What is Seniors Property Tax?

Property tax is a mandatory contribution to the budget, the tax base for which is the cost of real estate owned by individuals and enterprises.

After acquiring pensioner status, the main income of a non-working citizen is a pension assigned by the state. In the Russian Federation, pensioners, as one of the socially vulnerable segments of the population, are provided with benefits when calculating mandatory duties and fees for individuals or a complete exemption from payment in order to reduce the financial burden.

Benefits for pensioners in 2021: no need to pay property tax

I read and study our laws regarding pensioners on the issue of exemption from paying taxes on real estate and land, and I never cease to be amazed at our officials who write these laws and instructions for them. Do you seriously think that a pensioner has a computer and the Internet at home??? does he have the ability to financially pay for this??? Yes, all my friends have higher education and cannot afford to buy a computer and pay for the Internet from their meager pension!!! And what can we say about 80-90% of the country’s pensioners who do not know how to use computers at all?! And even more so, they do not know your invented Laws. They believe in the old fashioned way, as it was in the Soviet Union: the authorities will not deceive, they cannot deceive. And you are deceiving the people, outright deceiving them. I mean tax services. You seem to erroneously charge taxes to a pensioner, scare him with fines and penalties, and now you’ve come up with something even better - writing off debt from credit cards! Moreover, the tax that was dishonestly calculated for you and, most importantly, none of the tax authorities bears any responsibility for their mistakes! Or do you think it’s normal that a pensioner, being retired, should run around the tax office, knock on doorsteps and write you certificates using crazy forms that you have developed? There is a law according to which pensioners are provided with tax exemption benefits, and it is very clearly formulated. You have all the documentation on your property both in paper and on electronic media. So why are you chasing us pensioners with these crazy certificates? And why the hell do I, a 66-year-old pensioner, have a personal account?! I want to pay taxes on time and on time, but I cannot obtain this “secret information” from the tax authorities, only my personal presence is required. What kind of “secret”—confidentiality—are we talking about? Even if all the real estate of the President of the country and the entire government is officially published in information publishing houses, open to the entire people. And I wrote this only because I myself personally returned the illegally assessed land tax from the tax services - you wouldn’t wish your enemy half a year of ordeal in offices, and they don’t respond to letters at all! And currently, they illegally charge taxes on residential buildings. And I think with horror how I will return the illegally accrued funds again??? And why should we, pensioners, finance the mistakes of tax services, and then run around these tax services and get our own money back? Moreover, to receive threatening letters from them if payment is not made on time??? You have become disconnected from the life of the people... And grandfather Lenin also said that the land is for the people, and you take taxes from us for the land. Of course, you can take taxes, like the capitalists in the West, but they also have a pension worthy of 2-5 thousand US dollars, and not our beggarly one. I wonder, if you are up there, forced to live on the pension of an ordinary Russian, how will you feel? Try it for fun. Maybe after this experiment you will become human.

What property of old citizens is subject to taxation?

Property tax is imposed on all real estate of individuals. This payment is calculated once a year, receipts with the payment amount are sent to the registered addresses of the owners.

The payment deadline is December 2 of the current year.

All citizens who own the following types of real estate are required to pay the material fee:

- apartment;

- a private house;

- cottage;

- townhouse;

- country house;

- room;

- garage;

- unfinished objects;

- other buildings;

- shares in the above-mentioned objects.

To exempt these types of property from tax, it does not matter whether the owner is employed or not.

Conditions for exemption from mandatory contribution

Pensioners are exempt from paying property tax, provided that the pension due to them is calculated in accordance with the procedure established by decree.

You must also meet the following conditions:

- the property is registered as the property of the citizen claiming the benefit. If the right of ownership allocates a shared part of the real estate, the provision of benefits applies only to the share. That is, the property tax for pensioners is canceled, the remaining owners pay the payment in full;

- the property is not used for commercial purposes: an individual should not receive income from real estate.

A special condition is that only one belonging object is exempt from collection . That is, if a person receiving a pension is the owner of several apartments or garages, he has the right to choose only one object on which he does not pay property tax; other objects are subject to a mandatory contribution.

Important! At the same time, the cost of real estate should not exceed 300 million rubles.

Features of the bill adopted in 2021

According to Art.

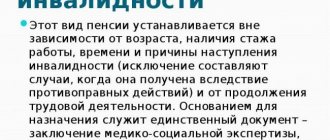

401 of the Tax Code of the Russian Federation, all structures are real estate if they are firmly connected to the land. However, their movement is impossible without serious damage to the structure. They must have an independent economic purpose and act separately in civil circulation. Thus, the barn and bathhouse can be transferred to the tenant separately. As a result, these structures are recognized as real estate for which taxes must be paid. If a person is both disabled and retired, he does not need to pay property tax on a building of any purpose and of any size. The building can be for both residential and non-residential purposes. As a result, such a person has the opportunity not to pay tax for an outbuilding with an area of up to 50 square meters. m., located in a gardening partnership.

If the property is not registered in the cadastral register, from 2019 a double land tax will be imposed on it.

How to apply for a tax benefit for pensioners: procedure and documents

Tax benefits ( certain benefits, additional rights, full or partial exemption from fulfilling established rules, obligations, or facilitating the conditions for their fulfillment

) for property for elderly people who are owners, is registered with the Federal Tax Service. To do this, you need to provide an application form and copies of documents to the tax office.

The application is written to the manager of the regional tax office.

The document must contain the following information:

- Full name of the applicant;

- pensioner’s personal tax number;

- passport details;

- registration address;

- the nature of the question and the desired method of obtaining an answer.

The application indicates the object for which the subject would like to receive a benefit. If the object is not specified, the benefit applies to the object with the highest tax ( a mandatory, individually gratuitous payment levied on organizations and individuals in the form of alienation of property, economic management or operational property belonging to them).

).

The following documents must also be attached to the application:

- a copy of the pensioner’s passport;

- copy of TIN;

- pensioner's ID;

- an extract from the Unified State Register of Real Estate confirming the right of ownership.

Important! The application can be submitted an unlimited number of times. This makes sense when you own several objects, the value of which changes periodically.

Deadlines and method for submitting an application

The application and documents can be submitted in person, sent by mail, or transmitted through the Federal Tax Service website. You can certify copies of documents in person by affixing a signature and the inscription “Correct” on them. It is also necessary to put down the date and transcript of the signature.

After reviewing the application and making the necessary amendments, the applicant receives a response from the Federal Tax Service in the manner specified in the application.

The benefit also applies to previous periods, but not more than 3 years.

Important! You must submit an application to cancel the tax before November 1 of the current year, that is, if a pensioner applied to the Federal Tax Service before November 1, 2021, then in 2021 he will not receive a receipt with the payment, and if a little later, then in 2021 he will pay the contribution to the budget for 2021 it will still be necessary.

Property tax deduction for seniors

A property tax deduction is the return of a certain amount of money from funds spent on the purchase of real estate.

Individuals who receive income from which they themselves or their employer transfer income tax to the budget have the right to a tax deduction. People receiving a pension are also entitled to a tax deduction when purchasing an item, regardless of whether they pay income tax or not.

To receive a deduction, several conditions must be met:

- the pensioner must have the status of a resident of the Russian Federation and be in the Russian Federation for at least 183 days a year;

- real estate must be purchased with the pensioner’s own funds ( regular (monthly or weekly) cash payments to persons who: have reached retirement age (old-age pension), are disabled, have lost their breadwinner. Depending on the organization

); - property ( a set of things that are owned by any individual, legal entity or public legal entity (including money and securities), as well as their property

) was not acquired from immediate relatives; - receipt of income on which income tax is paid, either in the current period or in at least one of the 3 years used to calculate the deduction.

Refunds are made from amounts up to 2,000,000 rubles when purchasing with cash and up to 3,000,000 when using a mortgage.

Refund deadlines

Working older people have the right to expect a refund for 4 years . Also, those individuals who acquired property before retirement or in the year of retirement can count on this opportunity.

If the property was purchased after retirement, the period for property deduction is limited to 3 years . The year of granting the benefit is considered to be the year of purchase of the home. That is, if a citizen has been retired for more than 3 years and does not officially work anywhere, he has no right to count on a material deduction.

Please note: a refund for a non-working citizen can be received by his spouse, subject to a registered marriage. Rules for receiving a deduction ( may mean

) are the same as for the property owner. This is due to the fact that financial assets acquired during marriage are considered joint property.

Documents for refund when purchasing real estate

The procedure for designing a deduction is similar to the procedure for registering a property tax benefit. A completed application and the necessary documents are provided to the territorial body of the Federal Tax Service.

These include:

- income tax return in form 3-NDFL, for the last 3 or 4 years, depending on whether the pensioner worked or not;

- income certificate in form 2-NDFL;

- contract of sale;

- act of acceptance and transfer;

- payment documents to prove the use of own funds;

- passport;

- pensioner's ID;

- marriage certificate if the spouse receives the deduction.

Please note: in addition to the purchase of property, a tax deduction is provided for amounts spent on housing construction and interest paid on targeted mortgage loans for the purchase of housing or personal construction.

Benefits for people of pre-retirement age

With the adoption of Decree No. 350-FZ on October 3, 2021, the new retirement age at which a citizen can count on receiving a property tax benefit was 60 years for women and 65 for men.

In this regard, the concept of “pre-retirement age” : at the moment it refers to the age 5 years before retirement, that is, 50 years for women and 60 years for men.

Important! Currently, land and property tax benefits for older people also apply to people who have reached pre-retirement age.

Land tax for pensioners

Tax benefits on land for pensioners are prescribed in paragraph 5 of Art. 391 Tax Code of the Russian Federation. According to its provisions, a pensioner is not exempt from paying land tax, but receives a deduction in the amount of the cadastral value of 600 square meters. m. (six acres) of plot area. Citizens whose plot does not exceed six acres do not pay land tax.

The deduction is provided only for one plot of land owned (at the choice of the pensioner); for the remaining plots of land, the tax base is not reduced.

This is established at the federal level, but regional authorities are given the right to increase this deduction, and they may also establish additional benefits.

Additional benefits may apply in regions and for real estate taxes. You can find out about all regional benefits for land and property taxes on ]]>the Federal Tax Service website]]>.

Categories of elderly people who can receive benefits

The pension and tax legislation of the Russian Federation determines whether persons receiving a pension under special working conditions are required to pay property tax. Military seniors can only qualify for tax benefits if they served 20 years or more.

Teachers and medical workers who receive a pension for long service can also count on receiving benefits

Thus, whether older people should pay all taxes, how to get the necessary benefits, and what contributions they do not pay at all is fixed by law. Tax literacy of people of retirement age and timely appeal to the Federal Tax Service will allow pensioners to reduce the financial burden on their budget.