Minimum pension in the Tambov region

The cost of living in each region of the Russian Federation is different.

For pensioners in the Tambov region, the lowest level of monthly income in the 3rd quarter of 2015 was 6,931 rubles. What the minimum pension will be at the end of 2015 - beginning of 2021 will become known only in January next year. But in the third quarter, the amount of minimum monthly payments amounted to 4,802 rubles. If the minimum pension does not reach the subsistence level, the amount of accruals increases due to the social supplement. The average amount of such additional payment is 1,263 rubles. In September, the Tambov Regional Duma adopted the corresponding Federal Law “On State Social Assistance”, which will come into force on January 1, 2021. The size of the monthly minimum wage for citizens of the Tambov Region, which will be established next year, is indicated here. It will be 7,468 rubles.

In order to apply for a social supplement, you need to contact the Pension Fund of the Tambov Region or, if we are talking about simultaneously submitting an application for calculation and calculation of payments, to the Multifunctional Center. If the amount of a pensioner’s monthly income is less than the established minimum wage, and he already receives a federal social supplement, contacting the Pension Fund office will only be required if the person decides to get a job (officially). A pension supplement in the form of an additional payment from the regional budget is received by citizens who belong to one of the categories:

- labor veterans (276 rubles per month);

- labor veterans of the Tambov region (241 rubles per month);

- disabled combat veterans (525 rubles);

- rehabilitated citizens (416 rubles);

- families of those killed as a result of hostilities (525 rubles).

After indexation of the old-age insurance pension, the amount of monthly payments to pensioners increased by 1,167 rubles. The disability pension increased by 716 rubles, and in case of loss of a breadwinner – by 864 rubles. The average insurance pension in the Tambov region this year is 10,980 rubles.

RUB 8,500.0 (for non-budgetary workers).

Data for 2021 will be announced later.

Do you need expert advice on this issue? Describe your problem and our lawyers will contact you as soon as possible.

Pension provision for disabled citizens varies in minimum levels depending on the region of residence. This is an objective factor that has developed due to the difference in living conditions in the constituent entities of the Russian Federation. Thus, pensions in Tambov in 2021 do not reach the national average. This happens because the minimum for non-working recipients is tied to the level of residence.

- standard of living of the population, that is, the cost of the consumer basket;

- budget occupancy associated with the average earnings of workers.

When determining the level of support for non-working, disabled citizens, government agencies are guided by the indicators established in the region. They are necessary to achieve a balance between the expenditure and revenue sides of the budget. The table shows the main parameters with explanations:At the legislative level, a rule has been adopted to support non-working recipients of state benefits. It is like this:

- The state is obliged to provide income to a disabled person at the level of the subsistence level:

Local measures to support pensioners in 2021

Attention: additional payments are made from the local treasury to the social security authorities.

Budget funds are allocated to citizens based on the norms of all-Russian legislation. A person entitled to such payments can apply for a pension. It depends on the criteria and types of content. Namely:

- 9 years of experience;

- 55th anniversary for women;

- disabled people from the date of recognition of the group.

- disabled people who have lost their breadwinner.

- State is established for civil servants with a certain length of service. It is also prescribed to soldiers who have become disabled in service.

Self-study documents

Law of the Tambov Region N 618-Z “On the regulation of certain issues of determining the living wage in the Tambov Region” (04/30/2021)

Federal Law N 178-FZ “On State Social Assistance” (06/11/2021)

Federal Law N 134-FZ “On the subsistence minimum in the Russian Federation” (December 29, 2020)

Law of the Tambov Region N 26-з “On the living wage in the Tambov Region” (07/05/2013) Inactive

Did you find this information useful?

0 0

Minimum pension in the Tambov region

Each region has its own minimum pension values, and the Tambov region is no exception. According to the Pension Fund, 147,800 residents of the region will receive pensions in 2021. The government annually indexes and recalculates the size of pensions to keep up with the rate of inflation.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem, contact a consultant:

7 (St. Petersburg)

It's fast and free!

In one year, different categories of citizens may receive several promotions. In order not to get confused by the changes, you need to decide what kind of pension a citizen can count on.

How to get a pension

The applicant should collect documents and make copies. The main package includes the following papers:

- confirming eligibility: SNILS;

- passport;

- work book containing all information about the length of service.

- certificate of assignment of a disability group;

- information about the presence of dependents;

Hint: documents are submitted to the branch at the place of registration.

To resolve pension issues, you need to visit the Pension Fund branches at your place of residence. Appeals related to payments are handled by a special center in Smolensk.

| Service region | Address | Telephone | Working hours with the public |

| Zadneprovsky district | st. 12 years of October, 7D | 7 | 9:00 — 18:00; lunch: 13:00 – 13:45 |

| Leninsky district | st. Lenina, 16 | 7 | |

| Industrial | st. Krupskaya, 51 | 7 | |

| Smolensky | st. Prigorodnaya, 4 | 7 | |

| Regional center for pension payment | st. Krupskaya, 37A | 7 |

Hint: On Fridays and pre-holidays, citizens are received until 16:45.

Dear readers!

We describe typical ways to resolve legal issues, but each case is unique and requires individual legal assistance.

To quickly resolve your problem, we recommend contacting qualified lawyers on our website.

Who is entitled to

Residents of the Tambov region have rights to receive a pension in the following cases:

if citizens hold government positions in the region, their age is increased to 65 years for men and 63 years for women;

The number of points received directly depends on the citizen’s salary and the amount of insurance premiums paid. Payments are made by the employer without the participation of the citizen.

Every year, while a citizen is officially employed and regularly makes contributions, he accumulates pension points and develops pension rights. The amount of the pension ultimately depends on these contributions.

The size of the minimum pension in the Tambov region from January 1, 2018

In 2021, the minimum pension in the Tambov region is 8,650 rubles. The regional government independently decides on the amount and recalculation of payments.

The indicator depends on the cost of labor and the economic situation in the region. The only restriction is the minimum standard of living, which local authorities have no right to violate.

The minimum indicators are calculated based on data received by the local Pension Fund. Thanks to published statistics, you can track transferred contributions and determine the payment threshold.

In the country, the minimum pension is 8,000 rubles. In the Tambov region there is an increase in pensions, which indicates stability in the region. The government does not plan to lower the minimum pension in 2021.

For non-working pensioners

In the Tambov region there live elderly citizens who are not employed and their pensions are less than the subsistence level.

In this case, the state automatically makes an additional payment, adding the missing amount. Each region annually receives money from the federal budget for these needs.

Additional payments are divided into 2 types:

Pensioners are considered a socially vulnerable group of citizens, since they are not employed. Therefore, in addition to the minimum pension, the state provides everyone with certain benefits and allowances.

According to Russian legislation, in the Tambov region, elderly citizens have the right to use the following benefits:

Social pensions increased from April 1

On April 1, a government decree came into force to increase social pensions by 2.9%. The increase will affect 3.9 million people, Izvestia writes. According to the document, the average pension will be increased by 255 rubles and will amount to 9,062 rubles.

About 9.7 billion rubles will be allocated from the federal budget to implement this measure. In addition, payments will be increased for disabled children and children who have lost one or both parents. The increase will also affect citizens who do not have enough experience for a “labor pension.”

In addition, the document implies indexation of pensions for veterans of the Great Patriotic War, military personnel who served in conscription, and other categories of beneficiaries.

Today, out of 354,204 pensioners in the Tambov region, 157,250 people receive pensions in Tambov. Since the cost of living in the region is higher than the average pension, the government has established a minimum living wage for each pensioner. The cost of living for a pensioner in Tambov from 2021 is 7,489 rubles.

The average annual insurance pension in 2021 will be 14,075 thousand rubles, for non-workers - 14,329 thousand rubles. The average annual social pension will be 9,045 thousand rubles.

In the Tambov region, as in other regions of Russia, a new type of pension has appeared this year - social. Payments in the amount of 10,068 rubles are received by children whose information about their parents is unknown. They will be paid a social pension monthly until they reach adulthood. When entering a university full-time, payments will be extended until the age of 23. The new social pension will be received by children who did not have information about their parents when registering.

www.onlinetambov.ru

See also:

- 24 Law of the Republic of Kazakhstan On the rehabilitation of victims of mass political repression Article 24. Victims of political repression Victims of political repression, as well as persons affected by political repression specified in Article 2 […]

- Federal Law on Housing and Communal Services From January 1, 2021, it will be possible not to pay for housing and communal services “The law says that if a utility company does not transfer data to the GIS housing and communal services, the consumer has the right not to pay the bill. And it will be [...]

- State duties when registering a car 2014 State duties when registering a car 2014 When paying the state duty online (gosuslugi.ru) there is a 30% discount. Yes, you can. On the government services website, payments are made using bank cards, as well as […]

Will there be an increase: latest news

In 2021, the main changes affected the distribution of pension funds, but not indexation. It will take place, as planned, in three stages for different types of payments:

The increase in military pension will be 4%, it does not depend on other payments.

Each region has its own minimum pension values, and the Tambov region is no exception. According to the Pension Fund, 147,800 residents of the region will receive pensions in 2021. The government annually indexes and recalculates the size of pensions to keep up with the rate of inflation.

7 (St. Petersburg)

It's fast and free!

In one year, different categories of citizens may receive several promotions. In order not to get confused by the changes, you need to decide what kind of pension a citizen can count on.

In 2021, the minimum pension in the Tambov region is 8,650 rubles. The regional government independently decides on the amount and recalculation of payments.

The indicator depends on the cost of labor and the economic situation in the region. The only restriction is the minimum standard of living, which local authorities have no right to violate.

Rules for calculating social supplement to pension

An important nuance that needs to be taken into account is that only non-working pensioners are entitled to an additional payment to their pension.

According to the law, if a person works on pension, and the payment for him is lower than the PMP, he is not entitled to additional payment. It is believed that he additionally provides himself with a salary and does not need additional payment.

Also, a pensioner will not receive a social supplement if he receives other types of income that, together with the pension, are equal to or exceed the PMP:

- additional material (social) support,

- monthly cash payment from the state (including social services),

- regional social support (except for one-time types of assistance).

Thus, the minimum old-age pension in all Russian regions, including the Novosibirsk region, is valid only for non-working pensioners . Working older residents of the region may receive a pension that is lower than this level.

The minimum wage in Tambov and the Tambov region

The future pension is determined by the level of wages. The employer must make contributions to the Pension Fund every month in the form of insurance contributions for the employee. This is how the citizen’s future pension is formed. Since the insurance premium was 22% in 2015, many employers chose to save on contributions. Because of this, employees of various enterprises began to receive “gray” wages.

In turn, this leads to the fact that the size of the old-age insurance pension will sharply decrease. Accordingly, even that category of citizens who have a long work history, when entering a well-deserved retirement, may encounter a situation where the pension will be accrued in a smaller amount than the established minimum subsistence level.

The UPFR in the Tambov region recommends that when seeking employment, citizens check with their manager whether the company makes contributions to the Pension Fund. You should also regularly monitor your retirement account. To check your insurance deductions, you can:

- Contact the UPFR client room in Tambov.

- Use the electronic service by logging into your personal account on the official website of the Pension Fund.

By visiting the latest service, you can find data on the number of pension points and length of service that is currently recorded. Also here you can see information about the calculation of insurance premiums. What pension will be paid after reaching retirement age depends on accruals, which, in turn, are determined by the amount of wages (subject to official employment).

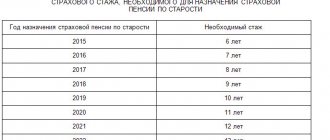

In 2015, an old-age insurance pension is awarded to citizens whose work experience is at least 6 years. The minimum length of service will increase by 1 year over the next 9 years. In 2024 it should be 15 years. If a citizen has received a salary in an envelope for a long period of time, he can only count on receiving a social pension. However, this type of accrual may be assigned five years later than in the case of an insurance pension.

In the country, the minimum pension is 8,000 rubles. In the Tambov region there is an increase in pensions, which indicates stability in the region. The government does not plan to lower the minimum pension in 2021.

In the Tambov region there live elderly citizens who are not employed and their pensions are less than the subsistence level.

In this case, the state automatically makes an additional payment, adding the missing amount. Each region annually receives money from the federal budget for these needs.

Pensioners are considered a socially vulnerable group of citizens, since they are not employed. Therefore, in addition to the minimum pension, the state provides everyone with certain benefits and allowances.

The minimum figure for pension contributions is determined from the total number of contributions transferred from the fund to the Tambov region.

This statistics allows you to determine the minimum payment threshold. These amounts, according to adopted legal acts, should not be below the subsistence level in a particular region of the country.

The national average for this amount is about 8,000 rubles. Today, in Tambov and the region, a minimum level of pension payments has been established in the amount of up to 8,760 rubles per month.

The main part of the amount is established by the legislator. The region has the right to regulate the rest of it. At the same time, such values can increase or remain at the same level. It depends on the economic situation in the region itself.

The size of the regional subsistence level for a pensioner (8,241 rubles) is greater than the subsistence level for a pensioner in the Russian Federation as a whole (the subsistence level for a pensioner in the Russian Federation as a whole has not yet been adopted).

The minimum subsistence level for a pensioner in the Russian Federation as a whole is established to determine the amount of the federal social supplement to the pension.

The regional cost of living for a pensioner is established in each subject of the Russian Federation in order to determine the social supplement to the pension.

Only non-working pensioners have the right to a social supplement to their pension if the amount of their financial support is lower than the pensioner’s subsistence level established in the region at their place of residence.

Please note that local legislation may provide for certain conditions for receiving a regional social supplement to a pension.

The social supplement to the pension is established from the 1st day of the month following the month of applying for it with the appropriate application and necessary documents.

What amounts are taken into account when calculating the amount of financial support for a pensioner:

- all types of pensions;

- immediate pension payment;

- additional material (social) support;

- monthly cash payment (including the cost of a set of social services);

- other measures of social support (assistance) established by regional legislation in monetary terms (with the exception of measures of social support provided at a time);

- cash equivalents of the social support measures provided to pay for the use of telephones, residential premises and utilities, travel on all types of passenger transport, as well as monetary compensation for the costs of paying for these services.

What amounts are NOT taken into account when calculating the amount of financial support for a pensioner: social support measures provided in accordance with the law in kind.

In the Tambov region, a subsistence minimum per capita has been adopted for certain socio-demographic groups (pensioners, children, the working population). It is used for:

- assessing the standard of living of the population in the Tambov region in the development and implementation of regional social programs;

- providing state social assistance to low-income citizens;

- formation of the budget of the Tambov region.

The cost of living is calculated once a quarter on the basis of the consumer basket (products, industrial goods, services) adopted in the Tambov region. It is not used directly for calculating and calculating pensions.

The minimum pension in Tambov and the Tambov region in 2019 is calculated based on the status of the citizen himself. At the moment, the level of pension contributions is fixed at around 12,400 rubles. Which is the average across the country. At the same time, the cost of living has been established at about 7,800 rubles. Additional payments by local authorities are made at the level of 300-500 rubles based on the status of the recipient.

The basic state pension in Russia is mandatory, but provides low returns. All workers are entitled to a state old age pension after eight years of social security benefits. Contributions are paid directly from your earnings along with other social taxes to the national Russian pension fund at the following rates:

- 22 percent for revenue up to RUB 624,000 (and 10 percent for any subsequent amounts)

- 5.1 percent to compulsory federal and territorial health insurance funds

- 2.9 percent to the social insurance fund.

People born before January 1, 1967 contribute 14 percent of their Russian state pension to the single social security and insurance tax. They do not pay into the savings portion.

However, people born on or after January 1, 1967 contribute 7 percent to Social Security and 7 percent to mandatory second-tier insurance. This is the savings portion that is managed by the asset managers who invest in the fund. You have the option to choose your own asset management company, otherwise it is assigned to a government bank.

In accordance with current legislation, basic old-age pensions include a pay-as-you-go system and consist of an insurance fund and a voluntary funded component. The advantage of voluntary contributions is that Russian pension amounts are paid as lifetime benefits and are tax-free.

The minimum pension in Russia in 2021 for non-working pensioners will correspond to the minimum subsistence level for a pensioner, effective from 01/01/2019 and calculated on the basis of the consumer basket for food and non-food products. You can see the GVG size by region in the table below.

Note: the national average PMS in 2021 is set at

RUB 8,846

according to

clause 5 art. 8

Law on the Federal Budget of December 5, 2017 No. 362-FZ.

The minimum pension in Russia in 2021 for non-working pensioners will correspond to the minimum subsistence level for a pensioner, effective from 01/01/2019 and calculated on the basis of the consumer basket for food and non-food products.

The amounts for the constituent entities of the Russian Federation differ significantly; they are shown in the table.

| No. | Name of the subject of the Russian Federation | Size of PMP in the subject, rub. |

| Central Federal District | ||

| 1 | Belgorod region | 8016 |

| 2 | Bryansk region | 8523 |

| 3 | Vladimir region | 8523 |

| 4 | Voronezh region | 8750 |

| 5 | Ivanovo region | 8576 |

| 6 | Kaluga region | 8708 |

| 7 | Kostroma region | 8630 |

| 8 | Kursk region | 8600 |

| 9 | Lipetsk region | 8620 |

| 10 | Oryol Region | 8730 |

| 11 | Ryazan Oblast | 8568 |

| 12 | Smolensk region | 8825 |

| 13 | Tambov Region | 7811 |

| 14 | Tver region | 8846 |

| 15 | Tula region | 8658 |

| 16 | Yaroslavl region | 8163 |

| 17 | Moscow | 12115 |

| 18 | Moscow region | 9908 |

| Northwestern Federal District | ||

| 19 | Republic of Karelia | 8846 |

| 20 | Komi Republic | 10742 |

| 21 | Arhangelsk region | 10258 |

| 22 | Nenets Autonomous Okrug | 17956 |

| 23 | Vologda Region | 8846 |

| 24 | Kaliningrad region | 8846 |

| 25 | Saint Petersburg | 8846 |

| 26 | Leningrad region | 8846 |

| 27 | Murmansk region | 12674 |

| 28 | Novgorod region | 8846 |

| 29 | Pskov region | 8806 |

| North Caucasus Federal District | ||

| 30 | The Republic of Dagestan | 8680 |

| 31 | The Republic of Ingushetia | 8846 |

| 32 | Kabardino-Balkarian Republic | 8846 |

| 33 | Karachay-Cherkess Republic | 8846 |

| 34 | Republic of North Ossetia-Alania | 8455 |

| 35 | Chechen Republic | 8735 |

| 36 | Stavropol region | 8297 |

| Southern Federal District | ||

| 37 | Republic of Adygea | 8138 |

| 38 | Republic of Kalmykia | 8081 |

| 39 | Krasnodar region | 8657 |

| 40 | Astrakhan region | 8352 |

| 41 | Volgograd region | 8569 |

| 42 | Rostov region | 8488 |

| 43 | Republic of Crimea | 8370 |

| 44 | Sevastopol | 8842 |

| Volga Federal District | ||

| 45 | Republic of Bashkortostan | 8645 |

| 46 | Mari El Republic | 8191 |

| 47 | The Republic of Mordovia | 8522 |

| 48 | Republic of Tatarstan | 8232 |

| 49 | Udmurt republic | 8502 |

| 50 | Chuvash Republic | 7953 |

| 51 | Kirov region | 8474 |

| 52 | Nizhny Novgorod Region | 8102 |

| 53 | Orenburg region | 8252 |

| 54 | Penza region | 8404 |

| 55 | Perm region | 8539 |

| 56 | Samara Region | 8413 |

| 57 | Saratov region | 8278 |

| 58 | Ulyanovsk region | 8474 |

| Ural Federal District | ||

| 59 | Kurgan region | 8750 |

| 60 | Sverdlovsk region | 8846 |

| 61 | Tyumen region | 8846 |

| 62 | Chelyabinsk region | 8691 |

| 63 | Khanty-Mansiysk Autonomous Okrug - Ugra | 12176 |

| 64 | Yamalo-Nenets Autonomous Okrug | 13425 |

| Siberian Federal District | ||

| 65 | Altai Republic | 8712 |

| 66 | The Republic of Buryatia | 8846 |

| 67 | Tyva Republic | 8846 |

| 68 | The Republic of Khakassia | 8782 |

| 69 | Altai region | 8669 |

| 70 | Krasnoyarsk region | 8846 |

| 71 | Irkutsk region | 8841 |

| 72 | Kemerovo region | 8387 |

| 73 | Novosibirsk region | 8814 |

| 74 | Omsk region | 8480 |

| 75 | Tomsk region | 8795 |

| 76 | Transbaikal region | 8846 |

| Far Eastern Federal District | ||

| 77 | The Republic of Sakha (Yakutia) | 13951 |

| 78 | Primorsky Krai | 9988 |

| 79 | Khabarovsk region | 10895 |

| 80 | Amur region | 8846 |

| 81 | Kamchatka Krai | 16543 |

| 82 | Magadan Region | 15460 |

| 83 | Sakhalin region | 12333 |

| 84 | Jewish Autonomous Region | 9166 |

| 85 | Chukotka Autonomous Okrug | 19000 |

| 86 | Baikonur | 8846 |

Addresses of branches of the Pension Fund of the Russian Federation in Novosibirsk and the Novosibirsk region

Address: 630007, Novosibirsk, st. Serebrennikovskaya 19/1 Hotline telephone Additional telephones: (383) 210-16-88 — Reception (383) 210-02-78 — Fax Address: 630015, Novosibirsk, Dzerzhinsky Ave., 12/1 Hotline telephone: 229 -19-49 Reception of citizens: Monday - Thursday: from 9-00 to 17-00, break: from 12-30 o'clock. until 13-15 hours. Friday: from 9-00 to 15-00, break: from 12-30 hours. until 13-15 hours. — Office of the Pension Fund of Russia in the Bagansky district of the Novosibirsk region Address: 632770, p. Bagan, st. M. Gorkogo, 21 Hotline phone number: 8-383-53-21-238 - pers. accounting and administration, 8-383-53-21-590 - pension issues - Pension Fund Office in the Bolotninsky district of the Novosibirsk region Address: 633344, Bolotnoye, st. 50 Let Oktyabrya, 5 Hotline phone number: 8-383-49-21-169 - pension questions, 8-383-49-22-805 - pers. accounting and administration - Office of the Pension Fund of the Russian Federation in the Vengerovsky district of the Novosibirsk region Address: 632241, p. Vengerovo, st. Lenina, 61/1 Hotline phone number: 8-383-69-22-317 - Pension Fund Office in Barabinsk and Barabinsky district of the Novosibirsk region Address: 632334, Barabinsk, st. Komarova, 23a Hotline phone number: 8-383-61-24-620 - Pension Fund Office in Berdsk, Novosibirsk Region Address: 633010, Berdsk, st. Ostrovsky, 66 - Office of the Pension Fund of Russia in the city of Iskitim and the Iskitim district of the Novosibirsk region Address: 633209, Iskitim, st. Pushkina, 39a Hotline phone number: 8-383-43-2-93-14 - pension and social issues; 8-383-43-2-31-96 - persuchet - Office of the Pension Fund of the Russian Federation in the city of Kuibyshev and the Kuibyshevsky district of the Novosibirsk region Address: 632387, Kuibyshev, st. Kuibysheva, 17 Hotline telephone: 8-383-62-53-224, 8-383-62-51-352 - Pension Fund Office in Ob, Novosibirsk Region Address: 633102, Ob-2, st. Chkalova, 40 Hotline phone number: 8-383-73-51-909 - pension questions; 8-383-73-54-636 — pers. accounting and administration - Office of the Pension Fund of the Russian Federation in Tatarsk and the Tatar district of the Novosibirsk region Address: 632122, Tatarsk, st. Smirnovskaya, 78a Hotline phone number: 8-383-64-22-329 - Pension Fund Office in the Dovolensky district of the Novosibirsk region Address: 632450, p. Satisfied, st. Lenina, 108 Hotline telephone: 8-383-54-21-445 - Pension Fund Office in the Zheleznodorozhny district of Novosibirsk Address: 630099, Novosibirsk, st. Oktyabrskaya, 49 Hotline phone number: 218-33-24 - pension questions; 231-05-60 - personalized accounting - Pension Fund Office in the Zaeltsovsky district of Novosibirsk Address: 630049, Novosibirsk, st. Dusi Kovalchuk, 276 Hotline phone number: 225-79-98 - Pension Fund Office in the Zdvinsky district of the Novosibirsk region Address: 632951 p. Zdvinsk, st. Marksa, 11 Hotline phone number: 8-383-63-21-645 - Pension Fund Office in the Kalininsky district of Novosibirsk Address: 630110, Novosibirsk, st. Teatralnaya, 44 Hotline phone number: 229-19-49 - Pension Fund Office in the Karasuk district of the Novosibirsk region Address: 632868, Karasuk, st. Timonova, 1 Hotline phone number: 8-383-55-33-142 - Pension Fund Office in the Kargatsky district of the Novosibirsk region Address: 632402, Kargat, st. Transportnaya, 14 Hotline: 8-383-65-21-688

Want to know how to earn over 450% per annum in the stock market?

Get a free course on investing in high-yield instruments that brought in more than $1 million in 2021.

I, Andrey Abrechko, an investment expert with 12 years of experience and the founder of the Academy of High Profit Investments, invite you to take part in my free course, where you will learn:

— which instruments are the most profitable in 2021;

— what are IPOs and SPACs and how to start making money on them from 100% per annum;

I will analyze my real case, where I will show with a clear example how I managed to make more than 450% per annum for 2020.

The course consists of 5 small lessons that will be sent to you via Telegram and you can watch them at any convenient time.

Follow the link and start free training