How much will survivor pensions increase in 2021?

- fathers and mothers who have reached the non-working age threshold or are burdened with health problems;

- representatives of the older generation, for whom there is no one else to look after, but in their time they raised their grandchildren;

- spouses deprived of the opportunity to earn money independently;

- disabled children left orphans or with only one parent;

- children receiving knowledge in institutes and other higher institutions;

- adopted children who are wards of foster guardians or adoptive parents;

- a child raised in another family, but dependent on payments, for example, from the father;

- stepsons and stepdaughters supported by the deceased, based on the evidence provided.

Only a citizen who has reached the age of 18 and is enrolled full-time in a higher education institution has the right to apply for an extension of pension contributions (subject to regular confirmation of the fact of continuing full-time education).

Survivor's pension in 2021 - amount, size

In addition to receiving social benefits, you can apply for other types of pension (and insurance) - if the deceased father or mother had savings. There are also state pensions that are awarded to children, husbands or wives, as well as parents of military personnel, employees of the Ministry of Emergency Situations, the Ministry of Internal Affairs, etc., if they died while on duty.

But elderly parents or those with disabilities can count on payments of this nature. Among other things, there is such a thing as “absence of a breadwinner” - such a pension is assigned to those who have no one to support. That is, the presence of another able-bodied child deprives parents of the opportunity to receive appropriate payments.

Survivor's pension: registration in Chelyabinsk in 2021

- statement;

- child’s passport (if any);

- representative's passport;

- child's birth certificate;

- death certificate of a parent (parents, single mother);

- certificate of registration at the place of residence (for children under 14 years of age);

- certificate from the university confirming full-time study (for persons from 18 to 23 years old).

Disabled citizens who were fully dependent on the deceased person or for whom his financial assistance was the main source of livelihood can apply for a survivor's insurance pension.

List of required documents

The applicant is entered into the national register and assistance is provided after providing a complete set of documents justifying the right to the specified benefit:

- ID card (birth certificate or national passport of a citizen of the Russian Federation);

- original death certificate of the breadwinner;

- official documents proving the fact of relationship with the deceased breadwinner (for example, a certificate of marriage, divorce, birth certificate, a court decision that has entered into force recognizing the relationship, etc.);

- SNILS;

- work book of the deceased or other documents proving the work experience of the breadwinner.

Insurance pension in Belgorod in 2021

Survivor's pension in 2021: amount of payments

The most important thing is to understand who is covered by this law and can qualify for a survivor's pension. Therefore, let's figure out who the law considers dependents. First of all, these are people who are completely and completely financially dependent on someone, that is, they are on the person’s full material support. First of all, these are children (children mean not only children born to the breadwinner, but also his brothers, sisters, and grandchildren), who are considered legally incompetent and cannot work and support themselves until they reach adulthood. Minor citizens, which include persons under 18 years of age, do not need to prove the fact of dependency; it is assumed based on their inability to work.

- Insurance. All family members can count on receiving it if the deceased person had work experience. The size of this payment depends on several factors - length of service, contributions to the Pension Fund, pension coefficient in the region, etc. It is calculated individually in each case.

- Social. If a person did not work officially, family members who were dependent on him can still count on state support. Unlike the insurance pension, the amount of this payment is fixed by government agencies.

- State. This pension is issued only to certain categories of citizens - military personnel, civil servants, astronauts, etc. The amount is calculated depending on certain factors. For example, if a military man dies in service from injuries received, then the pension exceeds 10 thousand rubles. But if the same military man dies out of service, the payments are only 5 thousand rubles.

This is interesting: Will there be a punishment under Article 228 Part 2 for personal use of the Criminal Code of the Russian Federation in the 19th Year of Reduction?

Directorate of the Russian Pension Fund - Belgorod

Where is it issued?

| Name of the organization | Directorate of the Pension Fund of Russia, Belgorod District, Belgorod Region |

| Area | West |

| Region of the Russian Federation | Belgorod region |

| Telephone | +7 (hotline) (reception) |

| Website | https://www.pfrf.ru |

| Operating mode | Monday-Thursday: from 08:00 to 17:00, break: from 13:00 to 14:00 Friday: from 08:00 to 16:00, break: from 13:00 to 14:00 |

| Institution address | Belgorod region, Belgorod, Nekrasova street, 9/15 |

| [email protected] |

Where to apply for standard tax deductions for beneficiaries in Belgorod in 2021

Survivor's pension in 2021

Citizens who have never encountered the nuances of receiving payments of this type believe that such pensions are accrued only for children under 18 years of age. In essence, we are talking about a breadwinner, and not only children can play the role of a dependent on his support.

In addition, when receiving a social pension for a child, you can also apply for other payments, including those of an insurance nature, provided that the deceased parent has savings. There are also state pensions available to children/spouses/parents of military personnel, employees of the Ministry of Internal Affairs, the Ministry of Emergency Situations and others who died both on duty and outside of work.

Multifunctional center “My Documents” - Belgorod

Organization

| Establishment | Municipal autonomous institution of the Belgorod region "Multifunctional center for the provision of state and municipal services" |

| What area is it located in? | Oriental |

| Region | Belgorod region |

| Operating mode | Monday-Friday: from 08:00 to 20:00 Saturday: from 08:00 to 14:00 |

| Website | https://www.mfc31.ru |

| Address | Belgorod region, Belgorod, Slavy Avenue, 25 |

| Phone numbers | 8 (contact center) |

| [email protected] |

Vacation for parents with many children in Belgorod in 2021

Will survivor pensions increase in 2021? When? How long

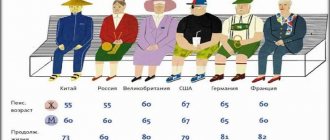

Survivor pensions are increased annually by a small amount; according to the new pension legislation, the size of next year's pension cannot be less than the size of this year's pension. Indexation of insurance payments is planned from February 1, 2021 and social benefits from April 1, 2021.

The increase in the retirement age has affected the indexation of pension payments; from 2021, pensioners will receive a large increase in their pension of up to 1,000 rubles. How much will be added to the survivor's pension in 2021, changes in payments

Survivor's pension in 2020-2020

In any case, the mother is left alone with two children in her arms. Such families are entitled to a survivor's pension for both children in 2021, that is, pension payments are transferred to each child separately if he meets the criteria listed above (age, disability). And depending on the place of work of the deceased breadwinner, either a state, insurance, or social pension can be paid for his two children.

Despite the apparent complexity, in order to apply for a survivor's pension, you need to collect a not so large package of documents. It is necessary to immediately make a reservation that depending on the type of pension, the list of documents may vary, so we decided to collect here all types of documents and indicate in brackets for what type of pension they will be needed, if this requires additional clarification.

This is interesting: Payments of benefits to Afghans in Tver

What it is?

Among other things, the Federal Law also states that not everyone is disabled or has lost a breadwinner. Receiving social benefits is contrary to the right to insurance benefits. Also, if a person has two permanent places of residence (for example, he is a citizen of Russia, but actually lives in another country or vice versa), then the right to a social pension is also withdrawn.

Note! People receiving an insurance pension are not entitled to a social pension. And citizens receiving social benefits lose their right to insurance.

There are significant differences between these types - both in the grounds for receipt and in the amount (read about the types of disability pensions, the features of social, insurance and government payments here).

Survivor pension in Chelyabinsk in 2021

A survivor's pension is a type of state assistance issued to disabled relatives who were dependent on the deceased if he had any insurance experience (a one-time payment of an insurance premium is sufficient), which can be documented. Moreover, the death of the breadwinner should not be a consequence of the actions of persons applying for such benefits (confirmed by a court decision in Chelyabinsk regarding such a citizen that has entered into force).

- first-degree relatives, as well as grandchildren if they are minors. At the age of 18 to 23 years, studying full-time at an educational institution. Adults, in a situation where they have been registered as a disabled person under the age of 18, and there are no other able-bodied guardians or parents;

- relatives of the first and second stages who have reached the age of majority, provided that they provide care for brothers, sisters, grandchildren, children of the deceased breadwinner, if they are under 14 years old;

- disabled spouses and parents, who at the date of death of a citizen were not dependent on him, at any time after the fact of death lost their jobs or any other income sufficient for a minimum existence;

- spouses, parents, grandparents of the deceased, if they are aged 55 years for women, and 60 years old for men. They have registered a disability of any group and are not officially dependent on citizens who are obliged to support them, fulfilling the requirements of Russian legislation.

Survivor's pension in 2021

Important! Adoptive parents, guardians, wards, and other persons have the same rights as blood relatives. This means that if an adopted daughter loses her parents, she will be able to receive a pension in the same amount as her own daughter, and vice versa.

Payments are made from the month following the month of application. If the breadwinner died a long time ago, but they only applied for benefits now, it is impossible to receive money for past periods. It is important to consider that documents are accepted only within a year after the death of the breadwinner. It will not be possible to apply for a pension later.

Latest news about survivor pension in 2021

Compensation payments are formed on the basis of the type of benefit, and payment is made in accordance with a certain time interval. These periods are also characterized by changes in the amount of financial assistance.

This is interesting: Guarantor Consultant Conclusion

The latest news is linking survivor pensions in 2021 to indexation. This payment involves the accrual of an appropriate amount of money received by relatives and family members who find themselves in a difficult financial situation or even completely lost their source of livelihood due to the death of the head of the family.

The size of the social pension in case of loss of a breadwinner in 2020

- insurance (according to Federal Law 400 of December 28, 2013 “On Insurance...” (hereinafter referred to as Federal Law No. 400));

- according to state penny. provision (GPO) (166-FZ of December 15, 2001 “On State..." (hereinafter referred to as Federal Law No. 166));

- pension assigned to family members of deceased persons listed in Part 1 of Russian Law No. 4468-1 of February 12. 1993 “On pensions...” (hereinafter referred to as the Law);

- social for children who have lost one or both parents, or children of a single mother who has passed away (hereinafter referred to as SPPK) (Federal Law No. 166);

- social services for children whose whereabouts of both parents are unknown (Federal Law No. 166).

Here you can find a complete list of documents required to assign a SPC. Some of these documents may not be required if state or municipal authorities have the relevant information.

Social pension for children

- in person or through a legal representative to the Pension Fund or MFC, in this case the day of application will be considered the date of receipt of the application;

- by mail to the Pension Fund of Russia - the day of application is the date indicated on the postmark;

- through your personal account on the official website of the Pension Fund of the Russian Federation - the day of application will be considered the date of submission of the electronic application.

We recommend reading: How can Sberbank pay insurance premiums for compulsory insurance online?

federal MSE (medical and social examination) can recognize a citizen as disabled, including a minor, and assign him a group However, disabled children constitute a separate category; they are not assigned a group until they reach 18 years of age.

Social pension for the loss of a survivor

The size of the social pension for the loss of a breadwinner is adjusted by a regional coefficient if the citizen lives in the northern territories. The value of this indicator ranges from 1.15 to 2, which depends on the location of the region. The coefficient is used only for the period of residence of the child in a certain territory.

Payments are terminated after the citizen reaches the specified age. In case of expulsion from an educational organization or transfer to a correspondence department, a citizen is obliged to report this to the Pension Fund the next day after the occurrence of these circumstances.

Pension amount

The amount of benefits due to a relative or family member for the loss of a breadwinner consists of 2 parts. It includes:

- Fixed payment (hereinafter - FV), established by law.

- Insurance pension for the loss of a survivor, which can be calculated based on the individual pension coefficient (hereinafter referred to as IPC). From January 1, 2018, the cost of 1 IPC point is 81.49 rubles.

Citizens living in the Far North or territories equivalent to it are entitled to an increase in pension in the event of the loss of a breadwinner. Its size is adjusted due to the regional coefficient (multiplied by it) - the indicators fluctuate in the range of 1.15–2 and depend on the subject of the Russian Federation. Applies only during the period of residence of the dependent in the territory of its coverage.

Calculation formula

The size of the survivor's insurance pension is calculated using one of two formulas. The choice of calculation option depends on the status of the deceased at the time of death. If the deceased was a pensioner, the formula PSPK = IPC (1) x SPB is applied, where:

- IPC – the individual pension coefficient of the deceased breadwinner, applied to calculate his insurance benefit as of the date of appointment;

- PSPC – payment amounts under the SPC;

- SPB – the cost of one pension point in rubles on the day the benefit was assigned.

If the breadwinner was not a pensioner at the time of death, the SPK benefit is calculated using the formula PSPC = IPK (2)/CI x SPB, where IPK (2) is the individual pension coefficient accumulated by the deceased on the date of his death. When calculating, the following nuances should be taken into account:

- The IPC of deceased parents is summed up when calculating the size of the pension assigned to orphans.

- The amount of the IPC can be multiplied by the regional coefficient if the payment is made by a dependent living in the Far North or a territory equivalent to it.

- The IPC doubles if the SPC benefit is calculated for the child of a deceased mother.

- How to retire early under the new law

- How to avoid gaining excess weight during self-isolation

- Why do you bite your nails and how to stop it

The calculation of the size of the insurance pension under the SPC is based on a static set of rights that the deceased has already earned during his life. Recalculation is possible if there is an increase in the cost of the IPC as a result of indexation, justified by an increase in the inflation rate and the volume of the consumer basket. It is produced according to the formula PSPC = stPSPK + (nIPK/KM/KI x SK), where:

- PSPC - survivor's benefit after recalculation;

- nIPK - the individual pension coefficient of the deceased, calculated on the basis of insurance premiums not taken into account at the date of his death;

- stPSPK – the amount of previous payments as of 31.07 of the year in which the recalculation is carried out;

- KM – coefficient of the ratio of the standard duration (in months) of the deceased’s work experience on the date of his death to 180 months;

- KN – number of dependents as of 01.08 of the current year;

- SC – the cost of the IPC as of the date of recalculation.

Social supplement up to the subsistence level in the region

If the SPC benefit is the recipient’s only income, and its total amount is below the subsistence level (hereinafter referred to as the subsistence minimum) in the region, the pensioner is assigned one of 2 types of allowances. Regional social supplement - RSD - is provided to citizens registered in constituent entities of the Russian Federation with a high price level and a monthly minimum wage higher than the general Russian indicator (for example, in Moscow). The federal social supplement - FSD - is assigned to residents of regions with established minimum wage levels below the average value.

Fixed payment amount

PV refers to a social pension in the event of the loss of a breadwinner and part of the full benefit under the SPC. Minimum size of PV as of 04/01/2018:

| Purpose | Amount (r.) |

| each disabled family member | 2491.45 (50 percent of the basic rate of FV) |

| For minors and full-time university students: | |

| who have lost one parent | 5240,65 |

| orphans (per child) | 10 481,34 |

Survivor's pension in 2021: size

- insurance pension, in the past it was also called labor pension;

- state, assigned to close relatives of a deceased military man or astronaut, as well as people involved in man-made or natural disasters;

- a social pension assigned if the breadwinner is not registered with the Pension Fund and has not made any contributions to it.

PPC is not a one-time payment, but a monthly benefit regularly paid to children until they reach 18/23 years of age, until they reach adulthood/if they provide the Pension Fund with a certificate from a university that they are full-time students.

Survivor's pension in 2021 - who is entitled to payment

Each benefit: insurance, state or social, intended for payment to the population, depending on the type, has its own conditions and calculation characteristics. The insurance pension is calculated every month and is aimed at supporting disabled citizens who have lost their only source of livelihood. It is paid according to two other indicators:

The second applies to an applicant for state assistance, who must prove his incapacity for work, the fact that he is dependent on a deceased person and that he permanently resides on the territory of the Russian Federation. Only after this will he receive the right to receive compensation payments guaranteed by the state pension policy.

09 Jun 2021 uristlaw 335

Share this post

- Related Posts

- Benefits for category 3 participants in 2020-2020

- 228 3 Conditional Term

- Military personnel of Age Group 5

- 3 Personal Income Tax House Construction

Who is entitled to social pension?

- Persons who have reached retirement age and have received old-age benefits.

- Disabled people of all groups.

- Citizens receiving survivor benefits.

- Persons who have been assigned social benefits in old age.

- Inability to receive labor benefits.

- Recognition of a person as disabled, and the disability must be an obstacle to his or her ability to perform work.

- A citizen must permanently reside in Russia.