What the law says

According to paragraph 2 of Art. 207 of the Tax Code of the Russian Federation, tax residents are persons who stay in Russia for more than 183 days within one year or receive income from sources in the Russian Federation. In this case, the days of entry and exit are not taken into account. In addition, this period is not interrupted:

- when traveling abroad for up to 6 months;

- undergoing treatment or training;

- carrying out work in offshore hydrocarbon fields.

As before, non-resident personal income tax in 2021 pays at a rate of 30%; this is stated in clause 3 of Art. 224 Tax Code of the Russian Federation. In some cases, the rate may differ. For example, participants in Russian companies contribute 15% on dividends. And foreigners who work under a patent or are highly qualified specialists pay personal income tax at a general rate of 13%. Similar amounts of payments are made by residents of countries that are members of the Eurasian Economic Union, as well as refugees.

As you can see, income tax in Russia is quite high for foreigners if there is no right to a preferential rate.

For more information, see “Personal Income Tax Rates”.

Personal income tax for non-residents

Income of individuals who are not residents of Russia , including those for which, in accordance with clause 2 of Article 224 of the Tax Code of the Russian Federation, a rate of 35% is used for residents, are subject to taxation at a rate of 30% (clause 3 of Article 224 of the Tax Code of the Russian Federation Federation). The same paragraph applies a lower rate of 13% for certain types of income or the circumstances of their receipt:

A tax resident of the Russian Federation is a person who is under the tax jurisdiction of the Russian Federation. Understanding whether a person is a tax resident of the Russian Federation or not is necessary for the correct calculation and withholding of income tax (NDFL). Residents of Russia pay income tax in the amount of 13% (except for exceptions, see clause 2 of Article 224 of the Tax Code of the Russian Federation), and non-residents - in the amount of 30% (clause 3 of Article 224 of the Tax Code of the Russian Federation) and, unlike residents, they cannot apply for personal income tax deductions.

We recommend reading: What Documents Are Needed When Purchasing a Plot in Snt

Calculation order

Income tax is determined on all funds received during the month (not on an accrual basis). The calculation is made separately for each amount.

The sequence of calculating personal income tax for foreign citizens in 2018 is as follows:

| Stage | What does it include |

| 1 | Residence is established in accordance with Art. 207 Tax Code of the Russian Federation |

| 2 | Determine payer status |

| 3 | Set the rate taking into account the above characteristics |

| 4 | The tax base (NB) is determined in accordance with Art. 211 of the Tax Code of the Russian Federation and calculate the tax |

| 5 | Fill out forms 2-NDFL and 6-NDFL |

Also see “Confirmation of the status of a tax resident of the Russian Federation” - a new service of the website of the Federal Tax Service of Russia.”

Personal income tax of a citizen of Ukraine with temporary residence permit

Good afternoon A Ukrainian citizen wants to work in our company; she is registered in Volgograd at her place of stay and has a TRP (temporary residence permit), but has no citizenship. How much personal income tax should be withheld from her salary and will she be entitled to a deduction for 1 child under 18 years of age? (I have a son - 14 years old). Lives in Volgograd since July 2021. Is he a resident?

We recommend reading: To charge a penalty in a government institution under an agreement, what kind of wiring

Julia, hello. A resident of the Russian Federation is any individual, regardless of whether he is a citizen of Russia or another country, who stays on the territory of the Russian Federation for more than 183 days during one calendar year. The presence or absence of a temporary residence permit does not affect the tax in any way - the length of actual stay in the Russian Federation is important. More than 184 days - 13%, less - 30%. A resident is entitled to benefits, a non-resident is not.

How to calculate personal income tax

EXAMPLE 1

accepted on March 12, 2021 for the position of A.N. Frolov, who came from Yerevan. An employee has been hired as a finishing foreman. At the time of signing the agreement, Frolov was on the territory of the Russian Federation. There is a migration card with a period of stay from March 1 to December 31, 2021. The tax base is 30,000 rubles/month. How to pay personal income tax from a foreigner in 2021?

Solution

Until March 1, 2021, Frolov was a non-resident, so income tax was withheld at a rate of 30%. The 183rd day of stay in Russia falls on August 28, 2021. This means that until this moment, income is taxed at a rate of 30%:

From August 29, 2021, Frolov’s income will be taxed at a rate of 13%. Then Stroymir LLC will retain:

EXAMPLE 2

The consulting company hired N.A. Golubev tax law consultant (qualified specialist from Munich). Salary 170,000 rub. Determine personal income tax for a foreign employee. Solution

Based on clause 3 of Art. 224 of the Tax Code of the Russian Federation and 207 of the Tax Code of the Russian Federation, foreigners with the status of a qualified specialist are taxed at a rate of 13%. It turns out that income tax is withheld from Golubeva in the amount of:

Also see “Rules for calculating income tax”.

Change of personal income tax founder

Fill out and collect all the necessary documents, make changes to the constituent documents, correctly remove old members of the company and introduce new ones. All changes in the composition of the LLC founders must be registered with the Tax Authority.

According to the minutes of the meeting, the share of founder A is 30% - (200500+127000+50100+2250000)*30/100 = 788,280 UAH. Upon exit, founder A receives in cash his share, previously contributed to the authorized capital in the amount of 30% in the amount of 60,150, 00 UAH, as well as a building with a residual value of 550,000 UAH Dt 46 Kt 40 - 60 150 increase in the size of the authorized capital Dt 67 Kt 46 - 60150 - reflected the receipt from the founder B Dt 301 Kt 67 - 60150 contributions paid to the cash desk.

We recommend reading: How to Correctly Prepare a Deposit for an Apartment Sample

How to fill out a 2-NDFL certificate

2-NDFL certificates for foreign workers in 2021 are filled out in the same way as for a Russian employee, but there are some nuances.

TIN

If a foreign worker is registered with the Russian tax office, fill out the “TIN in the Russian Federation”. When an enterprise has information about the TIN of the country of citizenship (nationality), then fill out the appropriate field.

FULL NAME.

Personal information is indicated as written in the identity document. It is acceptable to use Latin letters. If there is no middle name, the field is not filled in.

Status

When filling out personal income tax certificate 2 for foreigners, it is important to correctly indicate the status. For example, if a foreign worker is a qualified specialist of the highest category, in the column “Taxpayer Status” they put 3. If he is a non-resident, they put 2. If he is recognized as a tax resident in accordance with clause 2 of Art. 207 of the Tax Code of the Russian Federation, put 1.

Address

The place of permanent residence of the foreigner is determined. The address is written arbitrarily, in Latin letters.

Codes

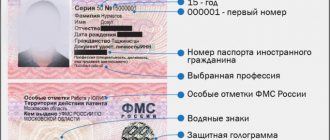

When filling out the “Identity document code”, they usually put the number 10 in the passport of a foreign citizen.

In the “Country code” field indicate the code of the state in which the foreigner permanently resides. It is taken from the All-Russian Classifier of Countries of the World (Resolution of the State Standard of Russia dated December 14, 2001 No. 529-st).

The payer's income and deduction codes are also filled out in accordance with legal requirements. The Federal Tax Service order No. ММВ-7-11/485 dated October 30, 2015 provides details on filling out the 2-NDFL certificate.

So we have looked at the main points that need to be taken into account when withholding personal income tax from foreigners in 2021, as well as filling out the 2-NDFL certificate.

Also see “2-NDFL for a foreign worker”.

Topic: Personal income tax from an employee of a citizen of Ukraine - help

During the tax period, the 12-month period is determined on the relevant date of receipt of income. That is, an employee’s tax status may change during the year. Traveling outside of Russia is only relevant for calculating the number of days of stay in Russia and does not interrupt the flow of the 12-month period.

From the 183rd calendar day of a foreigner’s stay in Russia (for 12 consecutive months), he becomes a resident, and, therefore, personal income tax is withheld at a rate of 13 percent (clause 1 of Article 224 of the Tax Code of the Russian Federation). The status of a foreigner (permanent resident or temporary resident) and the period of conclusion of the contract do not matter.

We recommend reading: Benefits for disabled people of group 3 in 2021 on long-distance trains

Income tax relief for foreigners

Certain categories of non-resident foreigners have the right to pay personal income tax at 13%.

| Status of foreign citizens who have the right to apply a preferential rate for them | Explanations |

| Highly qualified specialists from foreign countries (clause 3 of Article 224 of the Tax Code) | These include: · citizens with earnings of 83,500–167,000 rubles; participants of the Skolkovo project A rate of 13% is applied when withholding personal income tax from wages. For other payments (for example, cash compensation), tax is charged at 30% |

| Foreigners with a patent (Article 227.1 of the Tax Code) | Documented permission to get a job is usually issued to citizens of those countries with which Russia has a visa-free regime |

| Participants of the State Program for the Resettlement of Compatriots | This preferential rate equally applies to working family members of the participant |

| Citizens of the EAEU countries (Article 73 of the “Treaty on the EAEU” dated May 29, 2014) | These include: Belarusians, Armenians, Kazakhs, as well as citizens of Kyrgyzstan. Citizens of the EAEU countries have the right to work without a documented work permit |

| Refugees | This status is certified by a separate document, which gives the right to pay income tax at 13% |

There is only one general rule for residents and non-residents. Those incomes that are exempt from taxation by law are not subject to personal income tax.

On providing deductions to foreigners with refugee status

Persons recognized as refugees on the territory of the Russian Federation must also pay income tax when receiving income from work. Today this issue is being resolved taking into account the directives of paragraph 3 of Art. 224 Tax Code (Federal Law No. 285 of October 4, 2014).

Thus, confirmed refugee status makes it possible to use a reduced rate of 13% and calculate the amount of tax payable based on it. This provision applies only to those legal relations that began on January 1, 2014.

As for deductions for this tax, this issue is explained in detail by the Federal Tax Service in letter No. BS-3-11 / [email protected] dated 10.30.2014. This document informs that deductions are applied as standard when a resident pays income tax, calculated on the basis of 13%. (Clause 1 of Article 224 of the Tax Code). The types of allowable deductions in this situation are indicated in Art. 218 - 221 NK. The benefit is provided taking into account the requirements specified in Chapter. 23 NK.

From the above it follows that refugees, non-residents of the Russian Federation who have income and pay personal income tax on it at a rate of 13% (in relation to paragraph 3 of Article 224 of the Tax Code) are not entitled to the deductions indicated in Art. 218 - 221 NK. This relief is available to those refugees who have become residents of the Russian Federation, work and pay personal income tax at 13% (clause 1 of Article 224 of the Tax Code).

The Federal Tax Service draws attention to the fact that in order to receive a deduction, an employee must present to his employer (tax agent) all the necessary documents certifying his right to benefits. For example, to receive a standard deduction you need to present a copy of:

- passports containing information about the child;

- child's birth certificate.

Submitted documents from foreign countries are subject to prior legalization. Only after this they will be recognized as valid on the territory of the Russian Federation and will be accepted for consideration.

Acting State Advisor of the Russian Federation, 2nd class S. L. Bondarchuk.

Selling an apartment in Russia by Ukrainian citizens, paying taxes

In accordance with paragraph 17.1 of Article 217 of the Tax Code of the Russian Federation, income received by individuals who are tax residents of the Russian Federation for the corresponding tax period from the sale, in particular, of apartments that were owned by the taxpayer for three years or more, is exempt from taxation. But this rule applies only to tax residents.

When selling property of non-residents of the Russian Federation, as the Russian Ministry of Finance explains, the taxpayer status in this case should be determined based on the results of the tax period in which the property was sold (Letter dated August 24, 2021 N 03-04-05/6-1003). If during this period an individual was in the territory of the Russian Federation for at least 183 days, he is recognized as a resident of the Russian Federation and his income from the sale of property is not subject to personal income tax. Otherwise, tax is paid at a rate of 30%.

We recommend reading: Payment for services by invoice without an agreement