What determines the size of pension provision?

An old-age insurance pension is compensation to a person for wages or other income that he received during his working life. Cases when this happens are clearly described in the legislation. The state takes care of a member of society:

- upon reaching a certain retirement age;

- when assigning a disability group;

- in case of loss of a breadwinner.

The economic situation in the country is unstable. This leads to increased costs for people on food and necessary services. Pensioners, especially those who are unable to work, suffer the most from inflation processes. Therefore, two norms were introduced into the legislation to level the situation:

- Pension payments are indexed annually, that is, they increase by the fixed inflation rate;

- the amount of pensions of citizens who do not participate in labor activity is brought up to the minimum subsistence level established for the corresponding category of the population.

Important: a pensioner can receive a payment in hand that is lower than the cost of the consumer basket if he has additional income

Indicators affecting the pension content of residents of the Novosibirsk region

The government monitors the material support of disabled citizens.

The following parameters are studied:

| Index | Magnitude |

| Average pension | RUB 14,000.0 |

| Minimum pension (for non-working persons) | RUB 9,440.0 |

| Minimum wage (minimum wage) | RUB 11,280.0 |

| Number of recipients | 800 145 people |

| Living wage per capita | RUB 11,738.0 |

For information: accruals for disabled people of the 3rd (working) group may be significantly lower than the given minimum indicator.

Measures to support pensioners in the region

Powers to fulfill social obligations are divided between the federal center and regional authorities. The Novosibirsk government establishes benefits and preferences for certain categories of citizens. So, all pensioners are entitled to:

- services of transport companies on a preferential basis (free or with a 50% discount);

- compensation or subsidization of part of the costs of utilities;

- compensation for repairs;

- transport tax benefits.

The main additional payment is a regional subsidy up to the subsistence level. It is available to those whose total income is below the subsistence level established for pensioners in the region or country (the highest is selected). In this case, the pensioner should not be officially employed. It is formalized by the Pension Fund, as a rule, upon initial appointment. When calculating the social supplement, the amounts of all regular benefits (for example, for transport and utilities) are taken into account.

Hint: one-time social assistance is not taken into account when assigning additional payments.

Components of a pension

Residents of the Novosibirsk region can claim several types of security in the event of loss of ability to work. Each is calculated using a special formula. The main pension benefit is labor or insurance, according to the new terminology.

It consists of the following separate parts:

- Fixed, the same for everyone. Its size as of January 2019 was 5,334.19 rubles.

- Insurance, calculated individually based on:

- length of service earned during work;

- total insurance premiums converted into points.

- Additional payments and preferences.

Attention: additional points are given by the following periods:

care:

- a child under one and a half years old;

- an elderly relative who celebrated their 80th birthday;

- disabled group 1 since childhood;

- a disabled child;

service in the armed forces.

Social supplement up to the subsistence level

SD = PMP - MO

where PMP is the regional subsistence level of a pensioner, and MO is the general material support of a citizen.

The amount of financial support for a pensioner (MO) includes the following amounts:

- Pensions, including old-age insurance pension taking into account a fixed payment to it, funded pension, etc.;

- Urgent pension payment;

- Additional material (social) support;

- Monthly cash payment (MCB), including the set of social services (NSS) included in it;

- Other support measures in monetary terms (except for one-time ones): compensation for telephone payments, living quarters, utilities, travel on all types of transport, etc.

If the total income of a pensioner is below the subsistence level established in the region of his residence, the pensioner can apply for a social supplement to his pension - federal or regional.

A social pension may be assigned to those residents of both Samara and the Samara region who do not have enough experience and points:

- After 60 years - for all women without experience and sufficient points.

- After 65 years - for all those without experience and points for men.

- Persons with disabilities and who worked 1 or more working days.

- Children who are unable to work and have lost their breadwinners.

The size of the social pension for the loss of a breadwinner is 5,180 rubles, both in the Russian Federation and in the Samara region. Payments of state security pensions are due both to military personnel and persons equivalent to them, as well as to those who are entitled to pension payments based on length of service. As for funded pension payments, they are both assigned and paid in individual cases, depending on the provisions of the contract.

Level of minimum pension accruals by region

Electricity for Novosibirsk for 2021

The minimum pension provision for residents of the capital of the Russian Federation from January 1, 2021 is 12,115 rubles, for residents of the Moscow region - 9,908 rubles. In St. Petersburg this figure is 8846 rubles, in the Leningrad region – 8846 rubles.

What minimum established pension indicators in 2021 are shown in the table:

| City/republic | Minimum pension, rub. |

| Altai region | 8.712 |

| Komsomolsk-on-Amur | 8.846 |

| Arkhangelsk | 10.258 |

| Astrakhan | 8.352 |

| Belgorod | 8.016 |

| Bryansk | 8.523 |

| Chechnya | 8.735 |

| Chelyabinsk | 8.691 |

| Chukotka | 19.00 |

| Chuvashia | 7.953 |

| Jewish Autonomous Region | 9.166 |

| Sevastopol | 8.842 |

| Khabarovsk | 10.895 |

| Khanty-Mansiysk | 12.176 |

| Irkutsk | 8.841 |

| Ivanovo | 8.576 |

| Kabardino-Balkaria | 8.846 |

| Kaliningrad | 8.846 |

| Kaluga | 8.708 |

| Kamchatka | 16.543 |

| Karachay-Cherkess Republic | 8.846 |

| Kemerovo | 8.387 |

| Kirov | 8.474 |

| Kostroma | 8.630 |

| Krasnodar region | 8.657 |

| Krasnoyarsk | 8.846 |

| Mound | 8.750 |

| Kursk | 8.601 |

| Lipetsk | 8.620 |

| Magadan | 15.460 |

| Murmansk | 12.674 |

| Nenets Autonomous Okrug | 17.956 |

| Nizhny Novgorod | 8.102 |

| Novgorod | 8.846 |

| Novosibirsk | 8.814 |

| Omsk region | 8.480 |

| Orenburg | 8.252 |

| Eagle | 8.730 |

| Penza | 8.404 |

| Permian | 8.539 |

| Primorye | 9.988 |

| Pskov | 8.806 |

| Adygea | 8.138 |

| Bashkiria | 8.645 |

| Buryatia | 8.846 |

| Dagestan | 8.680 |

| Khakassia | 8.782 |

| Ingushetia | 8.846 |

| Kalmykia | 8.081 |

| Karelia | 8.846 |

| Komi | 10.742 |

| Crimea | 8.370 |

| Mari El | 8.191 |

| Mordovia | 8.522 |

| Sakha | 13.951 |

| North Ossetia | 8.455 |

| Tatarstan | 8.232 |

| Tyva | 8.846 |

| Rostov region | 8.488 |

| Ryazan | 8.568 |

| Sakhalin | 12.333 |

| Samara | 8.413 |

| Saratov region | 8.278 |

| Smolensk | 8.825 |

| Stavropol | 8.297 |

| Sverdlovsk | 8.846 |

| Tambov | 7.811 |

| Tomsk | 8.795 |

| Tula | 8.658 |

| Tver | 8.846 |

| Tyumen | 8.846 |

| Udmurtia | 8.502 |

| Ulyanovsk | 8.474 |

| Vladimir | 8.526 |

| Volgograd | 8.569 |

| Vologda | 8.846 |

| Voronezh | 8.750 |

| Yamalo-Nenets Autonomous Okrug | 13.425 |

| Yaroslavl | 8.163 |

| Transbaikalia | 8.846 |

Minimum old-age pension in the Novosibirsk region for 2021

Universities of Novosibirsk (universities, institutes) - rating, specialties, tuition fees, reviews, passing score for Unified State Exam 2020

The Russian government quite often names the national average amount of old-age pensions. In 2021 this is more than 14 thousand rubles, and in 2019 it will be more than 15 thousand. At the same time, for some reason, they forget about those senior citizens who receive the minimum payment. Although it is they who first of all need state support and an increase in pensions to a more decent level.

Unfortunately, the situation of such pensioners will not improve much in 2021, despite officials’ promises to increase pensions in the country by a thousand rubles per month. What will be the minimum old-age pension in the Novosibirsk region from January 1, 2021 for non-working pensioners, how much will it increase compared to 2018.

Let's learn about the life of Russian pensioners using a specific example from this region.

How is the minimum old age pension calculated?

Strictly speaking, Russian legislation does not contain such a concept as a minimum guaranteed pension. However, in practice, a minimum old-age pension still exists, and it is determined indirectly through other provisions of the law.

of these norms suggests that the old-age pension in Russia cannot be lower than the living wage of a pensioner.

This cost of living is determined by each region independently. What is characteristic is that there is no uniform method for determining it. Regions take real statistics on the cost of the consumer basket for pensioners as a guide. Then some regions and republics include future price increases in Rosstat data, while others do not.

Be that as it may, each region of Russia is obliged to establish its own minimum living wage for a pensioner on its territory before the start of the next year.

This additional payment is called social; it can be financed both by the all-Russian budget and by the budget of the region itself.

It all depends on the level at which the regional authorities set the cost of living for a pensioner. If it is lower or equal to the all-Russian one, funding comes only from the federal treasury.

If the regional indicator exceeds the national average, funding comes from the local budget.

In general, in Russia the cost of living for a pensioner for 2021 is 8,846 rubles.

Minimum old-age pension in Novosibirsk and the region from January 1, 2021

The regional authorities of Novosibirsk have set the cost of living for a pensioner in the region for 2021 at 8,814 rubles. This figure was enshrined in regional law No. 304-OZ of October 31, 2021. This value will be the amount of the minimum old-age pension in the region in 2021.

In 2021, the minimum pension level in the Novosibirsk region is 8,725 rubles. The increase in pensions for recipients of the minimum benefit is therefore 89 rubles.

The specified amount - 8,814 rubles - will be the minimum pension only for non-working pensioners. The law is based on the fact that if a pensioner works or receives some other income in addition to a pension, then he is not entitled to a social supplement. Even if the pension is below the subsistence level, the person generally receives an income above this amount and without additional payment.

But what about the thousand ruble increase promised by the state?

When agitating Russians for raising the retirement age, officials very often said that the pensions of current pensioners, thanks to this measure, would increase significantly in 2021. In general, pensioners will receive 12 thousand rubles more per year, which means the increase per month will immediately amount to a thousand rubles.

Unfortunately, these words turned out to be crafty and not entirely reliable.

We were talking about the national average pension. It is believed that in 2021 it is equal to 14.1 thousand rubles (sometimes they call the amount 14.4 thousand - officials themselves get confused). In January 2021, pensions in Russia will be indexed by 7.05%. After increasing the average pension by this percentage, it will actually increase by a thousand rubles.

However, the problem is that for those who receive a pension below the average, this seven percent increase will not mean a thousand rubles at all, but a much more modest amount.

Unfortunately, recipients of minimum pensions will receive nothing or practically nothing from this increase. For most of them, after indexation by 7.05%, the pension amount will still be below the subsistence level. The only thing that will lead to a slight increase in payments is an increase in this level in the region where the recipient of the minimum old-age pension lives.

In the Novosibirsk region, as we just found out, the increase will be a measly 89 rubles.

, please select a piece of text and press Ctrl+Enter.

| You can share this material with your friends: |

Work for pensioners in Kaliningrad and the Kaliningrad region

Of course, few elderly people managed to earn enough money during their working career to live and not need it in old age. Therefore, most people try to take on a part-time job or part-time job whenever possible.

Find out whether pensions for working pensioners will be indexed from January 1, 2021?

Advertisements on free job sites and on information boards at entrances continue to invite pensioners into various types of marketing networks: distribution of cosmetics, household chemicals, sale of high-demand goods, door-to-door visits for additional non-state insurance, etc.

They promise unlimited income and a comfortable life. We can only hope that fewer and fewer naive elderly people will fall into the clutches of these “benefactor-employers”. In fact, non-core and, most often, low-paid vacancies are open to pensioners.

For women: a cleaner, a dishwasher, a concierge, a cloakroom attendant, a saleswoman in a stall, at best a museum caretaker, a nanny in a kindergarten or a private company.

The older, stronger half of humanity are employed as watchmen or watchmen at construction sites.

It is best when the profession and qualifications, as well as the policy of the organization where the pensioner works, allow him to continue working in his usual place. But the realities of life for the youth of the staff.

We have already shared tips and talked about what remote work is for retirees and even prepared a whole list of current vacancies for both men and women.

Tax benefits for pensioners of Novosibirsk

Residents of the region can take advantage of tax deductions. Many older people continue to work after retirement. Moreover, employers continue to pay income tax in the amount of 13% to the city budget. When purchasing real estate, a pensioner gets back up to 260 thousand rubles from the amount spent (Part 10, Article 220 of the Tax Code of the Russian Federation).

City residents can reduce their expenses by reducing the amount of land tax. A 50% discount applies to plots used for summer cottage farming. The minimum pension in Novosibirsk was approved by the regional authorities in the amount of 8,538 rubles. Transport tax benefits apply to cars with an engine power of up to 150 hp. With.

What income is not subject to personal income tax?

When calculating income tax, the following are not taken into account:

- pensions;

- social payments;

- costs of trips to sanatoriums;

- expenses for treatment.

Disabled veterans can use medications prescribed by a doctor free of charge. The list of preferential funds is approved annually by the city administration.

Housing and communal services costs are a fairly large expense item for any family. To support pensioners, the regional authorities decided to provide subsidies. The amount of financial assistance depends on the person's income level. It should be taken into account that the minimum pension in Novosibirsk in 2021 decreased by 265 rubles. If a pensioner receives a pension in the amount of 9 thousand rubles, then the amount of the subsidy can be determined using the formula: 9,000x16% = 1,440 rubles.

The maximum amount of financial assistance is 2744.3 rubles. The amount of the subsidy depends on the type of property and family income. In 2016, Governor Resolution No. 29 was adopted, which spelled out the conditions for providing benefits.

To take advantage of the right to receive a subsidy, a pensioner must have a lease agreement or ownership in hand. Debts on utility bills are not allowed. Before applying, you must pay off your existing debt in full.

Benefits and payments to war children in Kaliningrad and the region

Children of war, according to federal law, should receive relief from the state on several points at once:

- free travel on public transport;

- payment for housing and communal services (50%);

- medicines (free if the drug is on the list approved in the region);

- connection of a city telephone line (free of charge);

- extraordinary medical care;

- funeral services;

- cash grants.

Unfortunately, until recently everything was fine with the last point in Kaliningrad. Since 2015, the regional public organization “Children of War” has been fighting for regional pension increases. After all, one thousand and a half is a lot of money for this segment of the population.

Finally, 1.35 billion rubles were allocated to the regional budget for the payment of monthly cash benefits (MCB) to veterans of labor and military service, home front workers and repressed people, and there are more than 70 thousand of them in the Kaliningrad region. The benefit amount will be 1650 rubles.

Conditions for assigning pension benefits in Novosibirsk

The criteria by which a person can begin to receive a pension are prescribed in federal legislation. They are related to the type of benefit. Namely:

1. By old age:

a. insurance is assigned if the criteria for length of service and points are met:

- after 60 years for women;

- after 65 years for men;

- at a different age in the presence of preferential grounds;

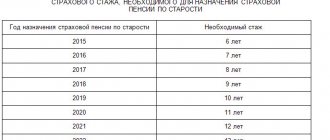

- work experience of at least 15 years (this indicator will be relevant by 2024, in 2021 the minimum experience is 10 years, within 5 years it will increase by 1 year annually);

- 30 individual pension coefficients (in 2021, the minimum amount of pension points was 16.2, the required number will increase annually and will reach 30 by 2024)

b. social:

- women who have celebrated their 65th birthday;

- men over 70 years of age;

- foreign citizens and stateless persons permanently residing in the territory of the Russian Federation for at least 15 years and who have reached the specified age;

- state: assigned to citizens affected by radiation or man-made disasters;

- The state pension for long service is assigned to federal civil servants, military personnel, astronauts and flight test personnel.

2. For disability:

- insurance in the presence of disability and at least one day of insurance experience;

- social in the presence of disability and lack of insurance coverage;

- state is assigned to military personnel, citizens who suffered as a result of radiation or man-made disasters, participants in the Great Patriotic War, citizens awarded the “Resident of Siege Leningrad” badge, and cosmonauts;

3. In the event of the loss of a breadwinner, a pension is entitled to:

- insurance is assigned upon the death of the breadwinner, who was dependent on the applicant for pension provision. The main condition is that the deceased breadwinner has an insurance period (at least one day);

- social is assigned to children under the age of 18, as well as over this age, studying full-time in educational organizations, until they complete such training, but no longer than until they reach the age of 23, who have lost one or both parents, and children of a deceased single person mothers;

4. State pension is assigned to disabled family members of fallen (deceased) military personnel; citizens injured as a result of radiation or man-made disasters, astronauts.

Note: workers born after 1966 are provided with a funded pension. To receive it, a person must redistribute part of the contributions to savings.

How is a pension processed?

All issues of calculating maintenance are dealt with by Pension Fund employees. The applicant is required to prove the right with documentary evidence. This is done this way:

- Documents collected: passport;

- SNILS, which proves the fact of insurance in the system;

- work book to determine length of service in detail;

- additional grounds for granting a pension:

- certificate of assignment of a disability group;

- death certificate of the breadwinner;

- additional documents giving allowances:

- children's birth certificates;

- a document confirming service in the armed forces;

- certificate of presence of dependents;

- preferential certificate.

Where to contact in Novosibirsk

| Service area | Address | Telephone | Working hours with the public |

| Dzerzhinsky | Dzerzhinsky Ave., 12/1 | +7 | 8:30 — 17:15 (on Friday until 16:00) |

| Railway | st. Oktyabrskaya, 49 | +7 | |

| Zaeltsovsky | st. Dusi Kovalchuk, 276 | +7 | |

| Kalininsky | st. Teatralnaya, 44 | +7 | |

| Kirovsky | st. Sibiryakov-Gvardeytsev, 59/1 | +7 | |

| Leninist | pl. Truda, 1 | +7 | |

| Novosibirsk | st. Serebrennikovskaya, 6 | +7 | |

| October | st. Inskaya, 122 | +7 | |

| Pervomaisky | st. Pervomaiskaya, 176 | +7 | |

| Soviet | st. Ivanova, 4 | +7 | |

| Central | st. Serebrennikovskaya, 4/1 | +7 |

For information: on pre-holiday days, reception of citizens is carried out according to the Friday schedule.

Measures to support pensioners in Altai

There are several programs in Altai to support people of retirement age. Every year they are improved, and new programs are formed.

Public organization – Union of Pensioners

There is a public organization in the region - the Union of Pensioners of the Russian Federation of the Altai Territory.

Public organization:

- brings together people with professional and life experience to help retirees;

- talks about pension legislation;

- helps implement various social programs;

- creates charitable foundations to help pensioners.

The Pensioners' Union cooperates with the authorities, receiving funding for various projects:

- mass sports competitions for pensioners;

- various competitions where you can show your creative skills;

- cultural events with the younger generation;

- computer literacy courses;

- evenings of relaxation and cultural education.

If a pensioner finds himself in a difficult life situation or is left alone, he can turn to the Union of Pensioners for help. They will provide him with support and suggest ways to solve his problem.

Project "Demography"

The Demography project covers different generations, including pensioners, who are helped during the “Older Generation” direction.

In the Altai Territory, all pensioners aged 65 years and older are given a unique chance to learn a new profession or start traveling.

There are also other directions:

- “Financial support for families at the birth of children”;

- “Promoting the employment of women with children”;

- “Strengthening public health”;

- “Sport is the norm of life.”

The national project not only helps to retrain as an accountant, confectioner, pharmacist, or computer operator, but also guarantees employment.

The project is being carried out by the Ministry of Social Protection of the Altai Territory. At the moment, the retraining project is already helping 800 pensioners.

Social tourism is also developing, where people of retirement age can travel along compiled tourist routes or visit famous cultural places, museums, theaters, etc.

The project was created to support families, increase the birth rate, and save the people.

Minimum pension in the Rostov region in 2020

At the same time, the all-Russian PM has been established for 2021, which is 8846 rubles. Payments are raised to this level for all non-working applicants, using federal funds. Working people and disabled people of group 3 can receive less than the established amount, as they receive additional income.

Our dear readers, we are glad to welcome you to our portal “SocLgoty.ru. In this material we will find out what the minimum pension is established in Rostov-on-Don and the Rostov region in 2021. Let's consider payments for working and non-working persons, talk about indexation and the features of calculating each type of benefit. Let's start looking at the topic with general concepts.

Electronic travel cards for pensioners

On December 1, 2016, an electronic travel pass system began operating in the regional capital. Now you can pay for travel either with a special card or in cash the old-fashioned way. However, paying in cash will cost one ruble more. Bus – 20 and 19 rubles, tram – 19 and 18, respectively.

The number of trips can be limited or unlimited. In the first case, the pass will contain 50 trips, which are reset to zero every month. In the second, you can drive as much as you like. You can also simply top up the amount on the card as needed.

For pensioners, you can purchase unlimited tickets valid on any major transport for 430 rubles.

How much will your pension increase?

When Law No. 350-FZ of October 3, 2018 was adopted, when determining the indexation percentage, they were guided by the amount of the average increase in pension. It was planned that during 2019-2024. Pension payments should increase annually by 1000 rubles. To ensure such an increase in 2021, the indexation coefficient was approved at 1.066, which corresponds to an increase of 6.6%.

Note that the increase of 1,000 rubles is determined relative to the average annual pension in the Russian Federation as a whole. In 2021, this value for non-working pensioners is 15,459.85 rubles, and during 2021 it should increase to 16,389.62 rubles. That is, an additional payment of 1 thousand rubles will be received by pensioners who receive this (or approximately the same amount) - about 15.5 thousand rubles. and higher.

For each pensioner, the amount of the increase will be determined individually. It will depend on how much the citizen received last year. Everyone can independently calculate how much their insurance payment will increase in January 2021.

- To find out the size of the pension from 01/01/2020, you need to multiply the amount of last year’s payment by 1.066.

- In this case, when calculating, you need to use the pension payment directly and not take into account various allowances (evidence allowance, social supplement to the subsistence level, and so on).

Example

In 2021, pensioner Lyubov Ivanovna received a payment in the amount of 10,000 rubles. After the increase, from January 1, 2020, she will begin to receive an amount equal to 10,000 × 1,066 = 10,660 rubles, that is, 660 rubles more than last year.

Self-study documents

Law of the Altai Territory N 36-ZS “On the procedure for establishing the level of the living wage in the Altai Territory” (04.07.2019) Decree of the Government of the Russian Federation N 975 “On approval of the Rules for determining the amount of the living wage of a pensioner in the constituent entities of the Russian Federation in order to establish a social supplement to the pension” (07/30/2019) Federal Law N 178-FZ “On State Social Assistance” (04/24/2020) Federal Law N 134-FZ “On the Living Wage in the Russian Federation” (04/01/2019)

Minimum amounts of a fixed payment of a disability insurance pension

| Category of pension recipients | The amount of a fixed payment to the disability insurance pension, taking into account increases to it |

| Disabled people of group I | Without dependents – 11,372.50 rubles per month With 1 dependent – 13,267.92 rubles per month With 2 dependents – 15,163.34 rubles per month With 3 dependents – 17,058.76 rubles per month |

| Disabled people of group II | Without dependents – 5686.25 rubles per month With 1 dependent – 7581.67 rubles per month With 2 dependents – 9477.09 rubles per month With 3 dependents – 11372.51 rubles per month |

| Disabled people of group III | Without dependents – 2843.13 rubles per month With 1 dependent – 4738.55 rubles per month With 2 dependents – 6633.97 rubles per month With 3 dependents – 8529.39 rubles per month |

| Citizens living in the Far North and equivalent areas | The fixed payment to the disability insurance pension and increases to it are increased by the corresponding regional coefficient |

| Group I disabled people who have worked for at least 15 calendar years in the Far North and have an insurance record of at least 25 years for men or at least 20 years for disabled women | Without dependents - 17058.76 rubles per month With 1 dependent - 19901.89 rubles per month With 2 dependents - 22745.02 rubles per month With 3 dependents - 25588.15 rubles per month (regardless of place of residence) |

| Disabled people of group II who have worked for at least 15 calendar years in the Far North and have an insurance record of at least 25 years for men or at least 20 years for women | Without dependents - 8529.38 rubles per month With 1 dependent - 11372.51 rubles per month With 2 dependents - 14215.64 rubles per month With 3 dependents - 17058.77 rubles per month (regardless of place of residence) |

| Group III disabled people who have worked for at least 15 calendar years in the Far North and have an insurance record of at least 25 years for men or at least 20 years for women | Without dependents - 4264.70 rubles per month With 1 dependent - 7107.83 rubles per month With 2 dependents - 9950.96 rubles per month With 3 dependents - 12794.09 rubles per month (regardless of place of residence) |

| Group I disabled people who have worked for at least 20 calendar years in areas equated to the regions of the Far North, and have an insurance record of at least 25 years for men or at least 20 years for women | Without dependents - 14,784.26 rubles per month With 1 dependent - 17,248.31 rubles per month With 2 dependents - 19,712.35 rubles per month With 3 dependents - 22,176.40 rubles per month (regardless of place of residence) |

| Disabled people of group II who have worked for at least 20 years in areas equated to the regions of the Far North, with insurance experience of at least 25 years for men or at least 20 years for women | Without dependents - 7392.13 rubles per month With 1 dependent - 9856.18 rubles per month With 2 dependents - 12320.22 rubles per month With 3 dependents - 14784.27 rubles per month (regardless of place of residence) |

| Group III disabled people who have worked for at least 20 years in areas equated to the regions of the Far North, and have an insurance record of at least 25 years for men or at least 20 years for women | Without dependents - 3696.07 rubles per month With 1 dependent - 6160.12 rubles per month With 2 dependents - 8624.16 rubles per month With 3 dependents - 11088.21 rubles per month (regardless of place of residence) |