Home page » Regional benefits and payments » Pension in Stavropol and the Stavropol Territory in 2021

Pensions in the Stavropol Territory in 2021 are paid on a general basis. This year, about 186 thousand citizens receive benefits. Increasing coefficients are not applied in the territory in question. If the amount is less than the subsistence level, the citizen is assigned an additional payment.

- Conditions for assigning pension payments in the Stavropol region

- Pension size in the Stavropol Territory in 2021

- Additional payments to residents of Stavropol in 2021

- The process of applying for a pension in Stavropol

Average age pension in the Russian Federation for 2021 and the first half of 2019

The Pension Fund of the Russian Federation at the end of 2021 - beginning of 2021 informed that the average old-age pension in the country is at the level of 14.1 thousand rubles. This is in comparison with the level of salaries paid to Russians, which is about 40% of average earnings. At the same time, the social pension is much smaller, on average it is 9 thousand rubles.

According to the figures provided by the government, the rate of increase in pension provision for citizens exceeds the inflation rate by 2 times. So, in 2021 it was held twice in February and April.

According to the developed plan, by 2024 the insurance pension (SP) will reach 20 thousand rubles. In 2021, the old-age pension was increased by more than 7%, and the level of payment increased by an average of one thousand rubles - in total, the average insurance payment is about 15.1 thousand rubles.

Pension size in the Stavropol Territory in 2021

The minimum pension must be no less than the minimum subsistence level in force in the territory of the subject in question.

A similar technique is used throughout the country; for this reason, the size of the pension does not have a fixed value.

Currently, the minimum wage for residents of the Stavropol Territory who have achieved deserved status is 8,297 rubles.

At the same time, the minimum pension is 9,200 rubles. The average pension in the Stavropol Territory is 13,500 rubles.

From 01/01/2021, pension payments are assigned on the basis that the cost of the IPC is 93 rubles. The fixed part of the pension is 5686.25 rubles.

Minimum size

There is no fixed concept of minimum pension in the legislation of the Russian Federation. The main condition when calculating the payment is that it should not be less than the minimum subsistence level for a pensioner accepted in a given region. If the accrued amount does not reach this amount, then local authorities seek funds to bring it to the level accepted in a given subject of the federation.

The social supplement is issued upon a written application from the pensioner to the Pension Fund, with supporting documents, about the discrepancy between the payment amount and the established minimum subsistence level for the pensioner. If a pensioner continues or resumes working, he cannot claim this social benefit. The increase in state payments by age is affected by:

- When a citizen reaches 80 years of age, the state introduces additional subsidies.

- Disabled dependents remain in the care of the pensioner: parents, children, grandchildren, adopted children.

- State indexations were adopted by the amount of inflation or another coefficient approved by the government.

- The pensioner begins again or continues to engage in official work.

When entering an insurance pension in the second half of 2021, you must work for at least 10 years and accumulate 16.2 points. And by 2022, these data will change to 15 years and 30 points. For civil servants the numbers are different:

| Period | Man's age | Woman's age | Experience | Point |

| II half of 2021 | 61,5 | 56,5 | 12 | 21 |

| 2023 and beyond | 65 | 60 | 15 | 30 |

If the citizen’s conditions are not met, then the insurance portion will not be assigned to him. The pensioner will receive social benefits from the state.

Social allowances

This type of support applies to non-working pensioners whose total income is below the subsistence level established for the corresponding category of the population.

In this case, the state content is recalculated in favor of the recipient in order to eliminate the difference in values. All monthly payments and social benefits will be taken into account here, with the exception of payments that are one-time in nature. Recalculation is carried out on the basis of a written application , which is reviewed by employees of the territorial branch of the Pension Fund.

In addition, pensioners retain all regional benefits, and low-income citizens who find themselves in difficult life situations are provided with targeted assistance.

Important! Employed pensioners cannot apply for a social supplement. For this category, a full recalculation is provided, taking into account the indexation carried out after completion of work.

Maximum size

What maximum age pension will be accrued to each citizen of the Russian Federation depends on the following circumstances:

- number of complete years as of the date of issue;

- total work experience;

- the presence of a regional component when living or working in difficult climatic conditions, for example, in the Far North or equivalent regions;

- salary received over the years of work;

- pension contributions made;

- how many years the citizen worked while at retirement age.

If a pensioner who was supposed to go on vacation at the age of 65 or 60 continues to work, then the amount of the payment will increase taking into account the following coefficients:

| Length of service in years after reaching statutory years | Increasing coefficient for a pensioner’s personal coefficient | Increasing factor for fixed part |

| 1 year | 1,07 | 1,056 |

| 5 years | 1,45 | 1,36 |

| 10 years | 2,32 | 2,11 |

It turns out that the longer a citizen continues his work activity after the official retirement age, the more he will receive from the state when he stops working.

How is it formed

As a result of the pension reform of 2007, several types of pension contributions are carried out on the territory of the Russian Federation:

| state | accrued to employees of the Ministry of Internal Affairs, military personnel, disabled people with military injuries |

| social | accrued to citizens who do not have the necessary labor protection and a sufficient number of insurance points |

| insurance | accrued to citizens who have reached retirement age with the required number of years and points |

The amount of monthly insurance payments is formed on the basis of pension points received by the citizen for the entire period of work. They are calculated based on years of work and salary.

For example, persons with at least 35 years of work experience with a salary of 26,000 rubles apply for a pension of 40% of their former salary. However, there are a number of restrictions on payments. The maximum pension cannot exceed the minimum subsistence level by 3 times.

Every year the cost of the insurance point increases as a result of indexation. In 2021, 1 point was equal to 78.58 rubles, in 2021 – about 80 rubles.

Benefits and allowances

Pensioners belong to a socially vulnerable category, so the state has provided not only the payment of pensions, but also other support measures. These include:

- Exemption from property tax for one property.

- The right to a tax deduction when purchasing housing. If a pensioner works, then he has the right to submit an application to the tax authority for a refund of the amounts paid to the budget for the previous 4 years.

- Exemption from paying land tax in the amount of up to 10 thousand rubles.

- If you have a prescription from your doctor, a disabled person's benefit card or a pension card, you can buy medications at half the cost.

- Preferential travel on public transport, if provided by local or regional authorities.

- Compensation or benefits for utility bills. In some regions, pensioners receive a refund when paying for housing and communal services, in others it is necessary to prove that the pensioner is living alone or his financial capabilities classify him as a low-income citizen.

Some benefits are provided to pensioners automatically; to receive others, you must contact the tax authorities, MFC or housing and communal services representative offices.

Pensions in a new way: social and insurance

Since 2015, it has become increasingly important for Russian citizens to receive official wages, from which the employer makes contributions to all funds, primarily to the Pension Fund. The cumulative part of future payments upon reaching retirement age depends on this.

For those who are not retiring soon, it is important to understand which additional periods will be included in the length of service and which the Pension Fund will not count. This will include: periods of annual paid leave, sick leave, maternity leave until the child reaches 18 months, military service and other periods when contributions to the Pension Fund were made. Studying at a university is not included in the insurance period, as is the period of child care from 18 to 36 months, as well as time off, leaves without pay and periods of being unemployed, without official confirmation of the status of unemployed in the employment service.

When a citizen retires, the points he accumulated during his work are recalculated at the rate established by the state at that time. In 2021, a point costs 87.24 rubles; by 2023, the amount will increase and amount to 116.63 rubles.

To establish a social pension, when there is not enough length of service and points for insurance, a citizen will have to wait until the following age:

- 65 years for women;

- 70 years for men.

But such a transition is not envisaged immediately; in 2021, a social pension will be assigned to men aged 66 and women aged 61. And by 2023, the figures established by law will be achieved.

To receive a pension social benefit, a foreigner must have lived in the Russian Federation for 15 years and reached the age prescribed by legislators.

The size of the social pension in 2021, taking into account indexation, varies from 7.8 thousand rubles. in the Tambov region up to 19 thousand residents of Chukotka.

If a citizen has not accumulated points and experience, but his health does not allow him to work, then he has the right to apply for a disability pension. Single pensioners and disabled people who cannot care for themselves and have no one to look after them can arrange their own stay in nursing homes, and their pension will be spent on accommodation, food and care.

Recipients of social pensions should take into account that in the case of official employment, the state cancels the payment of preferential benefits to them. But this state of affairs will allow the pensioner to accumulate the points and length of service that are missing for calculating the insurance pension.

For pensioners who prefer not to depend on home delivery providers, it is more convenient to receive their government payments on a card. To do this, just select a suitable banking product, take the card account number and take it to the Pension Fund, where transfers will be made. Banks offer many loyalty programs for senior citizens through debit and credit cards.

Those who fly will be interested in cards with miles, or if they want to purchase goods in installments, installment cards are suitable.

about the author

Klavdiya Treskova - higher education with qualification “Economist”, with specializations “Economics and Management” and “Computer Technologies” at PSU. She worked in a bank in positions from operator to acting. Head of the Department for servicing private and corporate clients. Every year she successfully passed certifications, education and training in banking services. Total work experience in the bank is more than 15 years. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

Conditions for assigning pension benefits in the Stavropol region

Pensions in the Stavropol region in 2021 are assigned taking into account the following criteria:

1. By old age:

a. insurance is assigned if the criteria for length of service and points are met:

- after 60 years for women;

- after 65 years for men;

- at a different age in the presence of preferential grounds;

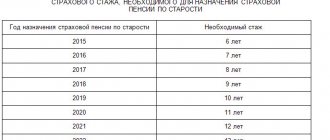

- work experience of at least 15 years (this indicator will be relevant by 2024, in 2021 the minimum experience is 11 years, within 4 years it will increase by 1 year annually);

- 30 individual pension coefficients (in 2021, the minimum amount of pension points is 18.6, the required number will increase annually and will reach 30 by 2024)

b. social :

- women who have celebrated their 65th birthday;

- men over 70 years of age;

- foreign citizens and stateless persons permanently residing in the territory of the Russian Federation for at least 15 years and who have reached the specified age;

- state : assigned to citizens affected by radiation or man-made disasters;

- The state pension for long service is assigned to federal civil servants, military personnel, astronauts and flight test personnel.

2. For disability:

- insurance in the presence of disability and at least one day of insurance experience;

- social in the presence of disability and lack of insurance coverage;

- state is assigned to military personnel, citizens who suffered as a result of radiation or man-made disasters, participants in the Great Patriotic War, citizens awarded the “Resident of Siege Leningrad” badge, and cosmonauts;

3. In the event of the loss of a breadwinner, a pension is entitled to:

- insurance is assigned upon the death of the breadwinner, who was dependent on the applicant for pension provision. The main condition is that the deceased breadwinner has an insurance period (at least one day);

- social is assigned to children under the age of 18, as well as over this age, studying full-time in educational organizations, until they complete such training, but no longer than until they reach the age of 23, who have lost one or both parents, and children of a deceased single person mothers;

4. State pension is assigned to disabled family members of fallen (deceased) military personnel; citizens injured as a result of radiation or man-made disasters, astronauts.

5. The funded pension is paid together with the insurance if the applicant has entered into an appropriate agreement with the Non-State Pension Fund. Persons born after 1966 have the right to such rights.

Advice: the right to pension benefits must be documented. It is advisable to submit an application to the Pension Fund office six months before eligibility.

Comments: 0

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article: Klavdiya Treskova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya