Military pensions and their increase until 2023

Military pensioners so far have to rely only on the indexation of their salary in the army. Their pensions are tied to military “salaries” through a reduction factor and are automatically indexed on October 1 of each year.

The reduction coefficient should increase, but the state periodically freezes it. So in recent years, there has most often been no accelerated growth.

At the moment, the next such freeze is valid until January 1, 2022. This does not mean that the coefficient will increase in 2022 - if the money is again needed for something else, the Supreme Commander will suspend the increase in the coefficient for another year.

If we focus on the growth of pay in the army, then the plans for the near future are as follows:

| date | Indexation percentage |

| October 1, 2021 | 3,7% |

| October 1, 2022 | 4% |

| October 1, 2023 | 4% |

Further plans have not yet been announced. But as for 2021, we can already say absolutely unambiguously - the indexation of allowances in the army and military pensions will not even compensate for the increase in inflation for 2020. Consumer prices rose by 4.9% last year – this is official data from Rosstat.

The average military pension in the country after the previous indexation in 2020 is 26,968 rubles. If the reduction factor is not unfrozen, by the fall of 2023 the amount will increase to 30,248 rubles.

See also:

Increase in military pensions in 2021

Image: okvk.mil.ru

Pensions of working pensioners

The government linked the increase in the retirement age with an increase in pensions at a rate higher than inflation, but the June bill did not say anything about increasing pensions.

The State Duma Committee on Labor and Social Policy, in its conclusion on the draft, called for “legislating the procedure for increasing insurance pensions at a rate exceeding inflation,” and Putin, in an address to Russians at the end of August, promised to include in the bill a mechanism for annual increases in pensions. Read on RBC Pro

Nassim Taleb - RBC: “I see a threat more serious than a pandemic”

Why Amazon creates failed products and what's wrong with their design

How 12 startups are revolutionizing global finance

When China will become the world's first economy: 5 scenarios from Bloomberg

It follows from the presidential amendments that the pensions of working pensioners, which have not been indexed since 2021, will increase in the coming years along with the pensions of non-working people. Otherwise, a special clause would be needed that the values of the SPK and fixed payment for 2019–2024 do not apply to working pensioners (there is no such clause in the amendments).

However, the press service of the Ministry of Labor told RBC that the increase in pensions in 2019–2024, prescribed in the presidential amendments, applies only to non-working pensioners.

“I created a pension fund for myself”: how to start a business before retirement Photo gallery

Plans for indexation of social pensions until 2023

Social old-age pensions are received by those who cannot access a regular old-age insurance pension. The reason is that there are not enough pension points or insurance coverage. People enter social pensions five years later than the general retirement age.

There are other types of social pensions (for example, for the loss of a breadwinner or disability), all of them are indexed on April 1 of each year.

The indexation percentage is determined according to a special scheme, so all plans in this regard are preliminary. For now, the state plans to index social pensions at the following rates:

| date | Indexation percentage |

| April 1, 2021 | 2,6% |

| April 1, 2022 | 8,5% |

| April 1, 2023 | 0,9% |

What will happen next is not yet stated in the budget plans.

Image: mos.ru

The size of the insurance pension by 2024 has become known

By 2024, the average annual old-age insurance pension for non-working pensioners will be 20,388 rubles. TASS reports this with reference to the materials of the Russian tripartite commission for review of the budget of the Pension Fund (PFR).

Pension indexation will be 5.5% per year, the average payment now is 16,789 rubles. The size of the insurance pension will increase by 3,599 rubles.

“The indexation of insurance pensions is planned annually from January 1... As a result, the average annual old-age insurance pension for non-working pensioners will be 18,447 rubles in 2022, 19,399 rubles in 2023, and 20,388 rubles in 2024,” the materials note.

It is expected that by 2024, 38.86 million people will receive an insurance pension, compared to 39.57 million pensioners in 2022.

The commission’s materials also note that social pensions in Russia will increase by 7.7% from April 1, 2022, by another 0.3% a year later, and by 9% from April 1, 2024. The average annual social pension in the country will be 10,773 rubles in 2022, 11,744 rubles in 2024.

The budget has allocated 3.5 billion rubles for the payment of funded pensions in 2022, and 5.5 and 7.2 billion in 2023-2024, respectively. For one-time payment of pension savings, 30.2 billion rubles are provided in 2022, 29.3 billion in 2023 and 28.4 billion rubles in 2024.

There may be fewer pensioners

In April, experts from the National Research University Higher School of Economics, in a report “The Russian pension system in the context of long-term challenges and national development goals,” warned that the number of those unable to qualify for an old-age insurance pension may increase.

Among the main reasons are the aging population and the peculiarities of the Russian labor market associated with growing informal or hidden employment (estimated at about 20–25% of the total number of employees).

“Structural changes are taking place in the labor market: a reduction in standard forms of employment, the expansion of digitalization of jobs, the expansion of platform employment [couriers, delivery workers, etc., taking orders from Internet platforms], as well as the emergence of various alternative employment formats - the growth of freelancing, the expansion of informal employment - all this narrows the possibilities for insurance financing of the pension system, because it reduces the taxable employment fund,”

— explained one of the authors of the report during its presentation, head of the Center for Comprehensive Research on Social Policy at the Institute of Social Policy, Oksana Sinyavskaya.

In addition, many citizens receive very low salaries, which means that very little money is deposited in their name in the Pension Fund. Moreover, 90% of all pension payments now occur through the pension system. Analysts believe that it needs to be improved, otherwise in the coming decades the gap between income before and after retirement will become critical and will resemble the situation with extremely low pensions in the 1990s.

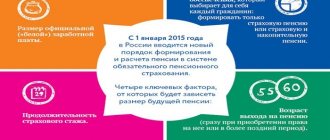

Since 2014, the funded part of pensions has been frozen in Russia. In the current version of the law, the freeze is in effect until the end of 2023. From January 1, 2021, thanks to this, 669.3 billion rubles will be saved, the government said. The freeze does not cancel or reduce the financial obligations of the state, it was noted in the explanatory note to the bill.

Contributions from working citizens are sent to the Pension Fund and form an insurance pension. The head of the Ministry of Finance, Anton Siluanov, noted that the issue of abolishing the funded pension can only be considered after the creation of a system of voluntary savings in the country.

Early retirement

In April, the Moscow branch of the Russian Pension Fund (PFR) reminded who can retire early.

“Starting from 2021, women who gave birth and raised four children before they reach the age of 8 years can apply for an old-age insurance pension upon reaching 56 years of age. <…> From 2023, women who have given birth to three children and raised them until they reach the age of 8 years will be granted a pension at the age of 57,” the Pension Fund said.

In addition, one of the parents who raised a disabled child under 8 years of age may leave earlier than the generally established period. At what age the child was recognized as disabled and how long he remained disabled does not matter.

Citizens with extensive work experience will also be able to apply for early retirement – 42 years for men and 37 years for women. Residents of the Far North can retire five years earlier than the established general requirements. The minimum experience must be 15 years.

Pension indexation schedule by year until 2024

So, in January, the Pension Fund paid new pension amounts for all non-working pensioners. The increase was 7.05%. For each, the increase was different depending on the previous size of payments.

Many pensioners are concerned about this issue, since the fixed payment is one of the basic parts of the pension. Let's find out in detail how exactly the fixed payment will grow (note, GROW) over the next 5 years. As a result of these increases, the government plans to increase pensions to 20 thousand rubles per month by 2024. Despite the fact that the calculated indexation percentages decrease every year, they are determined taking into account the advance of the projected inflation rate.

Labor veterans are entitled to free dental prosthetics. But medicine carefully hides this. They brazenly answer that there are no such benefits.

How will pensions increase in 2019-2024?

According to Law No. 350-FZ of October 3, 2018, during the period from 2019 to 2024 inclusive, insurance pensions will increase by an average of 1,000 rubles per year. Such an increase will be carried out as a result of indexation at a percentage almost twice the forecast inflation.

Pension increases in Russia over the coming years will occur at the following rates:

| Year | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

| Indexation, % | 7,05 | 6,6 | 6,3 | 5,9 | 5,6 | 5,5 |

| Average pension after indexation, thousand rubles. | 15,4 | 16,3 | 17,2 | 18,2 | 19,2 | 20,3 |

From the table above it is clear that the new indexation scheme for pension payments will ensure an increase in the average pension size by 1 thousand from 2021 and an additional increase in the average annual income of a pensioner by 12 thousand rubles.

The only downside is that this scheme had to be paid for by raising the retirement age. The authorities have repeatedly noted that accelerated growth of pension payments can only be achieved as a result of reform.