to regional authorities, life has not become more expensive over the year and the cost of living for a pensioner in 2021 is set at the level of last year.

Moreover, in some regions the PMP has not increased for 2 years. At the same time, there are regions in which the living standard of a pensioner has been stagnant for 3–4 years.

For example, in Tatarstan the last time an increase in PMP was observed was in 2017. And in regions such as the Belgorod region, Adygea, Udmurtia, and Chukotka District, PMP has not been growing since 2021.

That is, in 4 years, life for pensioners there has not risen in price one iota?

Low-income pensioners of the Republic of Karelia will receive the largest supplement to their pension in 2021. In 2021, the PMP there immediately increased by almost 3,000 rubles. A large increase was also recorded in the Jewish Autonomous Region - by 2.5 thousand rubles.

Note that these regions were previously named among those where pensioners are underpaid due to the fact that the authorities set the PMP below the actual annual average.

For just a few more days we are giving you six months of access to our subscription for free. In addition to 107 recordings of express seminars, you will have access to 15 online courses (some provide a Russian IPB certificate) and several tools for accountants for free. Leave your contacts below, the manager will contact you to provide access:

Hello, in this article we will try to answer the question: “Minimum pension in Chuvashia in 2021.” You can also consult with lawyers online for free directly on the website.

| Category of pension recipients | The amount of a fixed payment to the disability insurance pension, taking into account increases to it |

| Disabled people of group I | Without dependents - 11372.50 rubles per month With 1 dependent - 13267.92 rubles per month With 2 dependents - 15163.34 rubles per month With 3 dependents - 17058.76 rubles per month |

| Disabled people of group II | Without dependents - 5686.25 rubles per month With 1 dependent - 7581.67 rubles per month With 2 dependents - 9477.09 rubles per month With 3 dependents - 11372.51 rubles per month |

| Disabled people of group III | Without dependents - 2843.13 rubles per month With 1 dependent - 4738.55 rubles per month With 2 dependents - 6633.97 rubles per month With 3 dependents - 8529.39 rubles per month |

| Citizens living in the Far North and equivalent areas | The fixed payment to the disability insurance pension and increases to it are increased by the corresponding regional coefficient |

| Group I disabled people who have worked for at least 15 calendar years in the Far North and have an insurance record of at least 25 years for men or at least 20 years for disabled women | Without dependents - 17058.76 rubles per month With 1 dependent - 19901.89 rubles per month With 2 dependents - 22745.02 rubles per month With 3 dependents - 25588.15 rubles per month (regardless of place of residence) |

| Disabled people of group II who have worked for at least 15 calendar years in the Far North and have an insurance record of at least 25 years for men or at least 20 years for women | Without dependents - 8529.38 rubles per month With 1 dependent - 11372.51 rubles per month With 2 dependents - 14215.64 rubles per month With 3 dependents - 17058.77 rubles per month (regardless of place of residence) |

| Group III disabled people who have worked for at least 15 calendar years in the Far North and have an insurance record of at least 25 years for men or at least 20 years for women | Without dependents - 4264.70 rubles per month With 1 dependent - 7107.83 rubles per month With 2 dependents - 9950.96 rubles per month With 3 dependents - 12794.09 rubles per month (regardless of place of residence) |

| Group I disabled people who have worked for at least 20 calendar years in areas equated to the regions of the Far North, and have an insurance record of at least 25 years for men or at least 20 years for women | Without dependents - 14,784.26 rubles per month With 1 dependent - 17,248.31 rubles per month With 2 dependents - 19,712.35 rubles per month With 3 dependents - 22,176.40 rubles per month (regardless of place of residence) |

| Disabled people of group II who have worked for at least 20 years in areas equated to the regions of the Far North, with insurance experience of at least 25 years for men or at least 20 years for women | Without dependents - 7392.13 rubles per month With 1 dependent - 9856.18 rubles per month With 2 dependents - 12320.22 rubles per month With 3 dependents - 14784.27 rubles per month (regardless of place of residence) |

| Group III disabled people who have worked for at least 20 years in areas equated to the regions of the Far North, and have an insurance record of at least 25 years for men or at least 20 years for women | Without dependents - 3696.07 rubles per month With 1 dependent - 6160.12 rubles per month With 2 dependents - 8624.16 rubles per month With 3 dependents - 11088.21 rubles per month (regardless of place of residence) |

Who is eligible

In the Chuvash Republic, as well as in other constituent entities of the Russian Federation, there is a unified procedure for calculating insurance, social and state pensions. penny. provision.

In accordance with 400-FZ dated December 28. 2013 “On insurance…” (hereinafter referred to as Federal Law No. 400), the right to a minimum pension, with at least 9 years of insurance experience in 2021 (Appendix 3 to Federal Law No. 400) has a person who:

- has the lowest number of pension points at the time of retirement;

- has the right to a minimum fixed additional payment;

- and applied for benefits immediately after the right to it arose.

In 2021 there is fear for appointment.

benefits need at least 13.8 pension points (Part 3 of Article 35 of Federal Law No. 400). The cost of 1 point, according to 420-FZ dated December 28. 2021 “On suspension...” is 81.49 rubles. In accordance with Part 2 of Art. 16 Federal Law No. 400, the minimum fixed payment is provided for disabled people of the 3rd category - 2491.45 rubles.

According to the formula given in Art. 15 Federal Law No. 400, we get the minimum amount of insurance pension in Chuvashia, taking into account the latest indexation in 2021:

13.8 * 81.49 + 2491.45 = 3616.012 rubles

This calculation does not include a possible increase in the size of the fix. payments in accordance with Art. 17 Federal Law No. 400 (for example, for persons who worked in the Far North), a possible increase in the fixed payment in the event of retirement later than the right to it arises, and also does not take into account the max. IPC value (Appendix 4 to Federal Law No. 400).

The minimum amount of social pension, in accordance with Art. 18 Federal Law No. 166 dated December 15. 2001 “On State...”, also established for disabled people of the 3rd category who do not have other benefits (for example, a benefit such as an increase in social benefits by the regional coefficient in accordance with Government Decree No. 216 of April 17, 2006 “On district…”) – 4279.14 rubles.