Table of pre-retirement age by year of birth

A citizen is considered pre-retirement for 5 years before reaching retirement age. However, from 2021 to 2022, retirement dates will gradually increase from 55 to 60 for women, and from 60 to 65 for men. In this case, the 5 years defining the pre-retirement age limit will be counted taking into account such a gradual increase.

The table of retirement and pre-retirement ages by date of birth for women and men is presented below:

| Women | Men | When will they be considered pre-retirement? | ||

| GR | PV/PPV | GR | PV/PPV | |

| 1964 | 55.5 / 50.5 | 1959 | 60.5 / 55.5 | 2019 |

| 1965 | 56.5 / 51.5 | 1960 | 61.5 / 56.56 | 2019 |

| 1966 | 58 / 53 | 1961 | 63 / 58 | 2019 |

| 1967 | 59 / 54 | 1962 | 64 / 59 | 2021 |

| 1968 | 60 / 55 | 1963 | 65 / 60 | 2023 |

| 1969 | 1964 | 2024 | ||

| 1970 | 1965 | 2025 | ||

| 1971 | 1966 | 2026 | ||

| 1972 | 1967 | 2027 | ||

| 1973 | 1968 | 2028 |

Note. The following abbreviations are used in the table: GR—year of birth; PV and PPV are retirement and pre-retirement ages, respectively.

- Intermediate standards are established for women born in 1964-1967 and men born in 1959-1962 - these are values of 50.5-54 and 55.5-59 years, respectively. For example, in 2021, pre-retirement people include women with a date of birth between 1964 and 1966, and men with a date of birth from 1959 to 1961.

- For women born since 1968 and men born since 1963, the final standards are 55 and 60 years, respectively. In fact, they will be considered pre-retirees upon reaching the “old” retirement age.

With 37 years of experience, any woman can apply for a pension 2 years earlier: the media are silent about this

Almost all residents of the country are aware of the increase in the retirement age from January 1, 2021. At the same time, there was such a fuss in the media about this that some important details remained “behind the scenes.” So, for example, not everyone knows that according to the new law, absolutely any woman with 37 years of experience can retire 2 years earlier. Let's talk about this in more detail.

We recommend reading: Agreement and assignment of rights and obligations under a land lease agreement

From 2021, the retirement age will be raised gradually for men and women. As a result, men will begin to retire at 65, and women at 60. The stages of raising the retirement age are presented in the table:

At what age does a mother of 3 and 4 children retire?

Taking into account the President’s amendments to the pension bill, in 2019, women will generally be able to retire at the age of 55.5. Does this mean that large families with three and four children will have to wait until their 57th and 56th birthdays, respectively? Of course not. They will be able to apply to the Pension Fund on the same basis as other women when they reach 55.5 years of age. And this will continue until the female retirement age, established “on a general basis,” exceeds these 56 and 57 years, taking into account the transition period schedule.

That is, in fact, mothers with 4 offspring will be able to take advantage of the new benefit from 2021, and with 3 – from 2023. After this, the retirement age for the corresponding categories of large families will stop increasing and will stop at 56 and 57 years. For other women, it will continue to rise until they reach age 60 in 2028 (see).

Due to the fact that in 2019-2020 the retirement age will be increased in increments of 6 months, its own peculiarities also arise. For example, consider the case of a woman born in 1964:

- If she turns 55.5 years old in the first 6 months of 2021, then, according to the table below, she will be able to start receiving pension payments in the 2nd half of 2021 (regardless of the number of children).

- If she turns 55.5 years old from July to December 2021 inclusive, then she can count on payments only in the corresponding month of the 1st half of 2021 (that is, also only six months later).

The retirement age for families with many children will change annually until it reaches 57 years and 56 years, respectively, for mothers with 3 and 4 children. And that’s where the promotion stops for them. How this will happen taking into account the transition period is shown in the table.

Photo pixabay.com

Table - Benefits for mothers of many children upon retirement

| Woman's date of birth | In what year will you turn 55? | Retirement age for women under the new law, years | |||||

| On a universal basis | With 3 children | With 4 children | |||||

| New PV | SHG | New PV | SHG | New PV | SHG | ||

| January-June 1964 | 2019 | 55,5 | July-December 2019 | 55,5 | July-December 2019 | 55,5 | July-December 2019 |

| July-December 1964 | January-June 2020 | January-June 2020 | January-June 2020 | ||||

| January-June 1965 | 2020 | 56,5 | July-December 2021 | 56,5 | July-December 2021 | 56 | 2021 |

| July-December 1965 | January-June 2022 | January-June 2022 | |||||

| 1966 | 2021 | 58 | 2024 | 57 | 2023 | 56 | 2022 |

| 1967 | 2022 | 59 | 2026 | 57 | 2024 | 56 | 2023 |

| 1968 | 2023 | 60 | 2028 | 57 | 2025 | 56 | 2024 |

The following abbreviations are used in the table: RA—retirement age; GVP - year of retirement.

The table presented clearly shows why benefits for families with many children will actually be deferred for several years:

- In accordance with the new legislation, mothers of 4 children born in 1965 will be the first to become pensioners in 2021, taking into account benefits. They will be able to do this at 56 years old, while ordinary women this year will be able to retire only at 56.5 years old.

- For mothers of 3 children born in 1966, benefits will apply in 2023. They will retire at 57, while the rest of the women will retire in 2024 at the age of 58.

Example

If a woman born in 1965 with 4 children could retire in 2021 under the old law, then as a result of the reform she will be able to do this only in 2021 at the age of 56 years. And this will already be considered early retirement, because the general retirement age for women of this year of birth will be 56.5 years (i.e., in general, you will need to work 6 months longer).

Retirement periods for citizens

As a result of the reform, the concept of “pre-retirement” was introduced, meaning the status of people who have 5 years left before retirement. During this period of time, this category of people has benefits in the form of social guarantees and assigned jobs.

According to the age

- In 2021, the retirement age will increase by 0.5, which means that men will retire at the age of 60.5, and women – 55.5. Pension payments for the current year 2021 will be made in 2019-2020.

- In 2021, the increase will occur by 1.5: women. – 56.5 years old, male – 61.5 (21-22).

- In 2021, the retirement age will increase by 3 (women - 58; men - 63) (24).

- 2022 will be characterized by an increase of 4 (women - 59 years; men - 63 years) (26 years).

- Starting from 2023 – 5: women. – 60 years old, male – 65 years old (27).

For teachers and medical workers

For these groups of people, retirement follows length of service, namely 25-30 years. The specific length of experience depends on the position and specialization. The system described above was retained, but with the transformation as a waiting period of 5 years.

Stages, depending on the year of experience:

- 2019 (in 0.5 years) – pension in 2019-2020;

- 2020 (1.5 years) – in 21-22;

- 2021 (3 years) – in 24;

- 2022 (4 years) – 26;

- 2023 (5 years) – 28

For persons who worked in the Far North

The reform spells out specifics for people living in the represented region. The standard period is reduced by 5 years, however, now both men and women will be able to terminate the employment contract at 60 and 55 years, respectively.

Men:

- 55.5 years (1964) – 19-20;

- 56.5 years (1965) – 21-22;

- 58 years old (1966) – 24 years old;

- 59 years old (1967) – 26 years old;

- 60 years (1968) – 28

Women:

- 50.5 years (1969) – 19-20;

- 51.5 years (1970) – 21-22;

- 53 years old (1971) – 24 years old;

- 54 years (1972) – 26 years;

- 55 years (1973) – 28

For state and municipal employees

It is worth recalling that for civil servants the retirement age is increased gradually (6 months per year) from 2021 until 2021 inclusive. Then the pace will align with generally accepted legal boundaries.

Also, starting from 2021, the requirements for the minimum period of work experience of municipalities will be tightened. service, which makes it possible to receive payments upon reaching compulsory length of service, presented in the form of an additional benefit to the old-age pension. Taking into account all the reforms, the female part of the population will receive a pension upon reaching 56 years of age, and men - 61 years of age. Do not forget about length of service in the civil service - the period of work experience will be 16.5 years.

According to insurance experience

The reform carried out affects all aspects of establishing a pension, with the exception of the insurance period, which means the period of time during which contributions to the Pension Fund were made for the employee. Previously, before the adoption of the reform, a person required 9 years of qualifying experience. In the absence of this condition, the citizen could only receive a social pension.

For 2021, the situation has changed and now the years of insurance experience will increase according to retirement age, for example:

- 2019, 10 years of experience will be required;

- 2020 – 11 years;

- 2021 – 12 years;

- 2022 – 13 years;

- 2023 – 14 years;

- 2024 – 15 l.

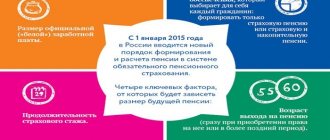

According to the individual pension coefficient (IPC)

The calculation of the IPC will be carried out in accordance with the previously established (2015) law.

The required lower limit of the individual pension coefficient in different years:

- 16, 2 – 2021;

- 18.6 – 2021;

- 21 – 2021;

- 23.4 – 2022;

- 25, 8 – 2023;

- 28.2 – 2024;

- 30 – 2025

Having carefully studied the nature of the changes, one can find an increase in the IPC by 2.4 up to 2025 inclusive. However, it is unknown whether the growth will continue or stop, but no changes in the coefficient are expected in the near future.

How is pension calculated for those born before 1967?

The formula for calculating the pension: P = BC + MF + LF, where P is the pension, BC is the basic part, LF is the accumulative part, and SF is the insurance part. Since the basic part is the same for everyone, and everyone has their own funded part, the question arises of how to calculate the insurance part. There is also a special formula for this: SP = PC/T, where PC is the pension capital, and T is the expected period of pension payment, it is calculated in months (this indicator is in the tables compiled by the Pension Fund, you can see it on the Internet).

The payment associated with a citizen reaching old age and calculated in accordance with current legislation is called a pension. Not only people who have the required length of service and have reached the established age, but also some categories of beneficiaries have the right to receive this allowance. For example, a pension is assigned for disability or loss of a breadwinner. In our state, pensions are calculated in different ways. After the last reform, the calculation of pensions changed, instead of amounts in rubles they switched to conventional units (pension points). The previous calculation remained only for people born before 1966. In this review we will tell you how pensions are calculated for those born before 1967.

How is the Old Age Pension calculated for those born in 1964?

The insurance period is the duration of periods of work for which insurance contributions to the Pension Fund of Russia were calculated and paid, as well as other periods counted towards the insurance period when a person was not able to work - non-insurance periods.

An explanation of this term is the topic of a separate lecture, which is quite voluminous and difficult to understand for non-specialists in the field of pension legislation. Below we will simply illustrate how the length of service taken into account when calculating the pension amount is determined.

Free legal assistance

This means that the woman will retire at 59 years old, i.e. August 20, 2020. Therefore, those who were born in the second half of the year (from July) will retire at age next year. Early retirement or who can retire early in the Republic of Kazakhstan: - those who lived from August 29, 1949 to July 5, 1963 (at least 5 years) in environmental risk zones affected by nuclear weapons tests at the Semipalatinsk nuclear test site:

At what age will a woman born in 1964 retire in 2020? Thank you. question number No. 13778952 read 12 times Urgent legal consultation8 free Do you have an answer to this question? You can leave it by clicking on the Reply button Similar questions How many years since 2002 are taken to calculate the pension. Woman born in 1962. And if wages are normal until 2002, and insurance premiums from 2002 are very small, then what will the pension be? At what age can a woman retire if she has three children? At what age will a woman retire if she has 1.5 years of work experience and four children? How many years does a doctor need to work to retire after length of service? My husband, born in 1963, retired in 1998 (MO). We have two one-room apartments.

Is a funded pension born in 1964 accrued or not?

Features of receiving a funded pension A citizen can receive savings from a non-state pension fund or from the Pension Fund of the Russian Federation - this will depend on where they were formed. We hasten to remind you that the funded part of the pension appeared in 2021, and for three years it could be saved by men born in 1953 and older, as well as women born in 1957 and older. From 2021, contributions to the funded pension are made only from payments of citizens born in 1967 or later. If a person retired on January 1, 2021 or later, he can exercise the right to receive a funded pension. 1.

We recommend reading: Vacation compensation upon dismissal in which cases you can not pay

Good afternoon For men, the funded pension begins in 1953. All the best! Sincerely, Olga Alpatova Personal consultation Thank you, you helped me a lot! Do you have an answer to this question? You can leave it by clicking on the Reply button There were deductions, where did they go? question number No. 12106570

Not everyone's retirement age will change

There are categories that have retained the same retirement age. The reform did not affect them; they will not have to wait 60 and 65 years. These are mainly those who have worked for many years in heavy production and in dangerous places. Here are examples of industries where you can qualify for early retirement without raising the age:

- Underground work or hot shops.

- Metro, locomotive crews and transportation in mines.

- Textile industry.

- Field, search and geophysical expeditions.

- Civil Aviation.

- Marine and river fleet, fishing industry.

- Coal mining and mine construction.

- System of execution of criminal punishments.

- Regular passenger transportation by buses, trolleybuses and trams.

- Rescue services.

- Education and medicine.

Such workers do not retire at the same age. Everyone has conditions based on gender, age and length of service. For example, if a woman worked as a trolleybus driver for 15 years and accumulated 20 years of total experience, she will be able to retire at age 50. For these categories, nothing has changed: their retirement age has not been increased, and for some professions it does not matter at all and only length of service is important.

There are also categories where it is not the profession that is important, but social indicators. For example, a woman who gave birth to two children and worked in the Far North can receive an early pension. Or guardians of a disabled person since childhood.

The conditions and categories for early assignment of a pension are listed in Articles 30-33 of the Law on Insurance Pensions.

How pensions for women born in 1961 will be calculated from 2021

Until 2014, 6% of wages was transferred to savings accounts, but by the end of 2015, each citizen had to decide which option would be used for payments in 2021. The law provides for the option of dividing the pension contribution as before - 10% for the insurance part and 6% for the savings part, which can be invested in highly profitable projects. However, there remains a risk of “burning out” with this invested part or not even winning back the inflation rate. The second option provides for a full transfer of 16% towards the formation of an insurance pension. To protect this amount from inflation, an annual indexation mechanism is provided.

At the same time, the legislation allows for a number of other restrictions. Thus, the number of points for 1 year cannot exceed 10, and until 2021 there will be a limit of 7.49 points per year of experience. However, women retiring in 2021 began their working careers even before all these pension reforms. Therefore, for them, the amount accumulated in the insurance account will be divided by the accepted point price. This value will be taken into account as the conditional total number of points.

How to calculate old age pension correctly

The calculation uses the so-called increase in length of service during Soviet times and in the new Russia. Soviet periods increase by 1%, periods of employment according to the Labor Code of the Russian Federation from the moment of collapse to 2002 by 10%.

These contributions increase over the years under an agreement concluded with the Pension Fund or Non-State Pension Fund, and upon retirement, a person has the opportunity to receive the invested funds and increased by interest as a pension.

This is interesting: How long does it take for the bank to remove the deposit from an apartment after full payment?

New retirement table from 2021 (latest news)

In Russia, a new project regarding benefits for senior citizens is coming into effect. The primary package of projects on innovations in the pension project comes into force by the Russian Federation on January 1. The legislation describes a gradual increase in the pension age category by 5 years to 65 for men, 60 for women, from 2021.

The primary change proposed by the draft in its original version is the increase from 2021 in the age category of pensioners to 63, 65 for women and men. But by corrections by the President, the designated parameters of the project have been adjusted. The President proposes important measures to mitigate pension reform:

- Reduction of the upper limit of a woman's age category from 63 to 60 years.

- The probability of access to earned rest by six months of the period previously described by the bill during the first 2 years.

Based on the described amendments, women born in 1964 significantly reduced the rate of age growth - they are able to apply for benefits for 6 months. before the new age.

So, female, born in 1964. assigned to the status of an elderly person at the age of 55.5 years.

Elderly age table:

| Year | How much will the PV increase? | PV | SVP | |

| M | AND | |||

| 2019 | +0,5 | 60,5 | 55,5 | 2019/2020 |

| 2020 | +1,5 | 61,5 | 56,5 | 2021/2022 |

| 2021 | +3 | 63 | 58 | 2024 |

| 2022 | +4 | 64 | 59 | 2026 |

| 2023, etc. | +5 | 65 | 60 | 2028 |

It is worth describing that the draft law that was first published, suggesting a change in the working capacity of persons, had a more difficult reform option - an annual increase of 1 year.

The updated standard on the growth of the pension age category from 2019 affects recipients of early benefits:

- Employees of the subjects of the North and areas close to them.

- Teachers, medical workers.

In the published standard for the designated categories, the described difference is preserved, but it will be taken in conjunction with the updated retirement age category.

Thus, the standard age for the described category of Russian residents will be raised to 55, 60 years, while a transition period will be assumed when the period of working capacity gradually increases until the final indicators of 2023 are reached for women and men.

According to the updated bill, after the end of the transition period, it is possible for established categories of employees to gain early registration authority 5 years after the end of their work experience.

At the same time, the increase is carried out gradually: each year the time of early appointment will be postponed by 1 year until the final indicator is established - 5 years (2026).

For teachers and doctors who gain accumulated work experience in the period 2019-2022, retirement is postponed for 0.5-4 years. If you obtain the required preferential internship in 2023 and later, you can be considered a senior citizen after 60 months.

Pension calculator Online

When calculating the conditional amount of the insurance pension, the following indicators for 2021 are used: Fixed payment - 5,334 rubles; The cost of 1 pension coefficient is 87.24 rubles; The maximum salary before personal income tax, subject to insurance contributions, is 85,083 rubles per month.

Examples of calculations for those retiring in 2021

As you can see, it is very difficult to correctly calculate your pension independently, given the large number of indicators. Therefore, it is more convenient to calculate your pension using the 2021 calculator online. To calculate your pension, you must enter the following information:

7.1. Hello! Yes, to calculate the estimated size of the labor pension, you can choose to calculate the average monthly earnings of the insured person for 2000 - 2001 according to individual (personalized) records in the compulsory pension insurance system or for any 60 consecutive months of work on the basis of documents issued in the prescribed manner by the relevant employers or state (municipal) bodies. Average monthly earnings are not confirmed by testimony; You can choose the years yourself. The calculation is made in accordance with Art. 14 and 30 Federal Law “On Labor Pensions”

- When entering fractional numbers into the fields of the calculator - length of service, earnings ratio (ER), etc. — they should be entered through a period. For example, if the length of service before 1991 is 5 years and 3 months, i.e. 5 full years and 3/12 (1/4) years, then enter 5.25 in the appropriate field. If your SPV is 0.9, then enter 0.9 in the appropriate field. This rule - entering decimal fractions with a period (rather than a comma) applies to all fields of the calculator.

- The actual pension accrued to you in the Pension Fund may differ slightly from the calculated one. This is due to the fact that some data - length of service, average monthly salary and others, which you enter from memory, are not reflected in the PF on your ILS or do not have documentary evidence.

Pension calculation year of birth 1964

As noted earlier, the requirements for length of service and the number of points have been changing annually for several years, and from 2021 the retirement age will also begin to increase. You can determine the requirements for applying for an old-age insurance pension depending on the year of birth for women and men using the table below:

How to find out from what year of birth and how much a funded pension is calculated

Its duration is set by the citizen himself, but it cannot be less than 10 years. It is assigned and paid upon the emergence of the right to an old-age insurance pension to persons who have formed pension savings through contributions within the framework of the State Co-financing of Pensions Program, including employer contributions, state contributions on income from their investment, and, in addition, from the mother’s money (family) capital.

- Citizens whose funded pension is 5% or less in relation to the amount of the old-age insurance pension, including taking into account the fixed payment, and the size of the funded pension, calculated as of the day the funded pension was assigned.

- Citizens counting on an insurance pension for disability or in the event of the loss of a breadwinner or under state pension provision, who, upon reaching the generally established retirement age, did not receive the right to an old-age insurance pension due to lack of the required insurance period or a sufficient number of pension points (taking into account transitional provisions pension formula).

We recommend reading: Payment of fees by IP card

Retirement of women born in 1964 under the new law

In 2021, a law raising the retirement age came into force, which primarily affected women born in 1964. They will be the first to retire under the new law. According to the standards of the old legislation, they were supposed to retire at the age of 55, that is, already in 2021. But taking into account the transitional provisions of the reform, the age value for them increases by 1 year (see Appendix No. 6 to Federal Law No. 400 of December 28 .2013).

However, women born in 1964 are eligible for a benefit that allows them to receive pension payments six months ahead of schedule. This right is granted in accordance with Art. 10 of Law No. 350-FZ of October 3, 2018. This means that their retirement is postponed only for six months.

Thus, women born in 1964 will retire at the age of 55 years 6 months. This will take place according to the following scheme (depending on the month in which they were born):

| Date of Birth | When will they retire |

| January 1964 | July 2019 |

| February 1964 | August 2019 |

| March 1964 | September 2019 |

| April 1964 | October 2019 |

| May 1964 | November 2019 |

| June 1964 | December 2019 |

| July 1964 | January 2020 |

| August 1964 | February 2020 |

| September 1964 | March 2020 |

| October 1964 | April 2020 |

| November 1964 | May 2020 |

| December 1964 | June 2020 |

The pension legislation provides for various benefits, as a result of which the retirement age can be reduced (that is, it will be possible to retire earlier than the period specified in the table).

What should be the length of service for retirement, taking into account recent changes: terms and conditions

If they have work experience, some people have the right to early retirement or to accrue pension payments.

The concept of special experience means the performance of a certain activity for a certain time in a certain area and in a certain profession. This type includes, for example, employment in the Far North, teaching activities, underground work and other difficult working conditions. In order for the state to start paying you a pension, it is not enough to reach a certain age. In addition, Russian pension legislation is not ideal and is constantly undergoing changes. For this reason, ordinary citizens are interested in what the length of service for retirement should be, taking into account recent changes, as well as the difference between work and insurance experience.

Retirement calculator

- The salary of a future pensioner or declared income for self-employment.

- Duration of experience.

- Socially significant periods of life, which include service in the Armed Forces, maternity leave, and parental leave.

- The method of pension provision chosen by the future pensioner in the compulsory pension insurance system.

- Continuation of work after retirement age.

- Savings pensions. Pre-retirees will have the right to use accumulated funds from the moment they reach retirement age under the old legislation, that is, from 55 and 60 years, depending on gender. In this case there is a slight limitation. The right to use savings can arise only if you have a minimum experience of 15 years and a number of points of at least 30.

- Insurance pensions for beneficiaries who retain the right to early retirement. In addition to those employed in hazardous industries (lists 1, 2), they will also include drivers of heavy trucks at mines and mines, field geologists, logging workers, female asphalt layers and crane operators, railway drivers (including metro) who directly transported passengers , port dockers, public transport drivers, fishermen, miners, civil aviation workers directly involved in providing flights, operational employees of the Ministry of Emergency Situations, workers of correctional labor colonies.

- State pensions. The changes will not affect persons who liquidated the Chernobyl accident, persons injured as a result of the Chernobyl accident, as well as their close relatives - family members.

- Pensions of civil servants. For this category of future pensioners, starting from 2020, their own step-by-step schedule will be introduced, which involves increasing the retirement age by six months each year until the maximum values are reached.

Difficulties of citizens born in 1960-1970.

Let us remind you that, as a result of the pension reform, people who were born in 1960-1970 may retire much later than they planned. After all, the retirement age is rising. But this does not mean that you do not need to worry about your future. It’s better to take all the points into account now, while you still have the opportunity.

In the 90s, these people were 20-30 years old. They all worked. But the crisis of the 90s. left a serious imprint, including affecting future pensions. The fact is that in the nineties, when there was widespread unemployment, a crisis in the country, and employees did not receive wages for 6 months or longer, many began to work unofficially.

And this is justified, they didn’t pay wages, but the whole family wanted to eat. Thus, many people, despite active work, do not have a corresponding entry in their work book, which in turn affects their pension provision.

But even if people born in 1960-1970 worked officially in the nineties, there could still be problems. Since then, many enterprises have gone bankrupt, others have closed, others have passed into the hands of private owners, and others have changed their name, current accounts, etc. many times. Therefore, obtaining the required documents for the Pension Fund for this working period is difficult, and sometimes even impossible.

So, when contacting the Pension Fund, it turns out that there are no certificates of employment, and these enterprises no longer exist, and the archive cannot help in any way. This whole chain leads to the person being assigned a social pension. And, as you know, she is small. And this is despite the fact that the citizen officially worked, but, unfortunately, cannot confirm this with anything.

Benefits that Russians will be deprived of when the retirement age is raised

The following pitfalls are also likely:

- the work book lacks the necessary entries, which affects the overall length of service;

- there is no data on experience at all for a 5-10 year period;

- it is impossible to obtain information from the place of former work;

- accrual of minimum pension points, etc.

All this is a consequence of the fact that many worked unofficially and received gray wages in envelopes.

Retirement table from 2021 for teachers and health workers

The bill also involves changing the boundaries of the period of working capacity for citizens who have the right to early registration. In particular, such adjustments will affect teachers and doctors.

According to the old law, they had the right to retire early upon receipt of the required number of years of experience - 25-30 years, depending on the place of work. Under the new law, all length of service requirements for these professions will remain the same, but pension payments will be available only 8 years after acquiring the required length of experience. Starting from 2021, these categories of workers will also undergo a transition period, during which each year the limit of the working capacity period will be postponed by a year relative to previous periods. You can determine the retirement schedule under the new law based on the data presented in the table below:

| Year of obtaining the required specialized experience | Postponement of early retirement date | Year of retirement |

| 2019 | + 1 | 2020 |

| 2020 | + 2 | 2022 |

| 2021 | + 3 | 2024 |

| 2022 | + 4 | 2026 |

| 2023 | + 5 | 2028 |

| 2024 | + 6 | 2030 |

| 2025 | + 7 | 2032 |

| 2026 and following years | + 8 | 2034 and beyond annually |

Thus, starting from 2021, teachers and doctors can acquire the right to apply for an early pension only after a certain number of years after receiving the required special experience:

after 1-7 years during the transition period (from 2021 to 2025); 8 years after acquiring the required experience, starting in 2026.